Can European equities continue to ignore bad news?

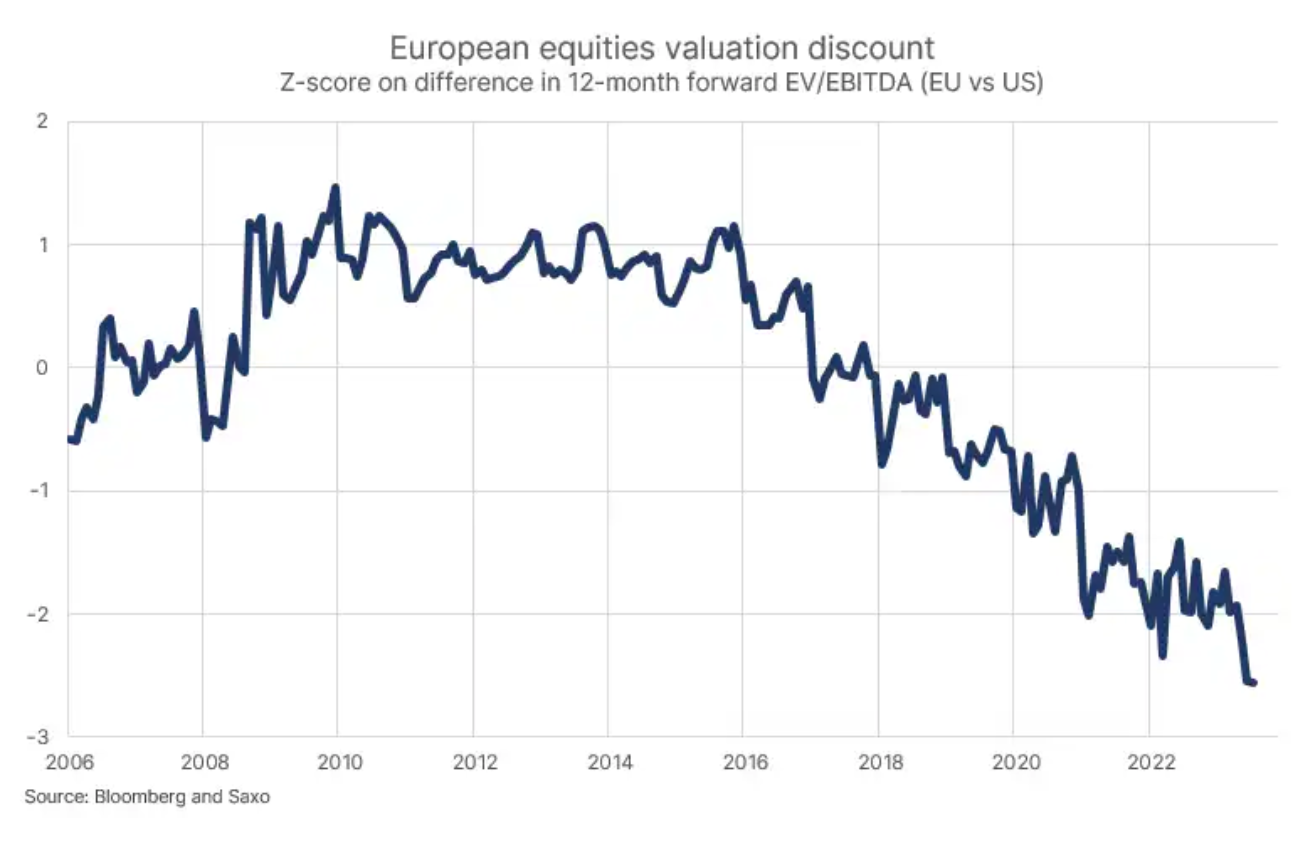

Economic growth in Europe is the lowest since 2011-2013, apart from the first months of the pandemic, and a new energy crisis in the coming winter cannot be ruled out. With Germany already in recession and German industry in a downturn, how long will investors be able to ignore the warning signs? The growth of profits in Europe has been negative for three quarters, which was confirmed by the second quarter. With growth prospects and the return of Germany as the 'sick man of Europe', stock valuations hit their biggest discount relative to US stocks since 2006, reflecting that investors have never been so negative about Europe compared to the US .

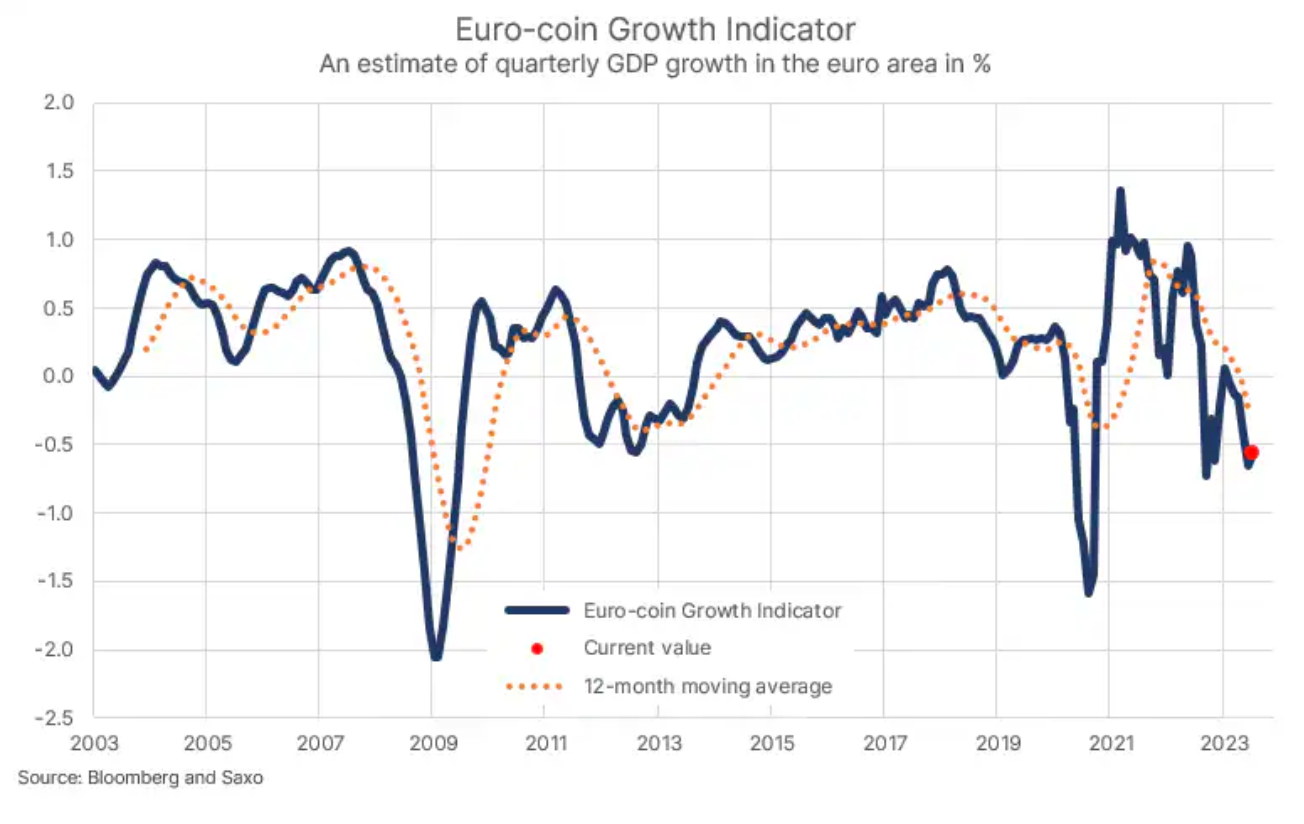

The lowest economic activity since the Eurozone crisis

European growth began to slow sharply in September 2022 as negative forces in the form of high commodity prices, in particular energy, reduced consumer confidence and made industrial production unprofitable. Thanks to an exceptionally successful winter with above-average temperatures, Europe has overcome its energy crisis. With commodity prices declining in 2023 and US consumer consumption remaining strong, economic activity in Europe rebounded in January and February, but already fell to sharply negative levels in June. There was a slight improvement in economic activity last month, but estimated quarterly GDP growth was still -0,56% (see chart) and the 0,3-month moving average fell to -2011%, the lowest level of activity since the euro area crisis in years 2013-XNUMX, excluding the first months of the pandemic.

Valuations of European equities are a challenge for investors

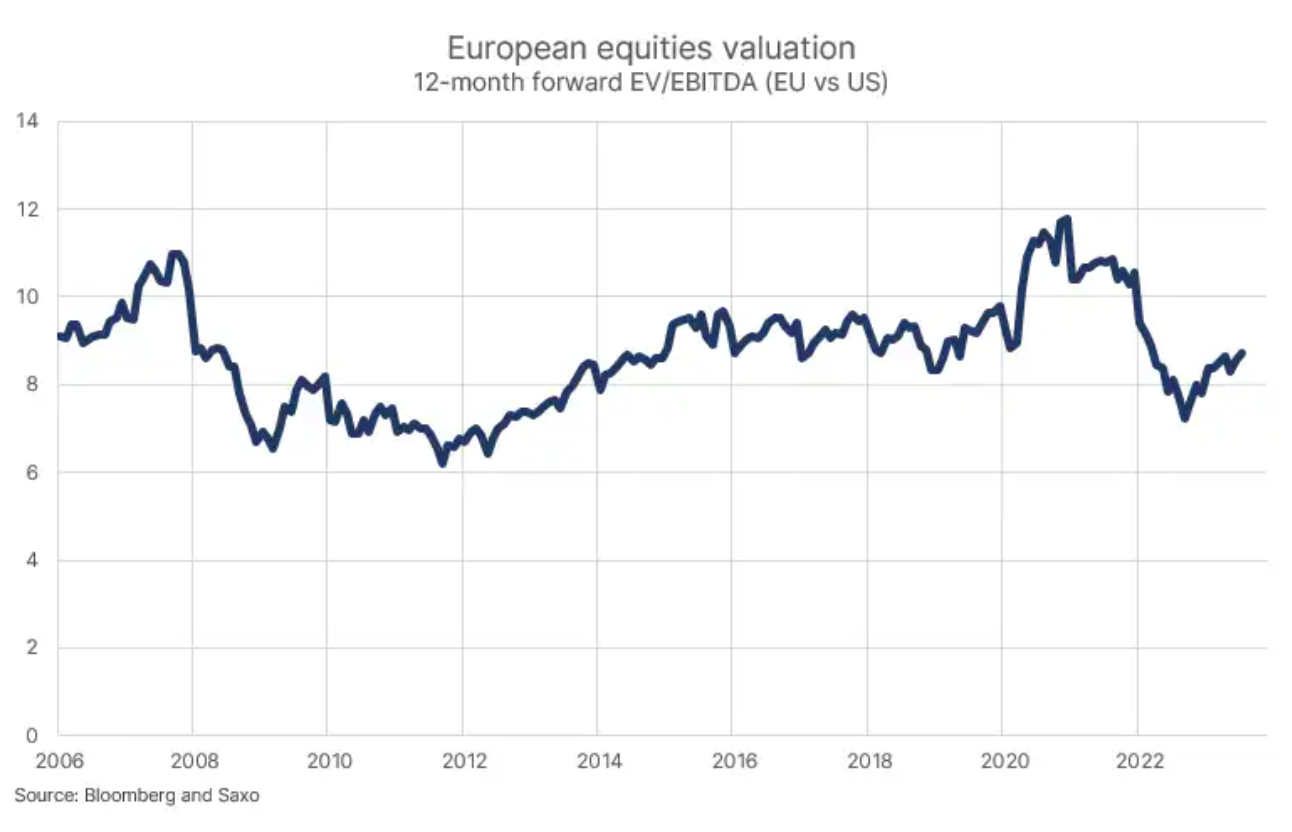

Lower economic growth in Europe negatively impacted earnings growth: XNUMX-month moving indicator EBITDA peaked in Q2022 2023 and has been declining since then, including Q2006 35. This, coupled with the excitement of AI technology benefiting U.S. tech stocks, has led to the biggest discount since January 12 valuation of shares of European companies in relation to shares of American companies. Investors are valuing European equities at a XNUMX% discount compared to expectations in the next XNUMX months. In other words, US equities are priced to perfection relative to European ones, so counter-current investors would naturally invest more in Europe than in the US, despite the problems with growth in the Old Continent.

Playing against US stocks is one thing, but the absolute level of valuation is another. European equities are trading at 8,7x on a 24-month future EV/EBITDA multiplier, which is approximately 2011% above the valuation levels investors were willing to pay for European equities in 2013-2011, when the continent faced currency and debt crises, and experienced the same low levels of economic activity as today. Proponents of rational and efficient markets could explain this difference by the fact that in 2013-XNUMX there was a real risk of a break-up of the eurozone, while growth is currently being driven by temporary factors such as higher energy prices related to the war in Ukraine.

While Europe represents value for investors, it also comes with risks. The Old Continent is fast approaching the second anniversary of the outbreak of the war in Ukraine, and Germany's structural problems with economic growth may hamper the growth of the whole of Europe, unless Berlin recognizes the new geopolitical realities associated with the game of fragmentation. The energy crisis resulting from the war in Ukraine and the cut-off of energy supplies from Russia is not over yet and may continue to recur and negatively affect the European economy for several years to come. Another risk relates to the lack of high-growth technology companies in Europe (risk of low profit growth in the digital era).

Will Germany be able to solve the problems of the "sick man of Europe"?

In the 90s and up until 2005, Germany was often referred to by the foreign press as the "sick man of Europe" because it had a structurally higher unemployment rate and low economic growth as a result of reunification. The term has recently been revived as the German economy has recorded negative or unchanged q/q GDP growth for three quarters in a row, and the industrial sector has complained about incompetent industrial and energy policies.

The breakthrough for Germany was the integration of China into the world economy as a result of China's admission to the World Trade Organization in 2001. China's economic growth in the following years was high, and China's share in world trade grew rapidly as American and European companies began accelerated "outsourcing" of production to China, as cheap labor and a powerful logistics infrastructure provided an ideal platform for this country to obtain the status of "the factory of the world". As part of building this "factory of the world", China needed a lot of advanced machinery and knowledge, which was provided by German industry, hoping to benefit from the wave of Chinese growth.

Angela Merkel, Chancellor of Germany from 2005 to 2021, enjoyed an impeccable reputation over the years; her reign coincided with the rise of China's economic power, positively influencing the German economy. One could cynically say that Merkel's success was the result of Chinese policy. However, one aspect was absolutely not a stroke of luck - it was a deliberate integration into the Russian economy in the form of cheap energy, ensuring industrial competitiveness in relation to other European countries. Along with politics Energy transition, which ultimately led to the complete shutdown of all nuclear power plants and more intermittent wind and solar electricity production, Merkel made it possible to reach the highest beta in the context of the existing world order and globalization.

It follows naturally that the game of fragmentation, with the US and Europe slowly loosening manufacturing and trade ties with China and Russia, will see Germany as the biggest loser in this situation. With the end of the last stage of China's rise and Russia's breakaway from Europe, the entire German economic model has changed for the worse. Perhaps the structural problems will not be as serious as in the days of the "sick man of Europe", i.e. in the 90s, but the failure to build a digital economy and a cluster of powerful technology companies, combined with the fact that the automotive industry is undergoing the biggest change in terms of competitiveness since 70 years, puts the German economy at significant risk.

A weak Germany, of course, has a negative impact on European economic growth, and investors betting on stocks of companies from the Old Continent should hope that Berlin will enter a new era of geopolitics and realize that it must radically change its economic model and invest heavily in this transformation.

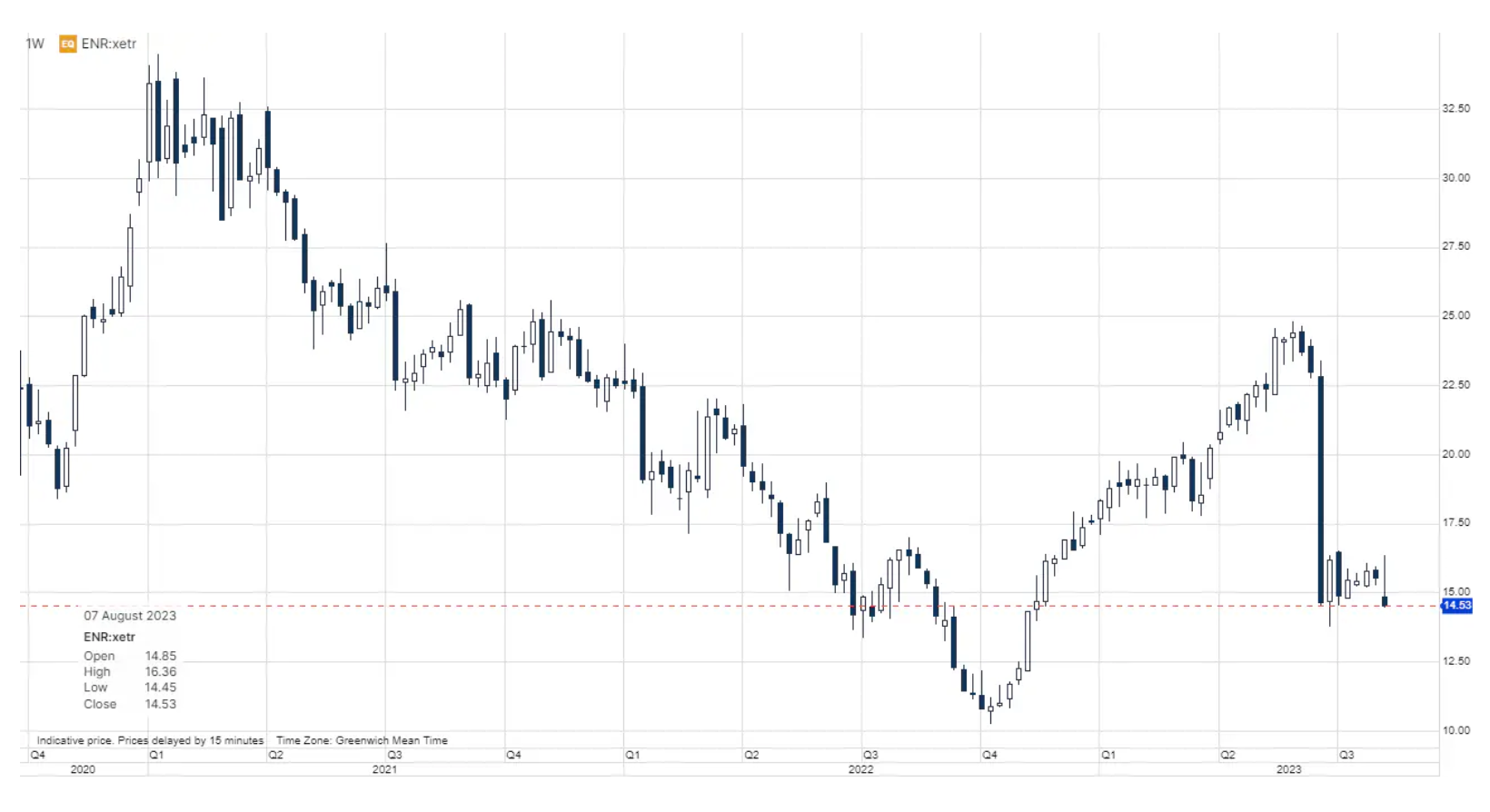

Siemens Energy is now a reflection of Europe's health

Shares in Siemens Energy are down 6,5% today as the power equipment maker said it expects a loss of €4,5bn for the current fiscal year due to new levies linked to design issues with its latest wind turbines that are negatively impacting 4% of installed capacity. While the wind turbine business is unprofitable and facing major challenges, the number of orders still looks good, especially in the grid technology segment, where orders increased by 2023% y/y in Q30 64 (ending June XNUMX) . In many ways Siemens Energy reflects the state of Europe. Some aspects are extremely negative, while others are really positive. Analysts predict FY2024 EBITDA of EUR 2,46 billion due to strong growth in non-wind business areas and share valuation of just 5,3x on future EV/EBITDA multiplier in the context of a company with an overall increase in orders of 54%. In the case of US equities, investors are willing to pay high prices for the hope of growth thanks to artificial intelligence technologies, while in Europe, investors are abandoning companies such as Siemens Energy despite the growth and portfolio of technologies necessary for the energy transition.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response