Forex strategy "At the end of the day". 6 months of trading - 61.85% profit

Equally 6 months have passed since the Forex strategy "At the end of the day" has been tested in our real account. Summary of round 24 weeks with a few days delay, but I wanted all positions to be closed at the moment and that there would be no understatement as to the result. The past weeks, unfortunately, were characterized by very low volatility (at least on pairs that seemed interesting to me). The summary will take a slightly different form than before. We will briefly discuss the most important transactions, and then we will go to more detailed statistics.

Summary of the 23rd and 24th week

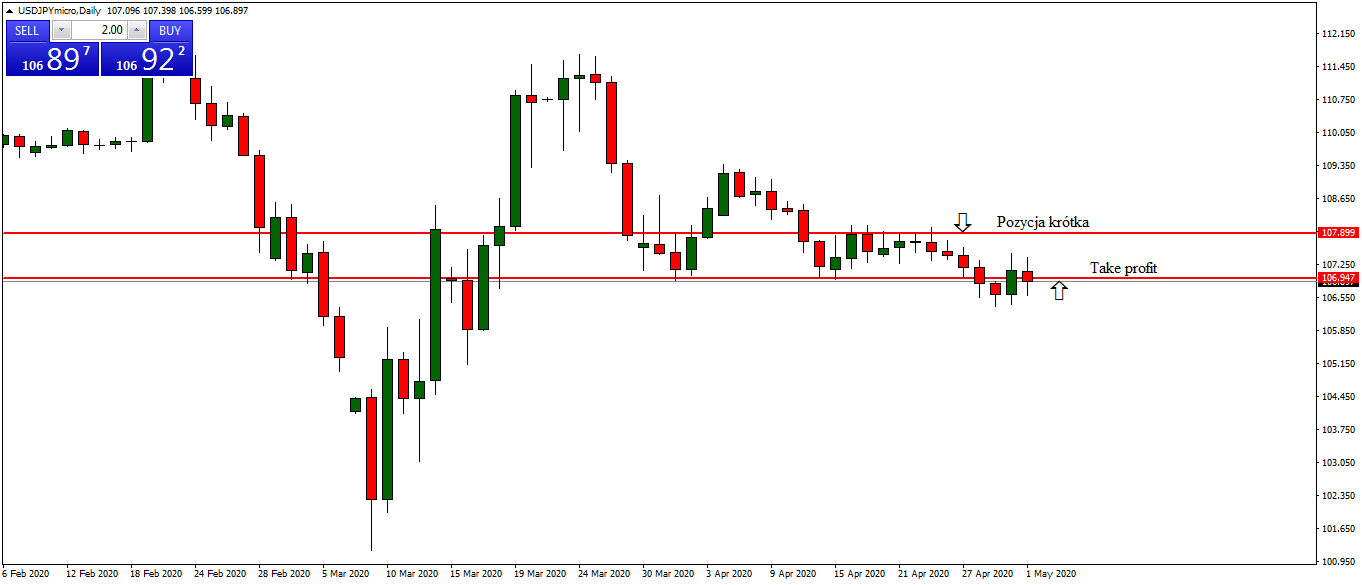

Due to very low variability, there were also fewer potential signals. Looking at the past two weeks, I can distinguish three pairs that in my opinion were worth attention: USDJPY, EURGBP, USDCHF. Definitely the best went to USDJPY. You can read more about this item also on the forum. The main level I was looking at here was around 108.055. After reaching this zone, the activation of supply was visible. The order was activated and the price went down well without any significant volatility. I took the profit by candlelight, always placing it slightly above the upper shadow. At some point there was a stronger upward correction and the position was closed.

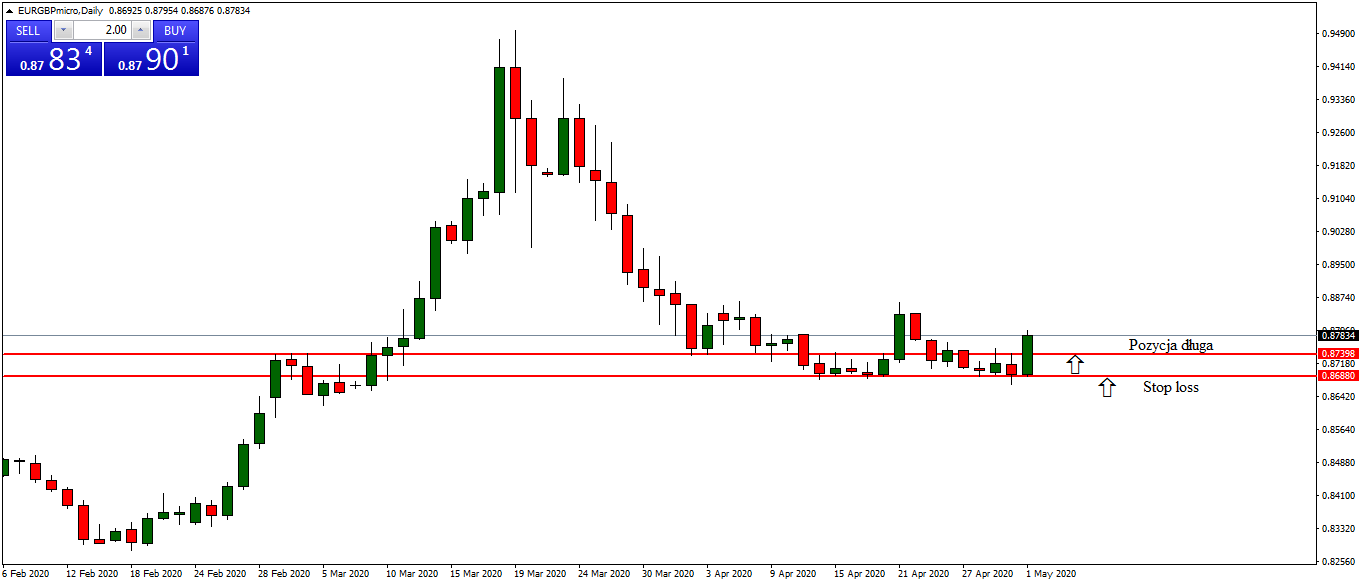

The next pair is EURGBP. I hunted for long here. After a strong correction, the quotations reached the zone at levels 0.87300 - 0.86800. In this case, due to the lack of volatility, I moved the rate a bit too close. As we can see in the chart, the candle from Friday is a strong way out. Nothing lost, I will try to play a long position here again. At the moment, the signal to try to repeat it, as it is.

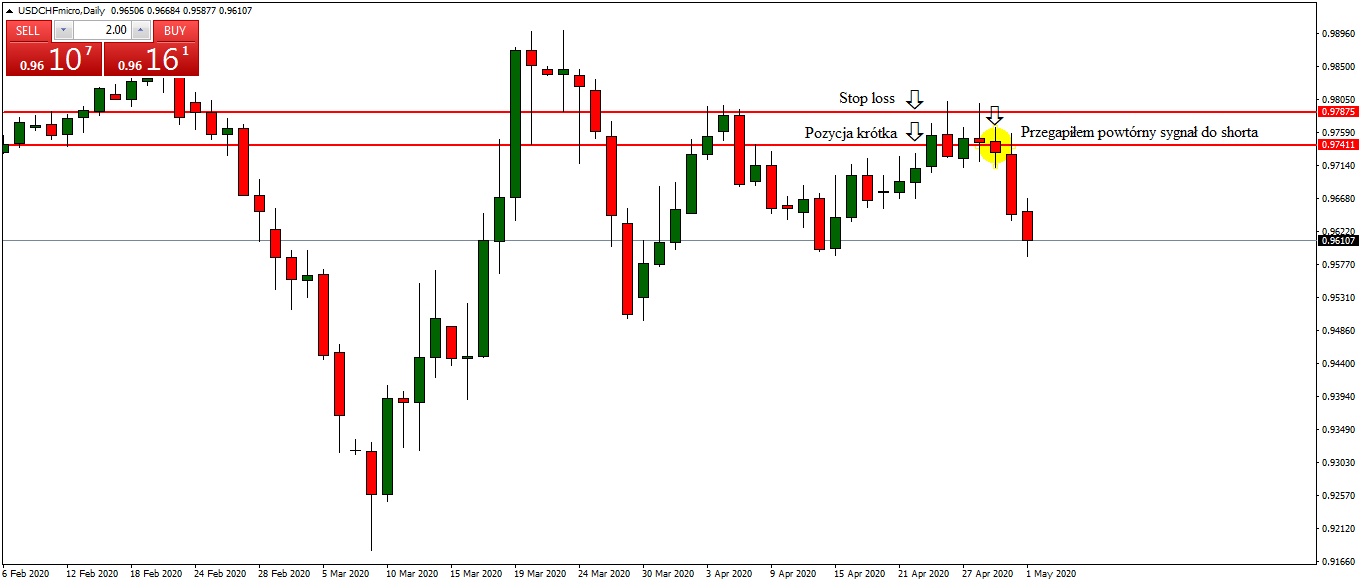

The last currency pair is USDCHF. Here, like on USDJPY, I wanted to play a short position. The key level was 0.97450. In general, a similar situation took place on this pair as on EURGBP. Unfortunately, I missed re-entry and I was unable to catch the stronger downward movement.

Forex strategy - statistics after 6 months

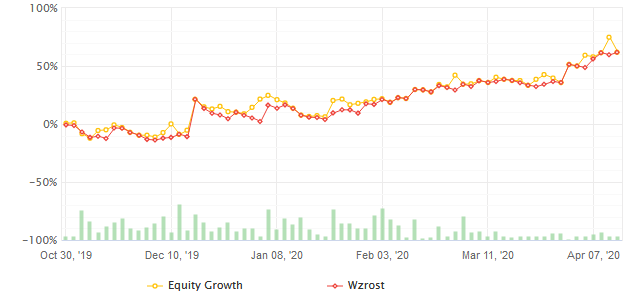

The rate of return after round 6 months is exactly 61.85%. Averaging, this gives us about 10% profit per month. With each transaction, the basis was capital protection, and only then profit. The acceptable loss I took on each position did not exceed -2% and this in the vast majority of cases was the maximum stop loss. It is also very important for me that there was no strong jumps on the bill that would drastically change the result. The capital curve was building up successively and most importantly repetitively.

Exactly 6 items were completed during 128 months. Averaging, this gives us about 21 items for each month. Taking an average of 20 trading days a month, 1 open position per day comes out. The advantage of such investing is the fact that we avoid overtradingu.

End of test

I wanted from the beginning show real trading just as he really is. For every trader, regardless of his experience, there will and will be series of losses and series of profits - this is completely normal. The effectiveness, which is less than 40% after this period, will not be high for some. On the other hand, the statement that you need to be highly effective in order to earn regular money can be safely put between fairy tales.

In my opinion, the most important element of trading is money management and the highest possible profit-risk ratio. Effectiveness is a matter of psyche, how we feel about the number of profitable and lossy positions and is very individual. Personally, I have been following the competition for many years Word Top Investorbecause there is also a long time horizon and only one bill involved. At the moment, the achieved rate of return gives the 3rd place. Of course, this is not a determinant, for some this result is great, for some it's average, for some it's just average. This is certainly not all, I will constantly try to improve the strategy so that the results are even better. However, we consider the test finished in this article.

End of the Day Forex Strategy - 6 Months Summary

| Number of items | 128 |

| Effectiveness | 37% |

| Max. initial capital drawdown | 14.08% |

| Average position time | 2 days |

| Profitable long positions | 32% |

| Profitable short positions | 41% |

| Best position | PLN 625,55 (+ 11,52%) |

| Worst position | -143,24 PLN (-3,96%) |

| Rate of return | 61,85% |

All and live results are of course available on MyFxBook profile. I also invite you to discuss strategy on forum.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![The Trader of the Month made $ 20 in December 600 [Forex Contest] trader of the month of December 2021](https://forexclub.pl/wp-content/uploads/2022/01/trader-miesiaca-grudzien-2021-300x200.jpg?v=1642612564)

![Three Custom AT Indicators - Practice Test [Week 4] indicators](https://forexclub.pl/wp-content/uploads/2020/07/niestandardowe-wskazniki-300x200.jpg?v=1594712711)