Three Custom AT Indicators - Practice Test [Week 3]

We have finished the third one test week based on 3 selected, non-standard technical analysis indicators (not available as standard on MT4). We are currently at the halfway point of our experiment - a total duration of 5 weeks.

The custom indicators included in the system are:

- Multi trend signal,

- CCI and CCI Divergence (in one window),

- 3D Oscillator.

The initial balance of our Live account on IC Markets is 1000 USD. Will we finally make a profit? Time will tell :).

Small steps but in the right direction

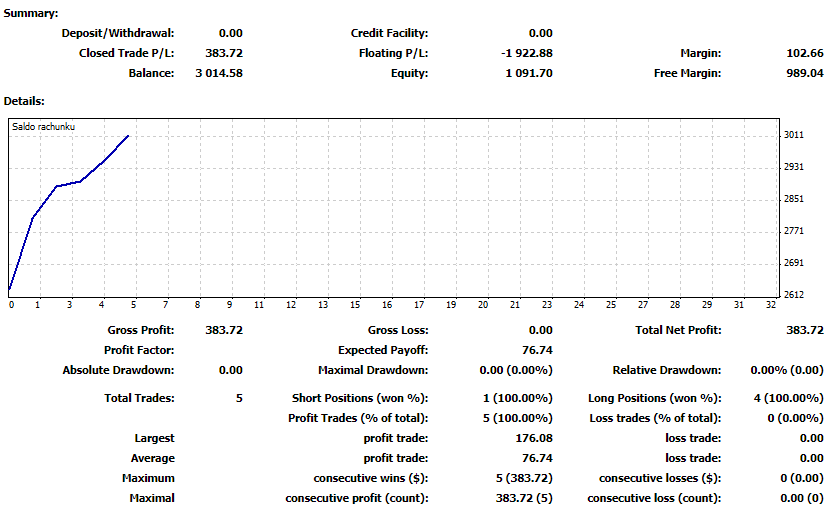

Last week 5 transactions were completed. They were all profitable and gave a profit of 383,72 USD. The small number of operations is due to the fact that it was late "Blockade removed", that is, a closed opposite batch of positions. An important issue is that we no longer have open "outstanding" positions, and our margin level and free margin have increased significantly, which opens the door to further opportunities.

Capital curve, real account. Source: MT4, IC Markets.

Account balance after the third week of trading:

- 40 items - all profitable,

- Total profit of USD 2014,58, which gives a rate of return of +201%,

- 1 active position with a balance -1922.88 USD,

- Looking at Equity, our balance sheet is +9,2%.

Summation

After removing the opposite position, our situation has improved significantly. Of course, the decision to close it was based on the tested indicators. In this case, the intervals H4 and D1 should be particularly taken into account. For sure this week we will try to perform as many operations as possible so that our balance increases systematically until the end of the test.

In the case of an active loss position, this is particularly important, because with each profitable transaction our capital increases and thus we increase our security, if, however, the upward movement on gold was continued.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Three Custom AT Indicators - Practice Test [Week 3] indicators at forex](https://forexclub.pl/wp-content/uploads/2020/07/wskazniki-at-forex.jpg?v=1594031122)

![Three Custom AT Indicators - Practice Test [Week 3] forex forecasts](https://forexclub.pl/wp-content/uploads/2020/07/prognozy-forex-102x65.jpg?v=1594026866)

![Three Custom AT Indicators - Practice Test [Week 3] siacoin is a cryptocurrency](https://forexclub.pl/wp-content/uploads/2020/07/siacoin-sia-kryptowaluta-102x65.jpg?v=1594111970)