Finally some good news: Food prices are falling

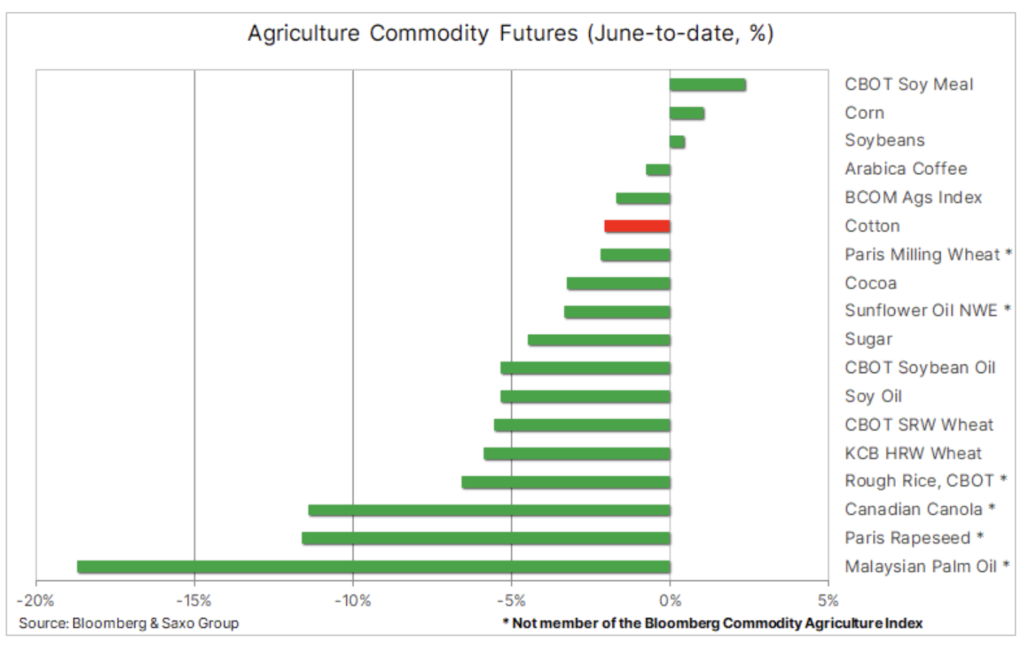

World food price inflation is showing signs of weakening since it peaked in March, and we have seen a decline this month for most major commodity futures. If this trend continues, it will be a welcome relief for consumers worldwide, many of whom are struggling with the recent spike in the cost of living. The biggest drops were recorded for wheat and cooking oils, the two food categories most affected by the Russian-triggered war in Ukraine. However, given the continuing tension and concerns over Ukraine, a prolonged decline seems unlikely until production levels are clearly established this season.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Food prices are slowly starting to decline

World food price inflation that according to the FAO, it is now almost 23% per annum, it is showing signs of weakening since it peaked in March. The world food price index, compiled by the FAO every month, peaked in March after Russia attacked Ukraine, which is a key global supplier of high-quality wheat and the largest exporter of sunflower oil, which has pushed prices to levels that raise concerns about the global food crisis .

Since then, however, some concerns have started to subside, and palm oil prices have fallen sharply on the prospect of increased supplies from a major producer, Indonesia, which temporarily imposed export restrictions in March. Meanwhile, winter wheat harvests in Europe and North America have partially mitigated supply concerns due to the lack of supplies from Ukraine via the Black Sea.

CHECK: The food market, or how to invest in food [GUIDE]

However, significantly lower prices should not be counted on as concerns about weather conditions continue to play a major role for countries such as India, as well as for key growing regions in France. Moreover, importantly from the point of view of food security this winter, negotiations on the export of Ukrainian grain through the protected corridor in the Black Sea did not bring much results and if Ukraine is unable to empty its silos before the next, albeit much smaller, harvest arrives, there will be a prospect of a lower than expected supply available.

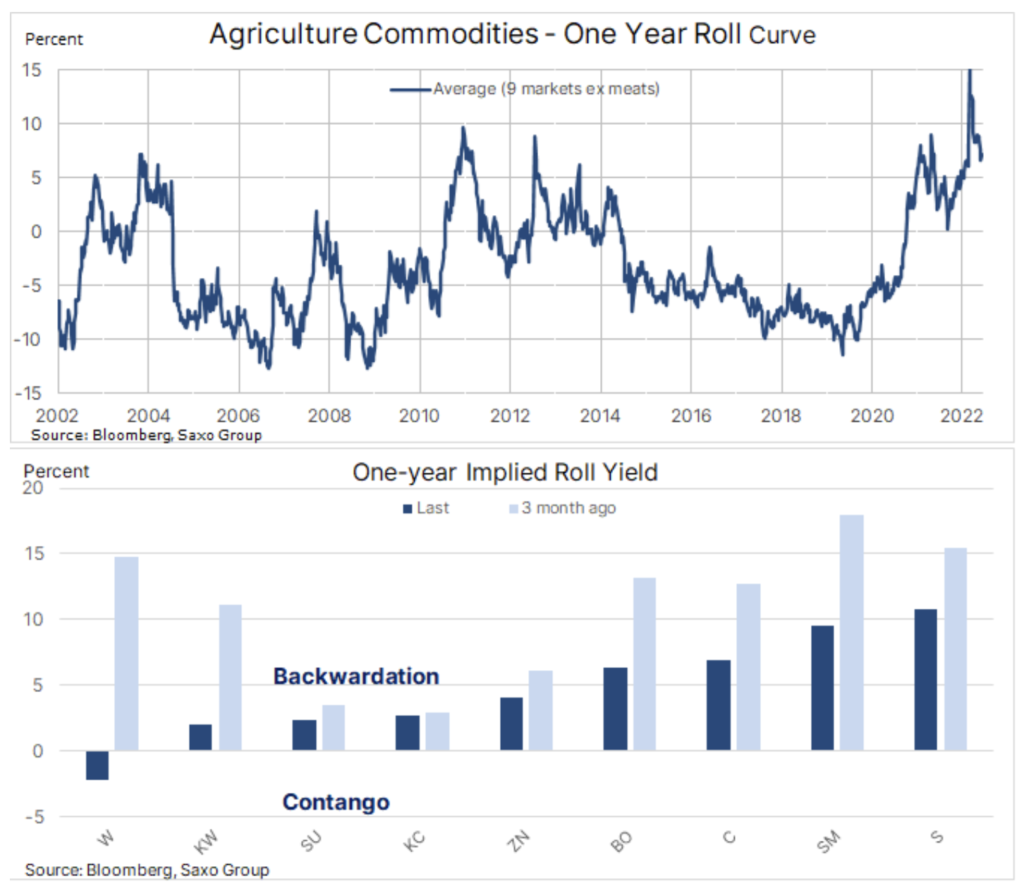

To assess the supply-demand relationship in individual markets, we usually analyze the twelve-month spread between the spot price of a futures contract and the contract price expiring in a year. The chart below shows very clearly how the agricultural market has changed over the past few years. In the six years following 2014, the supply in the agricultural market was exceptionally high due to favorable weather conditions for crops and low production costs. The market was then in stock contagionwhich means that spot prices were the lowest in relation to future prices.

This mild and quiet period was unexpectedly disrupted in early 2020, when the pandemic temporarily blocked the supply channels. In addition, the weather phenomenon called La Ninã, consisting of lower than usual temperatures around the equatorial Pacific Ocean, began to adversely affect growing conditions, in particular in South America, but also in the United States and Australia. These price-enhancing factors received a real turbo boost in early 2022 with soaring diesel and fertilizer prices and Russia's attack on Ukraine, which is the world's main supplier of key food products, from wheat and corn to sunflower oil.

However, the easing of conditions since the March peak has turned the one-year wheat spread on CBOT from a deportation of almost 15% to a modest contagion. Nevertheless, in Europe, the one-year spread for milled wheat prices listed on the Paris Stock Exchange continues to show a high deportation of almost 15%, highlighting the current challenges to the European harvest forecast and the uncertainty over the forecast supply of new harvest from Ukraine in the coming autumn.

Speculators limit long positions

Money management funds, also known as speculative investors, for the way they leverage their positions in the futures markets, from late April, almost a month before prices began to fall, became net sellers in the futures market. with regard to the nine food futures contracts under review. It is unclear whether this was due to an excessive number of purchases in these markets or a desire to post a profit after a sharp rise in prices, but after hitting a record 1 lots with a face value of $ 112 billion on April 000, this figure fell to 51,6 lots and $ 22 billion in the last reporting week ending 750 June.

From April on the charts wheat on CBOT, there are head and shoulder formations both for the current month of the closest expiry date, i.e. September, and for the December contract, which best reflects the final post-harvest availability in the current season. For this latest weakness to persist and lengthen, it is imperative that the neckline breaks sharply at $ 10,37 in September (recently $ 10,36) and around $ 10,48 in December (recently $ 10,52).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)