Currency summary of the week. The best quarter is behind us.

The last three months belonged to one of the most profitable (in terms of indices and increases in other assets, e.g. gold). Good moods favored us almost all the time, and the number of deeper corrections can be counted on the fingers of one hand. Can we therefore count on the proverbial descent to earth in the third quarter? Will investors start selling currently high-listed assets?

Market ignorants

Despite the champagne moods of the last quarter, some investors are awaiting a solid correction. Demand slowed down significantly last week and Friday was a low volatility day. There were also significant data from the USA (not only macroeconomic, which we will talk about later), which concerned the number of cases. For the first time since the epidemic, the number of new cases has reached 50 daily. President Trump, to whom the polls slightly recoiled in recent speeches, called for reason and asked to put on masks in public places where a lot of people gather. Some states are introducing additional restrictions on restaurants and bars on their own. Some hospitals (mainly in Houston) have a problem with the increasing number of patients. The situation in the US is therefore far from good or normalized. Markets continue to bypass this information, completely ignoring the epidemic's return scenario. It seems to me that this is primarily due to the lack of official information about the increasing likelihood of the disease coming back. No one is tempted to issue such a message yet. Both the US authorities and FED they are well aware of the panic in the markets that this announcement would cause.

US500 chart (CFD based on index S & P500), interval H1. Source: xNUMX XTB xStation

The situation on the US500 index is even a dream come true for investors. Information about the upcoming second wave of illness would certainly overstate him by a solid several percent, as was the case with the first reports of a serious number of coronavirus patients in the US, when the pandemic was just "starting to spin".

Is unemployment a thing of the past?

It is worth mentioning one more factor, which was quite a significant growth impulse in the last week. It is a reading from NFP report. The market consensus assumed that in the United States there will be more than 7-8 million unemployed. The large estimation range resulted mainly from the difficulties of classification by the office of employees who only work temporarily. This time, however, NFP did not show the next "package" of the unemployed, but the opposite situation. According to publications in the US, employment increased by 2,5 million.

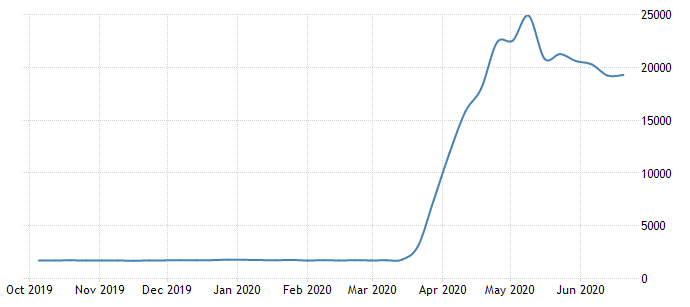

Unemployment in the USA. Source: Trading Economics

The number of unemployed people receiving benefits is falling. These are not as intense movements as in the case of increases that occurred with the introduction of restrictions. Nevertheless, this is a good signal for the US economy, which, however, should not be treated as the beginning of a steady trend and a return to levels before the beginning of the coronavirus in the US. The number of cases is again so high that the upward trend in unemployment may still come back to us.

Chart EUR / USD, H1 interval. Source: xNUMX XTB xStation

What does USD all say? The dollar remains slightly stagnant. It moves in the footsteps of "old" corrections, driving more and more uncertainty to the market. On the one hand, we could talk about preparing the USD for a larger appreciation, on the other hand, the lack of fear in the markets (on a larger scale), the issue of an epidemic treated as well as solid increases in gold and the stock market, may leave it in further depreciation. However, we have several demand breakouts that reach beyond the consolidation zone. The recent move, which slightly strengthened the dollar against the euro, however, was stopped a little higher between support and resistance. Perhaps this is a good place to observe the price and follow any impulse.

The euro will not leave easily

The good condition of the euro is primarily due to macroeconomic data strongly supporting the market. Apart from politics European Central Bank and the related topic of support packages for economies affected by coronavirus, we'll focus a bit on retail sales, which, like the NFP report in the United States, surprised the market. Retail sales in Germany jumped to 3,8% y / y. Considering the monthly dynamics we are dealing with an even better result, at the level of 13,9%. This is a good signal for the eurozone economies. This means that consumers are slowly returning to the level of expenditure we faced before the outbreak of the pandemic.

In the coming month, if there are no messages directly saying about the second wave of coronavirus in the US, we should not expect avalanche sales in the markets. The increases we have seen over the past three months have introduced a positive sentiment among investors. Therefore, there is a high probability that in case of correction, we will quickly return to demand trends.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)