Raw materials inhibit due to nervousness around the virus and choices

The commodities sector saw a sharp turn back from the strong gains generated over the past few months last week. In the context of the new wave of Covid-19 infections in Europe and the United States, as well as in connection with the key event in terms of risk - the US presidential election, the transition of investors to the defensive is not particularly surprising.

Be sure to read: How to invest in raw materials and precious metals [Guide]

Until recently, the potentially reflective effects of Biden's win, global concerns about the weather, and strong Chinese demand provided solid fundamental support to metals - both noble and industrial - and key crops, while crude oil saw a sideways trend as concerns o demand for fuel was offset by the reduction in production by OPEC +.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

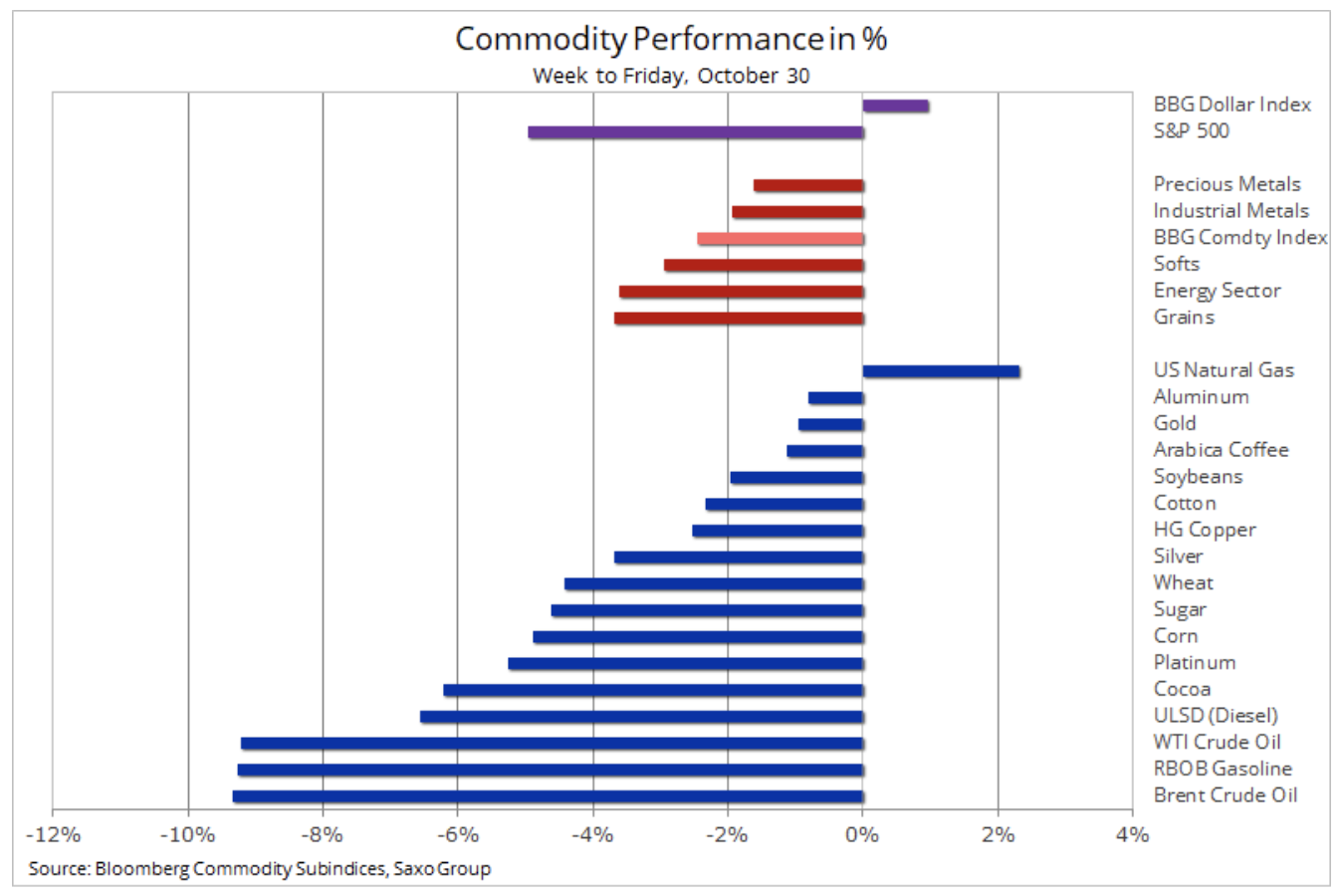

The - at least temporarily - ending this situation was contributed by the increase in risk aversion, as a result of which S&P 500 index lost around 5%, while the dollar strengthened by 1%, which put the Bloomberg commodity index down 2,5% with the biggest losses in the fuel and crops sectors. For the crops, which have seen some of the best performances in recent weeks, this illustrates the danger of positions becoming too large in times of lower risk appetite.

Petroleum

Oil experienced its worst month since March this year on rising concerns about fuel demand in the regions worst hit by the pandemic and rising production in Libya; these events have attracted more market attention than solid demand in Asia and the growing belief that OPEC + will delay the implementation of the agreed January production boost.

Brent oil dropped below support at $ 39 / b in reaction to higher-than-expected inventory growth in the United States and new lockdowns in France and Germany, which will undoubtedly be followed by other European countries. Overall, however, we suspect that ending the liquidation of long positions and the oral OPEC + intervention before reaching $ 35 / b could prevent further significant price drops.

Precious metals

As a result of recent events in the near future, it should be expected that investors will care more about capital protection than about profits. Against this backdrop, we believe that the greatest risk comes from commodities where speculative investors hold large, usually long, positions as they turn from projected long-term gains to a short-term, more defensive approach. As a result, crops and fuel are the hardest hit, while metals - both noble and industrial - have made a sharp turnaround.

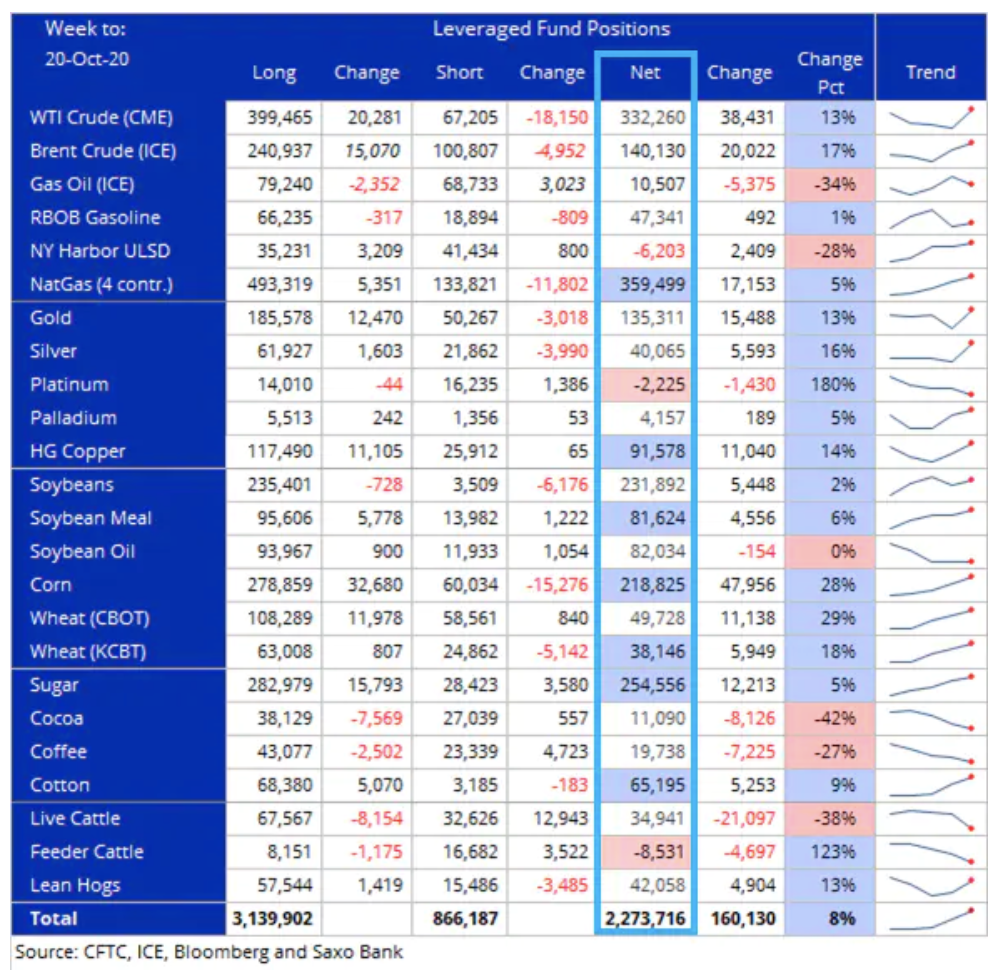

In recent weeks, the above-mentioned fundamental support has contributed to strengthening the demand for futures contracts from leveraged and trend following funds (CTAs). In the latest COT report for the week ending October 20 cumulative net long position in 24 major futures markets was 2,3 million lots, the highest level since February 2017. Raw materials such as natural gas, HG copper, soybean meal, corn, Kansas wheat, sugar reached new highs for several months and cotton; in addition, numerous purchase orders were placed for oil and gold. In the crop sector, the combined net long position of the six soybean, maize and wheat contracts was 702 lots, the highest level since 249. This clearly reflects strong underlying support, but at the same time warns that possible short-term changes carry a risk of a correction .

The table below shows speculative long / short positions and net positions of large speculative investors such as hedge funds and CTAs in key commodity futures. The data is compiled by the US CFTC and is published every Friday for the period ending last Tuesday. Color coded numbers in the net column show net positions at the extreme of +12 months.

Another example of a market where the outlook has been and continues to be overwhelmingly positive is the gold market. After hitting a record high of $ 2 / oz in early August, gold has depreciated over the past three months. These results, however, did not deter investors, who continued to increase their exposure, primarily through gold-backed equity funds.

In our last report on the gold market we warned that gold was not ready for an election shock or any other negative developments. We drew this conclusion after analyzing the activity in the options market before the election in the United States, which in terms of risk events did not increase significantly. Overview of the most popular options for GLD: arcx and GDX: arcx, the biggest ETF gold and mining companies showed - unsurprisingly but perhaps not surprisingly - an overwhelming interest in growth through call options. With this bullish market approach, the risk of a negative reaction increased to the extent that the new market weakness and the stronger dollar contributed to a decline not only in metals but also in most other commodities.

However, the gold chart does not yet show a trend that would raise concerns about a deeper and longer sell-off. Despite the recent weakness, the metal has yet to test the September low of $ 1 / oz, let alone $ 849 / oz, a 1% retracement of the March-August bull market. We perceive the current correction as temporary, and the record low rates and continued fiscal and monetary interventions provide the zloty with the necessary support. As a result, we also predict silver will pick up as post-election sentiment soothes.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)