The defense sector is on the rise, mood swings on the stock exchanges

The past week was marked by changing moods on the world's stock exchanges. As befits "Valentine's Day", investors fell in love with global stocks. Optimism, however, faded with the passage of subsequent sessions, but this did not prevent many stock indices from reaching their highest levels this year.

One of the driving forces behind the indices are companies with defense sectorbenefiting from the protracted war in Ukraine and the risk of conflict escalation. Despite the premises giving an excuse for a sell-off on stock exchanges, stocks are characterized by high resistance. The situation is quite different in the case of US bond yields, which continued to rise after the release of economic data.

High uncertainty characterizes investors investing capital in the Land of the Rising Sun. The appointment of a new governor of the Bank of Japan may be a catalyst for changes in monetary policy and affect market sentiment.

Mood swings in the stock markets

There was no shortage of emotions on the stock exchanges last week. Macroeconomic data releases in the US played a key role. Investors have long been resilient to hawkish inflation readings, but on Thursday the bulls capitulated and wiped out the gains from the first half of the week. The S&P 500 index eventually made a return of -0.28%. The Nasdaq Composite fared slightly better, ending the week with a symbolic increase (0.58%).

The indices in Europe continue their great run, which again gave a show of strength this week. The historic intraday high was broken by the French CAC40, recording a week-on-week increase of 3.06%.

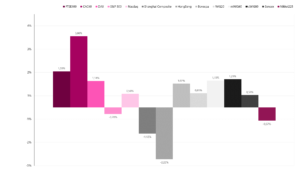

German tried to keep up with him DAX (1.14%) and the British FTSE 100 (1.55%), which for the first time in history exceeded the level of 8000 points. Mainly due to the continued pressure of the strong dollar, the situation in the emerging markets was slightly worse. The highest rate of return was achieved by the Brazilian Bovespa (1.02%). A positive result was also characterized by the index in India (0.53%). Stocks in Hong Kong (-2.22%) and Shanghai (-1.12%) ended the week in the red.

The unfavorable opinion of the CJEU spokesman on CHF loans affected the volatility on the local market. The banking sector was under pressure, but after a momentary panic, the index of the largest entities defended itself against the correction. All in all, WIG20 achieved a positive rate of return of 0.61%. Indices of small companies (sWIG80 gained 1.21%) and medium-sized companies (mWIG40 increased by 1.15%) also performed well.

The defense sector on the rise

The war in Ukraine, which has been going on for almost a year, has changed the attitude of many countries towards defense policy. The lack of symptoms indicating the approaching end of the war in Ukraine, together with many signals heralding a possible escalation of the conflict, translates into growing interest of investors in shares of companies from the defense sector. Last week, a meeting of NATO defense ministers was held on Ukraine. The main topic of the talks was support for the country, replenishment of equipment and ammunition. The US and NATO promise further assistance to Ukraine.

The plans include increasing the amount of ammo accumulated, as the faster consumption of shells than the production capacity causes the stocks to run out. German Defense Minister Boris Pistorius called on the country's defense industry to increase production capacity. The politician informed about the signing of an agreement by the German government with the armaments company Rheinmetall for the production of ammunition for the Gepard anti-aircraft guns used by Ukraine.

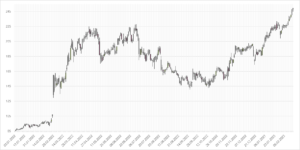

Rheinmetall AG is one of the largest entities involved in the production of equipment used during the war in Ukraine. The enterprise together with Krauss-Maffei Wegmann is a manufacturer of Leopard 2 tanks. The company's offer also includes various types of weapons, combat vehicles and command systems. The increased interest in the company's products and the geopolitical situation made the company one of the favorites of investors. Within 12 months, the company's shares gained over 150%, and in recent weeks the company has returned to favor, which allowed it to overcome the peaks of the second quarter of last year.

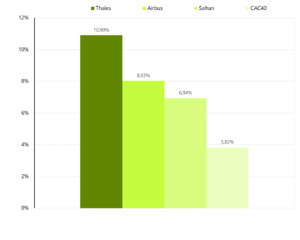

The ongoing missile attacks, the shelling of critical infrastructure in Ukraine, as well as information suggesting that Russia is accumulating planes and helicopters near the border may indicate another escalation of military operations. The conditions and geopolitical environment make the popularity of shares of companies from the defense sector visible in a broad perspective. The best example is the three companies listed on the Paris Stock Exchange, included in the composition CAC40 index. Shares of Safran, Thales and Airbus, whose activities are related to the defense sector, were one of the driving forces of growth last week, which allowed the CAC40 index to climb to record levels.

W. 4 Rates of return of French companies from the defense sector against the background of the CAC40 index in the horizon of 1 month. Source: own study, Yahoo Finance

Companies operating in the defense industry can also be found on the Warsaw Stock Exchange. On the wave of popularity of shares of companies related to the military, the quotations of Lubawa (manufacturer of bulletproof vests, tents, hangars, vehicle equipment), Protektor (manufacturer of military footwear) and Zakład Budowy Maszyn Zremb-Chojnice (manufacturer of specialized containers for the army) stood out in the last week.

V.5 Quotations companies in the defense industry on the Warsaw Stock Exchange. Source: own study, Stooq.pl

Changes in the Bank of Japan

Interesting things are happening not only on European and American dance floors. In recent days, investors in Japan have been warmed up by information about the appointment of a new governor of the central bank. Kazuo Ueda will replace Haruhiko Kuroda, who has accustomed investors to maintaining ultra-expansive monetary policy, as the head of the Bank of Japan. Ueda's nomination still needs to be confirmed by both houses of the Japanese parliament, and he will take office in April.

The change of power in the central bank is associated with uncertainty about the shape of monetary policy. A departure from the current strategy is almost a foregone conclusion, but the pace and manner of implementing changes will be crucial. The baseline scenario, according to most market analysts, is a gradual normalization of monetary policy. In the near future, the first steps to adjust the yield curve policy should be expected (Bank of Japan among others buys bonds to maintain the yield on 10-year debt securities at the level of 0.50%), but the complete resignation from negative interest rates may be stretched over time. Analysts have high hopes for the new governor of the central bank, who is an academic professor and in the past held a position on the board of the Bank of Japan.

The challenge for Ueda is enormous as Japan remains the last bastion of ultra-low interest rate policy. Increasing them by other central banks puts more and more pressure on the activities of the Bank of Japan. The effect of the current situation is the growing inflationary pressure and the price growth index at the highest level since 1991. The currency market may have a very large impact on the decisions of the central bank, where the weakness of the yen has become evident over the last few quarters.

The Japanese market in the coming months is worth watching. The method of adjusting the monetary policy may be a determinant of the assessment of Japan by foreign investors, and at the same time it will be a factor with a significant impact on the prices of instruments on the local financial market.

Bond yields up again

The macroeconomic data published last week in the US caused a lot of confusion on the markets. The growth rate of CPI inflation decreased from 6.50% to 6.40%, however the reading turned out to be higher than the market consensus (6.20%). Data on prices in the service sector may cause concern. Excluding the energy supply sector, growth accelerated from 7.00% to 7.20%. Among the main categories, food prices increased by 10.10% and energy prices reached a growth rate of 8.70%. The only category with negative dynamics was used cars, where prices fell by 11.60%.

The publication of producer inflation data added fuel to the fire. The value of the index decreased to 6.00%, while market analysts expected a reading of 5.40%. Despite declining producer price dynamics (the index was 6.50% a month earlier), fears about the stickiness of inflation have strengthened, which may affect further decisions of the Federal Reserve.

Such a combination of data combined with very good retail sales readings (MoM growth of 3.00%, market consensus: 1.80%) and positive data from the labor market (194 applications for unemployment benefits) translated into higher profitability US bonds.

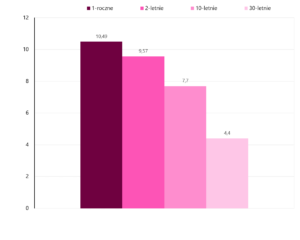

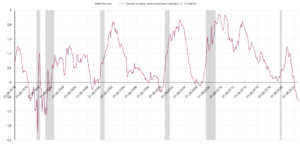

V.7 Change US bond yields over the week expressed in basis points. Source: own study, Stooq.pl. Investing.com

The increase in bond yields affected both short- and long-term securities. During the last 5 trading sessions, the scale of changes in short-term bonds exceeded the level of 10 basis points. A strong upward movement in the yields of 10-year bonds, observed almost since the beginning of February, caused them to reach the highest level since November last year. The last upward wave for 2-year bonds, amounting to approx. 0.6 percentage point, caused the yields to be just below the maximum values of the current trend. In the case of 1-year bonds, a new peak was set around 5%.

Over the last 3 months, a divergence has been observed between the behavior of short-term and long-term bonds. Yields on shorter-dated debt securities are near or even improving at highs, while long-term bonds have moved away from peaks. In this way, the inversion of the yield curve becomes entrenched. In the middle of last year, for the first time in the current cycle, we had to deal with a situation where the yields on 10-year bonds exceeded the level set for 2-year instruments.

Currently, the negative spread is around 80 basis points, its highest level since 1981. Reaching record highs is not a good sign for the economy. The negative difference between the yields on 2- and 10-year bonds has historically turned out to be one of the best indicators of an upcoming recession.

The high predictive effectiveness of the indicator is an important warning signal that should be taken into account when making investment decisions.

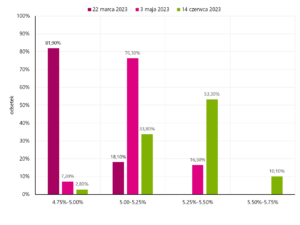

Periods in which we experienced an inverted US bond yield curve tended to be short-lived. The current cycle of interest rate increases is very likely coming to an end, which should stop the increase in short-term bond yields in the next few months. Currently, market expectations change from week to week. Last week, the market assumed two interest rate hikes and the end of the cycle in May. After a series of macroeconomic data releases in the US, the market expects an additional interest rate hike in June. At the same time, according to market expectations, the achieved level of interest rates is to be maintained until the end of this year.

W.10 Expected interest rates in the US after the next Fed meeting. Source: own study, CME Group

The first signs of a possible turnaround in the Federal Reserve's monetary policy may be an impulse to change the trend. At the moment of the emergence of symptoms indicating the upcoming "pivot", the yield curve should begin to flatten, and short-term bonds should become the segment driving such a move. Under the baseline scenario, nominal changes (expressed in basis points) in short-term bond yields are likely to exceed the corresponding movement for debt securities with maturities of 10 or 30 years.

Summation

Investors started the past week in good moods, followed by a deterioration in sentiment, which, however, did not prevent the Paris and London indices from reaching new records. The increased involvement of many countries in the development of the defense segment is conducive to the relative strength of companies in this sector. The optimism seen in the stock market is not reflected in the US bond market. Higher than expected inflation readings translated into an increase in bond yields and maintaining strongly negative spreads between short-term and long-term securities. The picture on the debt securities market signals a growing probability of extending the cycle of interest rate hikes and recession. Such a development of events is also a warning signal for the stock market, but so far stock indices have been very resistant to any kind of hawkish market information.

Source: Piotr Langner, WealthSeed Investment Advisor

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)