USDPLN above 4.00. The most expensive dollar since April 2017

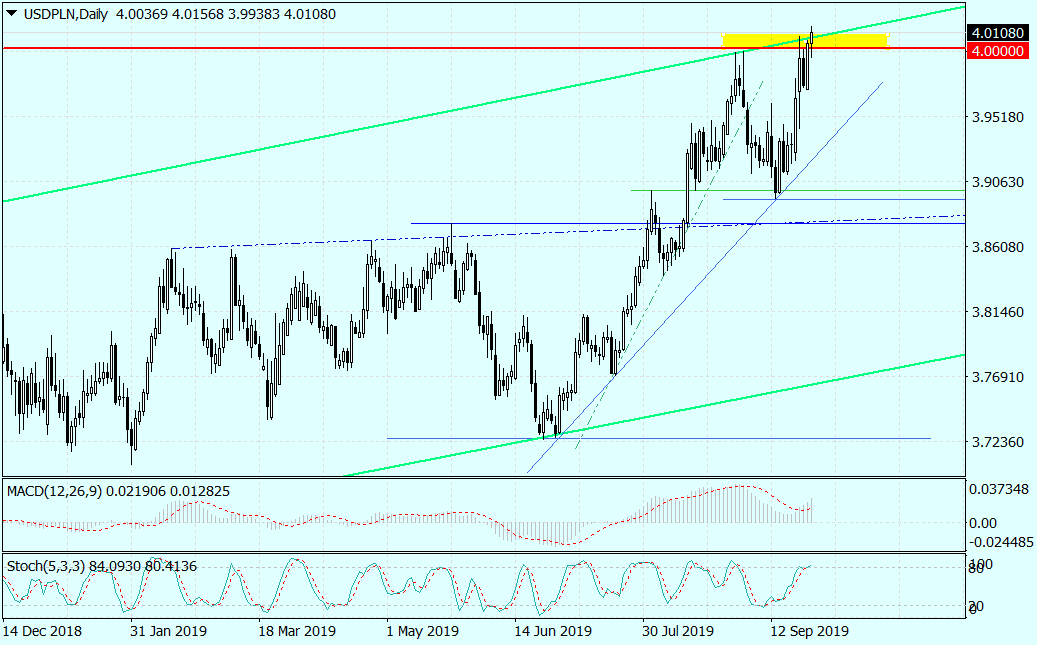

On Wednesday, for the first time in almost 2,5, USDPLN closed above the psychological barrier of 4,00 PLN. Today's rise to PLN 4,0156 at noon, which is the highest dollar valuation since April 2017, confirmed the dominance of the demand side, while suggesting further increases.

USDPLN dominated by bulls

The zloty strongly began to lose to all currencies last Friday. At that time, the impulse for the sale was the information that on October 3, the Court of Justice of the European Union (CJEU) would issue, as is commonly expected, a judgment unfavorable from the point of view of Polish banks regarding frank-borrowers. Later, this market sale of zloty remained podpompowana due to disastrous data from Germany (PMI indexes), which raised concerns about future slowdown in economic growth in Poland. This hit fertile ground, as the latest industrial production data disappointed strongly, and the results of retail sales and construction and assembly production were below forecasts.

The return of the USD / PLN exchange rate to the region of August highs, and then overcoming them, breaking the psychological barrier of 4,00 PLN and violation of the upper limit of the multi-month growth channel in which the daily chart moves, announces further increases. The first goal is the level of PLN 4,05, where short-term redemption should be so large that the sale of the dollar will become very tempting. And at the moment this is the base scenario for USD / PLN. It will remain valid until the exchange rate returns below PLN 3,97.

USDPLN chart, D1 interval. Source: MetaTrader 4 Tickmill UK

USD / PLN prices have exceeded the level of PLN 4,00 and may soon attack 4,05 PLN, and meanwhile, according to the latest survey published by Reuters, analysts expect a weakening of the dollar in the future. Not only in relation to the euro, which in the next year would translate into an increase in the exchange rate EUR / USD to 1,15, but also to the zloty. They forecast that in September 2020 the USD / PLN exchange rate will be at the level of 3,72 PLN. This fall is expected to be supported by the US currency's further loosening of monetary policy from the Polish currency's point of view Federal Reserve i European Central Bankas well as calming the situation on global markets.

Looking at the zloty behavior only through the prism of fundamental factors, one should agree with the above forecast. Good results of the domestic economy and lack of prospects for interest rate cuts by the MPC, when other banks cut those rates, speaks in favor of the Polish currency, suggesting to long-term investors to use current levels to buy it.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)