Foreign exchange market at higher turnover - improvement in volatility in August.

Over the past few months (with few exceptions), we have seen constant stagnation that has engulfed the currency market. August positively surprised most financial institutions in terms of volatility. Traders also gave good results. Let's take a look at the results published by leading companies in the financial industry.

Read: Forex trading in July - mixed data and low volatility

Stop on volume

Most companies, mainly from Asia, published reports with good results in terms of turnover. In the light of the last few months, detention has been a great success "Bad streak" per volume. Such a report can be proud of the largest provider of services related to risk reduction - CLS Group. The presented data show practically no change on a monthly basis. However, when compared to 2018, you can see progress.

The average daily trading volume presented by CLS remained virtually unchanged in August 2019. Exactly it amounted to 1,750 trillion dollars. According to annual figures, this figure reflected an increase of ten percent compared to the $ 1 trillion 1,605 of August 2018.

In category spot CLS currency volume recorded 441 billion dollars in turnover in August 2019. This represents an increase of 3,8 percent compared to 425 billion dollars in the previous year. This result was also higher by 14 percent in m / m terms. In July CLS presented in reports spot the amount 388 billion dollars.

Almost 30% up

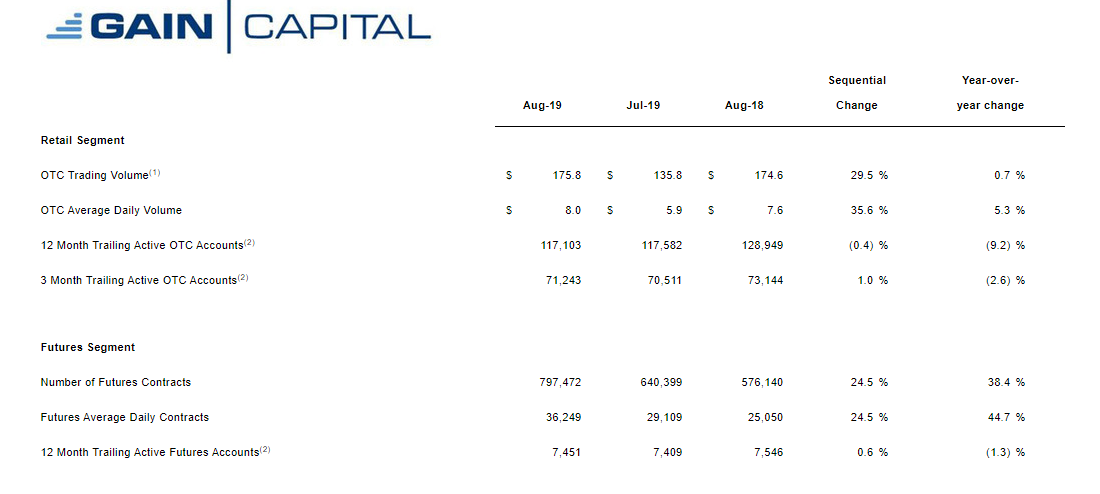

The group published very good results GAIN Capital. After a weak July, the data for August are really promising and put the currency market in a favorable perspective. Retail clients carried out transactions totaling USD 175,8 billion. Compared to the previous month in which over-the-counter (OTC) volume was just 135,8 billion dollars, the August result is 29,5 higher. Taking into account data for August 2018, GAIN also recorded an increase compared to 2019 of the year, by 0,7%.

The average daily trading volume in August was 8 billion dollars. Considering the July data, ADV has improved by as much as 35,6%. In annual terms, we are talking about an increase of 5,3%.

Mentioning the growing volume, it is worth analyzing the new bills that were established in August. The number of active accounts decreased by 0,4% on a monthly basis. However, this did not bother increasing the turnover of the whole group.

The futures segment also recorded good results. The number of contracts increased from 640 399 contracts in July, by 24,5 percent, to 797 472 contracts traded on the stock exchange in August. On a monthly basis, this result is more impressive. Significant progress was recorded at 38,5%. ADV (average daily trading volume) oscillates within similar limits as the results from month to month.

The currency market is booming in Japan

After a really bad summer turnover, the Japanese brokerage company saw considerable progress in August. Significant increases in the transaction volume mainly concerned the currency market. At first, we'll look at Gaitame in terms of investment accounts. By the end of August, the Japanese company had 498 028 accounts. Therefore, an increase of 1 794, or 0,4 percent, was recorded. Given the monthly average, this result is "natural" and similar to previous data in terms of m / m. A more important measure than the number of new and active accounts is the amount of the deposit on them. The published report shows that Gaitame recorded an increase in the value of deposits by 1,04% compared to last month. 114,8 billion ¥ is on the accounts of the Japanese giant in the brokerage industry, which gives us the amount of 1,1 billion USD.

So far, January was the best month of the year. The transaction volume was 272,2 billion ¥. During 2019, this number has never been approached once. It was not until August that currency turnover reached 26,9 billion ¥. This is much more than noted 143,5 billion transactions volume in July ¥. In fact, it is 88,8 higher by taking last month as a reference.

19% more than in 2018

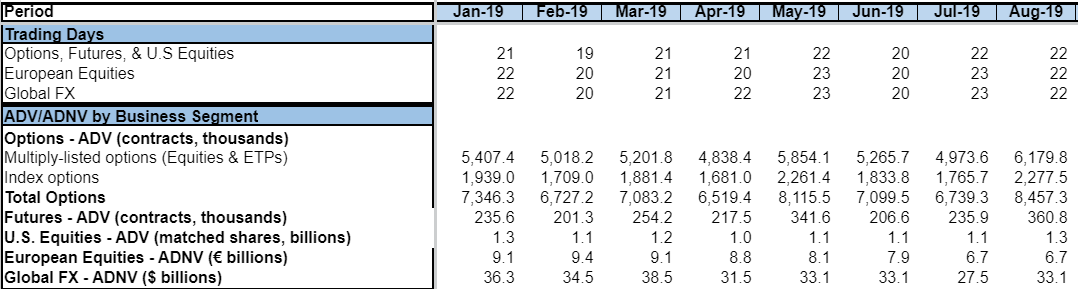

CBOE in a recently published report it boasts good results in options trading. As he reports, the growth covered the most important key segments of his business. In August this year, CBOE revealed its total trading volume of option contracts at 186 million, an increase of 19 percent on a year-over-year basis. In 2018, this number was 156 million. In quick conversion, the average daily turnover (ADV) was at the level of 8,45 million contracts.

ADV growth from month to month in August reached a progression of 25%. The stock exchange brought average daily volume of all futures (ADV) of 361 000 contracts. This represents 42 percent more than 253 000 contracts in July. The turnover on the currency market also improved, which recorded an increase of almost 15% compared to last month.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)