The volume in the Forex market in March is clearly up

Forex volume up

At the end of each month, leading FX companies publish information on average daily turnover. Messages regarding the March volume are very positive compared to previous months. Many analysts predict maintaining a positive trend on the volume for at least the next few months, with the indication that it is not necessarily as strong as March.

Be sure to read: February is not surprising in terms of turnover. Volume drops on FX.

39 billion dollars a day

Let's start with one of the largest "donors" of the volume. We are talking about Integral, which in its recent turnover publications reported an average increase of 17% compared to last month. It is definitely better than the end of 2018, where this time was considered a period of "mini bull market" in the markets. The form of the increase in volume is explained by the growing number of customers, increasing interest in currencies and favorable market conditions. What's more, it also indicates the significant involvement of current customers in OTC. This translates, of course, into concluding larger transactions, analogically to the increase in turnover.

Turnover statistics on the platform Total Price.

Japan shows strength

The increase in turnover may not be as spectacular as its predecessor, but still visible. GMO Click, a retail broker in Japan, published the trading volume in March 2019. Despite the fact that the growth did not cause too much optimism, comparing it to February the result was clearly larger.

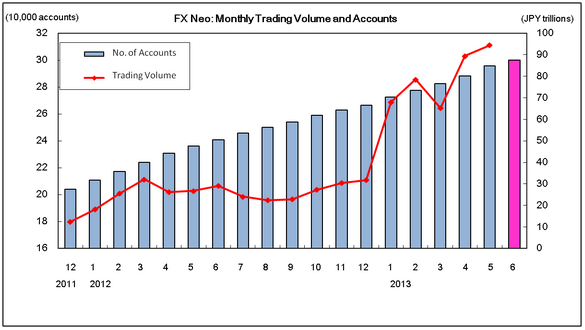

The other Japanese supplier FXNeo turned out to be better (which, to some extent, is connected with the first one, providing it with the instruments of the over-the-counter market). Looking at his reports on turnover, they are very satisfying. According to the information provided. The total volume was 618,6 billion ¥. Comparing this result to the previous month, it improved by as much as 22,6% (in February it was exactly 504.3 ¥ billion). A good result was also obtained thanks to the affiliated with GMO Click, 365 Click Platform. The number of active and newly created accounts increased by 1,4%, which translates into just under 7 thousand. new users.

Despite the fact that the volume of information on the Japanese market is positive, if we compare it with the previous year, visible regression is noticeable.

Volume statistics on the platform FX Neo.

Good results of the Moscow Stock Exchange

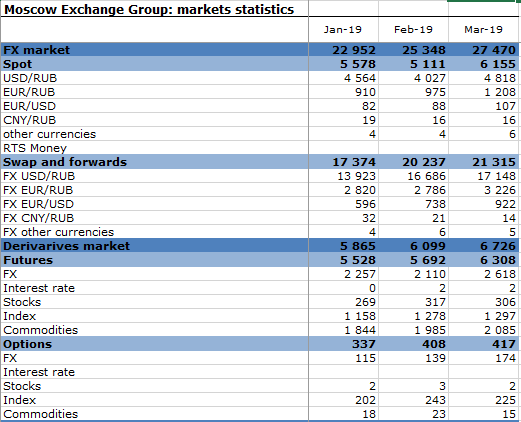

The last analyzed (in terms of volume) area is MOEX (Moscow Stock Exchange). Looking at the volume generated on the forex market in March, it does not differ from the overall market results. Average daily currency trading volumes exceeded 1,37 trill RUB in March (21,1 billion USD), which corresponds to an increase of 10,0 per cent. ) compared to last month. As before, when comparing this data to the year 2018, they do not look so spectacular. This number decreased in y / y terms 15%.

Returning to MOEX data, the largest Russian institutional trading system also reported that the total turnover on the currency market increased by 8,7 percent in terms of m / m to 27,5 trillion rubles (421 billion dollars) from 25,3 trillion rubles (385 billion dollars) in the previous month .

The stock market volume MOEX.

The total foreign exchange turnover of MOEX in March 2019 included transactions with the value 6,2 bln RUB, which means an increase of 22% month to month with 5,1 bln RUB in the previous month. It is also worth taking a closer look at swap and forward transactions that have reached the level of 21,3 bln RUB, or 5,4% more than equivalent data (20,2 billion RUB) for February.

Summation

Despite the fact that the volume shows an upward trend, analyzing it since the beginning of 2019 and comparing to the previous year, it does not look so phenomenal anymore. Nevertheless, the current sentiment in the currency market according to general forecasts should lead to an increase in turnover on the stock markets for several months (with a smaller momentum).

Check it out: New indicator on xStation - Accumulation / Distribution Density

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)