Crude oil protected against declines in equity and bond markets

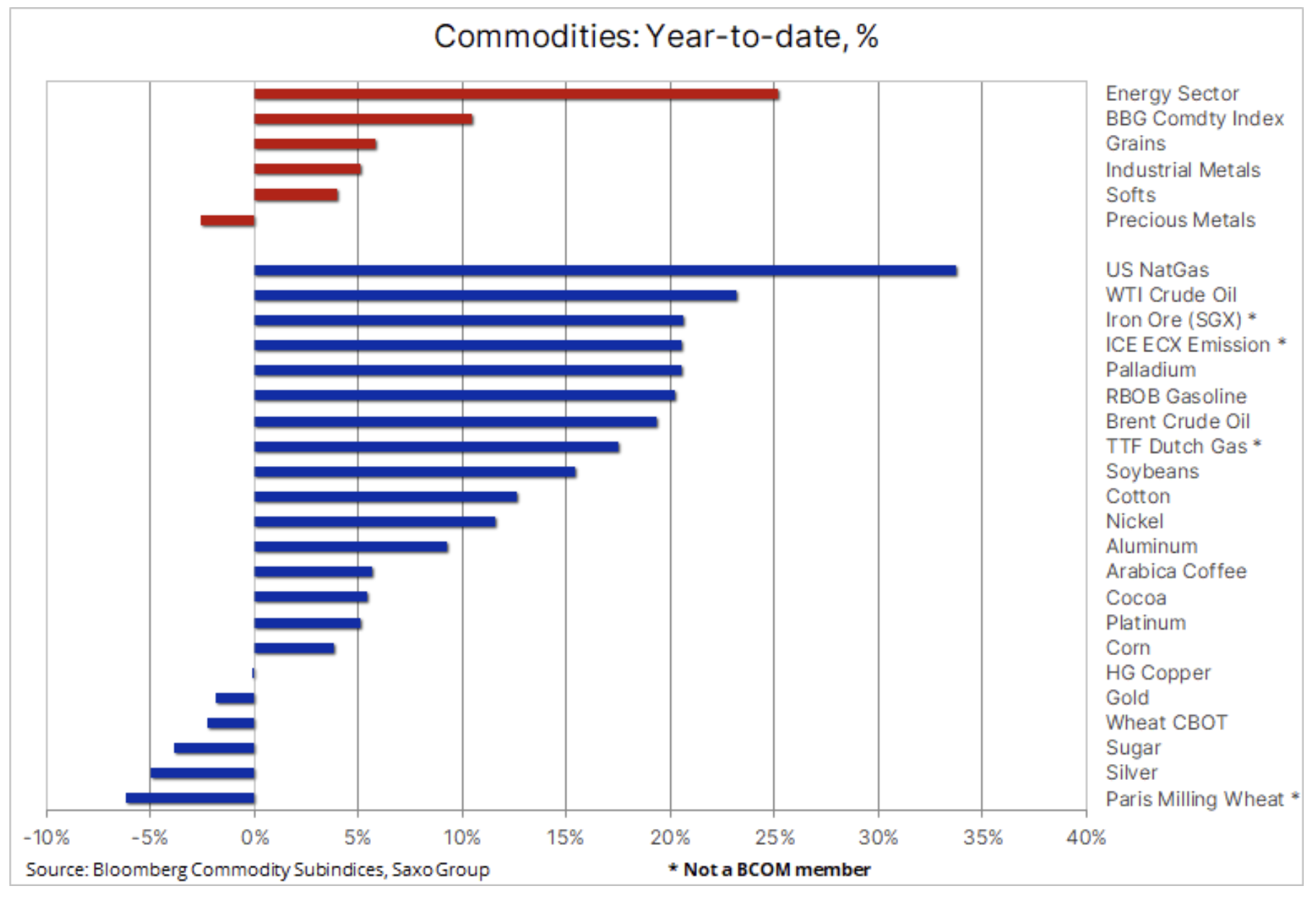

The turmoil in the stock and bond markets has become the new normal while commodities continue to rise. The Bloomberg spot commodity index, which monitors the performance of 24 of the most important futures contracts, climbed more than 11% after seven consecutive weeks of gains, hitting another all-time high. As you can see clearly below, the gains were driven by the continued boom in the energy sector: US natural gas appreciated 40%, and oil, one of the world's most important production factors, surged almost 25%.

The past week was marked by volatility in the stock market, showing that the stock market is unbalanced and that prices could move in any direction in the short term. In our opinion, the main risk is downward, incl. due to a change in the rhetoric of world central banks. This was the case recently in the case of the ECB, which finally succumbed to the growing inflationary threat and, as a result, abandoned its dovish stance so far and acknowledged the need to accelerate rate hikes.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Following this announcement, European bond yields surged and the US's loss of yield advantage resulted in massive short coverage of the euro, thus supporting the longest streak of dollar losses since April. A weaker dollar is generally good for commodity markets and for growth in emerging markets that are more dependent on commodities than developed markets.

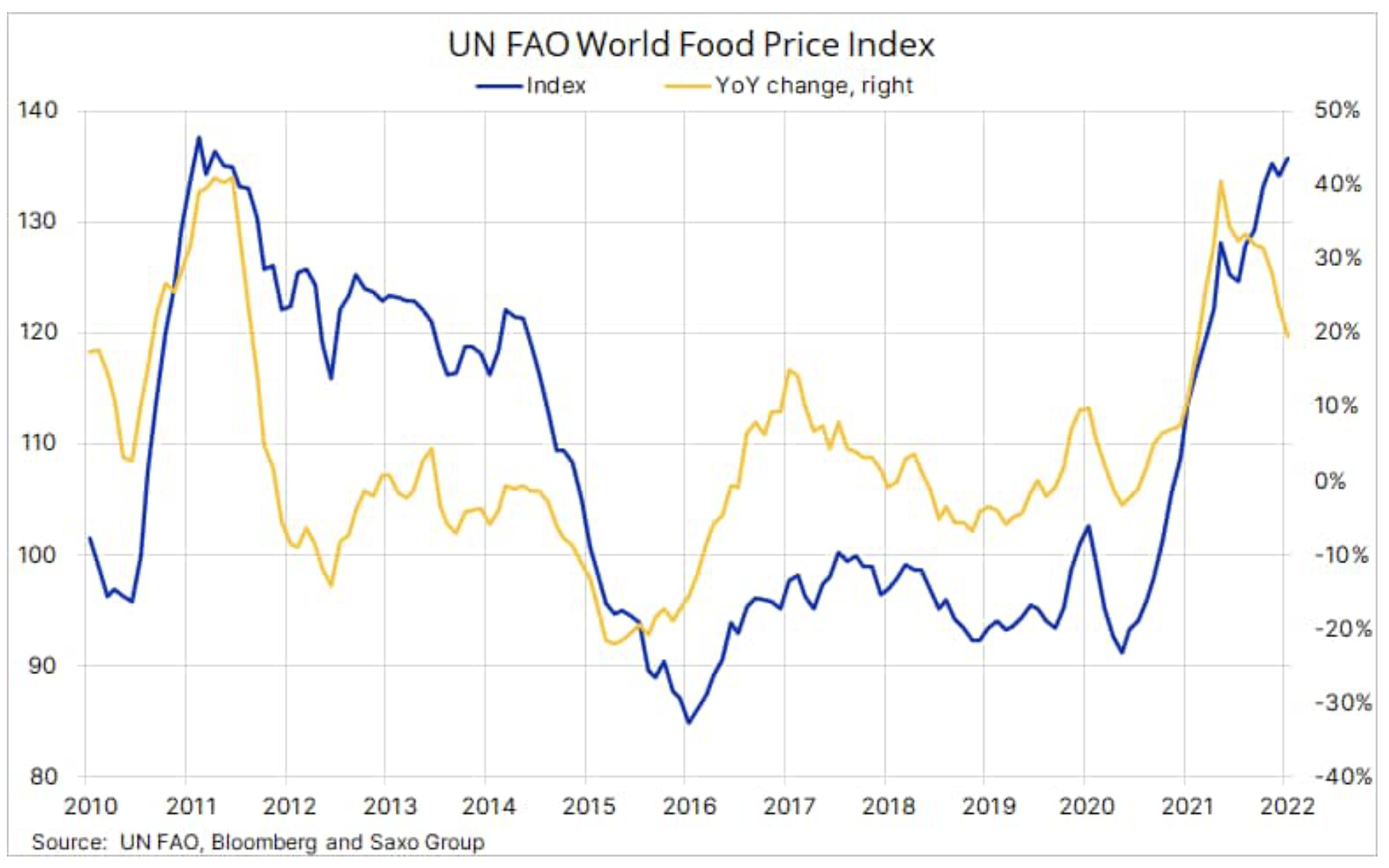

According to the FAO food price index, which monitors a basket of 95 globally traded food products, world food prices rose again in January. This index has approached the record high of 2011, when soaring cereal prices and general cost of living triggered the outbreak of the Arab Spring. However, taking into account the base effect, year-on-year growth slowed down to 19,5%, compared to 40% in May 2021.

Higher food prices last year were the result of the economic recovery after the pandemic increased demand, a difficult year in terms of weather conditions and the prospect of production discontinuation next season due to the La Ninã phenomenon, Covid outbreaks challenging supply chains, labor shortages and more recently also rising production costs due to soaring fertilizer prices and the cost of fuels such as diesel.

This year, vegetable oils are at the forefront, with soybean and palm oil at the fore, supported by strong demand for plant-based fuels as crude oil continues to become more expensive. Palm oil futures traded in Malaysia last week hit a record high amid fears of a contraction in supply after the largest producer - Indonesia - announced export cuts to keep domestic prices under control. The price of soybeans was supported by a steady downward revision of the Brazilian harvest estimate due to adverse weather conditions; Political tensions in Argentina, the world's largest exporter of soy products, also contributed to market nervousness.

Continuing the topic of export restrictions, Russia announced a two-month export ban on ammonium nitrate to ensure a successful sowing season in the country thanks to the large supply. The price of ammonium nitrate has quadrupled in the last year due to the increase in the price of natural gas, which is commonly used as a raw material in the production of two nitrogen fertilizers - ammonia and urea. As Russia is one of the largest exporters in the world, the effects will be felt not only in Europe, but also in Ukraine, which is the main producer of high-quality wheat, corn and edible oils.

Petroleum

As already mentioned, the energy sector remains the leader of the broadly understood boom in commodity markets, with the current unstoppable oil rally already in its seventh week. Both WTI and Brent crude oil reached new cycle highs above $ 90, with rising spreads in futures prices nearing termination, signaling an increasingly tight supply. The combination of limited supply, inflation, a weaker dollar and the current turmoil in the stock and bond markets has likely spurred an increase in demand from "paper" investors, with large fund asset managers and speculative investors looking for a safe haven to weather the current storm in traditional investment portfolios .

Support is also provided by geopolitical tensions, freezing Texas weather which has struck supply to some extent, and the latest weekly US Energy Information Administration (EIA) inventory report showing another decline in US oil stocks and a decline in production since December by approximately 300 thousand barrels a day. Fundamental data pointing to a rapidly declining supply in the market last week gained support after OPEC + agreed to another 400k increase in production. barrels per day, while ignoring the problem of the growing discrepancy between quotas and production.

Bears on oil market - if any remain - may see this as a sign that OPEC + maintains the view that once the peak winter demand is reached, oil markets will be sufficiently large. The bulls, on the other hand, read the lack of intervention as a signal that no action can be taken at present, as only a few producers are able to increase production. Any unilateral decision by countries such as Saudi Arabia or the United Arab Emirates to temporarily increase production can almost nullify production reserves, with the risk of a sharp increase in prices in the event of an unforeseen disruption of supply.

Global oil demand is not expected to peak in the near term, which will put even more pressure on production reserves, which are shrinking every month, thus increasing the risk of even higher prices. This confirms our long-term positive opinion on the oil market, as it faces many years of potential underinvestment - major players are redirecting some of their already reduced capital expenditures to low-carbon energy production. Clearly, both WTI and Brent crude oil need to consolidate their firm gains, but until the XNUMX-day moving average is breached there is potential for further gains.

Precious metals

Gold stabilized after the January decline caused by the FOMC and fell in the range of around $ 1 during the week, with any drop below that level to buy again. At the same time, silver has stayed above key support at $ 800, but has so far struggled to find the momentum that supported the strong spike in early January. The market has been negatively impacted by rising bond yields after the European Central Bank and the Bank of England joined the Federal Reserve, adopting a more hawkish stance on interest rates to fight inflation. Aggressive signals from Europe unintentionally contributed to the sharp appreciation of the euro against the dollar, which was heading towards the largest weekly decline since November 22. The biggest challenge came on Friday after much better-than-expected US report pushed bond yields up sharply, while the dollar managed to recoup some earlier losses.

Despite the strong demand from central banks, we are maintaining a patient but positive outlook for precious metals in the long term:

- As a hedge against inflation and a defensive asset, gold can attract investors' attention again in the face of increasing volatility in the equity and bond markets as the market adjusts to rising interest rates. The start of a cycle of interest rate hikes by the FOMC in the past has often signaled a low gold price; this cycle is scheduled to start on March 16.

- Gold shows some resistance to rising real yields, and investors focus on hedging their portfolios against the risk of slowing growth, and hence - a drop in stock market valuations. Last month, institutional investors, many of whom reduced their exposure in 2021, began to make a comeback, and the total position in gold-backed equity-listed funds rose to its highest level in four months.

- As 5% to 15% of the exposures of the world's most popular commodity indices are for gold, any demand for these indices, as has been the case recently, automatically generates additional demand for gold.

The short term technical outlook remains neutral with solid support towards $ 1, while a break above $ 780 is needed to pull buyers back toward $ 1 and ultimately the November high of $ 825.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)