We target the best European joint-stock companies

Although the European stock market is as interconnected with the global economy as any other, it provides investment opportunities that may be difficult to find elsewhere. While US indices are increasingly dominated by technology companies, Europe offers a more diversified investment environment. To highlight some of the European opportunities, we present the best-performing stocks over the last 5 years across the giant index Euro STOXX 600 with a market capitalization of +5 billion EUR on the first day of measurement.

The European stock market in brief

With a bit of good will, it could be argued that the European stock market is the world's oldest stock exchange. It is generally believed that the Amsterdam Stock Exchange, which dates back to 1600, is the oldest modern place for trading shares.

Regardless of this European stock exchange's old-timer status, the Euro STOXX 600 index offers a fairly well-diversified group of companies covering all of its 11 so-called sectors GICS. At the time of writing, financial companies make up the largest portion of the index – just over 18%. The top five also include industry, health care, consumer staples and luxury goods, while real estate has the smallest share (1,3%).

This diversification is worth noting, especially in the context of the growing risk of concentration on the main US indices, as Peter Garnry, our director of equity market strategy, has repeatedly written about. In the case of these indices, shares of technology companies constitute an increasing part of them, which means that the investment risk associated with shares of such companies is also increasing.

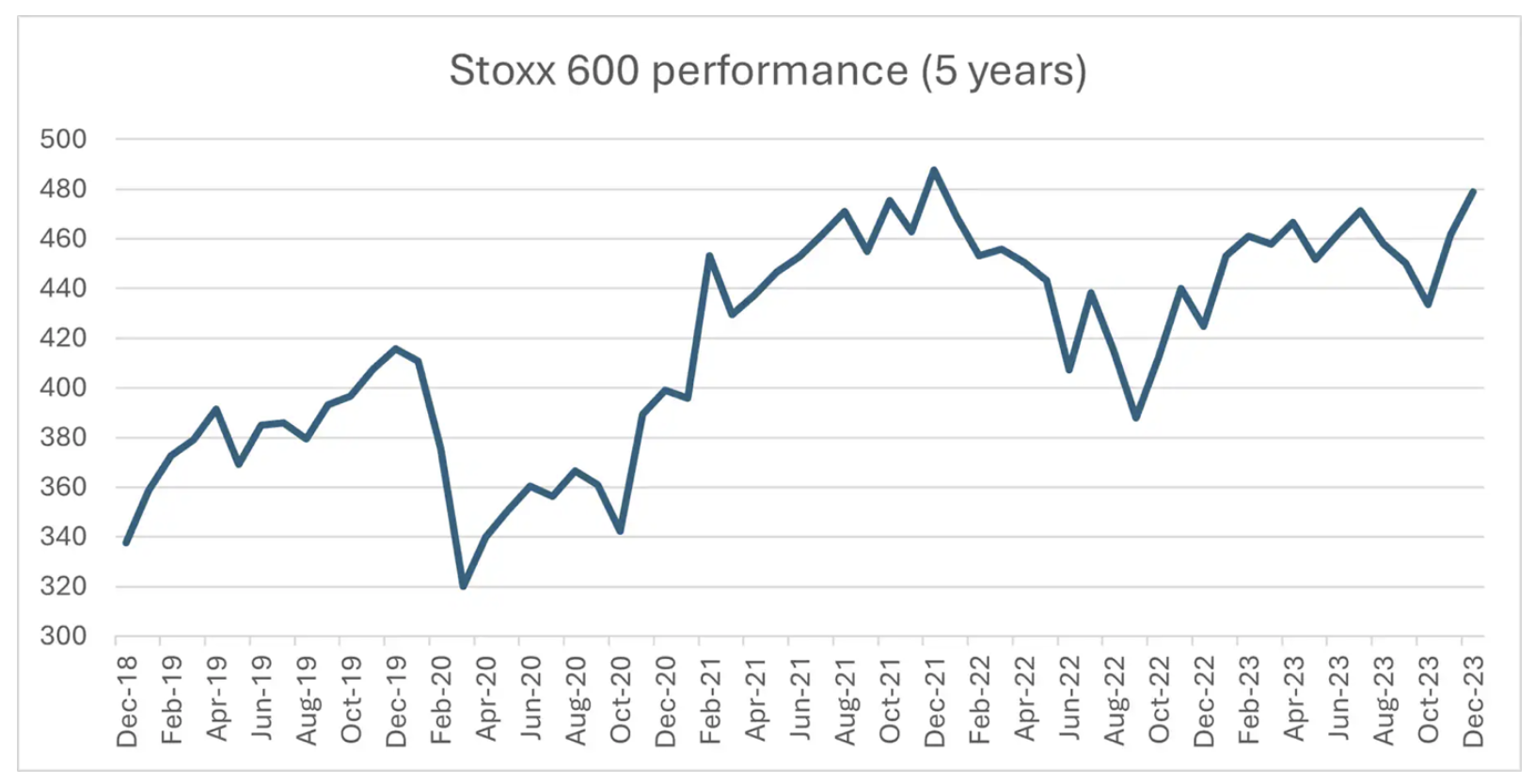

The Euro STOXX 600 Index has the same solid performance as most indexes around the world. As a result, it grew by approximately 2018% from December 2023 to December 40. For comparison, indexes such as S & P 500 or Nasdaq, have recorded higher returns over the last five years, but this is largely due to the above-mentioned growing concentration of the technology industry on these indices, which also involves certain risks.

Exposure to this index can be gained through products such as the iShares STOXX Europe 600 UCITS ETF, the Lyxor Core STOXX 600 ETF and the BNP Paribas Easy Stoxx Europe 600 UCITS ETF.

Five-year results: the largest European companies are established

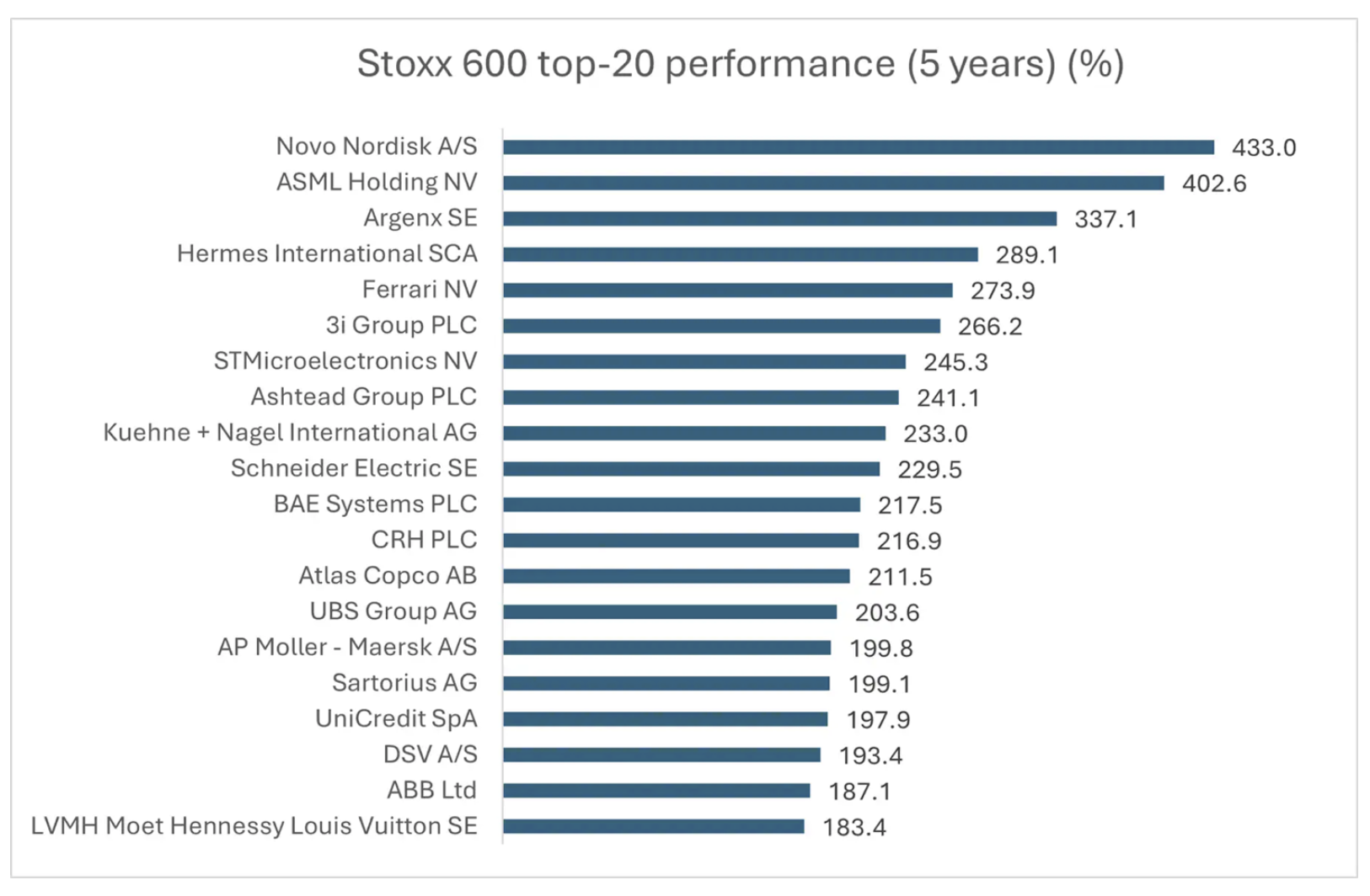

Since 2019, the 20 best-performing stocks have generated returns of over 180%, with Novo Nordisk achieving the best return (433%). This also means that Novo Nordisk has become the most valuable company in Europe in terms of market capitalization. Interestingly, the second most valuable company is LVMH, which ranks 20th in terms of generated results. ASML, the second best performing company, was fourth among the region's most valuable companies, just behind Nestlé, which - with a five-year return of 70% - did not make our list.

The 20 best-performing companies come from 10 different countries. Four of these countries are represented by three companies, one of which, we are pleased to announce, is Denmark (where Saxo is also based). The other countries are Great Britain, France and Switzerland. Italy and the Netherlands are represented by two companies, while Germany, Sweden, Ireland and Belgium each have one company on our list.

Stocks of the 20 best performing companies on the Stoxx 600 index (5 years) (%)

Author Søren Otto Simonsen, Senior Investment Editor, Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response