The Saudis are pushing up the price of oil, grains are still up

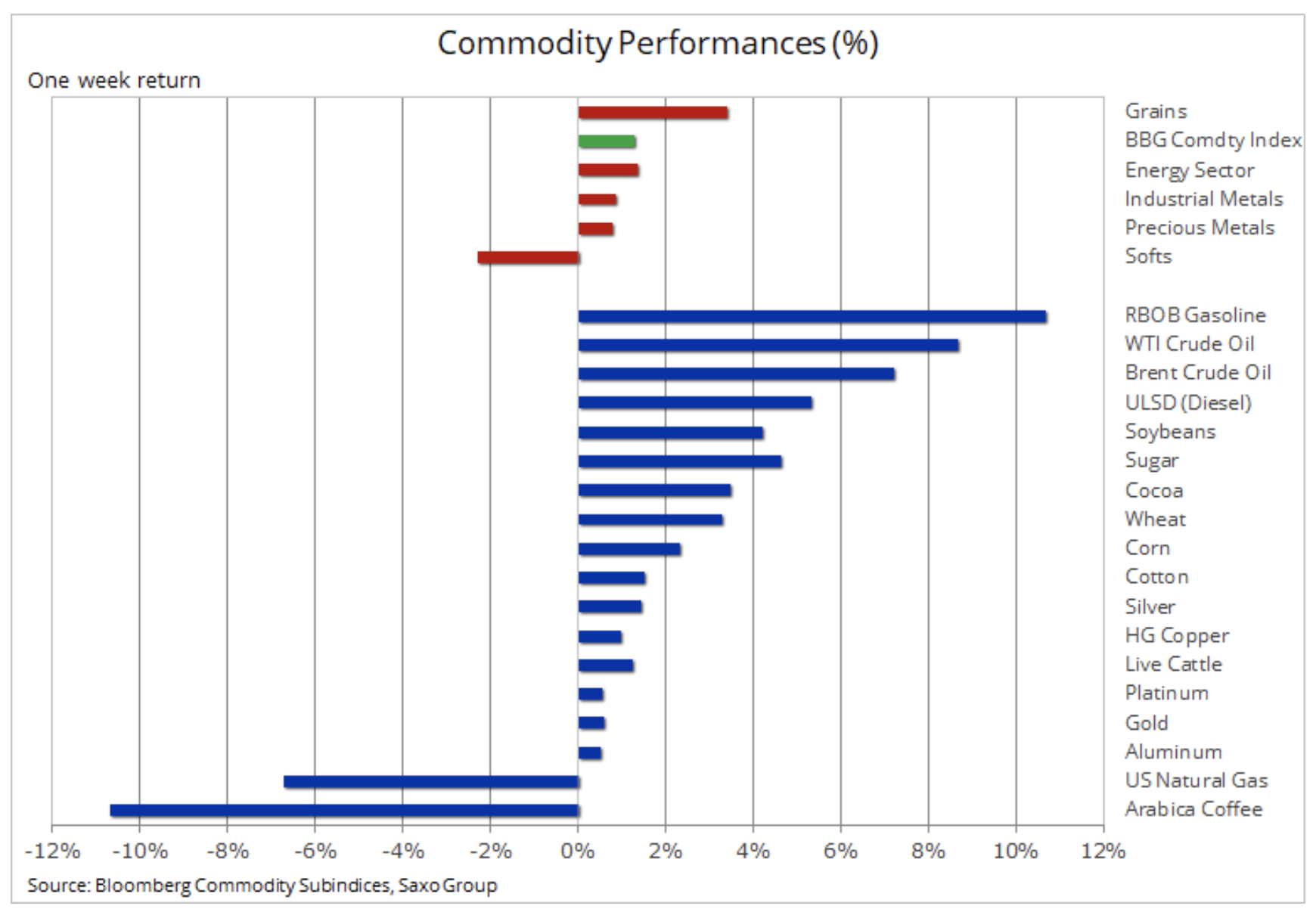

The Bloomberg Commodity Index, which monitors a basket of major commodities evenly broken down into energy, metals and agriculture, recorded an increase for the first time in three weeks. The week of gains across all three sectors is driven by a weaker dollar, a continued wave of US agricultural futures, a Saudi-assisted rebound in oil prices, and economic optimism in China. Gold behaved relatively passively due to the fact that algorithmic traders were at the helm, which so far has resulted in an unusually high positive correlation with movements in the S&P 500 index.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Oil and fuel products took the lead as the sector revived from the last correction. At the OPEC + meeting, the Saudi Minister of Energy launched a vigorous attack against members of organizations cheating on mining quotas and against investors who were short selling in the futures market. This came one week after OPEC, the MAE and BP warned of an uncertain recovery in demand due to the steady increase in coronavirus cases detected worldwide.

Precious metals

Same as silver, gold Gained slightly last week despite some weakening after the FOMC gave no news and US equities hit support levels. Although Federal Reserve interest rates would be at their lowest possible levels for more than three years to come, and the initial reaction of the markets, including the fall in stock prices and the strengthening of the dollar, raised concerns that the Fed is beginning to run out of tools at its disposal, in the absence of any further element of surprise.

In a recent analysis we mentioned that gold seemed passive as its movements reflected movements in US stock prices. The lack of new data on bonds and the dollar means that algorithmic trading (algo) systems, often based on correlations between markets, have taken the lead, creating an unusual positive correlation between gold and equities. Up to a point, correlations work well as a trading strategy. Therefore, the stock market can set the direction in the very short term.

However, our long-term forecast remains positive. Information on hedging against inflation triggering an increase in demand, the forecast weakening of the dollar and the positive forecasts regarding the date of launch of the Covid-19 vaccine are overly optimistic. That being said, and given the potentially very brutal US election period, we stand by our positive outlook for gold. Meanwhile, in the short term, the direction will be the results of US companies with mega-capitalization and the dollar exchange rate. As a result, the two-month consolidation period will most likely be extended.

Petroleum

Clothing attracted buyers after the recent sharp correction and drop below the trend line that has been maintained since June. The recovery was driven by optimistic economic data from China and the United States, the world's largest oil consumers, as well as an overall improvement in risk appetite after US mega-cap companies found support.

Most important, however, was the decisive oral intervention by Saudi Minister of Energy, Prince Abdulaziz bin Salman, after the OPEC + meeting. He started the meeting with strong condemnation of those OPEC + members who, contrary to the arrangements, produced too much oil. During the question-and-answer session, he warned short selling investors not to test Saudi Arabia's patience by announcing that he would personally guarantee that "anyone who views this market as a form of gambling will suffer hellishly painful consequences."

While this may signal frustration that OPEC + production cuts are not producing clear results so far, the minister probably wanted to prevent the escalation of short selling in the context of warnings from OPEC, IEA and BP against an uncertain recovery in demand in a situation where production reserves and inventories are exceptionally big. Since July, when fundamentals began to weaken, though not price, the gross short-term position of hedge funds in WTI and Brent crude oil has more than doubled to 235m barrels.

While short sellers can influence the market for a short time, the fundamentals will always be the main factor. While the 15% correction of Brent crude oil has made the price of this crude more in line with today's fundamentals, further growth requires more than just verbal intervention, even with the largest producer in the world.

We are cautious about crude oil's short-term potential for further growth until OPEC + surprises the market, shifting from the 2mnb / day increase planned for January. While the United Arab Emirates, which lagged behind in August, are reducing production again, Iraq and Libya have raised some doubts. According to the data so far, Iraq has increased its production this month, while the ceasefire in Libya could increase production from the current level below 100 barrels per day.

NATGAS

American natural gas fell below $ 2 again, a seasonal low in nearly 20 years. The decline in demand due to the lockdown and the disruptions caused by Hurricane Sally, affecting both demand and exports, contributed to a greater-than-expected increase in inventories on a weekly basis. At the start of Friday's session, the gas price found support at the key level of $ 1,94, but the market nervousness is likely to continue until the annual shift from injection to extraction during the winter season, when heating demand exceeds production.

Agricultural commodities

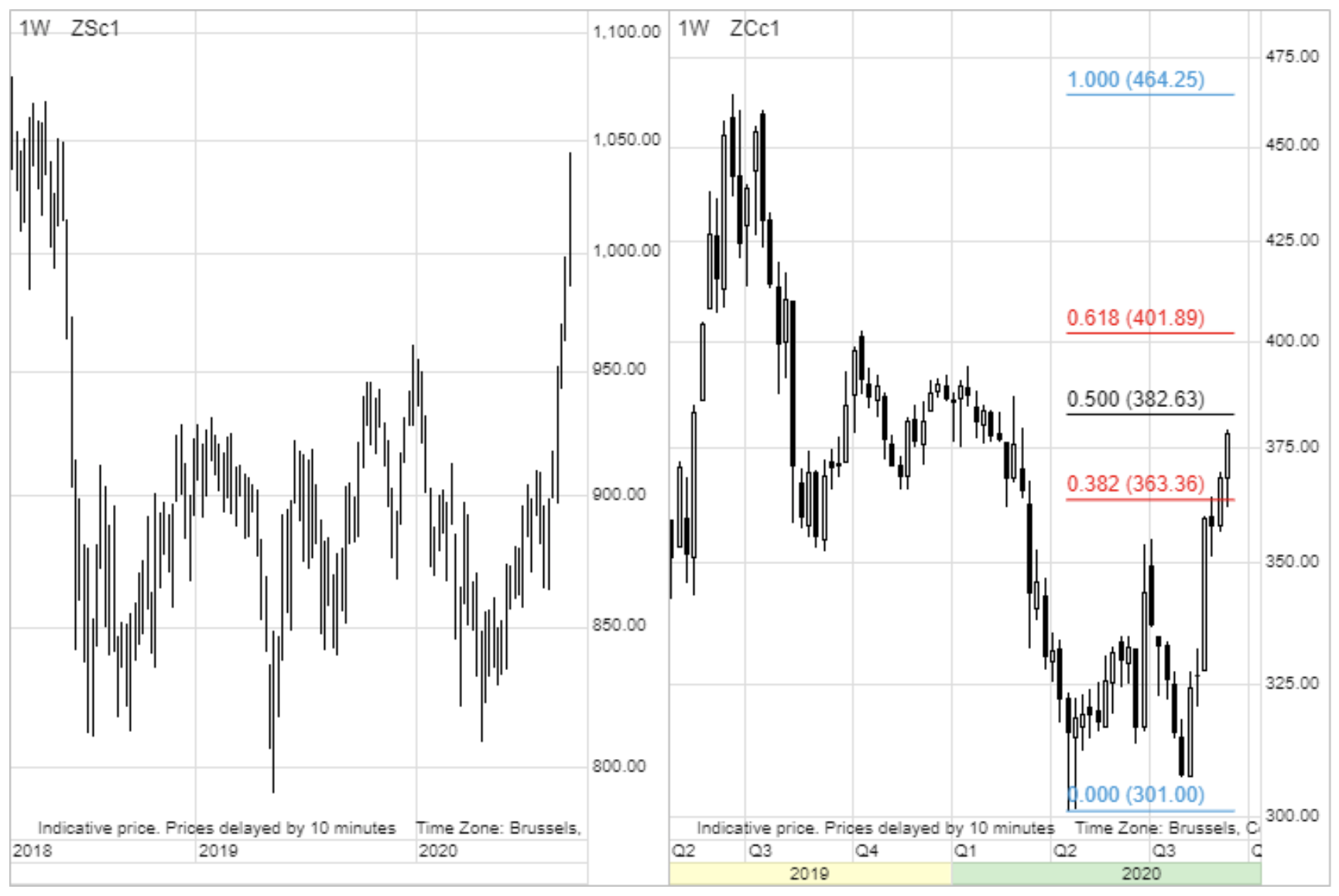

Soybean It is likely to see growth for the sixth consecutive week due to increasing purchases from China after unfavorable weather conditions in recent months have damaged crops in certain parts of the country. According to the US Department of Agriculture, soybean sales in the season beginning September 1 hit a record 30 million metric tons, more than half of which went to China. Last week, the price hit again above $ 10 / bu, to its highest level since May 2018.

Due to the fact that the prices corn China's Dalian Stock market hit its five-year high, demand for US corn was also solid, and the Chicago Stock market rose to its six-month high. On September 23, Chinese customs authorities will publish monthly data on imports of agricultural products. These figures will be carefully analyzed in view of the Trade Agreement, and also to determine the potential for further gains ahead of the US harvest season.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)