Wall Street overshadowed by the results and the FOMC

The previous week on Wall Street ended with four consecutive upward sessions and new historic records. This new, last week of July, begins with the announcement of profit taking on the US stock market. On Monday morning, US index futures fell 0,4-0,6 percent.

What Wall Street is waiting for

Record-taking profits would be natural for Wall Street, but even if indices fell by one percent on Monday, that would not be a decisive factor for the whole week. On what levels the Industrial Average, S & P500 and Nasdaq Composite will end the week and in what moods they start August will depend on two factors. Two key factors. First, it will be the Wednesday's FOMC meeting. Second, US tech companies' earnings reports this week. Interestingly, the latter factor will be more important.

FOMC and monetary policy

On Wednesday, July 28, the FOMC will make a decision on monetary policy in the US. This meeting will not be groundbreaking. Not only will there be no change in interest rates (0-0,25%), but also major corrections in the statement. Monetary authorities, led by Jerome Powell, will continue to insist that this latest historic spike in US inflation is only temporary. Hence, investors in the matter of monetary policy will rather shift their attention to the August symposium in Jackson Hole, where they expect the Fed to signal the direction of its changes in the future. Nevertheless, the FOMC meeting itself is always a market event, and even single sentences from Powell may decide about the reaction, hence Wall Street will carefully watch this event.

Financial results of key companies

Much more emotions in the US stock market should be caused by the season of publication of the results for the second quarter of 2021. Especially that this week's financial reports will publish such technological bosses as: Tesla (Monday after the US session), A (Google) Apple Lossless Audio CODEC (ALAC),Microsoft (Tuesday) Facebook (Wednesday) i Amazon (Thursday). This week, 180 companies included in the S & P500 index and 10 companies in the DJIA will report their results.

The reports published by the companies so far show that 88 percent. S & P500 companies had profits in the second quarter above the market forecast, and 86 percent. surprised positively with higher-than-expected revenues. And most importantly, in the reporting period, over 74 percent. had profits higher than a year ago, and almost 21 percent. higher income.

Technical analysis

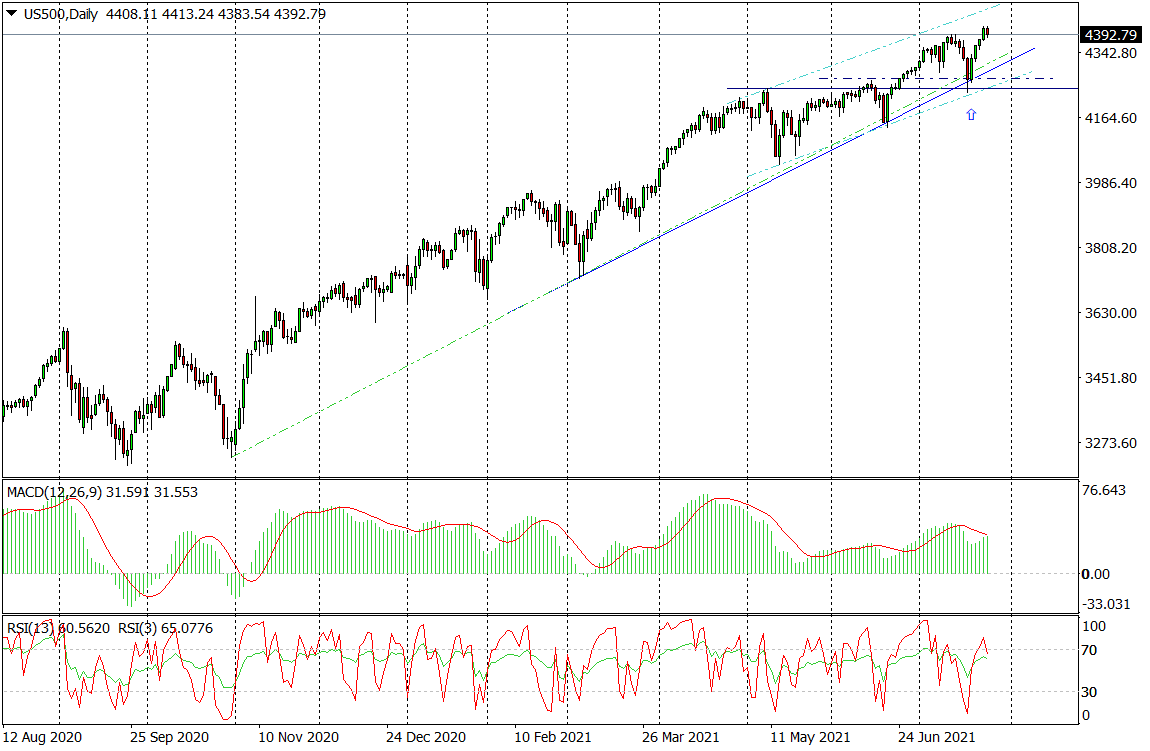

The technical situation on the US500 chart, even despite the visible negative divergences with the indicators, remains good. And it should stay like that until mid-August. This market has been characterized by a high regularity of stronger corrections for several months, which, however, do not threaten the main upward trend. It was like that last time. The week-long profit taking ended on July 19 in the vicinity of the more important demand zone. Hence now, assuming the continuation of this stock market regularity, the US500 will slowly rise for at least 2 weeks, when in mid-August the risk of a stronger downward correction will increase again.

US500 Daily Chart (S&P 500 CFDs). Source: Tickmill

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)