With the green transformation, battery production will become a high growth industry

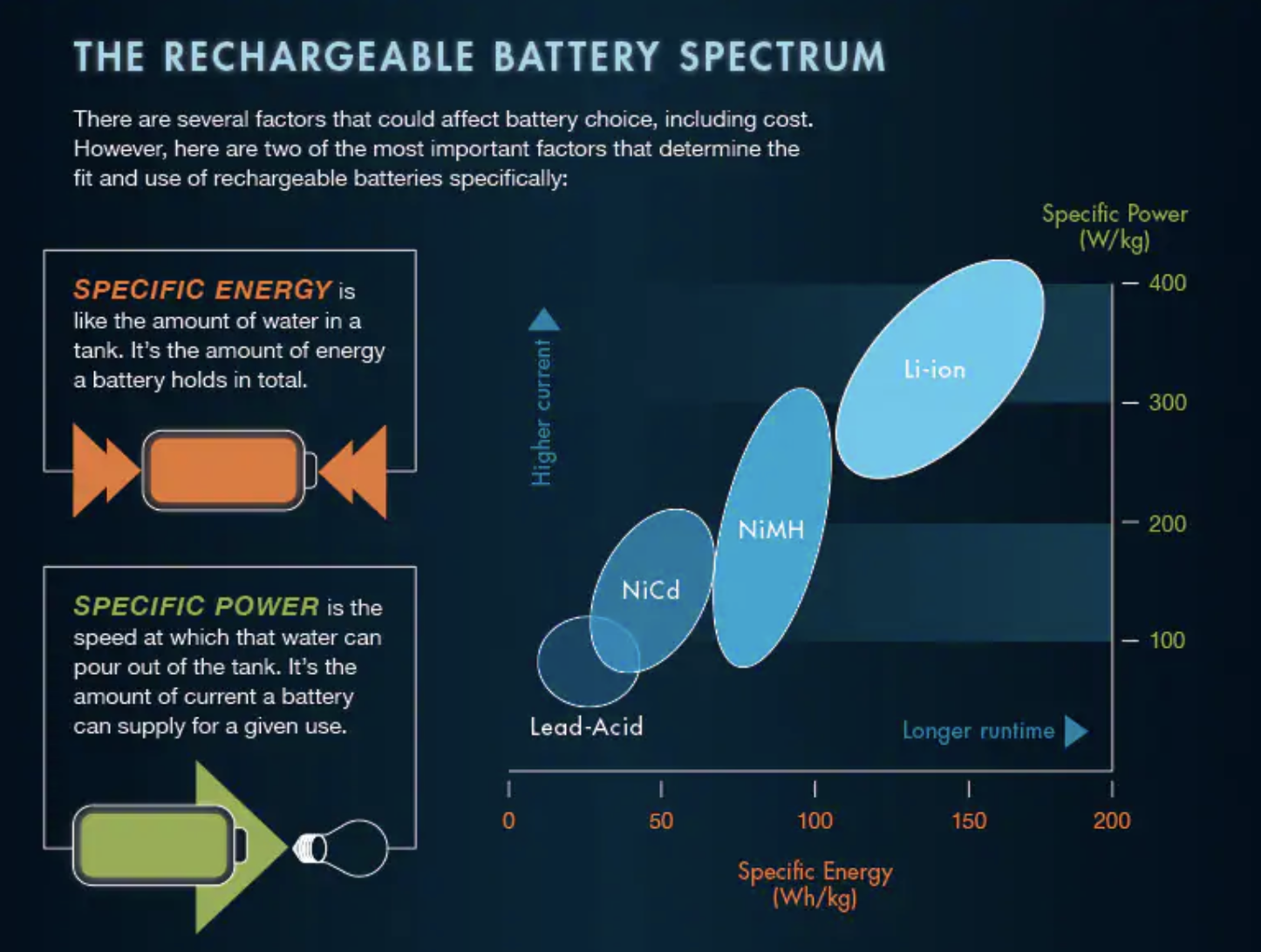

Over the past 15 years, battery manufacturers have embarked on a veritable technology race as batteries and accumulators become a component of an increasing number of products, from smartphones to electric vehicles, tablets, bicycles, and industrial applications. The industry is turning from lead-acid batteries previously used in automobiles, industry, households, etc. to lithium-ion batteries, currently at the vanguard of mobile electrification.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

Electric cars and green energy are driving the battery revolution

The two main drivers of the shift to lithium-ion batteries are electric vehicles and energy storage, which can absorb excess energy from renewable sources. Until recently, the demand for lithium-ion batteries was mainly consumer electronics such as laptops, cameras, smartphones and other devices, however, such applications require a lower energy density, so the demand function has only contributed to a gradual reduction in the cost of these batteries. Powered by Tesla electric vehicle revolution, however, increased the demand for lithium-ion batteries with higher density and volume, lowering costs thanks to economies of scale.

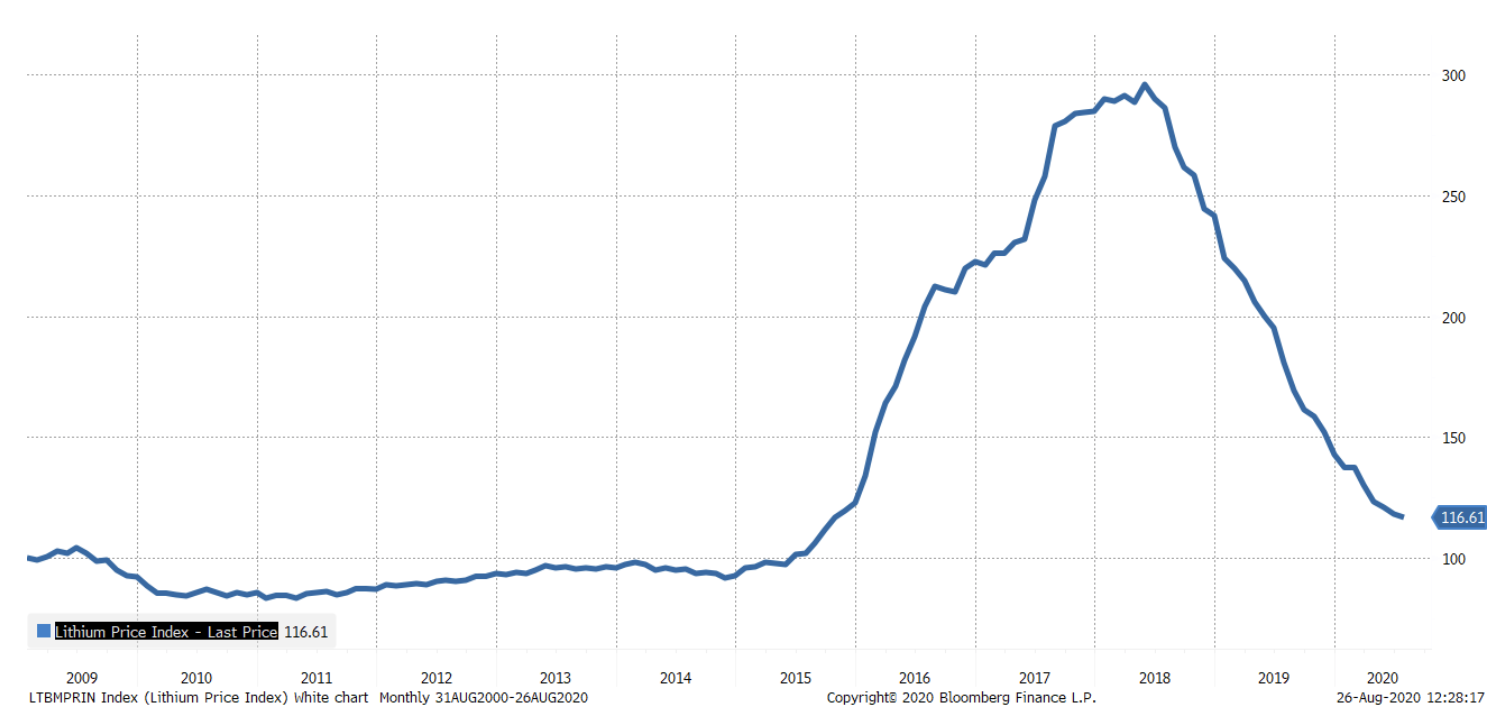

Since the main component of a lithium ion battery is lithium, its price naturally matters to the overall cost of the battery. In 2009-2014, the price of lithium was stable, however, as the production of electric vehicles accelerated, the supply became small, and the price increased by 2015% from the beginning of 2018 to mid-220, motivating for large-scale investments in the extraction of this raw material ; when the supply increased, the price fell 60% from its peak. Currently, the price of lithium is only 18% higher than at the beginning of 2009, which translates into a low cumulative annual growth rate (1,5%). Lithium mining companies are unlikely to take over the bulk of the revenue stream from the battery revolution, so we do not expect these companies to be the most interesting investment.

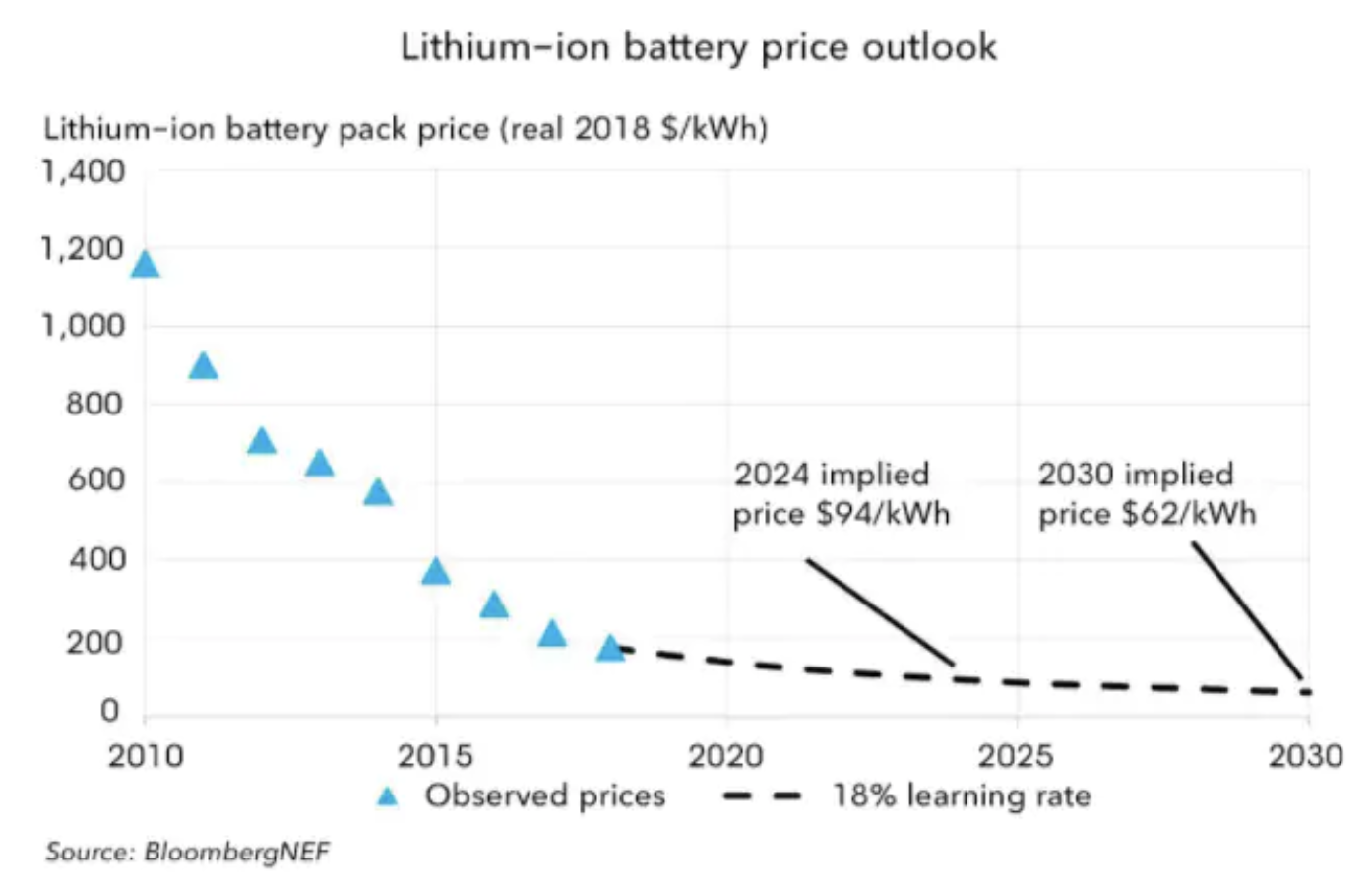

The cost of the lithium-ion battery has dropped from nearly $ 1 / kWh in 200 to $ 2010 in 176 and $ 2018 in 156, and by 2019, BNEF (Bloomberg New Energy Finance) expects the price to drop to 2030 USD / kWh. The cost reduction will result from the economies of scale resulting from the proliferation of electric vehicles and energy storage for renewable energy production, and BNEF predicts that in 62 the global market for lithium-ion batteries will achieve annual revenues of nearly $ 2030 billion.

Electric cars, the main driver of the demand for batteries, will experience a real revolution in the coming years. According to BNEF, by 2022, the number of electric car models in the world will reach 500, and the sales volume will increase from 1,7 million in 2020 to 26 million in 2030, to reach 2040 million in 54, which will be 58% of total new car sales. Such long-term forecasts tend to overestimate as technological advances are unpredictable and could turn out to be much faster, with multi-country regulation being the most important factor. By 2040, the increase in electric vehicles will reduce oil demand by 17,6 million barrels per day, or about 17% of daily oil demand in the run-up to the Covid-19 pandemic. By 2040, the demand for electricity for electric vehicles is expected to increase by 1 TWh, which translates into approximately 964% of global electricity demand.

China is focusing on increasing production, however recent analyzes show that in terms of costs, Indonesia is currently outperforming the Middle Kingdom due to lower labor costs and easy access to nickel and cobalt (both of these metals account for 22% of battery costs), although there is this is with more carbon dioxide emissions from the electricity used to produce batteries. Whether Indonesia can seize this opportunity remains to be seen, but as it is likely to be a high-tech tech race, we believe China will dominate the industry.

Direct exposure to the battery and energy storage sector is difficult

The biggest problem with the battery sector is that many companies in the battery sector do not provide direct exposure to lithium-ion batteries. Lots of available ETF is too comprehensive, and some of them even include traditional car manufacturers or mining companies offering little exposure to lithium in their basket. We decided to select the available actions to obtain a narrower and in our opinion better exposure profile for lithium-ion batteries and general energy storage technologies.

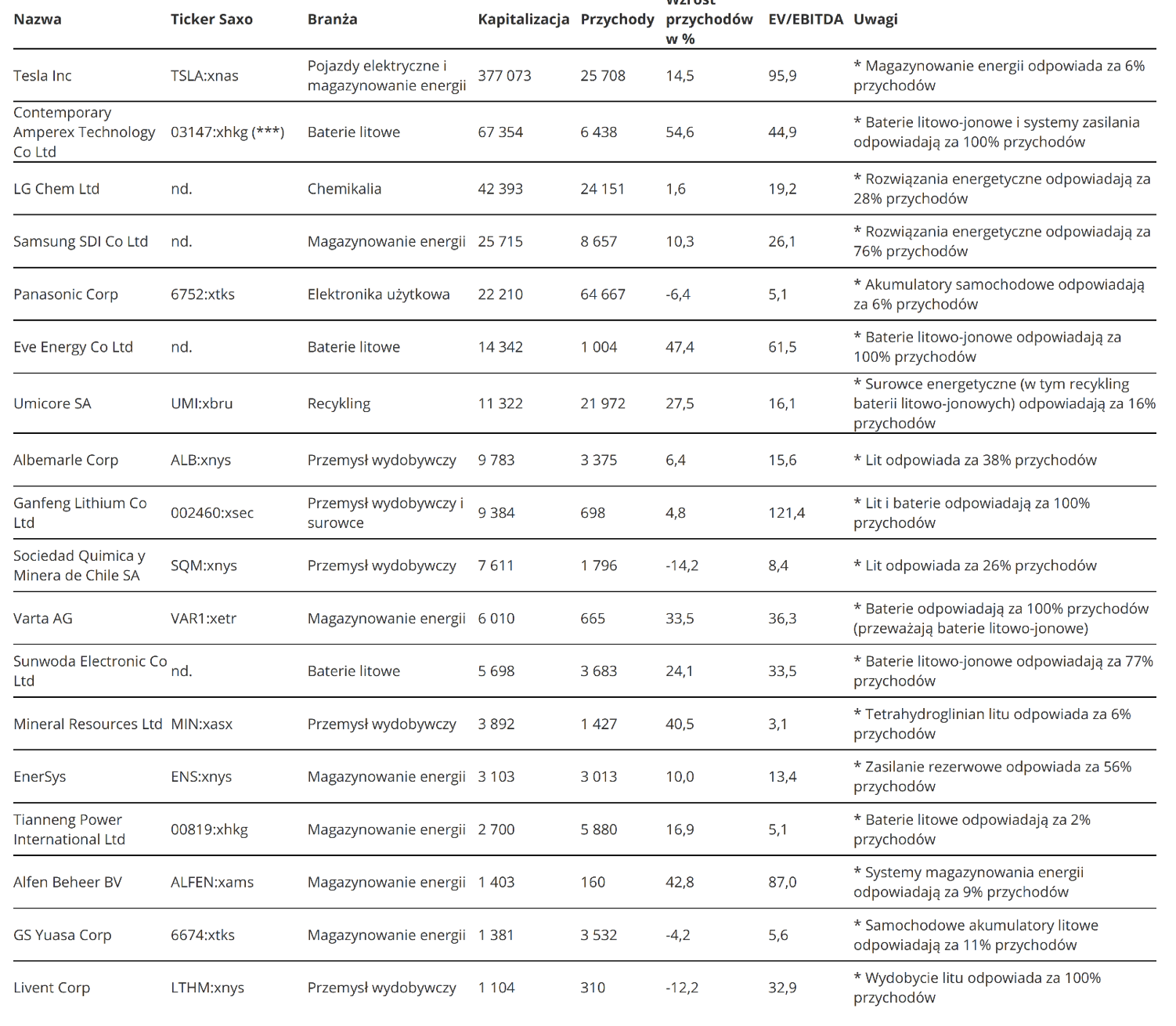

Key to the stocks of the 18 companies in the table below is that they will benefit from trends in mobile electrification and renewable energy, which will intensify if you win Joe Biden in the US presidential election in November.

Source: Bloomberg and Saxo group of companies. * Capitalization and revenues in million USD. ** The% increase in revenues is the annual rate of revenue growth. *** Stock not available on Saxo trading venues, but the CSOP SZSE ChiNext ETF provides exposure to these stocks at 9,2%.

Some of the companies on this list may be under discussion. Tesla, with just 6% of its revenues from energy storage solutions, may be too far-reaching, but on the other hand, the company will benefit from cheaper lithium-ion batteries. We have included two companies that are not normally mentioned in this context, namely Alfen and Umicore. Alfen, based in the Netherlands, has been listed since 2018 and offers energy storage solutions as well as electric vehicle charging stations, so the company will also benefit from cheaper and more accessible batteries driving the demand for electric cars. Umicore, based in Belgium, has a strong position in the recycling sector with the recycling of energy resources, including lithium-ion batteries, accounting for 16% of its revenues. With lithium-ion batteries growing in popularity, recycling will increase in importance, and the company seems to be in the best position to take advantage of this trend.

Another observation from the table is that direct investment in lithium-ion batteries is mainly offered by Chinese companies, the most interesting of which is Contemporary Amperex Technology Ltd (CATL), as it recently signed a large contract to supply Tesla with lithium-ion batteries for car production electric in China. CATL, Eve Energy and Sunwoda Electronic are not available on Saxo's trading venues as the stocks of these companies are not listed on the main market but are part of the ChiNext market, which only some institutional investors have access to.

One of the companies frequently mentioned is Panasonic, as it was the first company to trust lithium-ion batteries for electric vehicles, becoming Tesla's primary partner early on. However, while the investment is for lithium-ion batteries, automotive batteries only account for 6% of Panasonic's revenue and therefore are not a true share price driver. Panasonic is a large consumer electronics company and could unlock significant shareholder value by carving out a segment of car batteries.

We have several lithium mining companies in our cart as it is by far the main component of lithium ion batteries. The other key metals are nickel and cobalt, but we did not include any mining companies in these two categories.

The annual average revenue growth of these companies is 18%, and their average EV / EBITDA multiplier is 35, which is almost three times the multiplier on the global stock market. This is naturally a high price to pay for this trend, but our overall view of the long-term trend is that the market continues to undervalue the cumulative effects of multi-year trends. While the battery and energy storage industry may face problems with regard to pricing multipliers, we believe the demand profile will remain robust for the next three decades as the world moves towards a less carbon-based economy powered by electric cars and energy renewable.

Lithium-ion battery

The first commercial lithium-ion battery was produced by Sony in 1991, and since then the battery has undergone a real makeover in terms of both energy density and cost. The entire history of the technology that led to the production of lithium-ion batteries is well documented on the visualcapitalist portal. As you can see in the figure below, the lithium-ion battery is leading the way in runtime and energy density, which explains why the technology is at the forefront of mobile electrification and surplus energy storage from renewable sources.

The idea of a lithium-ion battery dates back to the 70s, when Stanley Whittingham, an English chemist working at Exxon Mobile, became interested in this issue. This concept was commercialized by Sony, and the production of laptops sparked a massive demand for lithium-ion batteries. The technology is now key in the transition from a carbon-intensive economy, as recognized last year when the Nobel Committee awarded the Nobel Prize in Chemistry to three scientists behind the technology.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)