Gold starts 2023 with a breakout from the range

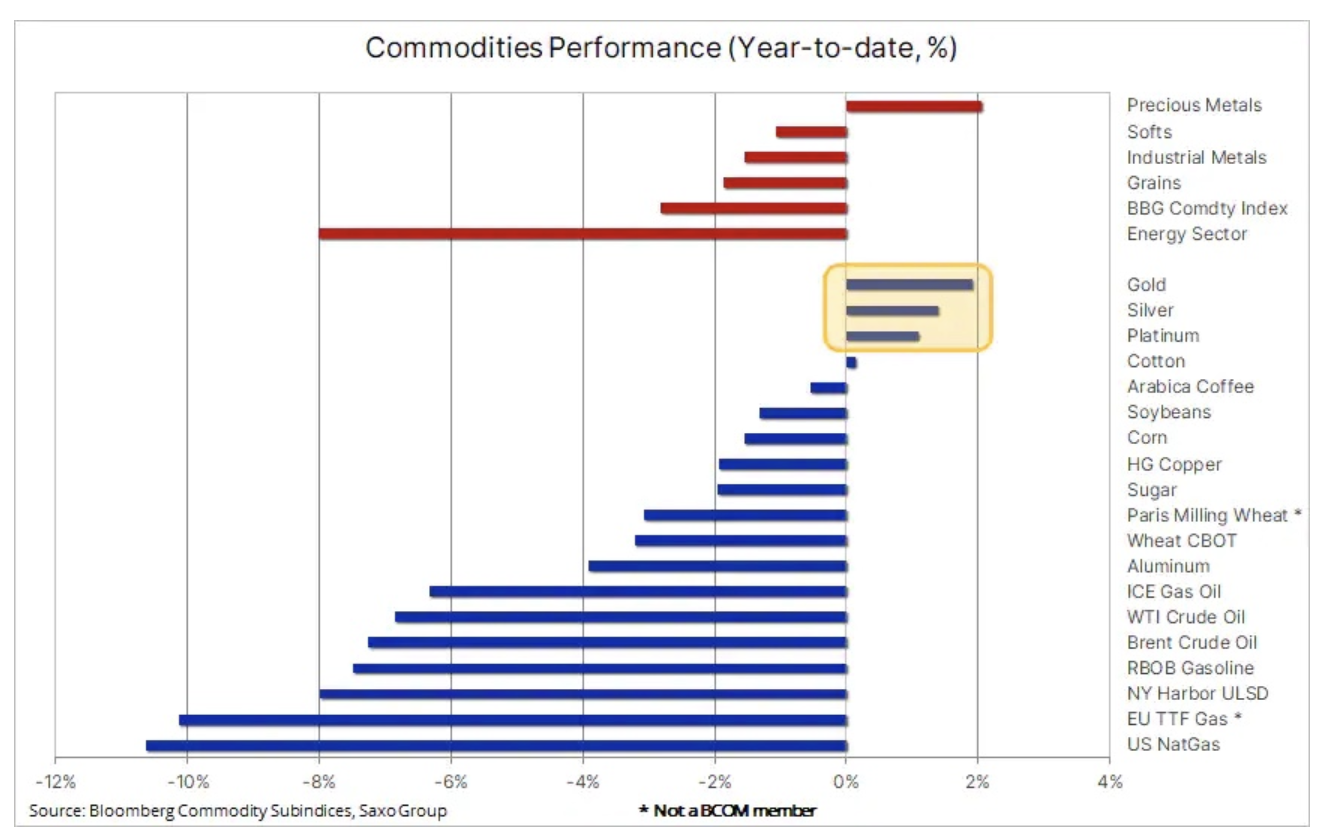

Gold along with silver i platinum as one of the few raw materials, they record an increase at the beginning of the new year. Gold's latest resilience and momentum from December have been carried over to January as investors look to hedge against what is expected to be an equally challenging year ahead, particularly for equity investors.

Overall, we anticipate 2023 to be favorable for investment metals prices with recessionary and stock market valuation risks, central bank interest rate hikes peaking coupled with the prospect of a weaker dollar and mid-term inflation not returning to expected 2,5%, instead stabilizing around 4%. This approach prevailed on Tuesday, the first true trading day of the new year, when the dollar strengthened temporarily and bond yields tumbled while equities tumbled, with major companies such as Tesla or Apple Lossless Audio CODEC (ALAC), – a leader in terms of market capitalization – reached new lows in the current cycle.

Inflation, interest rates, geopolitical risk

In regards to stocks, our chief equity analyst Peter Garnry wrote in a recent post analysis:

“It's a new year and new hopes, but all things related to inflation, interest rates, geopolitical risk and China remain the same. With Q2023 earnings releases starting in a few weeks, the key question is whether companies will revise their XNUMX forecasts downwards and whether they still see difficulties with operating margins.”

In addition to the aforementioned supporting factors for gold this year, we anticipate continued strong demand from central banks providing a soft lower bound in the market. In the first three quarters of last year, the World Gold Council reported that the institutional sector purchased 673 tons of the metal, the largest amount since 1967 in full years. In part, this demand is driven by several central banks seeking to reduce exposure to the dollar. Such "de-dollarization" and general appetite for gold should make it another solid year for gold buying by the institutional sector.

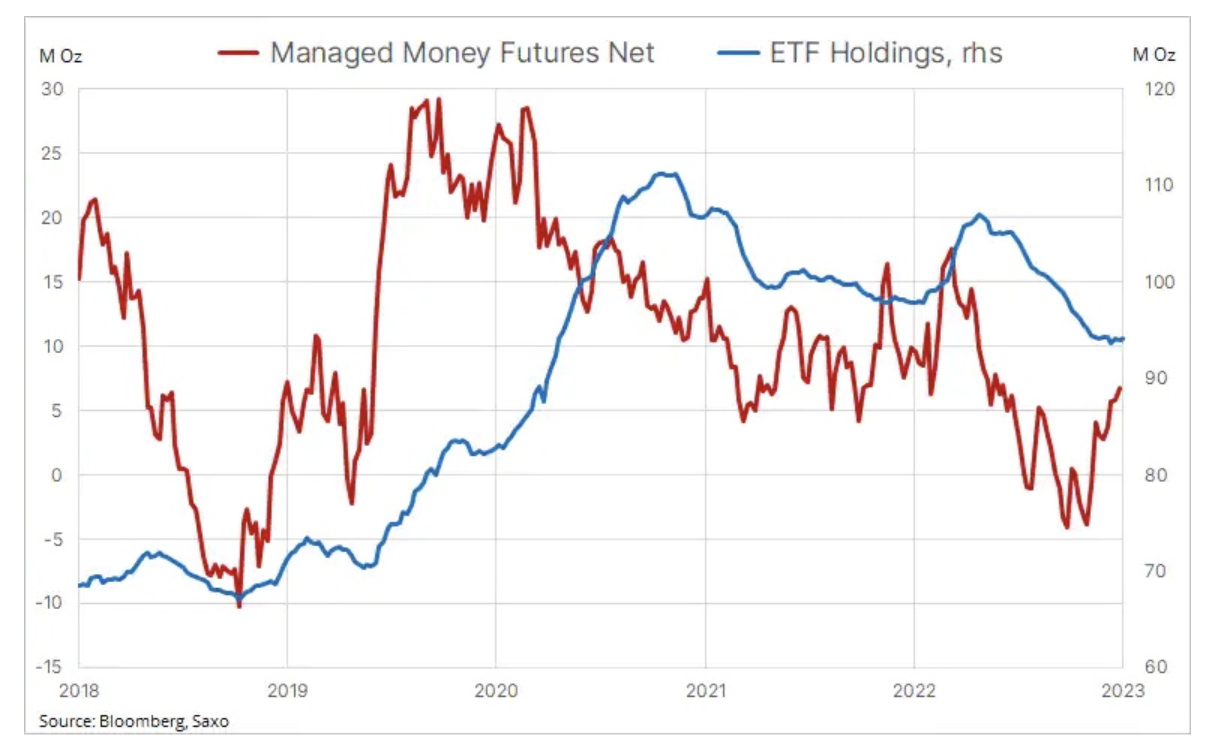

In addition, we expect a more gold-friendly investment environment to offset last year's reduction in exchange-traded fund holdings of 120 tonnes, potentially resulting in an increase of at least 200 tonnes. At the same time, hedge funds have become net buyers since the beginning of November, when a triple bottom signaled a change in the then dominant strategy of selling gold at any sign of strengthening. As a result, from a net short position of 38k. contracts, the funds reached a net long position of PLN 27 as at December 67. contracts.

What will the future hold?

The attitude of investors at the beginning of a new financial year is always cautious for fear of making a mistake. At the same time, however, the fear of missing something (FOMO) can contribute to the dynamic building of positions that can be left in the event of a change of direction. In the short term, these mechanisms will have an impact on the price action in the gold, silver and platinum markets, especially given their strong increase in the first few hours of the session.

From a technical perspective, yesterday's acceleration above the already strong uptrend at $1 increased the risk that prices in the market moved up too fast and too soon, and potential buyers should consider holding off until the correction or consolidation phase. The next key resistance level is the June high ($852) followed by $1, with the latter representing a 878% retracement from the 1 correction line. A reversal towards the 897-day moving average cannot be ruled out, however, currently at $61,8, which would signal a possible change in overall positive sentiment.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response