All eyes are on Nvidia. AI is a key driver of stock markets

There is probably no more important earnings release for stock market sentiment right now than Nvidia's fiscal 2024 Q31 earnings results (ending January 2024, 20,4), which will be released Wednesday evening after the close of the U.S. stock market. As the AI boom is bigger than ever and spreads to more and more stocks, all eyes will be on these results. Analysts expect revenues to be $238 billion, up 4,60% YoY, and EPS to be $613, up 1% YoY, arguably the most remarkable growth in the large-cap business ever recorded. We've never seen a company with a market value of $12 trillion, trailing 45-month revenues of $55 billion, and a net profit margin of XNUMX% growing at such a breakneck pace.

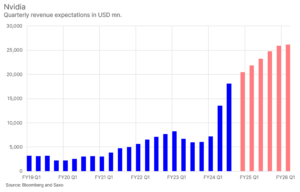

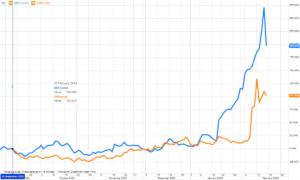

The chart below shows Nvidia's revenues and analyst estimates predicting quarterly revenues will reach over $25 billion over the next year. This revenue level is about four times higher than in late 2022, when Nvidia was hit by a decline in demand for bitcoin mining due to falling prices and lower technology spending overall as Silicon Valley adjusted to higher interest rates.

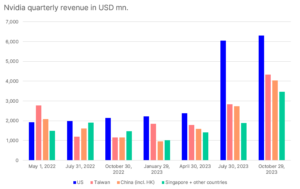

If we look at the geographical breakdown of revenues, we see that in the previous two quarters, the highest growth was recorded in the US segment, followed by the Chinese and Taiwanese segments. Singapore was once again separated in the previous quarter, accounting for 15% of revenue. This is obviously strange, and it is clear that Singapore is being used as a legal hub for the re-export of Nvidia chips to countries where export controls may apply. As we have highlighted in the past, a significant portion of Nvidia's revenue comes from China and Singapore (37% of revenue), which, given ongoing trade frictions and a potential Trump election victory this year, could become a key geopolitical risk for Nvidia.

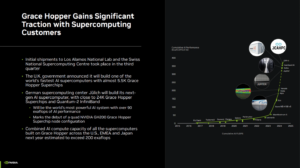

Will Nvidia beat estimates? And how is the market positioned? Nvidia has beaten revenue and EPS in the last 7 of 8 earnings releases, and recent signals from Arm and other companies in the AI ecosystem do not suggest growth will slow in the near term. We tend to believe that analysts will once again underestimate Nvidia's growth, but the uncertainty is 2,5 times greater than usual around this earnings release. The normal 1-day average move around Nvidia's earnings is 4,3%, but this time the stock options are trading at 10,5%. To get a sense of the explosive growth in cumulative AI performance, we highlight a slide from Nvidia's recent investor slide (see below).

What about Nvidia's valuation? Can the prospects justify it? As we pointed out in a recent equity note on Arm stock, Arm and Nvidia are valued well above the market, which is not surprising given the underlying growth of AI chips. But is that too much? This, of course, depends on the underlying assumptions about the future. New York University professor Aswath Damodaran, one of the world's leading stock valuation specialists, recently wrote about the Magnificent Seven and said this about Nvidia:

“… When it comes to Nvidia and Tesla, questions remain about what the end game will look like in terms of market share. Historically, neither the chip nor automotive industries have been winner-take-all businesses, but investors are clearly pricing in the possibility that the changing economics of AI chips and electric cars could transform these industries.”

Later in the article, Damodaran clearly states that Nvidia looks overvalued, despite including significant AI growth in his valuation models, before running into a contradiction because he himself owns shares in Nvidia.

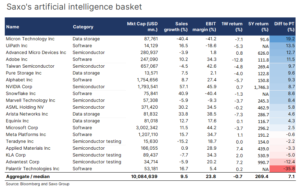

The topic of AI is a key driver of stock markets

Last year was marked by the development of artificial intelligence, which fueled growth on stock markets. Our AI thematic basket consists of 20 stocks that have a high degree of exposure to the AI boom, representing $10 trillion in market value, which is approximately 16% of the market value of the MSCI World Index. As the table below shows, this is a group of companies enjoying near double-digit growth rates and high profit margins. Analysts also remain bullish on AI stocks, with the average 5-year total return being much higher than the market would indicate.

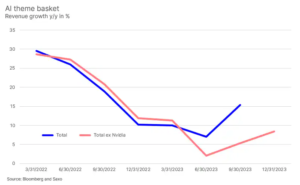

If we look at the revenue growth for this group of AI-related companies, we can see why the market is excited about this topic. Median revenue growth excluding Nvidia bottomed out in Q2 2023 at 2% YoY and has so far rebounded to 8,4% YoY in Q4. If Nvidia is included in the calculations, revenue growth increased to 15,3% YoY in QXNUMX and will undoubtedly increase again in QXNUMX.

AI sentiment also appears to have reached proportions not seen since the 2021 tech bubble and dot-com era. The stock pair Arm and Super Micro Computer are up 102% and 197%, respectively, since September 14, 2023, with the big jump coming this year. There really is a sense of fear of missing out (FOMO) when it comes to AI stocks. But for all important long-term technologies, the start tends to be bubble-like because we get too excited in the short term and extrapolate too deeply. Recent news about the latest program artificial intelligence An OpenAI called Sora that can render detailed, longer-length videos than ever before based on text input is an example of the incredible hype and excitement around AI technology. This AI boom is likely to be no different from previous cycles.

Key financial results this week

In addition to Nvidia's important earnings release, the market also received network results Walmart (Tuesday) and Home Depot (Tuesday). This week is also an important period for global mining giants such as BHP, Rio Tinto and Glencore. Iron ore prices were on average 19% higher in USD terms in the second half of 2023 compared to the same period a year earlier, so analysts expect positive growth rates for both BHP and Rio Tinto. The Bloomberg Industrial Metals Index, which is a broader measure of industrial metals prices, fell on average in 2H2023 compared to the same period last year, and as a result, analysts expect Glencore to report a 6% revenue decline in 2H2023 r.

The list below shows all the major earnings releases this week:

- Wednesday: HSBC, Rio Tinto, Glencore, Analog Devices, Nvidia, Synopsys, BAE Systems, Nutrien, Rivian

- Thursday: Fortesque, Zurich Insurance, Nestle, AXA, Booking, Copart, Intuit, MercadoLibre, EOG Resources, NU Holdings, Mercedes-Benz, Iberdrola, Pioneer Natural Resources, Danone, Anglo American, Wolters Kluwer, Rolls-Royce

- Friday: Allianz, Deutsche Telekom, BASF

- Saturday: Berkshire Hathaway

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)