Currency summary of the week. Will sentiment on the pound change?

Last week we could see how much the market stopped being sensitive to important readings and meetings. I mean mainly Minutes FED, after which the currency market did not really react at all. Summing up the sessions of last week, it is worth leaning over several currencies, which may surprise us in the next days. We are talking here mainly about pound and dollar, where both on the second and the second volatility settled for longer.

Pressure on the FED pressure on the dollar

On Monday, we witnessed several comments from the President of the United States, who expressed his dissatisfaction with Federal Reserve policy. In his opinion, monetary policy easing should reach not 25, but at least 100 basis points, to bring the intended effect. Therefore, both Trump and the market are counting on successive interest rate cuts. So far, the White House is not speaking on this matter. Nevertheless, most investors probably know how the currency exchange reacted to the policies and messages issued by the Fed. Currently, the Federal Reserve policy is so obvious that the market treats all publications with a grain of salt.

In the last the Minutes publication that we wrote about in this article, there was no unexpected return of shares or any news. The reserve still treats further interest rate cuts with a great distance. This conflicts with Trump's policy, which aims not only to protect the United States from the economic slowdown, but above all, it wants "Tighten" good economic situation of the country until the next election.

Chart EUR / USD, D1 interval. Source: xNUMX XTB xStation

The dollar remains strong. The situation of exporters is not very interesting. Strong local currency will affect the results of companies that ship a significant proportion of their goods outside the US. We will see this in the summary reports for the third and fourth quarter. For now, the economy is bypassing the recession phase, and a strong dollar creates a vision of a stable and pro-development state policy. In the coming weeks it will be difficult to see a significant depreciation of USD. The zone in which the dollar circulates is paired with the euro and small inside bar may be an opportunity to catch more traffic.

Pound in reverse?

The German Chancellor is certainly one of those people who saved the British currency a bit from further appreciation, mainly against a strong dollar. For now, the move is closer to correction of recent declines, although I must admit that it shows the potential for the pound to recover slightly.

Chart GBP / USD, H4 interval. Source: xNUMX XTB xStation

The mere suggestion of establishing talks and a chance to find an agreement between Ireland and Great Britain has shaken the pound specifically. Two main conclusions can be drawn from this. The first is that the market is looking for relief in growing tensions on a global scale. The second, which is somewhat the result of the first - investors' moods are pessimistic, and all information that eliminates speculation about the escalation of the conflict is received better by the stock exchanges than macroeconomic data. In the light of events and the hot relations between the United States and China, and the vision of a hard Brexit, it's hard to speak of a positive sentiment. One, big unknown is weighing on the markets, and every good news giving hope for improvement is well absorbed by them.

On the pound, at the H4 interval, we have the first positive signal to take a longer position. The EMA ribbon (20,40,100) and favorable volume are an interesting start to watching GBP / USD in the coming days.

Germany is talking about a recession

Last week, we witnessed the first clear statements of Bundesbank experts. As one of the first without using "safe" phrases they talked about the recession in Germany. Until quite recently, poor export readings and, above all, PMI for industry were treated as "local" economic problems. Why? Other economic indicators, e.g. PMI for services, remained within the contractual limit above 50 points. Hence the diagnosis of a "mini recession" only in the context of an industrial slowdown. The Bundesbank's comment contributed to the bad moods of German investors. Namely, the bank currently sees no need to change its fiscal policy.

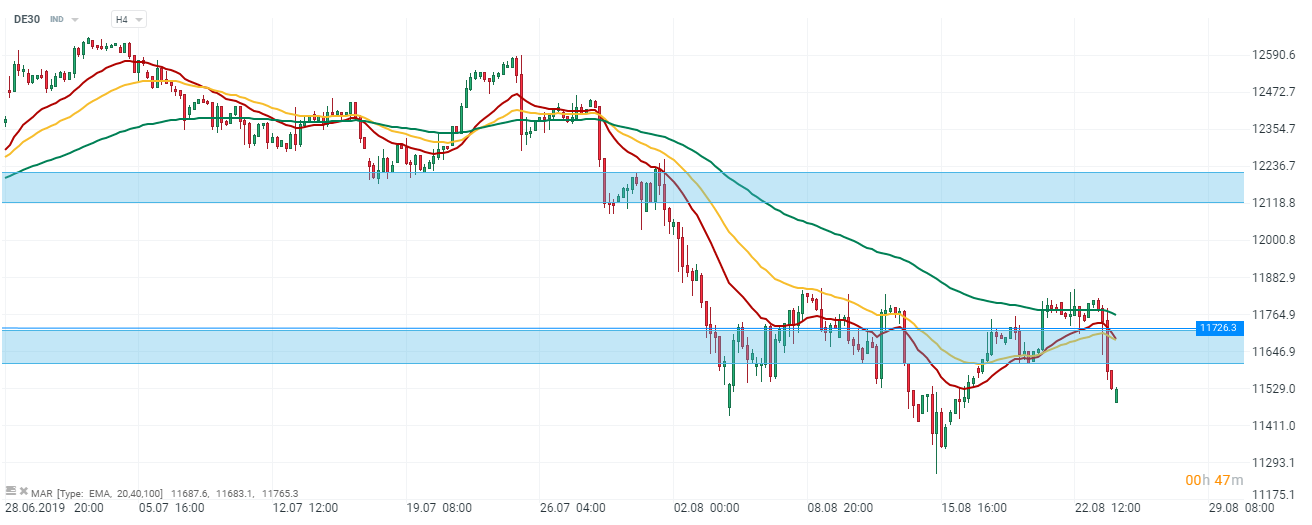

Chart INDEX DAX 30, H4 interval. Source: xNUMX XTB xStation

The main German DAX index deepened declines after neutral week on Thursday. The euro is still doing poorly against the dollar. This pair recently formed a double bottom formation, where investors see the potential for further appreciation of the euro. However, taking fundamental data into account, recent increases can largely be treated as the calm before the storm, leading to further declines.

China and yuan in focus

An eye for an eye, a tooth for a tooth - this is the attitude adopted by the Chinese government in the face of the US tariffs. Chinese policy, apart from focusing on the weakening of the yuan (which hits US tariffs and favors local exporters), additionally introduces its products to products imported from the United States. US $ 75 billion worth of products are to be subject to tariffs on September 1. Even greater aggravation of the conflict results in the inclusion of 5% on US oil duties. the Shanghai index containing Chinese joint-stock companies is not surprising at the moment, and after the weekend (at the time of writing the article 3: 35) it opened a considerable downward gap.

CHNcomp INDEX chart, H4 interval. Source: xNUMX XTB xStation

Fears of an economic slowdown go down into the background. The United States did not take into account the possibilities of the Chinese economy and the "ingenuity" of the local authorities. What's more, the problem appears in the Fed's neutral policy, which will maintain a series of cuts to maintain further economic growth in the US.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)