The relationship between the US elections and the situation on the markets

With November's U.S. elections on the horizon, it's worth considering how the presidential election and stock markets connect. Do markets influence elections, does the president influence markets, or are these two things completely unrelated? The answer lies somewhere in between.

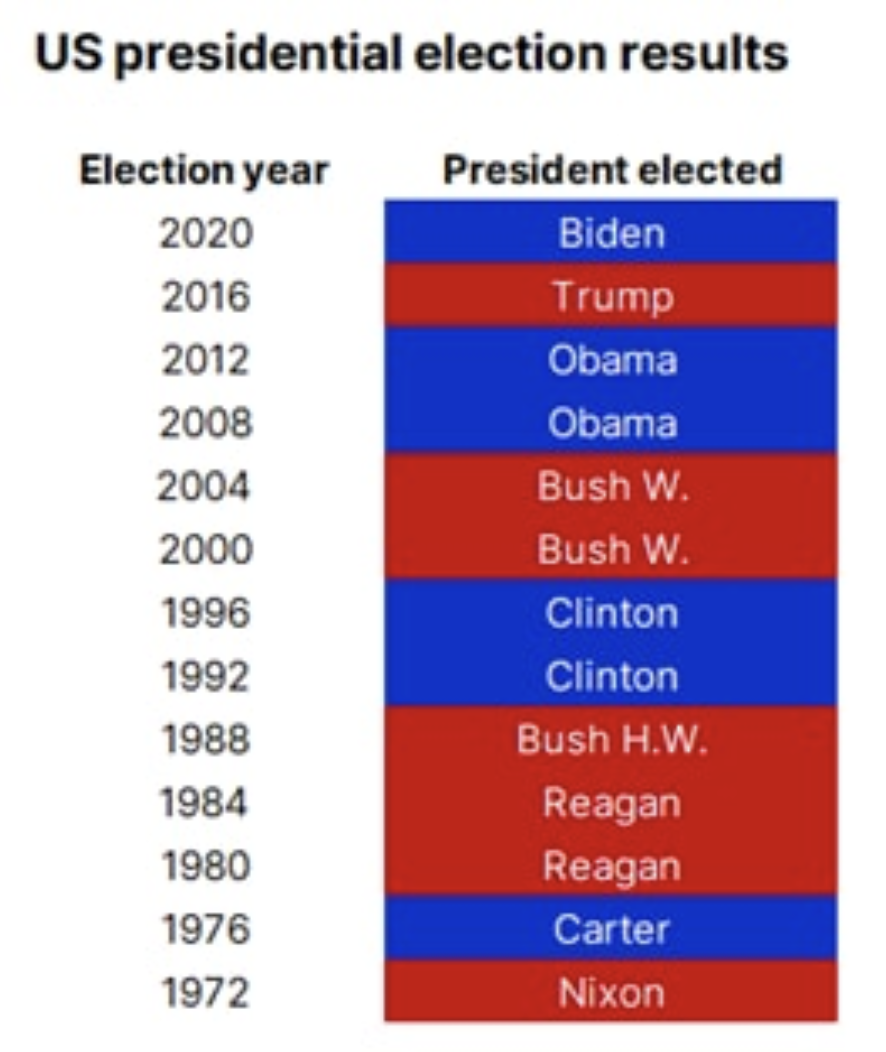

Let's look at the thirteen presidential elections since 1972. This period followed the breakup of the so-called the Bretton Woods system in 1971, which meant the US dollar became independent from gold and fundamentally changed market dynamics. Thirteen picks are not enough to establish statistical significance, so any conclusions should be taken with a pinch of salt. Moreover, it is questionable to what extent outlier years such as 1980, 1996, and 2008 influence or inflate the results, so the conclusions are suggestive at best. Of these thirteen elections, seven were won by Republicans, and six by Democrats. The incumbent president won five times, and seven times the result meant a change of the ruling party, while in one election a new president from the ruling party appeared.

Does election year affect market performance?

The first question worth answering is whether markets perform differently in an election year than in other years. After all, one would reasonably think that the sitting president would do everything in his power to support the economy.

At first glance, this hypothesis actually seems correct, since the average rate of return for S & P 500 (not including dividend reinvestment) in an election year averages 8,7%, compared to 7,7% in other years. But, as always, the devil is in the details. Mathematical concepts do not allow us to take the average return from election years and compare it with other years. To correct for this, we combined these 13 years of return data and calculated the total compounded return for these election years. The compounded return for election years is 7,8% annualized, which is very close to the compounded return for non-election years, meaning there is no significant difference.

Does the stock market influence election results?

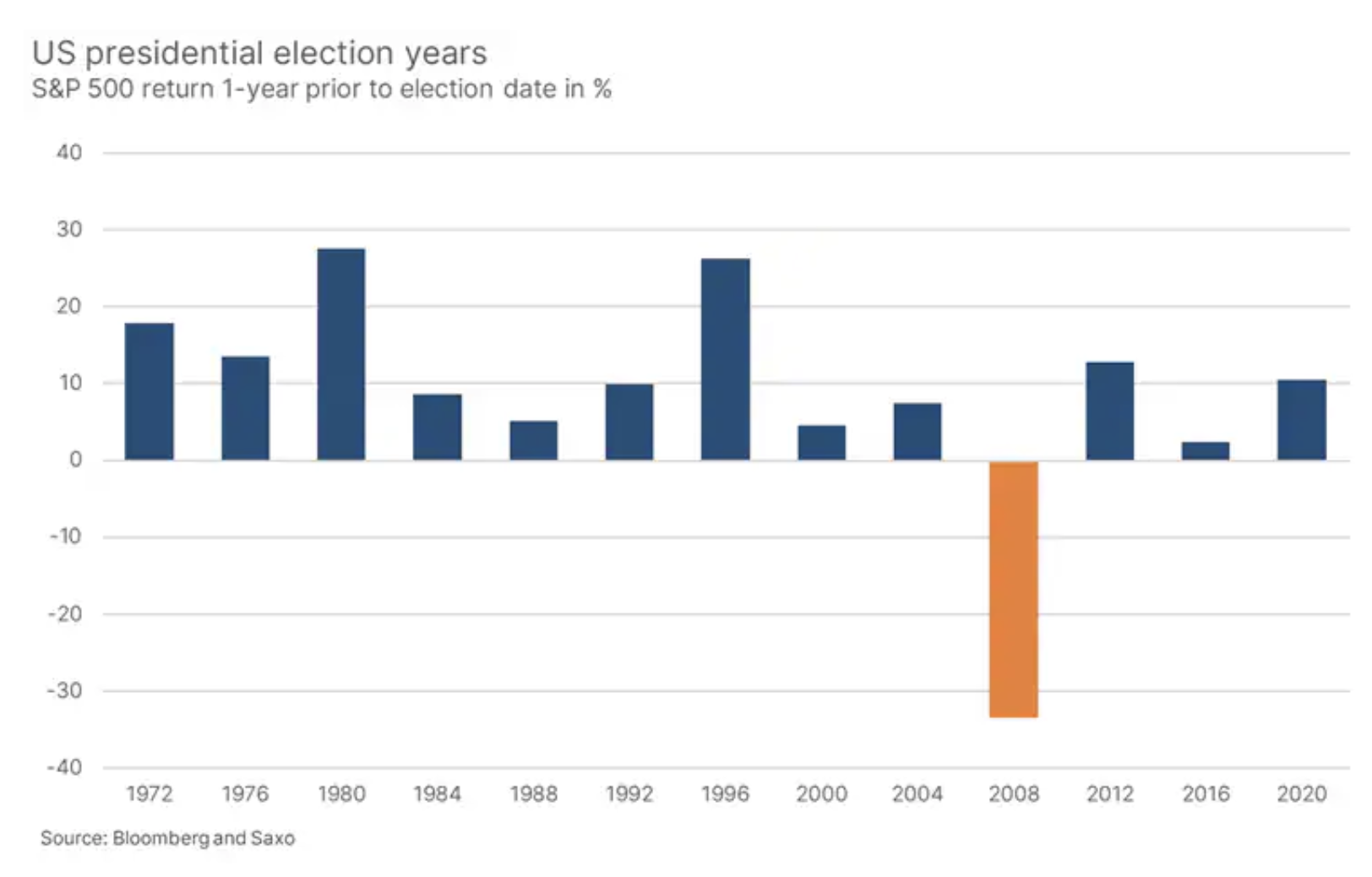

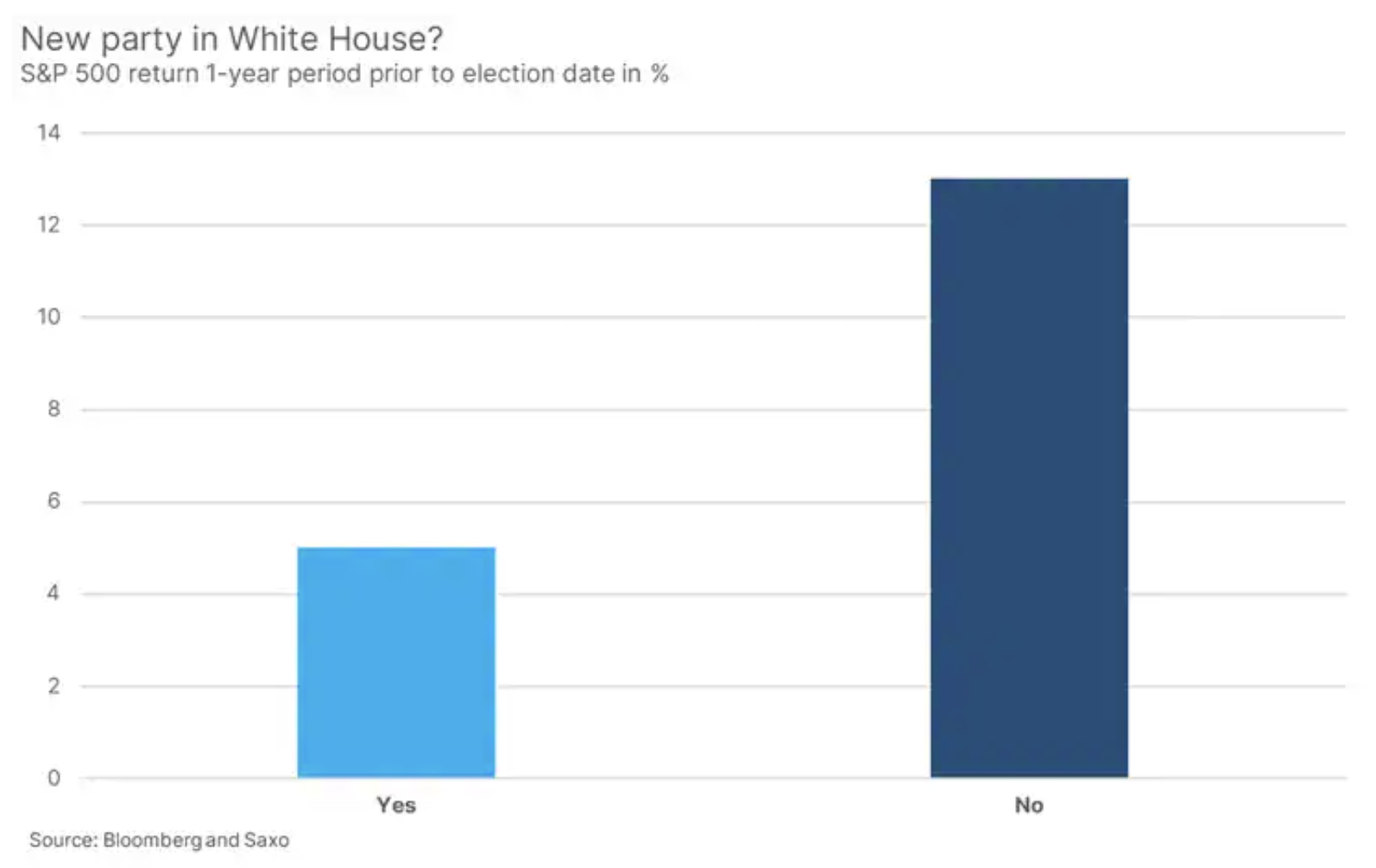

We can also consider whether stock performance can say anything about who wins the election. After all, the stock market is one of the best barometers of economic sentiment and prospects. It summarizes the collective view of the future, so a rising stock market on Election Day indicates that the future is improving, which should theoretically be a positive for the party controlling the White House. Here we looked at the S&P 500's annual return during election years with and without the changing of the guard.

Based on the chart above, one could make a rather weak argument that the strong US stock market is an additional tailwind for the party controlling the White House. However, we cannot conclude that there is any causal relationship between stock market performance and election winners.

Does the stock market favor the party in power?

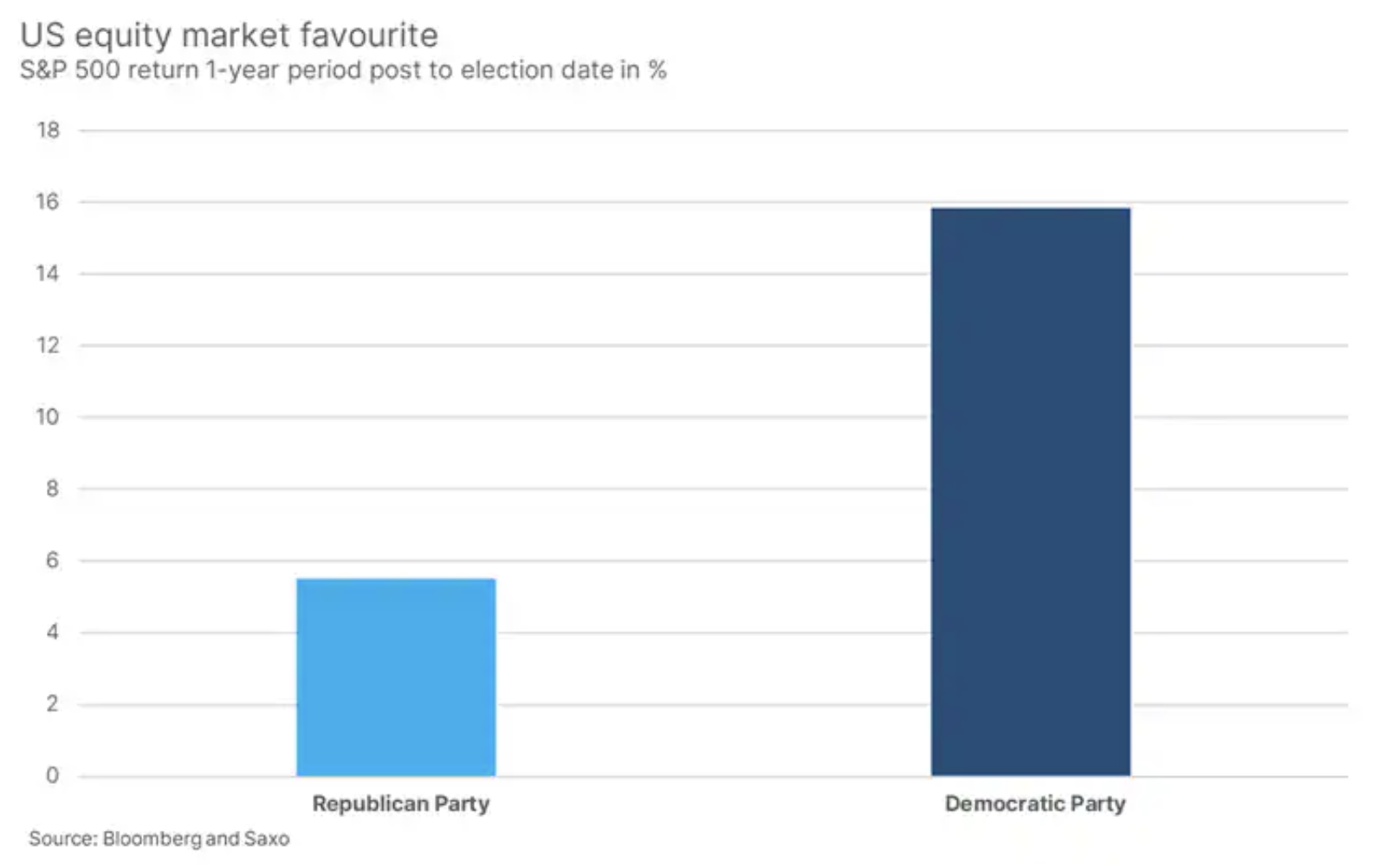

The last thing we will examine is whether the markets prefer a Republican or Democratic president. To do this, we looked at returns from the S&P 500 index in the year following the election date.

Interestingly, you can see much higher returns a year after an election if a Democrat became president. However - and this is also important in the context of the rest of this article - it is important not to view the data in a vacuum, as these results are, to some extent, the result of outlier years such as 1976, 1996 and 2020.

Summation

Based on this analysis, the strongest conclusion is that there have not been enough elections since the departure from Bretton Woods for us to be able to say anything definitively. However, available data show that there is no significant difference in stock market performance in election years compared to other years, but there is a tendency for the party whose representative held the presidency in years with good stock performance. Finally, over the thirteen-year period in question, the year after the election, markets did better with a Democrat than a Republican president, although this appears to be skewed by events unrelated to party politics.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)