Cloud market - How to invest in companies from the cloud sector? [Guide]

In recent years, investors increasingly meet companies operating in cloud sector. Some people think that this is just another advertising gimmick that does not bring any added value. However, this is not true. Cloud solutions can increase productivity in the company and reduce some costs. Cloud solutions allow companies to undergo the next wave of digitization.

The cloud market itself is very extensive. In the narrowest definition, these are only cloud solution providers. In a broader version, these are the owners of data centers rented by cloud providers, as well as companies offering their applications operating in the cloud. The following text will explain what the cloud market is and how you can invest in it.

What is a cloud?

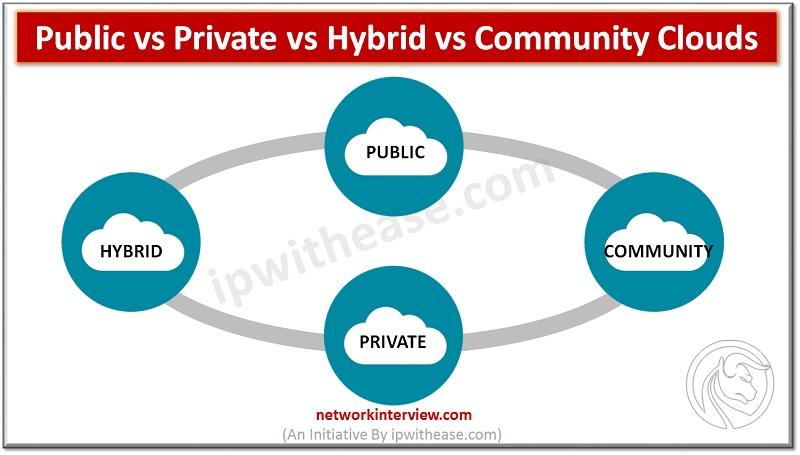

The cloud is basically a global network of data centers that allow a number of functions. These include: data storage, running applications, managing a social network, or providing services such as online streaming. Simply put, servers are supposed to provide services or answer queries. However, the cloud is not a uniform offer. Can be listed here:

- Public cloud - it is a cloud service in which the data center offers its services to many users who use the cloud for, among others, hosting. Among the uses of the public cloud are, for example, e-mail services or video streaming (e.g. Netflix).

- Private cloud - however, some companies cannot afford to have their data stored in a public cloud. This may be due to company policy or legal requirements. In such a situation, the space in the data center is entirely dedicated to one customer. Data is sent over a closed network, not the internet. This is to increase the security of transmitted data.

- Hybrid cloud - it is a solution in which the company uses both the private cloud offer (for critical data) and the public cloud offer for less sensitive data.

- community cloud - it is a solution where the data center is shared among government organizations. The aim is to coordinate joint projects of government agencies more efficiently.

Source: networkinterview.com

Cloud history

Despite the fact that the cloud is becoming popular now, the history of this solution dates back to the beginning of the 2002st century. Of course, at the very beginning of the Internet, there were concepts of a remote data storage and sharing service. However, several years had to pass before the idea of the cloud was crystallized. Interestingly, the first big player to create a cloud service was not technological giants, but a "small" (from today's perspective) Amazon, which focused on online commerce. In XNUMX, Amazon launched its cloud service under the name Amazon Web Services (AWS). Amazon it was simply renting out surplus computing power to companies. In the following years, the service was developed.

Source: AWS, new logo

Interestingly, the AWS offer did not meet with an immediate reaction from the competition. More wealthy capital competitors like Microsoft, IBM whether telecommunications companies have started to slowly enter this market. This gave Amazon time to expand its competitive advantage. Currently, AWS is the leader of the cloud market in the United States and Europe. It should be noted, however, that competitive pressure from Microsoft as well Google is getting stronger.

However, US companies did not take over the world market. It is worth mentioning that local oligopolists have sprung up on the Chinese market. In the cloud market in the Middle Kingdom, it has the largest market share Alibaba and Tencent.

IaaS, PaaS, SaaS - what does it mean?

When checking what many companies operating in the cloud are doing, they often come across terms such as IaaS, PaaS or SaaS. Knowing them will make it much easier to understand the business model of a company operating "in the cloud".

IaaS

It stands for Infrastructure as a Service. This is a cloud computing offer where the service provider gives the user access to computing resources (storage, servers, etc.). An organization using IaaS uses its own platforms and applications on an infrastructure provided by a cloud service provider. Thanks to this solution, the company does not have to spend money on equipment or real estate (for a data center). The service is scalable (the increase in demand for computing power does not require additional CAPEX). The recipient of the services only pays a fee for the use of computing power.

PaaS

It is an abbreviation of Platform as a Service, meaning platform as a service. This offering allows users to access the cloud where they can design, deliver and manage applications. In addition to access to the mass memory, the user also receives access to ready-made tools, thanks to which he can create, configure and test his own applications. Some IaaS vendors offer additional PaaS. Thanks to this workaround, enterprises focus on creating their own solutions without worrying about infrastructure. So it's a good solution for software companies that can use PaaS to test and build new applications and prototypes more easily.

SaaS

It stands for Software as a Service. It is a cloud computing service that allows users to access the software. The aforementioned software is based on the provider's cloud (also external). Users of the software in the SaaS model do not have to install the application on local devices. Access to them is offered via a web browser or API. The customer pays for the service in the subscription model. Thanks to this solution, the subscriber does not have to worry about updating and incur large initial fees (as was the case in the on-premise model). SaaS solutions may concern, for example, ERP, office applications or e-mail. An example of such solutions is Salesforce or Spotify.

Tier data centers

Interestingly, cloud service providers do not need to have their own data centers. Very often they rent such centers from specialized companies that only deal with such activities. Among them can be mentioned GDS, CyrrusOne or equinix. Some of them work in the form REIT.

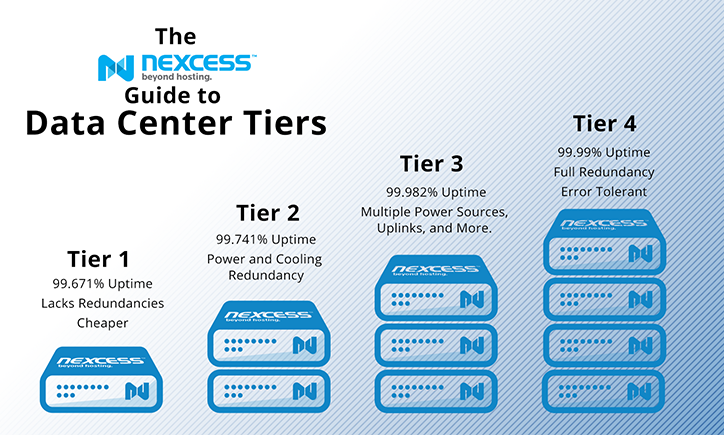

- Tier I.: Non-redundant system. Data center infrastructure located in a dedicated area outside the office space. Small server rooms for internal needs. Annual unavailability is approximately 29 hours.

- Tier II: Basic redundancy. The power and cooling systems have redundant components. Maintenance requires a temporary break in the center's operation. N + 1 redundancy. Annual unavailability is about 22,5 hours.

- Tier III: Independently managed infrastructure. No impact of the management and replacement of infrastructure components on the operation of the IT system. N + 2 redundancy. Maintenance and servicing do not require power and cooling shutdown. Yearly unavailability for about 1,5 hours.

- Tier IV: Fail-safe infrastructure. It has "immunity" to single, unplanned events such as fire, leakage or explosion. Annual unavailability approx. 30 minutes.

How to choose an interesting company operating in the cloud market?

Anyone investing in individual companies operating on this market must make a preliminary selection. This is because the investor does not have an infinite amount of capital and should only invest in promising companies. It seems a truism, but many investors, fascinated by the prospects of a given market, do not pre-select companies. When you buy a random company from the industry, you have exposure to the market, but the long-term rate of return can be disappointing. Below, we present the basic variables that an investor should take into account when looking for an interesting company.

Business measures

In the company's analysis, it is also worth looking at the operational activity. This is especially true for SaaS companies. Very often, such companies spend a lot on customer acquisition (sales, marketing costs). The result is that they achieve "astronomical" losses. The operating loss can be as high as several dozen percent of revenues. So how do you tell if a company is spending money effectively? The key measures are:

DBNER (dollar-based net expansion rate)

The measure may seem "terrible" but it gives a brief overview of how the acquired customer group "behaves" in the years to come. It is natural that the acquired clients "crumble" in the following years. This could be due to a transition to competition or bankruptcy if the client is a business. Theoretically, the revenues of the cohort (group of clients acquired in a given year) should decrease in the coming years. However, some businesses are able to increase revenue from "retained" customers, which "fills in" the hole caused by the departure of some subscribers. The higher the value of this indicator, the better. The limit is 100%. If DBNER is below 100%, the company constantly needs new customers to keep growing. This does not mean that if a company has a DBNER below 100% it is a weak business. However, this is a warning sign.

Relation of CAC (customer acquisition cost) to LTV (lifetime value)

It is a relationship that allows us to determine whether the company is growing “healthily”. LTV is a measure of how much a given customer will generate gross profit on sales (some people use revenue) over their “life cycle”. In turn, CAC is the cost that the company must incur to acquire a customer (marketing, sales, promotion). A business that grows "unhealthily" has a higher CAC than LTV. This means that despite the increase in revenues from customer acquisition, the company will generate losses on acquired customers in the foreseeable future. This means that the company "burns" money into meaningless growth.

Rule 40

It is a very popular measure, especially among companies operating in the SaaS model. It helps you analyze companies that have a rapid increase in revenues but have losses or low profits. For this purpose, a rule has been formulated that says: add together the revenue growth rate and the net profit margin or the FCF margin. If the sum is greater than 40, the company has "healthy growth". For example, if a company grows on revenues at the level of 65%, and generates a net loss of 20%, it achieves the result of 45, which is above the "limit of 40". As a result, the rule was fulfilled. It is worth remembering that rule 40 is calculated differently, sometimes it happens that analysts add an EBIT margin or a "cleaned" EBITDA margin to the rate of revenue growth.

Profitability of the business

You need to know what phase the business is in. Some companies are able to increase the scale of operations by a dozen or so - several dozen percent per year, and yet keep their margin. Very often in such a situation the enterprise generates free cash flow in addition to net profits. This is most often a feature of mature companies that do not have to aggressively fight for the client. Sometimes there is a situation where the company does not report accounting profits yet, but the SaaS model in the growth phase generates a large amount of cash. An example is Salesforce from 2019, when the company generated approximately $ 126 million in net profit and over $ 3,5 billion in free cash flow (FCF).

Salesforce stock chart, interval W1. Source: xNUMX XTB.

More mature companies can be measured with indicators such as: P / E (price to profit), P / FCF (price to cash flow) or PEG. In the case of companies from the data center market, the P / FFO (funds from operations) ratio is very often used.

However, due to the "initial phase" of this market (IaaS, PaaS, SaaS), many companies choose the following strategy: "Grow first, then earn". For this reason, many companies focus on taking market shares. Each generated cash is spent on product development or customer acquisition. Enterprises in the initial phase are usually valued on the basis of the P / S (price to revenues) ratio.

Gross margin on sales

This is the so-called first margin, which is before deducting operating costs. Gross margin is the difference between revenues and costs of products, goods or services sold. For companies operating in the cloud sector, gross margins above 70% are not unusual. Gross margin analysis can help you better understand your company's policies. Its decline may mean that the company has lowered the price of its service in order to attract new customers or protect its market share. Sometimes, a decrease in the margin may result from the company's entry into a new area of activity with a lower margin.

Analysis of operating expenses

Operating expenses should be analyzed based on their relation to overall revenues. This allows you to see whether costs can be optimized with the growth of the business scale. It is especially worth following the costs of research and development (R&D), which are a necessary component of the development of technology companies. R&D spending that is too low can contribute to the creation of a "technology debt" which will cause an outflow of customers. In the case of sales and marketing (S&M) expenses, it is good if the increase in S&M costs is slower than the increase in revenues. As a result, the ratio of S&M expenses to the company's revenues decreases. Over time, operating expenses should grow more slowly than revenues, and as a result, the operating margin increases.

Cloud market - in which companies to invest

As already mentioned, there are many companies operating in the cloud market. There are many business models, therefore we will present examples of companies from individual industries.

IaaS and PaaS

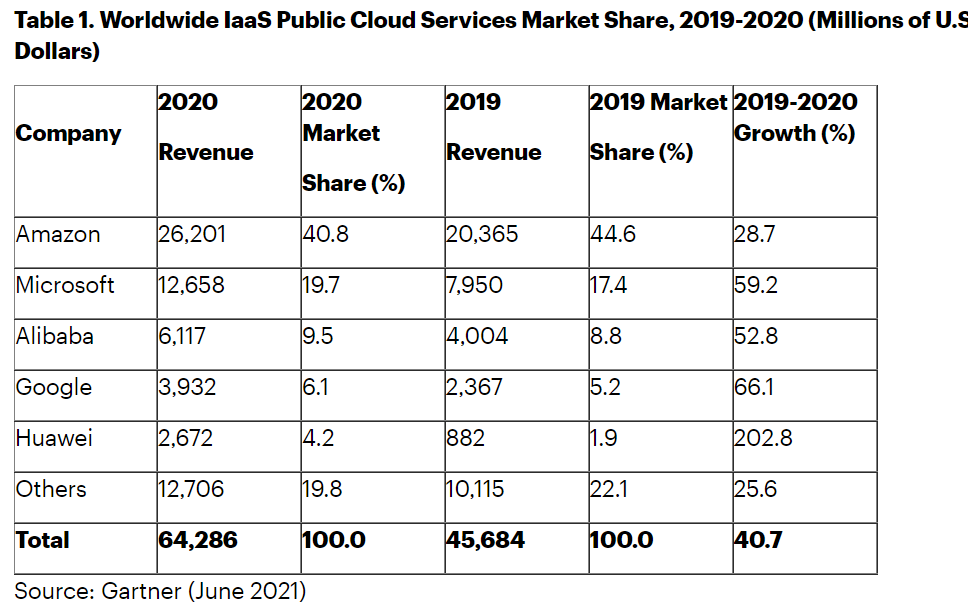

The most famous companies offering IaaS and PaaS services include the largest suppliers such as Amazon (AWS), Alphabet (Google Cloud), Microsoft (Azure). It is also worth mentioning the cloud offer of companies such as Alibaba, Tencent and Huawei. According to Gartner's data, the IaaS market was estimated at $ 2020 billion in 64,3. This meant a market growth of over 40% y / y. As you can see in the chart below, the top 5 providers on the IaaS market generate 80% of revenues. It's worth noting that Amazon has a dominant position in the market, but lost some of its share in 2020.

In turn, according to Gartner's analysis, from April 2021, the PaaS market was estimated at $ 2020 billion in 47.

It is worth mentioning that there are very few companies that only supply cloud services. The biggest players on the cloud market are only "segments" in the activities of large corporations such as Amazon, Alphabet or Microsoft. One of the "clean" players in this market is Kingsoft Cloud, one of the largest companies of this type in China.

Some also invest in companies that offer the equipment necessary for the operation of IaaS and PaaS offerings. Such companies include, for example, Arista Networks.

Investing in SaaS companies

In the case of SaaS, the market is estimated at over $ 100 billion. In recent years, there have been a lot of debuts of companies operating in the SaaS model. Companies operating on the SaaS market include companies offering communication solutions (Slack, Zoom) and a CRM offer (Salesforce, Zendesk) or an offer related to increasing the productivity of teams at work (Trello, Confluence).

Zoom stock chart, interval W1. Source: xNUMX XTB.

Investing in data center providers

You can also invest in companies that offer access to data centers. The companies operating in this business model are listed on the stock exchange. These companies are gaining in popularity of cloud services on the market. The more companies operating in the cloud, the greater the demand for new data centers. Examples of such companies are the Chinese GDS or the American Cyrus One and Equinix. It is worth mentioning that many companies in this segment operate as REITs.

Equinix stock chart, interval W1. Source: xNUMX XTB.

ETFs for the cloud market

If an investor is not sure who will be the winner in the cloud market, he can take advantage of ETFs offering exposure to this market segment. Thanks to this, the investor can gain exposure to all cloud segments: IaaS, PaaS, SaaS.

An example of such an ETF is Global X Cloud Computing ETF (CLOU)which gives exposure to companies from the IaaS, PaaS and SaaS market. The components of the ETF are 36 companies. The largest shares in ETF are:

- Zscaler - 5,10%,

- Paylocity - 5,06%,

- Paycom - 4,87%,

- Shopify - 4,70%,

- Dropbox - 4,28%.

The company's assets under management total more than $ 1,3 billion. The management fee is 0,68%. The ETF is available on the US market. The benchmark for the ETF is the Indxx Global Cloud Computing Index.

Another type of ETF is WisdomTree Cloud Computing UCITS ETF, which is traded on several European markets (including Great Britain, Germany, France, the Netherlands). The fund was established at the beginning of September 2019. The ETF is physically replicated and the benchmark is the BVP NASDAQ Emerging Cloud Index. The assets under management (AUM) of this ETF amount to € 673 million. The largest shares in ETF are:

- Asana - 3,32%,

- Cloudflare - 2,69%,

- Adobe - 2,49%,

- Box - 2,48%,

- Atlassian - 2,47%.

Where to invest in the cloud market - ETFs and stocks

An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Cloud market - How to invest in companies from the cloud sector? [Guide] cloud market](https://forexclub.pl/wp-content/uploads/2021/08/rynek-chmury.jpg?v=1629704639)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Cloud market - How to invest in companies from the cloud sector? [Guide] the graph gt crypto](https://forexclub.pl/wp-content/uploads/2021/08/the-graph-grt-crypto-102x65.jpg?v=1629458880)

![Cloud market - How to invest in companies from the cloud sector? [Guide] Will the FED trigger a correction](https://forexclub.pl/wp-content/uploads/2021/08/Czy-FED-wywola-korekte-102x65.jpg?v=1629707705)