William Delbert Gann - trader, freemason, columnist

William Delbert Gann is one of the most famous traders in history. Apart from good investment results, he was also a popularizer of stock exchange education. He is also the author of many indicators and market structures that are still used today. The article will briefly describe the profile of this trader.

WD Gann was born in 1878 in Lufkin, Texas. The Gann family lived off the agricultural work it was cotton cultivation. His education was sketchy as he helped his father work the farm. It is worth mentioning that he came from a very religious family (Baptists), which influenced Gann's further perception of the world. Interestingly, already as an adult Gann became a Mason. William Delbert Gann had the 33rd (highest) degree of the so-called Scottish Rite. This was one of the reasons why he had a great deal of knowledge of ancient Egypt, Greece, and the contributions of these civilizations to mathematics. Through self-employment, Gann gained knowledge in areas such as geometry or astronomy. It is also worth mentioning that Gann was interested in fields considered pseudoscientific, such as astrology. Based on the collected knowledge, he developed many methods and tools that are still used by traders today. Among them can be mentioned Gann cycles, Gann angles or Gann squares.

Be sure to read: George Soros - speculator, philanthropist and public enemy

Stock market career

1903 was very important in Gann's career. That's when she moves to New York in search of work. He found her on Wall Street. Soon after, he transformed the experience he gained into creating his own company WD Gann & Company. It was the transition to 'own business' that allowed them to develop their own strategies. The basis was their own failed transactions. As a result, after some time, we managed to achieve fantastic rates of return on the capital market.

Contemporaries' memory has brought the amazing rates of return achieved by this trader. The first significant success came in 1908 when the $ 130 bill was increased to $ 12. It was not a coincidence, a year later, successful transactions caused him to increase his account 000 times. In 1923, in just 60 days, he increased his bill from $ 973 to $ 30. Ten years later, he did an incredible thing. In 1933, he made 479 transactions, 422 of which were profitable. Such efficiency also went hand in hand with skillful scaling of positions. As a result, the rate of return this year exceeded 4000%. This meant that he increased the invested capital 40 times.

Books by Gann

He did not leave his thoughts on the market only to himself. Gann was a very prolific writer. Among them can be mentioned:

- Truth of The Stock Tape (1923)

- The Tunnel Thru The Air (1927)

- Wall Street Stock Selector (1930)

- New Stock Trend Detector (1936),

- Face Facts America (1940)

- How to Make Profits Trading in Puts and Calls (1941),

- How to Make Profits in Commodities (1941),

- 45 Years in Wall Street (1949)

- The Magic Word (1950).

The last book published during his lifetime was WD Gann Economic Forecaster (1954).

Gann's methods

The methods developed by Gann find just as many supporters and opponents. However, it is worth bringing them closer so that the reader can decide for himself whether they are interesting for him or not.

Relevant numbers

Gann believed that a multiple of seven could mark a potential trend turning point. He was also of the opinion that one should observe the price behavior when 7 months pass from the significant price extremum. The squares counting from 1 to 12 were also important for Gann, that is: 1, 4, 9, 16, 25, 36, 49, 64, 81, 100, 121, 144.

Gann's fan

This is a concept that resulted from Gann's great attention to the price-time relationship. According to this view, the market does exist "good", and "badly" the relationship between these two variables. It is best if the changes in price and time are in balance with each other. The aforementioned equilibrium is in the angle of 45 degrees, which is called 1 * 1. This means that a one unit change in time causes a unit price change. This is not the only important angle in the fan. It is also worth mentioning the angle 1 * 8 (82,5 degrees), 1 * 4 (75 degrees), 1 * 2 * 63,75 degrees) or 15 degrees (4 * 1).

If the price is moving "faster" the fan angle is steeper. The steeper the angle in the fan, the less likely it is to maintain the current impulse.

Gann thought it was worth following the price behavior around the 45-degree line. If the instrument moves in an uptrend and the price breaks the "top" line 1 * 1, then a bull weakness signal is generated. In the case of a downtrend, if the price breaks "from the bottom" the 1 * 1 angle, a signal of supply weakness appears.

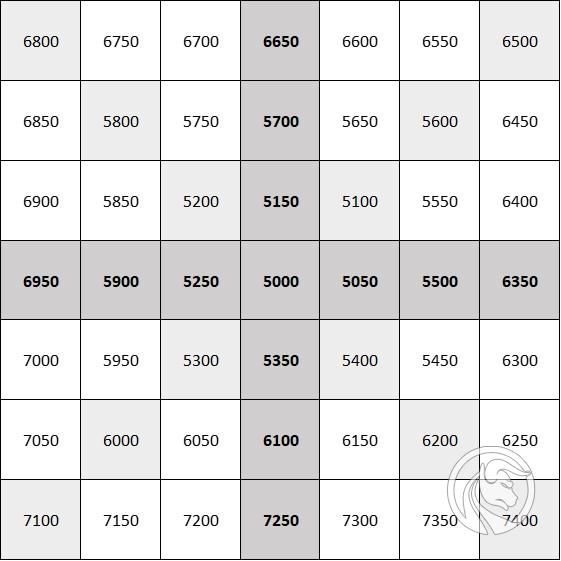

Gann square

The square is another concept invented by William Delbert Gann. It is a tool that is used to determine potential support and resistance levels. The starting price is in the middle of the square.) The following fields contain price titles by a specific value. The price increase is counterclockwise. The numbers that fit into the "cross" with the center point at the starting point mark potential turning points. Some also look for significant points on the diagonals of the square.

Below you can see an example of a Gann square with a starting price of 5000 and a price change of 50 points.

Gana cycles

The long-term Gann cycles of 20, 60 and 90 years are very famous among investors. According to Gann, the most important is the 60-year cycle, which ends the third 20-year cycle. The Great Depression of 1929 came about 60 years after the panic of 1869. However, it is worth remembering that the precision of the cycles is not surgical. For example, in 1989 there was no market crash on Western markets. Two years earlier, in 1987, there was the famous "Black Monday".

Another important period is the 90-year cycle. An example is the crisis of 1929, which fell 92 years after the famous panic of 1837. In turn, the March panic caused by the market response to the coronavirus (2020) was 91 years after the 1929 crisis. Another example is the 1957 bear market, which occurred 88 years after the 1869 panic.

A look at the market

It is also worth knowing how Gann viewed the market and what rules he applied. Of course, the market has evolved over time, but it is worth checking what this outstanding trader paid attention to. One of the more popular ones were:

- If the high price of the week happened on Friday, expect the market to pick up in the next week;

- If the low price of the week happened on Friday, expect the market to fall next week;

- In an uptrend, the minimum week is usually Tuesday;

- The weekly price high in a downtrend usually occurs on Wednesday;

- When price reaches a high over the past 4 weeks, it is likely to continue gains;

- With the price reaching a 4-week low, further drops are possible;

- When market prices are volatile or there is a consolidation, it is a signal that the trend is changing;

- You cannot ignore a double or triple hole if the gap between wells is at least 6 months;

- If the market grows for 5 days in a row, there is a chance that the downward correction will last 3;

- In a situation where the market grows for 9 consecutive days, there is a chance that the correction will last for 5 days;

- If the next revision is greater than the previous one, it means that the trend is changing.

Skepticism towards Gann

Some researchers are skeptical about Gann's achievements. The reason was his "career" as a seller of trading trainingwhich cost $ 5000 (the so-called Master Course). One of the skeptics was Alexander Elder, who in his book "The New Trading for a Living" cited that Gann's son believed his father was earning money mainly from journalism and the sale of courses. FB Thatcher was of a similar opinion, who believed that Gann:

"He was a great seller, not necessarily a good trader".

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)