The energy sector is in the lead, metals are weakening

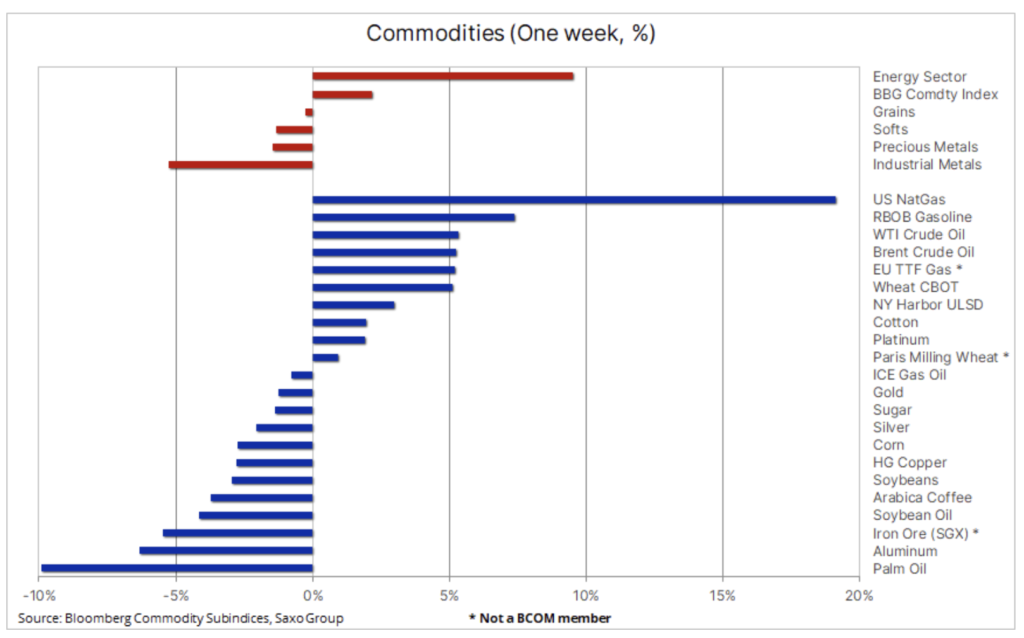

The commodity sector shows an increasing mismatch between metals and energy as the war in Ukraine continues to raise concerns over the supply of crude oil, refined products and natural gas. Industrial metals prices are falling amid concerns over the short-term direction of the Chinese economy, while precious metals are looking to defend themselves against rising yields and a strengthening dollar as the US Federal Reserve it is fighting inflation harder and harder.

The situation on the raw materials market

The commodity sector shows an increasing discrepancy between metals and energy as the Russo-Ukrainian war continues to raise concerns over oil supply, refined products and natural gas, and industrial metals continue to be adversely affected by concerns over the short-term direction of the Chinese economy. Recently, the Bloomberg spot commodity index rose by 2,2% and is just below the April record, however - as can be seen in the table below - the gains were mainly due to strong growth in the energy sector, led by US natural gas, which peaked price for almost 14 years.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

An increasing challenge for industrial metals is China's insistence on vigorous 'zero Covid' policy despite rising economic and social costs. Lockdowns have limited mobility and productivity, and thus their forecasts for economic growth. On Thursday, the Standing Committee of the Chinese Communist Party, chaired by President Xi, reiterated its position and called on party leaders to continue implementing measures to prevent the spread of the pandemic. Although the number of infections in Shanghai - China's financial center - has been steadily declining since April 22, the prospect of a return to normalcy still seems at least a few weeks away.

A major investor in Hong Kong recently described the current situation in China as the worst in 30 years as Beijing's increasingly restrictive zero-Covid policy slows economic growth while causing public discontent. As a result, global supply chains remain under threat and congestion in Chinese ports is worsening, while demand for key commodities, from oil to industrial metals, has declined markedly. One consequence is that the government needs to implement significant incentives to support the recovery of economic growth, which is currently well below the 5,5% target. Such initiatives are likely to support the industrial metals sector given the emphasis on infrastructure and energy transition; therefore we hold the view that minimum prices will soon be reached after the recent decline.

Other factors currently affecting the commodity sector remain the supply disruptions caused by the war in Ukraine, supporting energy prices, while the continued rise in US bond yields and the strengthening of the dollar continue to pose some problems for investment metals such as gold and silver. The US Federal Reserve increased the pace of monetary policy tightening, raising its benchmark interest rate by 50 basis points; similar increases are envisaged at subsequent meetings FOMCThe next ones will be held on June 15 and July 27. Simultaneously Bank of England warned of the risk of a recession related to double-digit inflation, and heightened inflation concerns pushed 3-year US bond yields above XNUMX%, while global equity prices plunged again, further worsening the investment climate.

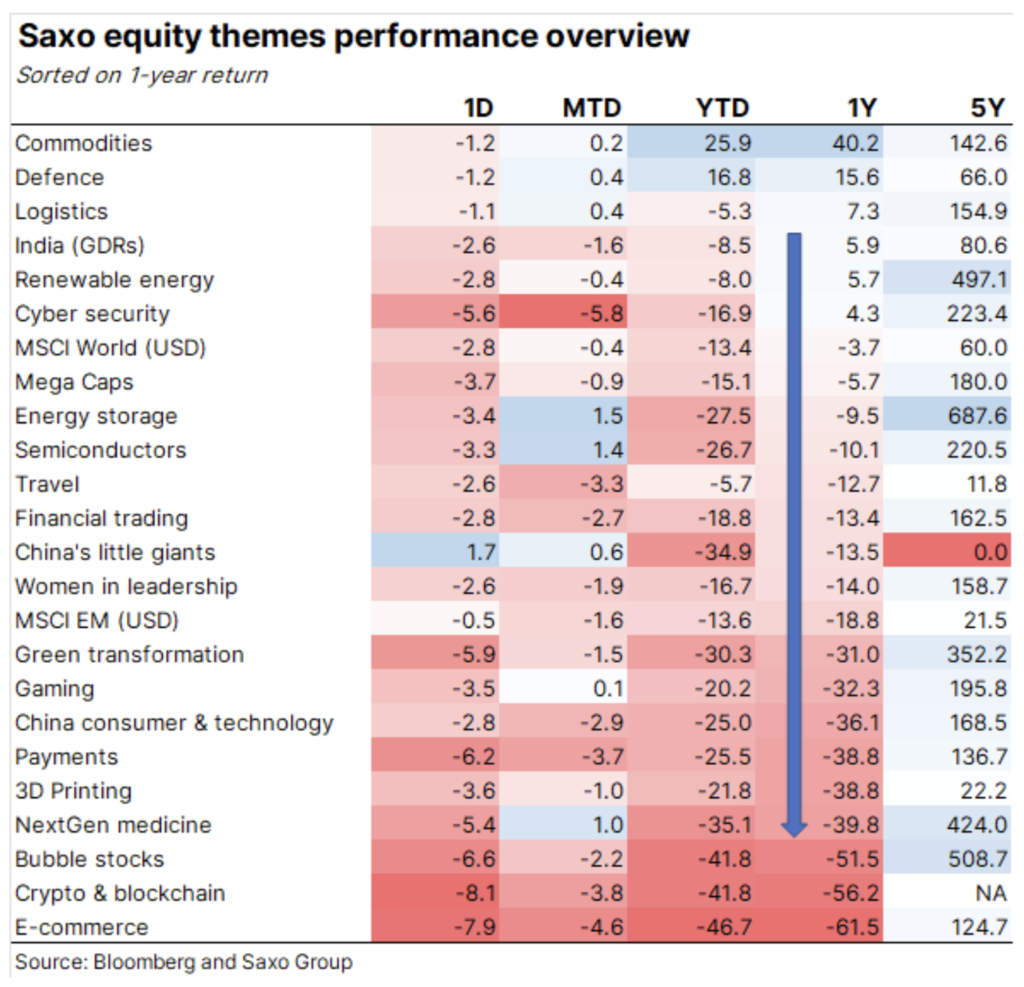

At Saxo Bank, we focus more on stock exchange themes rather than individual industries, and the table above shows the historical discrepancy seen last year between past favorites such as e-commerce, cryptocurrencies and blockchain technologyand the "bubble stock" of the ARK Innovation Fund managed by Cathie Wood. At the top of the table is our commodity basket, which includes 20 key companies operating in three main sectors: energy, metals and agricultural products, as well as in the defense sector, due to the increased emphasis on security after Russia's invasion of Ukraine.

As part of my last webinar and in the podcast on the portal MACROVoices I have listed the reasons why, in our opinion, the commodity boom still has considerable room for maneuver and why prices may rise even if demand comes to a halt due to lower economic growth.

Petroleum

Oil grew for the second consecutive week; Investors stopped focusing on the risk of a slowdown in demand amid lockdowns in China and interest rate hikes, focusing again on increasingly tight supply. The OPEC + Group announced another increase in oil production by 432 thousand tonnes. barrels per day in June, but due to the fact that the members of OPEC10 (countries covered by quotas) in April lagged behind by 800 thousand. barrels per day, and delays are also recorded by Russia and Kazakhstan, the group is currently unable to deliver the barrels on target. The EU embargo on Russian crude oil and the surprising announcement by the United States that it will start replenishing its strategic reserves already this autumn are also contributing to the price increase.

The continued focus of the market on the economic slowdown in China prevented oil prices from further spiking after the European Union announced steps to become independent from Russian crude oil and distillates in the coming months. Middle distillate stocks in Singapore and New York, two major trading hubs, continued to decline as a result of a deepening global shortage, in particular for diesel, the engine of the global economy. Despite lockdowns in China, the decline in Singapore mirrors the rise in consumption in Asia outside of China.

We reiterate our outlook for Brent for the current quarter with a wide range of $ 90-120, as well as the view that structural issues, notably the persistent underinvestment and OPEC's drive to increase production, will continue to support prices in the coming quarters. This week, investors will closely scrutinize monthly oil market reports - EIA on Tuesday, and OPEC and IEA on Wednesday - for guidance on the current supply and demand landscape.

NATGAS

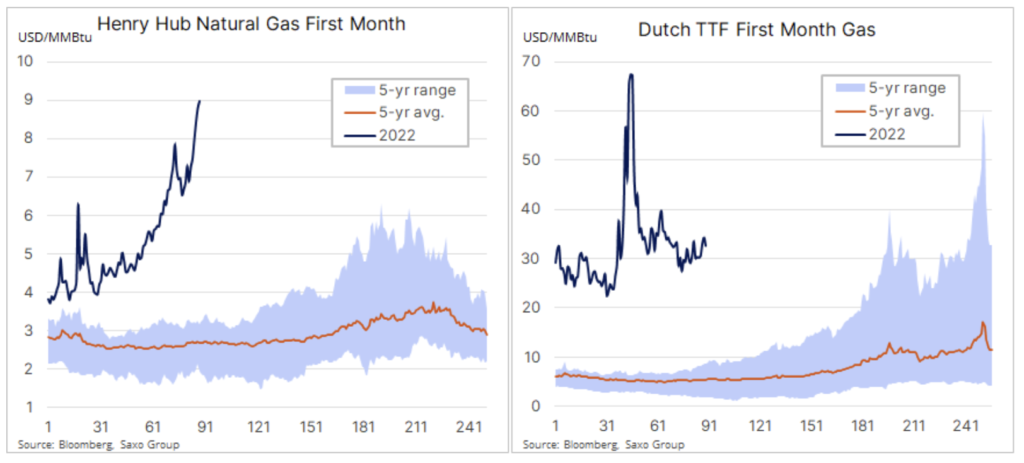

American natural gas recorded the largest weekly growth since 2020 and the highest weekly closing price since August 2008. Gas price, currently around $ 9 / MMBtu, has tripled compared to its ten-year seasonal average. According to Refinitiv data, since the beginning of March the demand of American LNG production plants has averaged over 12,3 billion cubic feet of gas (equivalent to 127 billion cubic meters of gas).3), which is about 17% more than last year and almost as much as the US housing sector consumes.

In addition, recent growth has been supported by expectations of warmer-than-usual weather in much of the US South and Midwest, while output growth remains moderate. As a result, US inventories are 16% below the five-year average, and the combination of strong demand for LNG supplies from Europe and only a modest increase in production could cause inventories to grow slowly in the coming months. In Europe, the price of the Dutch benchmark TTF gas contract is six times higher than the long-term average, and gas prices remain high due to continued concerns about supplies from Russia.

Gold

Gold

Gold oscillates in a wide range of USD 1-850, with support from higher oil prices, due to the signals they send regarding inflation and geopolitical risk, is counterbalanced by a further strengthening of the dollar, which increased by 1% yoy to date, and the steady increase in bond yields in major economies. As highlighted earlier, we still believe gold's performance this year is satisfactory. While dollar returns remain low at just 920%, the further strengthening of the dollar provided double-digit returns to investors in other currencies such as the euro (6,5%) and the yen (2,6%). Additionally, due to the very bad performance of equities and bonds, the relative performance highlights the advantages of diversifying with gold in a difficult year like the current one.

We are reiterating a positive outlook for gold due to the need to diversify against volatile equities and bonds as inflation is increasingly grounded and geopolitical issues persist. As we mentioned, there has been an increase in sales recently from technical traders expecting rising yields to drive prices down. For this bias to change, gold needs a solid breakout again above $ 1 an ounce. Silver should also be watched as it slipped back towards key support in the $ 920-21,50 region, which brought the XAU / XAG ratio to a new eight-month high above 22 ounces of silver for one ounce of gold.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)