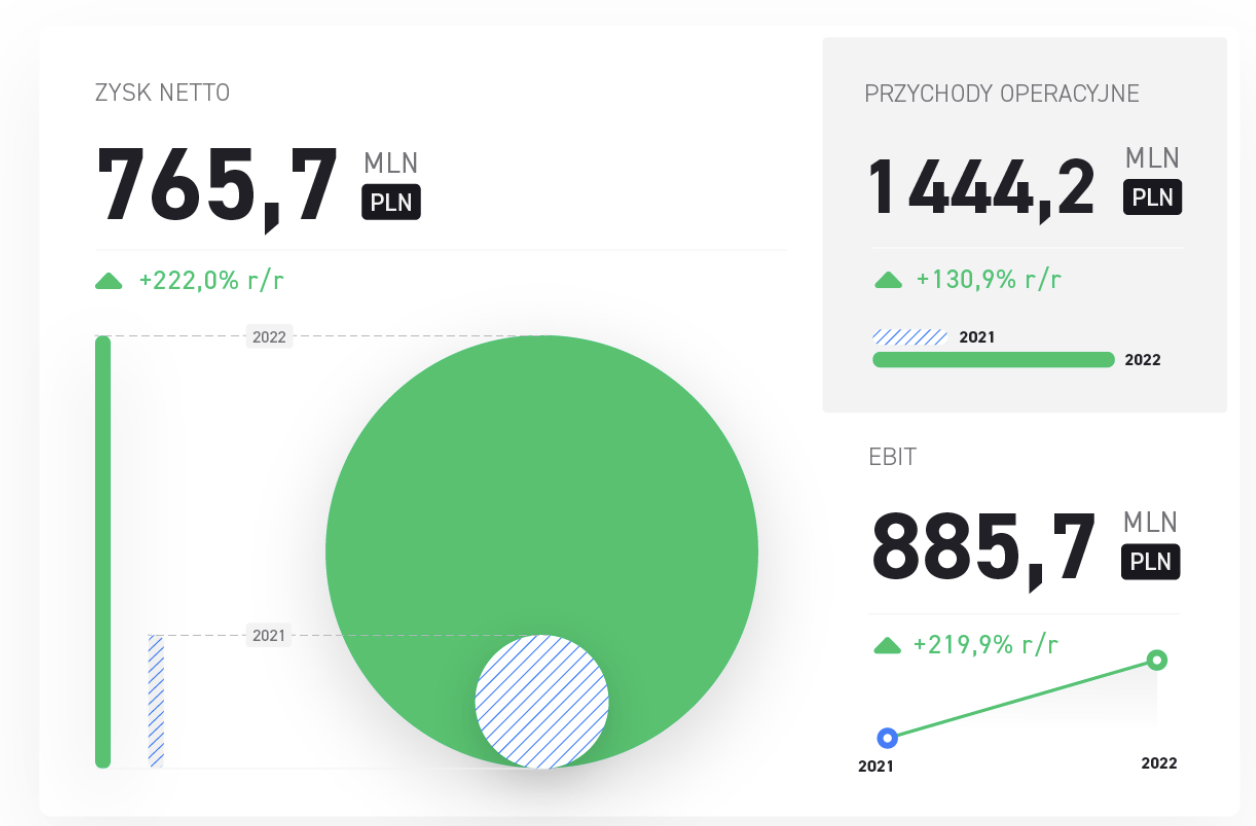

XTB financial results for 2022: Profit increase by 222% y/y

XTB presented preliminary financial results for 2022. In this period, the company generated a consolidated net profit of PLN 765,7 million, which was as much as 222% higher than in 2021. High volatility on the financial and commodity markets as well as active marketing activities resulted in a record-breaking year in terms of the number of acquired customers.

- Consolidated net profit in 2022: PLN 765,7 million, 222,0% more than in 2021;

- Over 51 thousand customers acquired in the fourth quarter and over 196,8 thousand in total. in 2022;

- An increase in the quarterly trading volume of clients on CFD instruments by 60,3% y/y - from 1,074 million to 1,720 million lots;

- Increase in profitability per lot year-on-year by 48,9%.

XTB financial results strongly up

Dynamic development XTB, with favorable market conditions, resulted in record-breaking financial results in 2022. Throughout 2022, XTB developed a consolidated net profit of PLN 765,7 million and it is more than 3 times more than in the previous year (PLN 237,8 million). Operating revenues after four quarters of the previous year amounted to PLN 1 million, compared to PLN 444,2 million in 625,6. The increase in revenues by almost 2021% year on year is a record achievement in the history of the Group. Operating expenses in 140 amounted to PLN 2022 million (in 558,6: PLN 2021 million).

In 2022, the trend of dynamically growing customer base and the number of active customers continued. In In the fourth quarter of 2022, XTB acquired over 51 thousand. customers, which, together with the results from the previous quarters of that year, gives a total of over 196,8 thous. new customers in the last year. Thus, in each of the four quarters, the company fulfilled its declarations assuming the acquisition of at least 40 new jobs on average. customers quarterly. The total number of customers at the end of the fourth quarter exceeded 614,9 thousand. An important indicator influencing the result is the average number of active customers - in the fourth quarter it amounted to 161 thousand. compared to 127 in the same period of the previous year. In 2022, the average number of active customers was 153. (in 2021: 112) This translated into an increase in the trading volume of clients on CFD instruments expressed in lots – in the fourth quarter it amounted to 1,720 million transactions compared to 1,074 million in the corresponding period of 2021 (increase by 60,3%). Profitability per lot increased by 48,9% year-on-year. The value of net deposits also increased from PLN 2,93 billion in 2021 to PLN 3,42 billion in 2022.

– Undoubtedly, 2022 was a record year for XTB. High volatility in the financial markets and rising inflation caused the society to look at money management differently. As a result, there was an increased interest in investing in financial markets, both in a more active and passive way. Years of building an international brand, increasing the customer base, developing the product offer and focusing on financial education have translated into our financial results - comments Omar Arnaout, CEO of XTB.

CFDs on indexes number 1

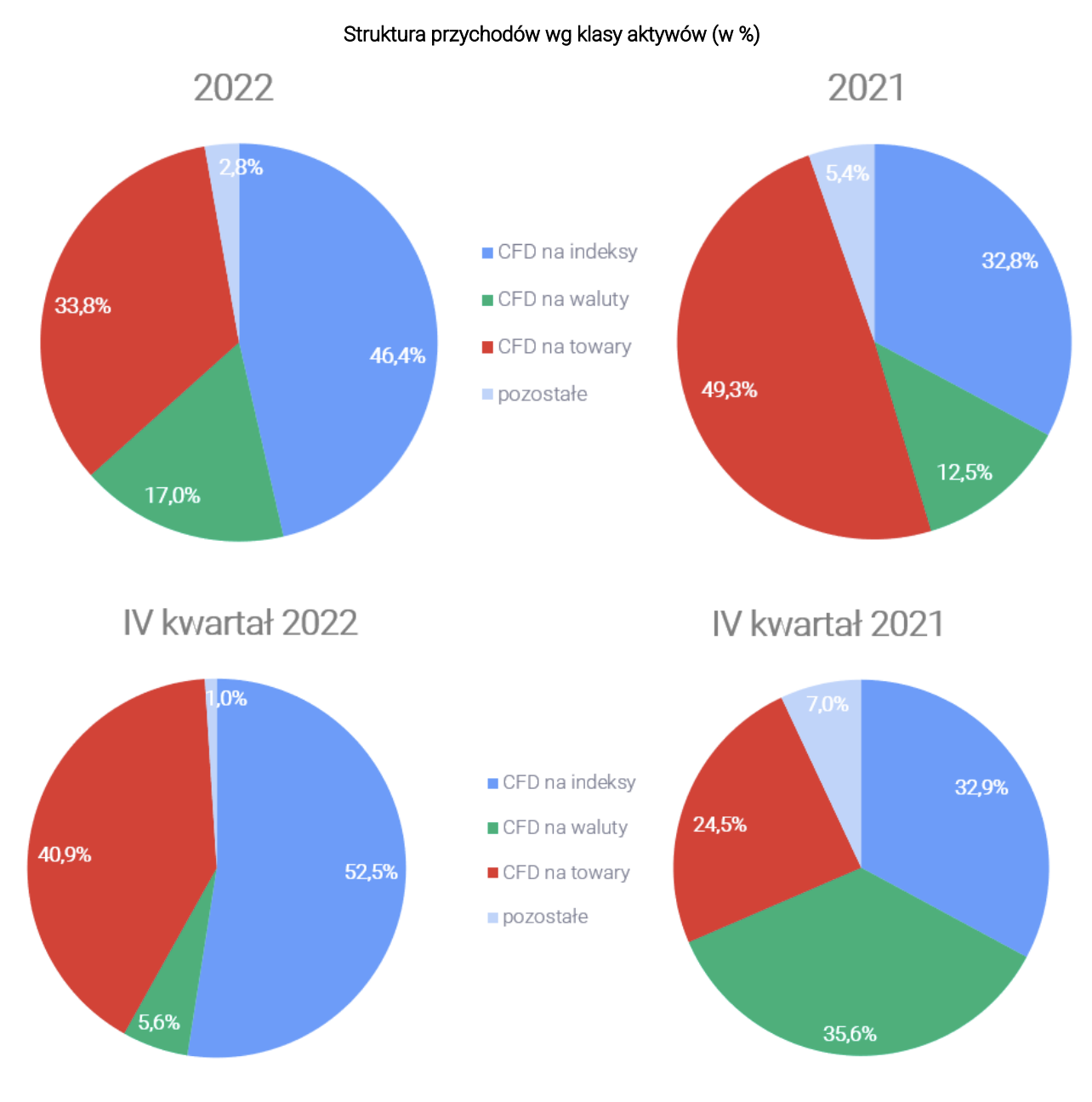

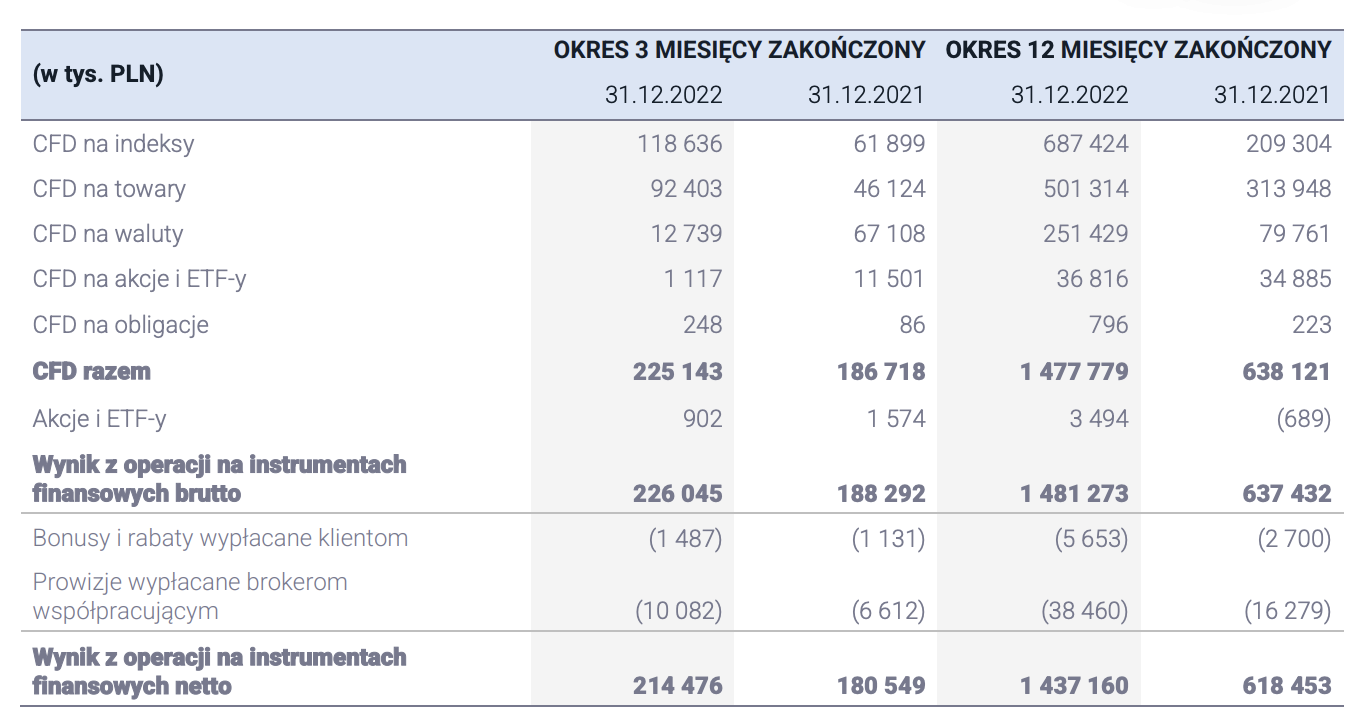

When it comes to XTB's revenues in terms of the classes of instruments responsible for their creation, in the fourth quarter of 2022 CFDs based on indices were the most profitable.

Their share in the structure of revenues from financial instruments reached 52,5%. The same asset class also generated the most revenue for the Group throughout 2022 (46,4%). This is a consequence of high profitability on CFDs based on US 100 indices, DAX (DE30) or U.S. 500. The second most profitable class of assets were CFDs based on commodities, with a share in the structure of revenues in the entire 2022 amounting to 33,8% (in Q2022 40,9: XNUMX%), and the leading instruments in this class were CFDs based on quotations gold, prices oil and natural gas. Revenues from currency-based CFD instruments accounted for 2022% of all revenues throughout 17,0.

Costs go up too

Operating expenses in 2022 amounted to PLN 558,6 million and were PLN 209,8 million higher than in the corresponding period of 2021 (PLN 348,8 million). The most important items were the costs of salaries and employee benefits, resulting from the company's development and employment growth, and marketing costs, resulting from new promotional activities. In the fourth quarter XTB the global marketing campaign with the brand ambassador continued Conor McGregor, one of the most successful and recognizable mixed martial arts fighters in the world. What's more, he is one of the highest-paid athletes in the world, which he has achieved thanks to many successes both in sports and in investing. Fintech, in line with its strategy, is constantly working on making its offer more attractive. All thanks to focusing on reaching the mass customer, which is currently a priority in the development of the company.

- The past year was extremely constructive for us, because we showed that we can perfectly take advantage of market opportunities. Currently, our priority is to further expand the customer base, which is why we continue extensive marketing activities. In 2023, we would like to raise the bar even more and acquire at least 40-60 thousand per quarter. new customers. But that's not all. I can safely say that investing has entered the mainstream, which is why our ambition is also to reach a mass client. Therefore, we are working on introducing new products to our offer that will allow us to increase the number of active users even more - comments Omar Arnaout.

Detailed information summarizing the activities of the XTB Group after four quarters of 2022 and preliminary financial and operating results are presented in the current report [LINK]

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)