Commodities hold their breath amid concerns about growth in China

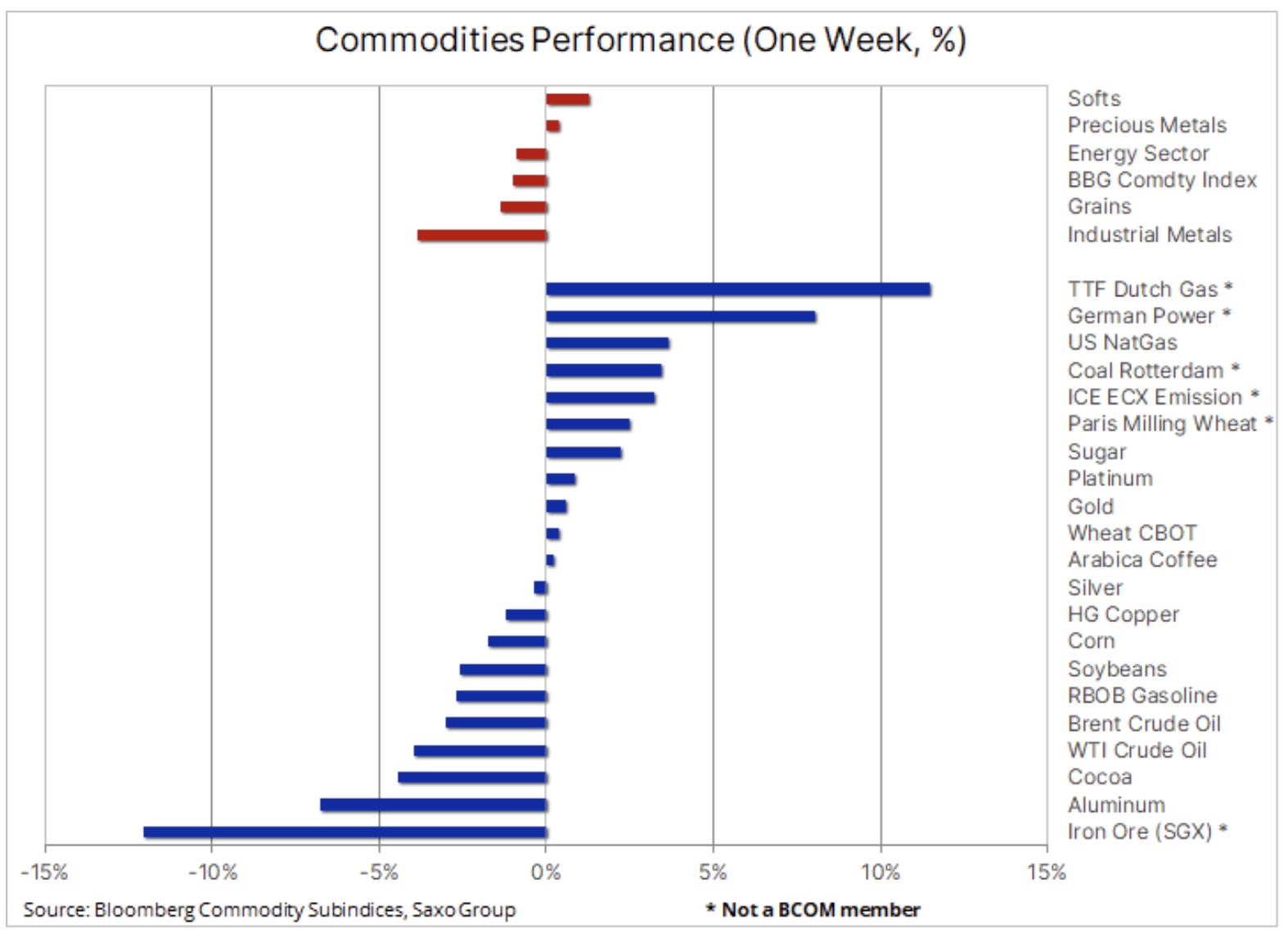

Consolidation continues in the commodities sector following a sharp increase in September-early October; last week, the Bloomberg commodity index fell for the third consecutive week. Investors' risk aversion was driven by a large amount of incoming data pointing to a moderating economic growth expectations, in particular in China, where slowing production, rising debt risk in the real estate sector and a nationwide electricity shortage suggest a slowdown in economic activity. In addition, the recent government-induced collapse in coal prices in China has pushed down the prices of some of the most energy-intensive metals, most notably aluminum material.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Industrial metals

Industrial metals saw the biggest weekly decline for the reasons mentioned above, and since reaching a record high three weeks ago, the London Metal Index has fallen by 10%. China's drive to reduce energy prices through coal interventions has so far resulted in a 50% decline in coal prices, which has translated into a decline in industrial metals prices due to lower production costs. Copper wiped out most of the gains recorded in the period of growth in October, and while data from stock exchange-monitored warehouses clearly indicate a contraction in supply, the market was driven by concerns about demand in China and the eradication of recently opened long positions.

Precious metals

Gold and silver are showing signs of life after the market recognized that the long-awaited announcement of the US Federal Reserve limiting asset purchases was mild in the sense that the FOMC did not seem particularly inclined to raise interest rates and reiterated that inflation will be of a temporary nature. The view on easing monetary policy was additionally strengthened by the decision of the Bank of England to keep rates unchanged despite inflationary pressures at the highest level in almost 25 years. Gold has returned to $ 1 after another sharp and short-lived sell-off, but overall the market clearly lacks the momentum to push it out of the range where it has been for many months.

US 1-year real yields returned below –18%, which contributed to the strengthening of the dollar and reduced volatility in the stock market. The latter phenomenon was one of the reasons why stock fund assets fell to their lowest level in XNUMX months, as real money investors were moving away from gold due to the need to diversify their portfolios. On Friday, the market focused on the monthly US employment report, which proved to be solid once again, potentially influencing monetary policy views.

Petroleum

Clothing it is increasingly showing signs of entering a period of consolidation, and after a two-month boom that saw Brent and WTI crude prices rise by nearly a third, it could be argued that this was long to be predicted. In our opinion, however, this phase will be temporary due to the fact that the strong fundamental reasons for the recent boom have not disappeared. In this context, we still see the risk of an even greater rise in prices towards the end of the year and early 2022.

Here are some of the reasons for the recent fall in oil prices. It is worth emphasizing that some of them may very quickly see a twist towards strengthening prices.

- The prospect of a further increase in monthly production by OPEC + at the rate of 400 barrels per day.

- The suspended negotiations with Iran are scheduled to begin on November 29, and in the unlikely event of any breakthrough, Iran could increase its production.

- Stabilization of gas prices - albeit at a high level - in anticipation of an increase in flows from Russia, which will weaken the impact of the gas-oil ratio on the increase in fuel prices.

- Further concerns about further disruptions in demand caused by the Covid pandemic, primarily in China, the world's largest importer.

- U.S. crude oil inventories are projected to increase seasonal due to weaker demand from refineries during the annual maintenance period.

- The continuation and potential acceleration of the release of strategic oil reserves by the US government. Over the past two months, it has averaged 1,1m barrels per week.

- Sell-off among technical traders and speculative investors in response to last week's drop below the latest support level; With regard to WTI crude oil, this applies in particular to the upward trend from the August minimum.

In addition to the above short-term developments, the oil market faces long years of potential underinvestment - major players are losing their appetite for large-scale ventures, in part due to uncertain long-term outlook for demand, but also, increasingly, due to credit constraints on banks and investors on ESG (environmental, social and corporate governance) issues and the emphasis on green transition.

Whether the range for Brent crude oil in the short term is USD 80-85 or USD three to four below will largely depend on US price-cutting actions, the Covid-19 situation and - this week - the gas market and to answer the question of whether Russia will increase gas supplies to Europe as promised, thereby potentially contributing to further price reductions.

Agricultural commodities

According to the FAO world food prices last month they reached their highest level in 10 years and the world food price index rose by 3%. This index, which covers 95 prices for various food products, grew by more than 30% last year, with increases in all five sectors. Last month, vegetable oil prices reached a record high after an increase of almost 10%, which resulted in an annual increase of + 74%. Other sectors with strong annual increases are sugar (+ 41%) and cereals such as wheat, corn and rice (22%). In addition to worries about the weather and strong demand, the FAO identified labor shortages in certain parts of the world as a factor in the rise in food production and transportation costs.

World wheat prices went up sharply at the beginning of last week: the price of consumer wheat on the Paris Stock Exchange hit a record high of around 300 EUR / t, while on the Chicago Stock Exchange the price of this grain exceeded 8 USD / bu for the first time in nine years. The low harvest in North America, combined with the decline in exports from Russia, the world's largest exporter, contributed to an increase in demand for European wheat, with the prospect of another potentially difficult year for agriculture in 2022 due to the return of the La Ninã phenomenon and higher costs fertilizers, some of the largest importers have already started to increase the buying rate.

This applies, among others, to China, as well as countries in the Middle East and North Africa. For example, Saudi Arabia has recently reserved 1,3 million tonnes of wheat, which is almost twice the amount expected. The largest importer - Egypt - which has so far lagged behind in purchases compared to last year by more than 20%, increased the pace of purchases after the recent rejection of offered prices. This indicates that countries - not only in North Africa but also in other parts of the world - need more supplies to stem the rise in local food prices and to secure supplies against the coming of winter.

In a context of increasingly fierce competition among buyers for supplies, some relief in the market will be provided by the upcoming harvest in Argentina and Australia. The harvest begins now and will run until January; so far, the forecasts for production in both countries appear promising. After reaching the aforementioned record price for consumer wheat in Paris, a retracement at the end of the week could signal a short-term peak.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)