Round II of the Forex TMS competition is behind us. How did the best invest?

In the first week of competition, the best players bet on the raw materials market. Natural gas was particularly popular. In the second round, stock indices broke the popularity of commodities. The winners of the second week focused mainly on the American and German markets.

Forex TMS Competition - Round II

The middle part of the educational competition, organized by the TMS Brokers brokerage house, fell on the period of declining stock exchange indices, undecided movements in gold quotations, cheaper oil and the weakening US dollar.

German DAX, and more specifically CFD DE30, caught up in the lows in September. Similar, shameful records were also seen on other European dance floors. The mood was dictated by concerns about delays in approving the US fiscal package. The risk has raised and continues to be a potential disruption in the course of the US elections (scheduled for November 3). Additionally, the market is sensitive to the impact of the second wave of the pandemic that is just sweeping across the Old Continent. There was little optimism in the reading of the state of German industry. The PMI reading for this sector increased to 58 points. from 56.4 points Additionally, the Markit institute emphasizes that maintaining the pace of growth at this level will be difficult to maintain.

Last week also saw a second debate between President Donald Trump and Joe Biden, the Democrat candidate. The clash between two politicians in a civilized atmosphere brought nothing new. There was also no major reaction from Wall Street. Admittedly, at the opening of Friday's session, the overseas indices were declining, but in the second half of the session, NASDAQ100 and Dow Jones began to slowly recover.

High activity and high rate of return

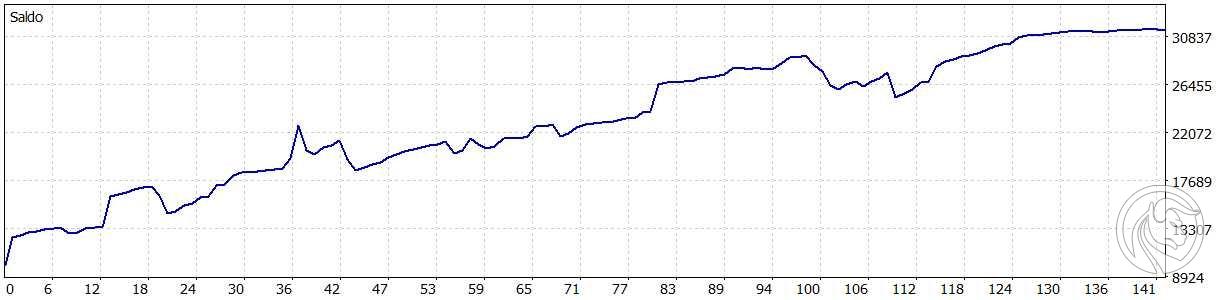

In the second week of the competition, the best ones invested mainly on stock indices. A winner with achievements 214,75 proc. rate of return (nickname: Hajer), he made over 140 transactions on contracts US100 CFDs. The portfolio includes single positions on DE30 (DAX contract), gold or USD / JPY. However, what decided about the victory was trading on a technological index. "Hajer" had a highly speculative style. The "buy" transactions are almost alternating with the "sell" positions. Single market entries were short, from several to several dozen minutes. The best single position earned the winner more than 2,5 EUR, the worst reduced the player's wallet by 2268 EUR.

Portfolio equity curve of the winner of the 2nd week of the competition. Source: TMS Brokers

Only one market and one direction

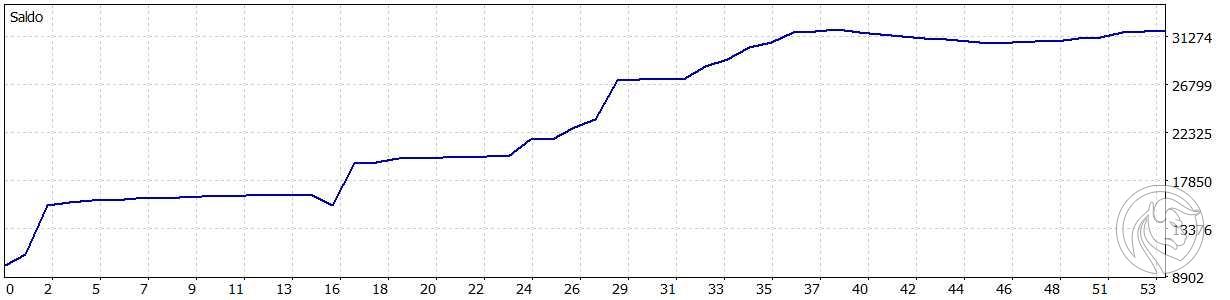

The runner-up obtained 197,57 proc. rate of return. This is a classic example of focusing on one market. In this case it was DE30 (a contract based on the German DAX). Relatively high volatility of the index last week allowed for an above-average result. The Frankfurt stock exchange was in retreat for most of the five sessions of the second round of the competition, with red dominating. This downward trend was taken advantage of by "ANRO1999", which from the very beginning positioned itself to sell the index. Short positions prevail in the portfolio, and the best one gave the runner-up over 4 600 euro. There are no drastic drops on the capital curve. The silver medalist made almost 3 times fewer transactions than the winner of the second stage.

The capital curve of the investor's portfolio, which took second place in the second week of the competition. Source: TMS Brokers

Not quantity, but quality

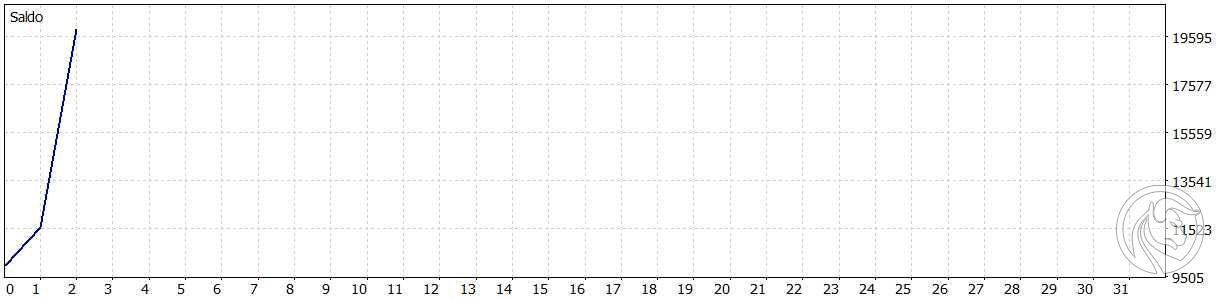

The lowest place on the podium was taken by a player with the nickname "DamonPunk". This trader proves that the high rate of return (194,98%) is possible even when we make few transactions. This example shows that it is not quantity but quality that matters. In the investor's portfolio we find only 2 sell positions, which were concluded on Monday (October 19) and Wednesday (October 21), and closed one after another during Thursday's session. The bronze medalist proves that even if I don't have too much free time to trade, we can compete for prizes in the competition or high profits in real investing.

Portfolio capital curve of the bronze medalist of the 2nd week of the competition. Source: TMS Brokers

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)