Will the companies' results drive the S & P500 to records?

American S & P500 index he has had 4 consecutive upward sessions behind him, which pushed him to the highest levels in a month, and above all, definitely confirmed the end of the one-month profit-taking that started in the first days of September. This is exactly what the fierce defense of the level of 4300 points at first suggests. in early October, and then draw the local inverted head and shoulders pattern on the daily chart on the daily chart last Thursday.

Of course, after 4 sessions of increases, the risk of 1-2 day profit taking increases, but in general the message of the situation on the chart is optimistic.

New historical records for the S & P500?

Situation on the S & P500 chart makes us expect a slow march higher and higher, which in November may bring new historical records. It is impossible not to notice, however, that this optimism flowing from the chart takes place in a situation when, at the same time, inflation, and with it debt yields, are soaring higher and higher, oil prices are systematically rising, and the global energy crisis is a fact. Are increases and new records possible in such conditions? Yes, such an opportunity is offered by the current season of publication of quarterly results on Wall Street. Of course, provided that investors focus on the results for the third quarter, and not start to think about risk factors related to the results generated in the fourth quarter.

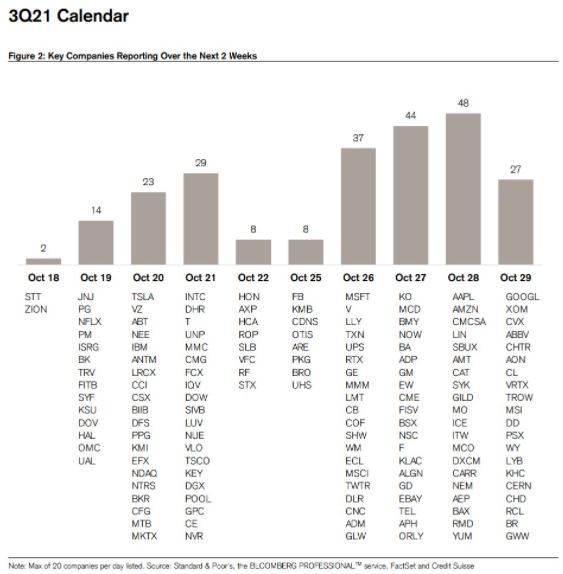

Today, before the trading session, financial reports for the last quarter will be published, inter alia, by BoNY Mellon, Halliburton, J&J, P&G and Travelers, and after the Netflix session. This and next week will be crucial in terms of results. The largest companies will publish them. This also opens a possible window for further increases. The more so that in the first week of November, the attention of all markets will focus on the data from the US labor market, and above all at the meeting FOMC.

Calendar of publication of financial reports by companies from Wall Street

It is estimated that companies from the S & P500 index will report an increase in profits of approximately 30% in the third quarter. and an increase in revenues by 15 percent. In fact, the results could be even better. This is evidenced by positive surprises in the already published results. As much as 80 percent companies boasted above-consensus earnings per share. This is more than the five-year average (76%). It looks even better in the case of revenues. Already 83 percent had better than expected revenues. companies, while the average is 67 percent. Therefore, if investors on Wall Street turn a blind eye to other risk factors and focus only on performance, it is quite easy to imagine that the S & P500 will continue to grow.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)