Oil is a geopolitics problem, sluggish demand reflects

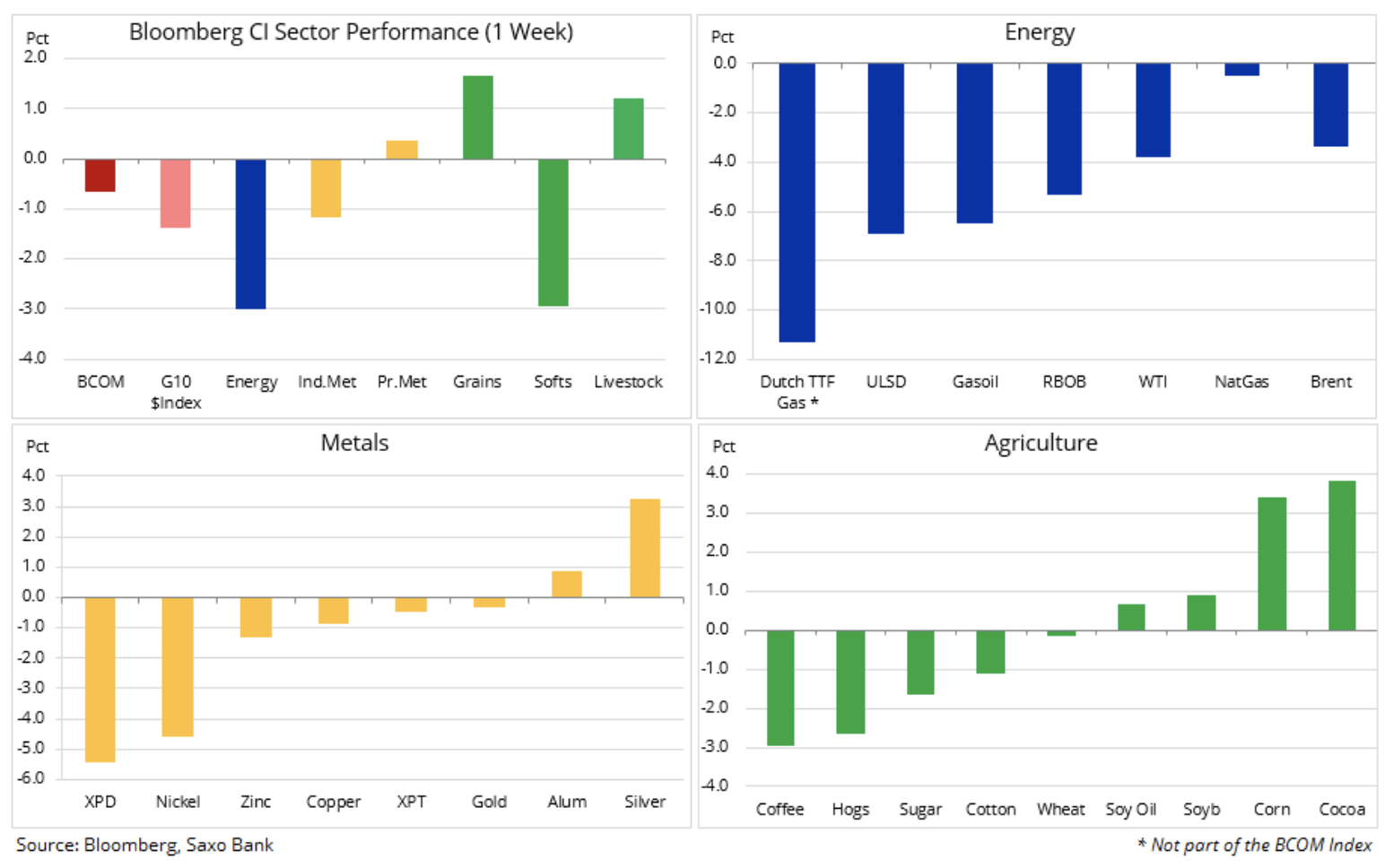

Petroleum it's a geopolitics problem, sluggish demand reflects. In the last week of May, trading in raw materials varied. May turned out to be the month of many markets coming back to life after the Covid-19 breakdown in the first quarter. Despite the intimidating economic data, the consistent loosening of restrictions around the world has raised hopes for a V-shaped recovery in the coming months. Unfortunately, we do not share this optimism, given that millions of workers are unlikely to return to work, and that there is still a risk of virus recurrence in economies that are opening too soon.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Petroleum and precious metals in the spotlight

The Bloomberg commodity index has gone down and the energy sector has lost some of its record-high profits following a fall in April. Industrial metals also performed worse due to the growing tension between the United States and China, despite new incentives being introduced by the People's Congress. The problems of precious metals quickly ended - both goldand silver continued to enjoy demand due to the weaker dollar, lower real yields and frictions between the two largest global economies.

Precious metals

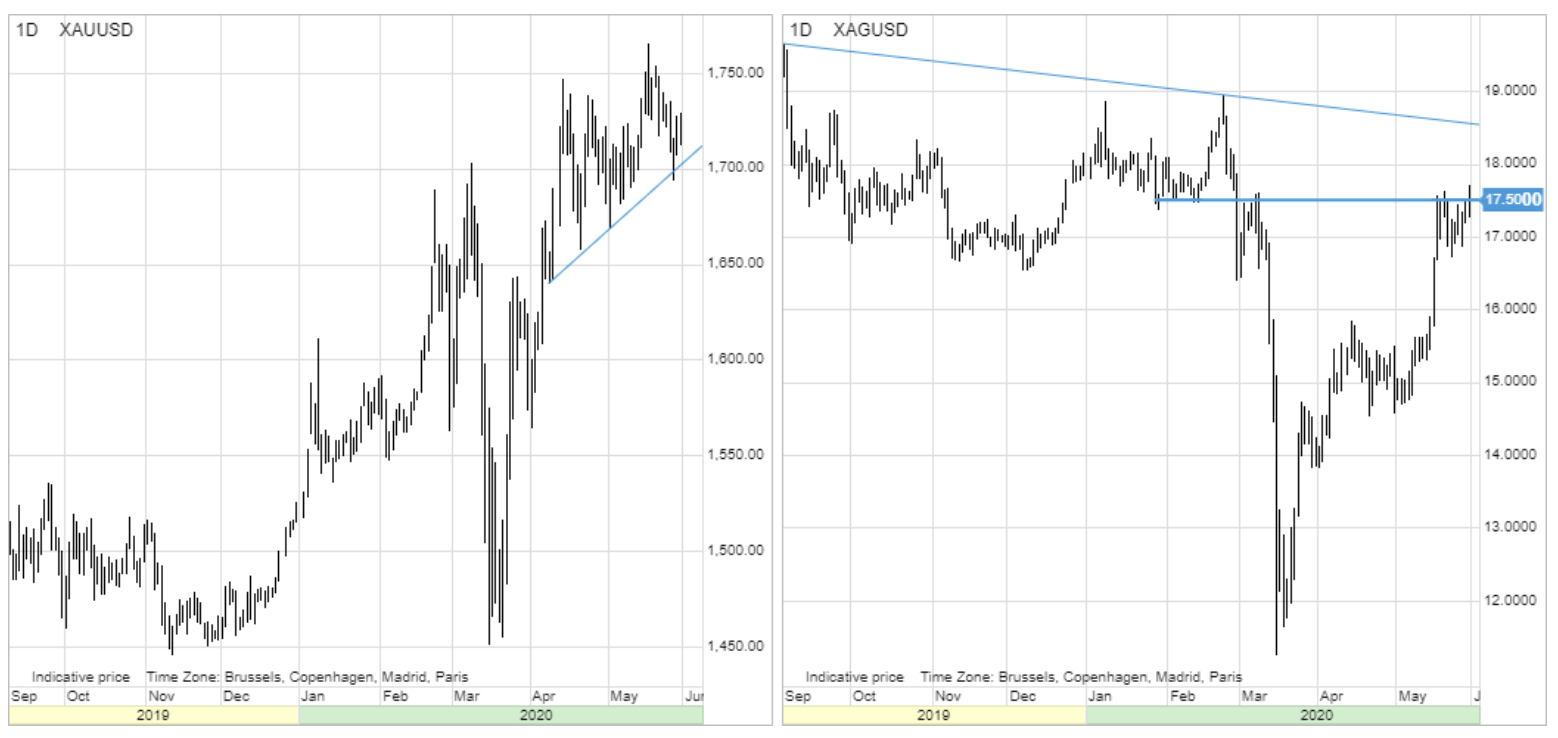

While silver continued to recover from the significant losses recorded in March, gold's resistance was tested again this week. No further impetus after the last break to USD 1 increased market nervousness, culminating in a temporary drop in spot prices below USD 765 / oz last week. However, just as breaking up did not attract new buyers, a fall below the level of support did not cause a wave of new sales.

Support was quickly restored after the dollar and bond yields went down due to escalating tensions between Washington and Beijing. Investors still perceive gold and, more recently, silver as capital protection. While hedge funds, which often conclude transactions based on short-term technical price changes, have been relatively calm in recent months, the demand for gold-based stock market funds has continued to be associated with strengthening. Global volume ETF Gold-based investors have steadily risen to a record high of over 3 tonnes over the past six months.

A similar situation related to silver, which despite the fall in March in recent months has recorded a strong increase in investments to new record levels almost every day. After strengthening by 50% from the minimum in March at 11,65 USD / oz, this metal also managed to regain some losses against gold. The ratio of gold to silver, i.e. the value of one ounce of gold expressed in ounces of silver, has improved from a record level of 125 recorded in March to the current level of 98, although it is still well above the five-year average of around 80.

We are reiterating a positive forecast for both metals, primarily for gold, given the narrowing of its premium to silver. The main reasons why we cannot rule out a new record high in the coming years are as follows:

- Gold used as collateral against central monetization of financial markets

- Unprecedented government incentives and the political need to raise inflation to support debt levels

- The inevitable introduction of yield curve controls in the United States, forcing a fall in real yields

- Increase in global savings in the context of simultaneous negative real interest rates and unsustainable high stock market valuation

- Increased geopolitical tensions related to shifting blame for the Covid-19 pandemic

- Increased inflation and weakening of the US dollar

Petroleum

Market boom oil, which began after falling below zero on April 20, shows the first signs of inhibition. This came after the WTI oil futures contract reached 35 USD and the Brent oil contract did not exceed USD 37,2 / b - both levels represent a 38,2% reduction from the discount from January to April. A short decline in the May WTI oil contract expiring to negative values last month probably provided the greatest support for the strong bull market following it.

The April 20 event shook the global oil market, and producers realized that drastic steps should be taken to protect the market from further losses. Most likely, this led to the close and rapid agreement shown by major producers in May.

In the latest report on the oil market, the International Energy Agency (IEA) noted that in May, global oil supply fell by 12 million barrels per day to a nine-year minimum of 88 million. At the same time, demand is expected to recover from a decline of 22 million barrels per day in May year-over-year in May to a decline of 13 million in June.

This process was supported by the rapid and in most cases forced reduction of American oil from shale production, currently estimated by the IEA at 2,8 million barrels per day y / y in 2020. Earlier cuts in production by OPEC + always caused some fluctuations, as group members risked giving up part of their share in North American producers. This risk disappeared after the collapse of the WTI oil market, as a result of which many producers recorded losses, which forced them to stop production.

After potentially reaching the consolidation phase, it is worth considering what could cause further weakening. In this context, there are a number of risk areas, primarily:

- Re-increase in Covid-19 incidence after loosening restrictions

- The ability of OPEC + to maintain the current close agreement

- Determination of lossy US producers to increase production when WTI oil prices return above USD 30 / b

- Post-pandemic changes related to global consumer behavior (less flights, more work from home)

Breaking above USD 35 / b in July futures contract on WTI may signal a potential extension towards $ 40 / b, while support should appear at USD 30 / b. Only a fall below USD 28 / b raises concerns for a deeper correction.

In addition to the risk of another trade war between the United States and China, as well as a weaker than expected recovery in demand, oil will focus on the OPEC summit and the OPEC + group in Vienna in early June, when producers will discuss further decisions. Fears that Russia may oppose the continuation of cuts after July may again increase market nervousness before the meetings on June 8-10. This is due to the assumption that more expensive oil is hitherto associated with a reduction in supply - a decision that is easily reversible - and not a solid recovery in demand.

Copper market

Copper HG, like crude oil, seems to need more and more consolidation. After recovering almost all losses from the March sell-off caused by Covid-19, the metal may struggle to break above $ 2,50 / lb - a level that provided support but is now a resistance line as of 2017. The recently completed Chinese People's Congress has offered new incentives to increase demand for raw materials in key sectors such as construction and transport. Overall, however, this was not the fiscal bazooka seen in the market in previous declines. While these measures may stabilize the outlook, they are unlikely to bring growth back to 6%. For now, traders hope that the global economic recovery will win against the escalating tensions between the United States and China.

Corn Market

Maize, the most popular fast selling product among hedge funds recently, has sought the highest weekly growth since October. The recent recovery in the oil market has increased demand from ethanol producers, who usually purchase nearly 40% of US-produced corn. In the context of the potential short-term risk of heat and drought in the American Middle East, the price of this raw material has gone up and now it seems that the lower limit has stabilized at a key level of USD 3 / bushel. In the week ending May 19, speculative investors had a short net position of 245 lots (000 million tons), and further coverage of short positions could cause the futures contract to enter a resistance area above USD 31 / bushel. Wheat is also reporting transactions related to weather conditions, while soy is struggling with the fact that tensions between China and the United States are damaging China's outlook for demand.

Coffee market

Rollercoaster associated with Covid-19 on the coffee market has come full circle. After a 25% strengthening in March due to concerns about disruptions in supplies from South America, the price went down again. Extended insulation around the world has reduced the demand for high-quality beans from cafes. This week, the price exceeded the support level and fell again below USD 1 / lb, well below the current cost of production for many South American farmers. This may be the main topic of discussion at the next virtual meeting of the International Coffee Organization Council on June 1.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)