Crude oil rebounds, short selling back in the spotlight

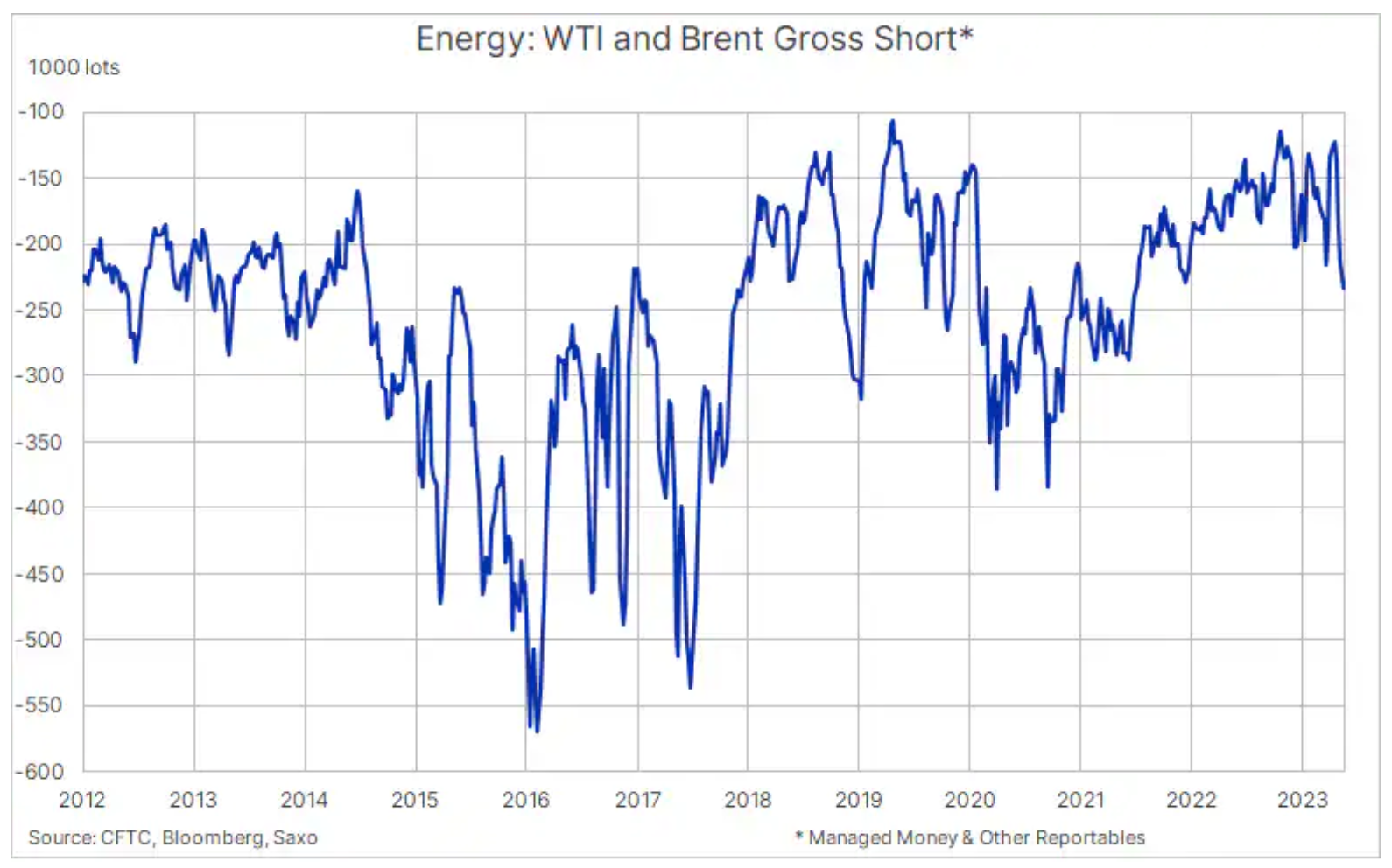

Oil prices they do not break out of the range, and given the latest broadly negative price news, this may indicate that the sell-off that has been going on for a month is over and the focus is on consolidation and subsequent rebound. Speculative investors have recently increased their gross short position in WTI and Brent oil to near the level they were before the production cut OPEC + April 2, and after another remark by the Saudi energy minister that they should "be careful", some of them may have begun to have doubts.

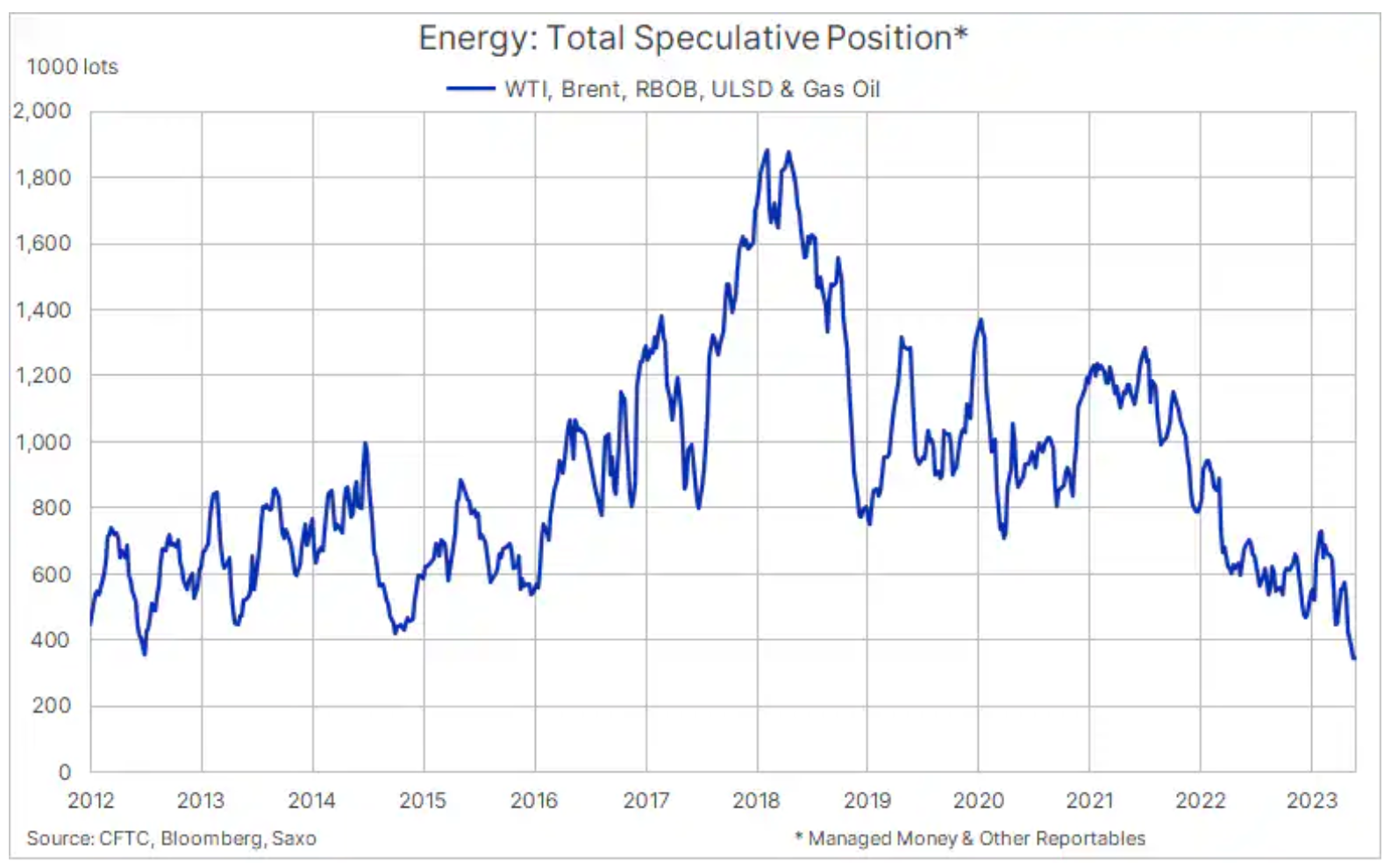

The negative news mentioned above was mainly related to the recent strengthening of the dollar, as the debate on possible further interest rate hikes attracts more and more investors' attention. The US debt problem, the risk of a recession and a weaker-than-expected recovery in China were also of some importance, but given that traders have already achieved their lowest exposure to the five largest oil and oil futures contracts in more than a decade, it could be argued that that these potential headwinds are already almost fully factored into valuations.

Oil bounces back

The strengthening seen yesterday was likely supported by comments from Saudi Arabia's energy minister, Prince Abdulaziz bin Salman, speaking at the Qatari Economic Forum in Doha. He reiterated that OPEC+ seeks stability through its actions rather than reaching a certain level or price range. He also spoke of his distaste for speculators trying to influence the price of oil, saying they suffered from the April 2 production cut and should "be careful".

CHECK: How to Invest in Oil? [Guide]

His comments highlight the growing concern over the weakness seen over the past month. Some of that was due to a new resurgence of short selling, and the latest Commitment of Traders data shows that short selling is back. In the week ending May 16, the combined gross short position on WTI and Brent reached a nearly two-year high of 233 million barrels, up 111 million barrels over the last five weeks and 40 million barrels more than the gross short position recorded before the production cut from 2 April.

The price range for Brent crude oil is narrowing – currently between USD 74,50 and USD 77,50 – and given the current positioning, the potential for growth is increasing. However, the signal of reaching the minimum in the market will only be an attempt to break through and actually breaking above the psychological level of USD 80. Until then, this oil is likely to remain within the range. Similar moves have been seen with WTI oil, currently in the $70-73,90 range.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response