Forex Strategy "At the End of the Day". Summary - weeks 10 and 11

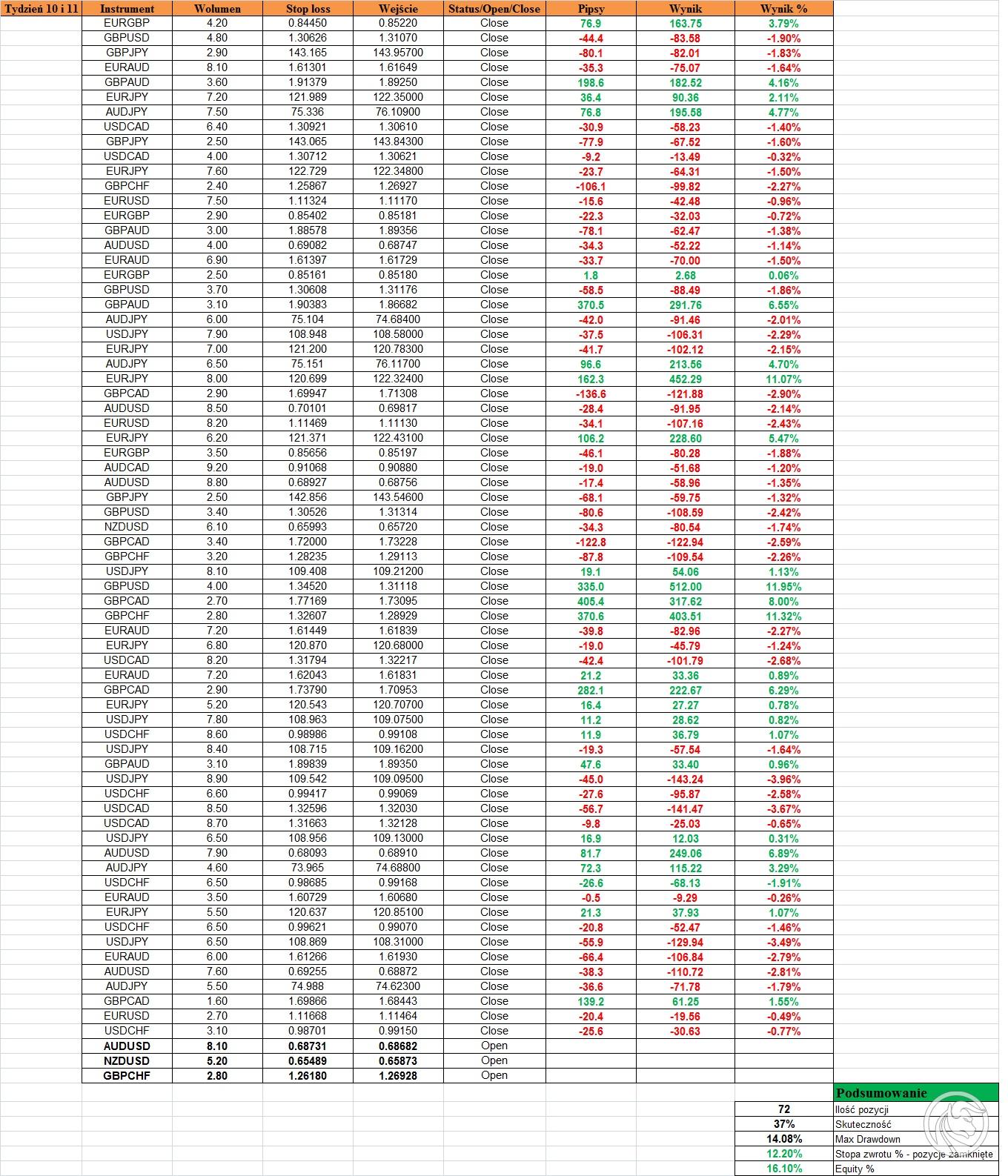

We continue the test of the "At the end of the day" strategy (described here). The time has come to summarize the 10th and 11th week of trading. In my opinion, it was a good time for strategy. That's why, that more information on the current status of the position appears on the forum, I will briefly discuss the most important closed transactions of the past two weeks, and then we will go to the setups, which are still "in the game".

Be sure to read: End of the day strategy - Summary of the 8th and 9th weeks

Selected transactions

When it comes to the most important profitable items, here I can include:

- GBPAUD - the continuing upward trend allowed the opening of another long. The transaction was closed on Thursday downward adjustment.

- EURGBP - take profit has also taken place here. I had the order around 0.85210. The price went down hard, followed by correction and closure.

- AUDJPY - analogous situation, downward trend, correction and take profit. I admit that this pair also looks interesting in the perspective of the coming weeks. Another strong zone was breached around 74.900. If there is a reflection up, it's possible that I will consider another short.

As for lossy transactions, the most important are:

- GBPUSD - admits that the pound has been a bit of a problem lately☺. The fall candle from Friday does not completely change my main scenario which is the upward approach, but currently I am not looking for a position in this pair. The situation will change if the price permanently returns above 1.31000.

- GBPJPY - here a similar scenario. The candle from Friday is heavily in supply, but in my opinion nothing is yet decided. I am not currently playing this pair. Back to the upside scenario, there will be a price above 145.840.

Open positions

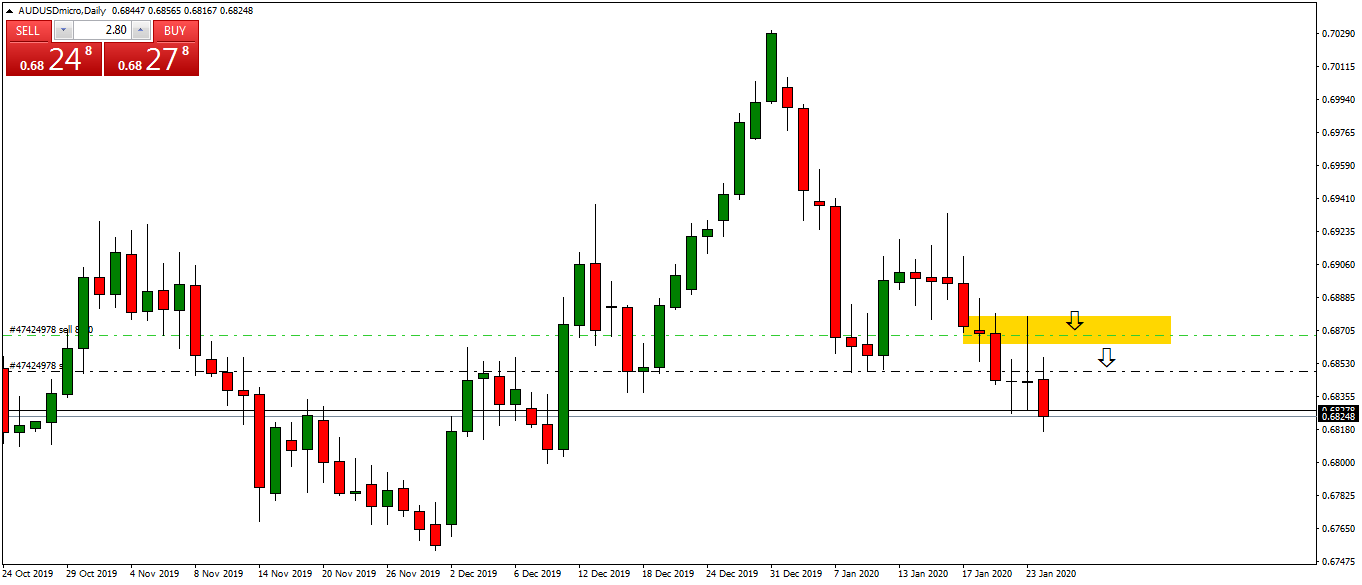

AUDUSD - short - a few days ago the couple beat a strong zone around 0.68800. The sales order has been activated at 0.68680. The price went down, according to the assumed scenario. At the moment, I have a secure position on a small profit.

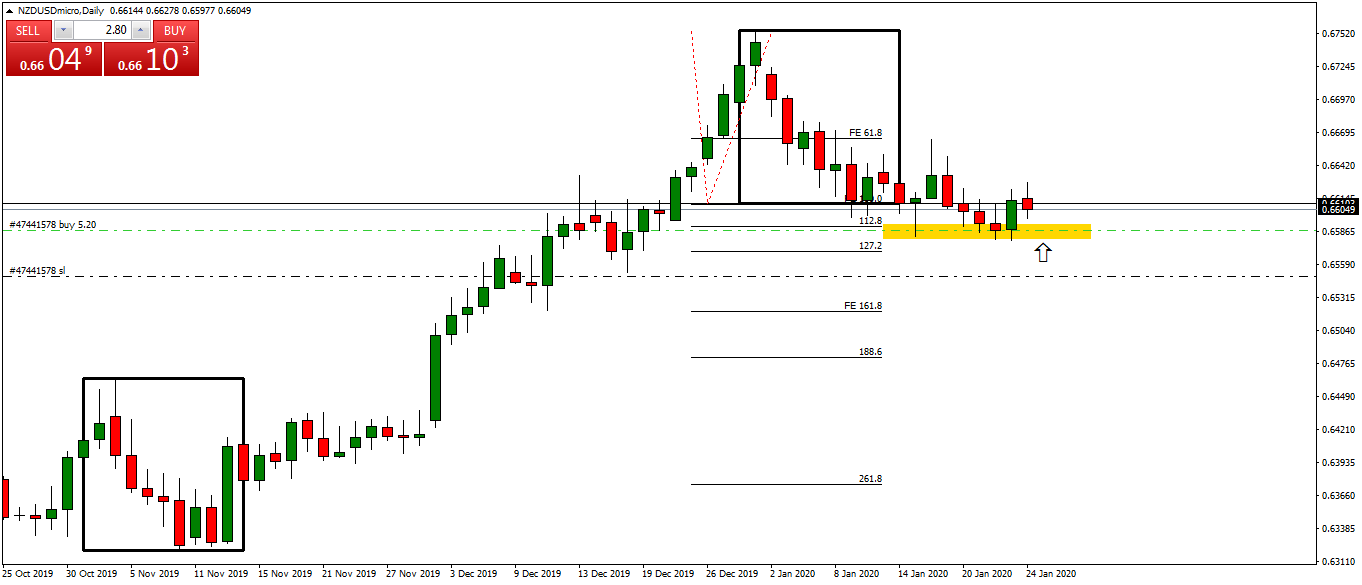

NZDUSD - long - the pair reached the strong demand zone at 0.65860 last week. Additionally, the level is boosted by 112.8% overbalance. Despite the downward Friday candle, the position is still in profit. We will see what the next days will bring.

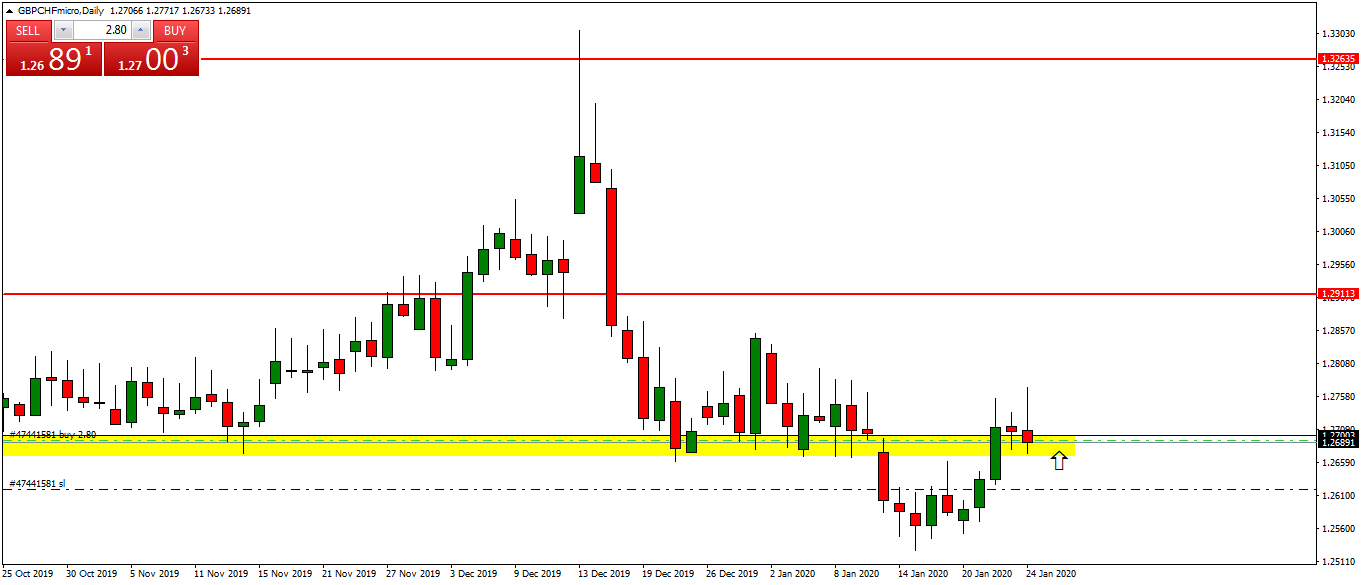

GBPCHF - long - as I wrote earlier, the situation in the pound is not entirely clear, but I always stick to my trading assumptions and plan. As for this pair, for me the border zone that will determine the further direction is the level around 1.26780. Despite the Friday candle, we are still above, which is why he keeps long. If the price permanently closes below this level, it negates my upward move scenario.

To sum up, at this moment, equity is around 16.10%. The following weeks also promise to be interesting. Information on new items will be published on a regular basis in the Forex Club forum. Feel free to comment and follow the results live on MyFxBook.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)