Fall in prices of oil and metals, gas and coal down sharply

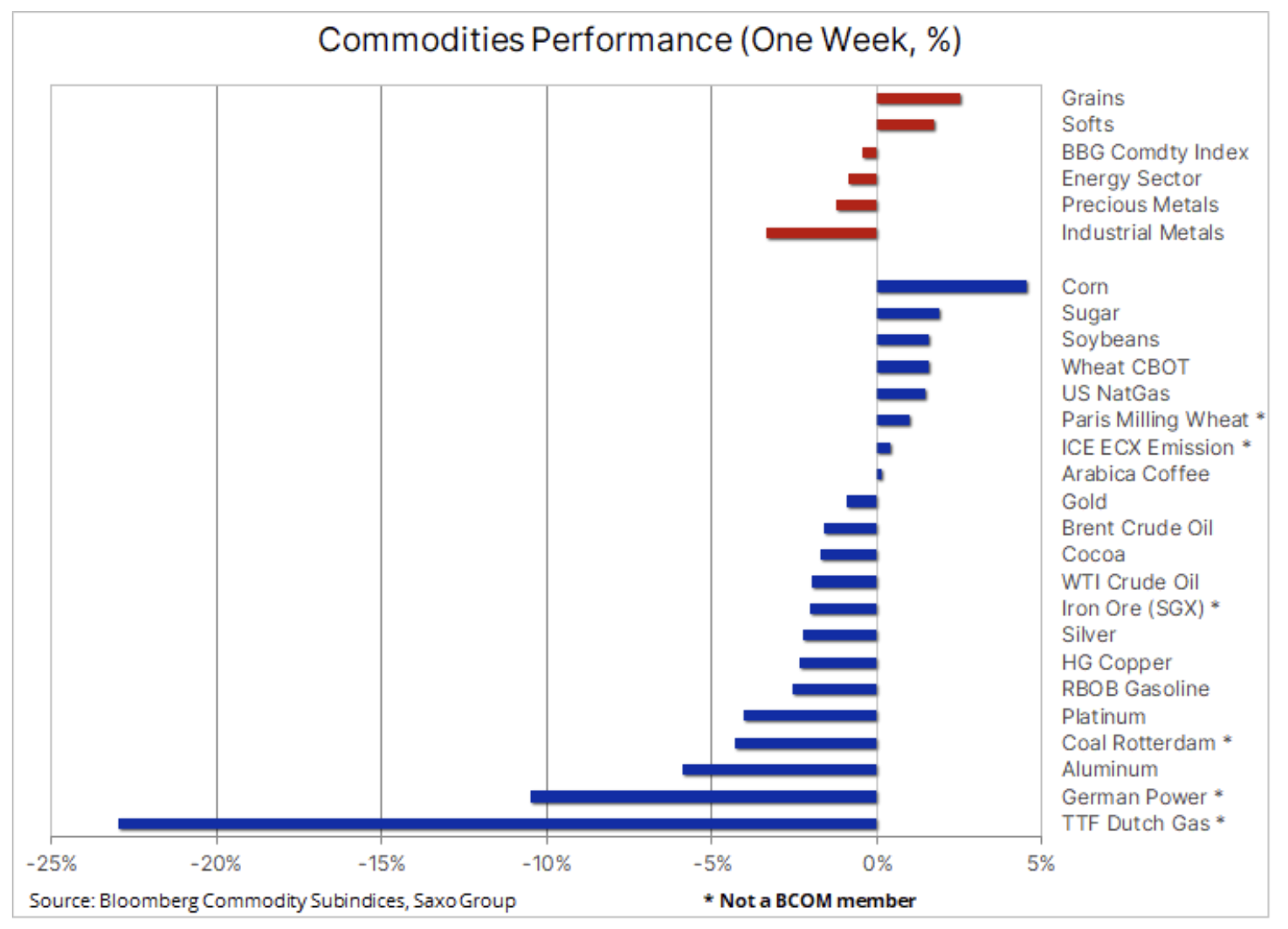

The last week of October brought different results depending on the market of a given raw material or sector. At the end of the month, investors started showing some risk aversion due to the amount of data coming in pointing to a slowdown in global economic growth. Part of it is a direct result of higher commodity prices, including the recent sharp rise in fossil fuel prices that has forced some of the most energy-intensive industries to cut production levels. Moreover, the sharp fall in coal and gas prices contributed to a partial elimination of factors that had so far supported the prices of crude oil and industrial metals.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Many of the world's key economies have experienced dramatic movements at the front end of the yield curve. This came after investors unexpectedly and collectively realized that soaring inflation could force central banks to step on the brake by raising interest rates much earlier than expected. As a result, the yield curves over the past week have flattened or - in some cases - even reversed, suggesting traders are increasingly pricing in slower economic growth as central banks begin to tighten monetary conditions. The effects of these developments have also led to some overestimation of a number of currencies against the US dollar, which has plunged for the third consecutive week.

By contrast, last week's profits were primarily in the agricultural sector as the increased risk of another La Ninã phenomenon in the coming winter pushed up the prices of a number of key agricultural commodities. In the energy sector, the situation varied: crude oil showed signs of a lag, and the sharp fall in gas and coal prices contributed to a reduction in potential support from the gas-to-oil shifting process, which has been suggested in recent weeks could increase in the coming months. demand of one million barrels a day.

Industrial metals

Industrial metals ended this crazy month with a decline and a loss of some of their recent strong gains amid concerns about economic growth and demand, which slightly worsened the overall positive outlook for the sector in the short term. After strengthening 15% to a record high in the first half of October, the London Metal Index lost more than half of its gains for the remainder of the month. The fall in coal prices in China by almost half also contributed to a strong decline aluminum prices - the metal that requires the most energy to produce.

To quote the Bloomberg portal:

"Chaos on copper market this month is a particularly extreme example of the impact of disruptions in logistics chains and the global energy crisis on supply in commodity markets. Inventories are declining and spot prices in five of the six major metals markets in the LME show high premiums on futures, signaling that buyers are dwindling. ”

Is the commodity boom over?

With the outlook for global growth starting to seem increasingly problematic, the natural question is whether such a deterioration will be enough to reverse this year's strong rally in commodities markets. We do not consider this to be the case as the significant demand for a green transition has not yet materialized as the pressure continues on ESG compliant (environmental, social and governance) investments to prevent the leverage necessary to ensure an adequate level of investment. supply in the coming years by the so-called industries of the old economy, in particular by the mining and oil industries.

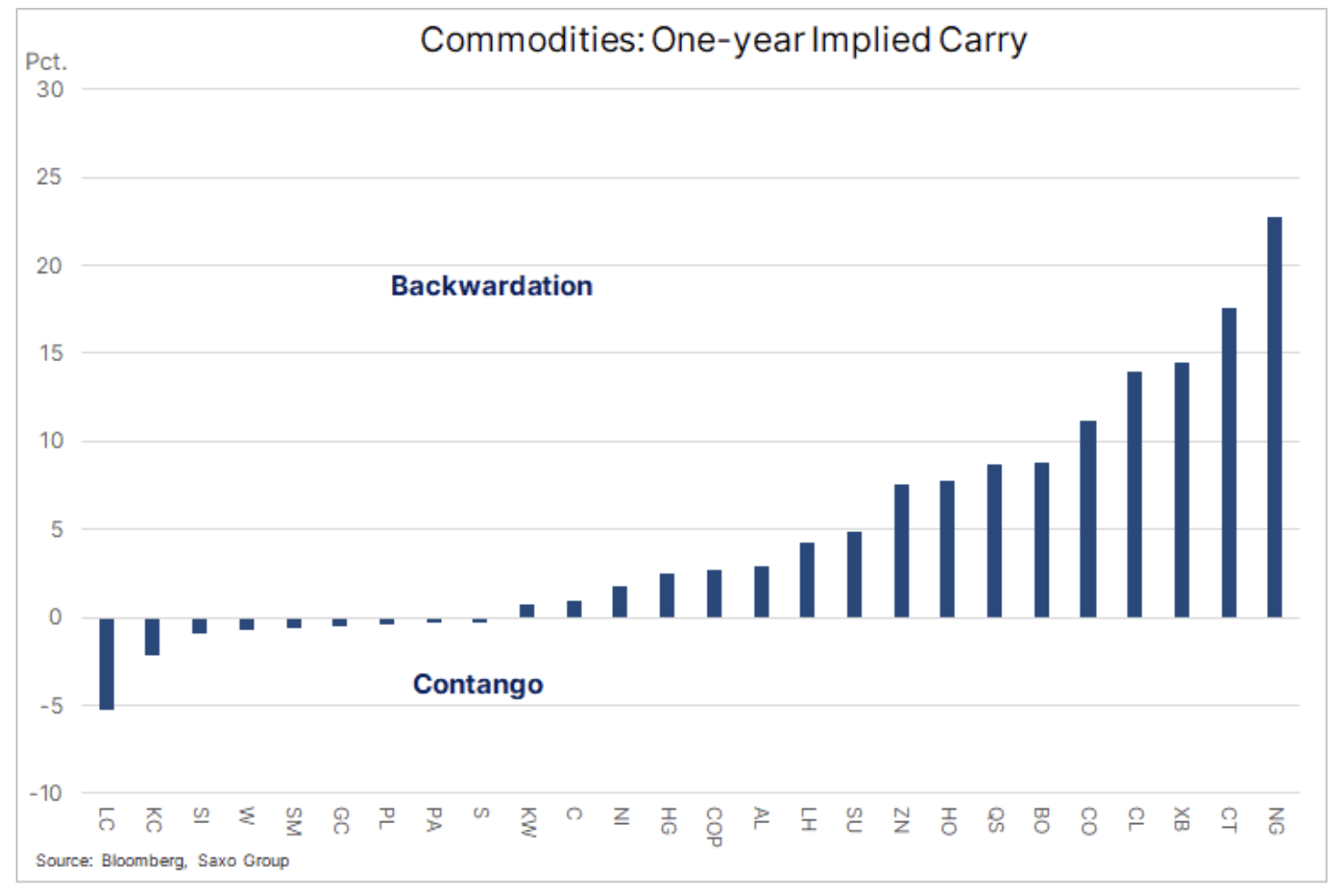

Commodity prices are not only dependent on demand, but increasingly also on the availability of supply, and taking into account the factors mentioned above, we predict that the supply of many individual commodities will be increasingly limited. We can see how significant this restriction turns out to be in the chart below, which shows the percentage price difference for raw materials with immediate delivery and one year ahead. The higher the deportation, the more limited the supply in the market will be and buyers will be willing or forced to buy raw materials for immediate delivery at a higher price.

The prospect of limited supply in northern hemisphere gas markets in winter has pushed the annual spread of US natural gas prices to an extreme of almost 23%. Even excluding natural gas, the average deportation across the five crude oil and fuel products futures exceeded 9%, an unrecorded level since at least 2005. As we mentioned, the industrial metals markets are currently seeing the same phenomenon: the average deportation in in the context of copper, aluminum, nickel and zinc, reached the highest level since 2007.

Petroleum

Clothing last week it showed signs of material fatigue and while we do not anticipate a reversal, the market may enter a period of consolidation before gaining momentum again as the year approaches. The reasons for this correction, apart from the reduction of long positions by speculative investors, are manifold, and although some of them are directly related to the oil market, others - equally important - concern China, the Russian president Vladimir Putin, and the German government.

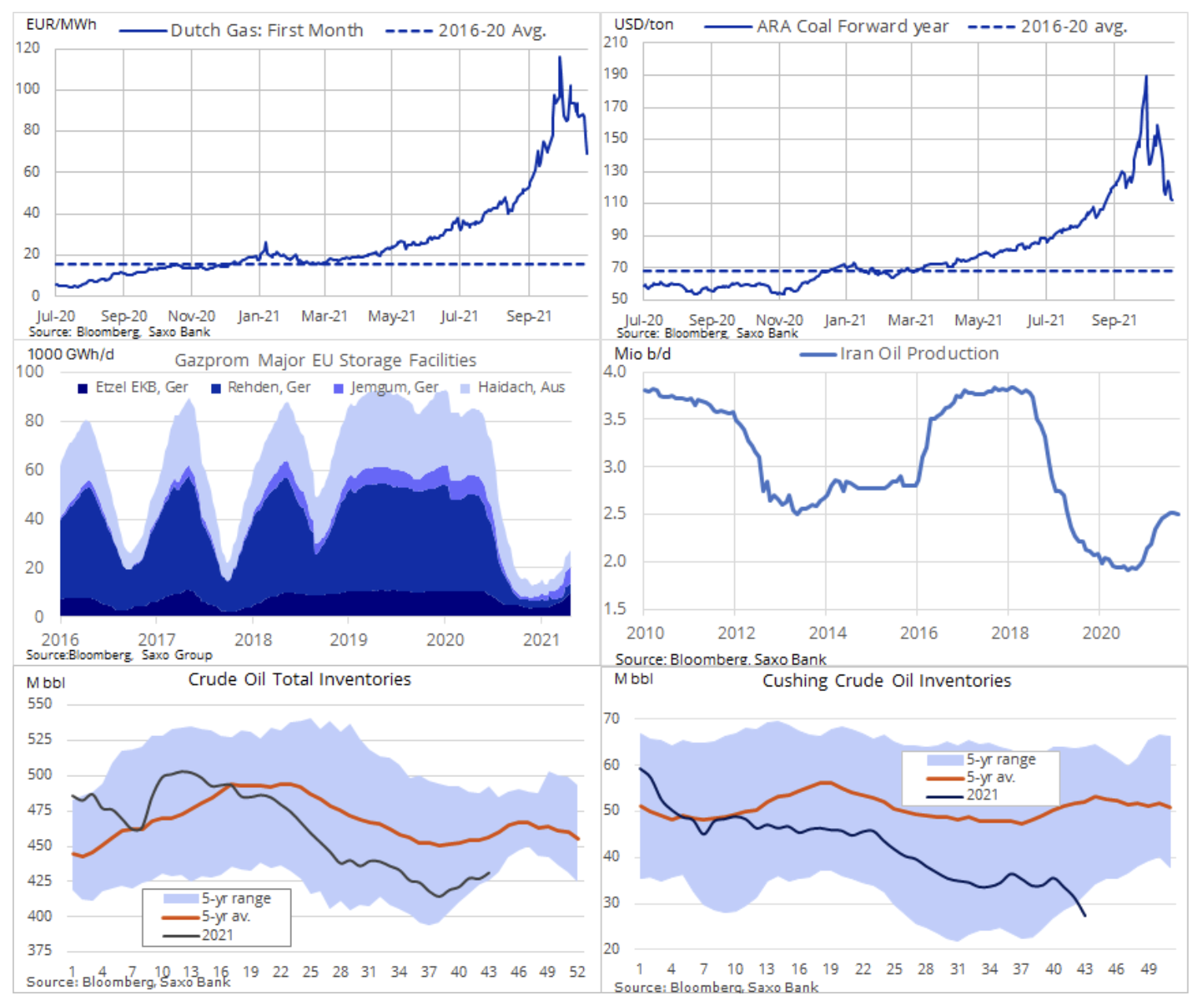

Until last week, the global energy market was red hot, and strong oil rallies, gas and coal formed a feedback loop, as a result of which the prices of most fuels reached long-term or even record highs. The limited supply of gas and coal in Europe and Asia, which resulted in an almost punitive price increase, which was detrimental to economic growth, was one of the main reasons for additional oil price gains in recent weeks. It is estimated that the prospect of increased demand for diesel, heating oil and propane at the expense of gas has increased global crude oil demand by one million barrels a day.

The reasons for the revision in oil prices last week can be traced back to the following key factors:

- Iran and the EU agreed on Wednesday to restart nuclear negotiations, which could ultimately lead to an increase in oil supply. Prior to the re-imposition of sanctions by Donald Trump in 2018, Iran was producing about 3,8 million barrels per day, which is 1,3 million barrels per day above current levels.

- EIA's weekly inventory report showed greater-than-expected increase in crude oil stocks. While the rise in inventories as such is in line with seasonal forecasts, the continued decline in Cushing, Oklahoma, raised some concerns about the availability of this commodity at the key WTI oil futures hub.

- Gas prices have plunged after Putin's promise to increase supplies, perhaps in response to the statement by the German economy ministry that certification of the Nord Stream 2 gas pipeline will not threaten the security of supply in the EU. The price of the Dutch benchmark TTF gas contract with the next expiration date has returned below EUR 70 / MWh or USD 23,5 / MMBtu - a level where demand for the pivot to oil at the expense of gas is starting to weaken.

- China's coal price collapse affected the rest of the world after the government redoubled efforts to secure electricity supplies, considering imposing price caps and calling on miners to increase production. In the past nine days, China's coke and thermal coal futures have declined by around 45%.

The robust fundamentals forecast supporting higher fossil fuel prices until 2022 has not changed in our view, but recent events highlight the magnitude of potential volatility in these markets in the presence of both supply and demand uncertainties.

Precious metals

Gold remains within the range; Support in the form of decline in US real yields at the beginning of last week was reversed sharply before the weekend, and the negative impact of this situation was only partially offset by the weaker dollar. The technical outlook remains neutral: the market still does not have enough energy to hit the resistance at $ 1 hard enough ahead of the key $ 813 level, and as long as that situation persists, the price could fall due to, among other things, the aforementioned already profit taking in other commodity markets last week.

At the same time, the collapse of industrial metals prices made the situation of silver more difficult, and the gold-silver ratio rose again to 75 (ounces of silver to one ounce of gold) from the last low, i.e. 73. In recent weeks, the rise in industrial metals prices, the weakening of the dollar and rising expectations Combined inflation pushed the price of silver to its highest level in six weeks before the latest wave of sales restrained the metal's short-term potential. The key resistance is still a double peak at USD 24,85, while the support should be around USD 23,40.

Agricultural products

The prices of agricultural products start to rise again after being in the range for several months. Last week, this sector was responsible for the largest part of growth - both cereals and the so-called soft products. Even though maize was the leader, with its highest price in two months, the sustained strong rise in world wheat prices began to attract unwanted attention in the market. Like rice, wheat is one of the most important food products, and rising wheat futures in both the Chicago and Paris exchanges to their eight-year highs will nervously watch key buyers in the Middle East, North Africa and China - with The Middle Kingdom is already one of the world's largest importers of this grain.

Global reserves this year have contracted as a result of a troubled growing season in some key wheat production regions in North America, Russia and Europe. With the influx of buyers observed in recent weeks, some of these key importers are hedging against limited global supply, further contributing to the emptying of silos ahead of the period in which the El Ninã phenomenon will become more and more certain in the coming months. This period may also be adversely affected by the prospect of an increase in production costs due to higher prices of diesel oil and fertilizers. Higher fertilizer prices pose a risk to future crops, e.g. maize or wheat, and while huge harvests are promising in Australia and Argentina, concerns about supply may still support prices.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)