Japan's answer to demographics and productivity issues: generative AI robots

Japan's expertise in semiconductor manufacturing and robotic integration contribute to the country's dominance in the field of artificial intelligence. The combination of two of the most important market themes this year - Japanese stocks and AI - means a flood of investment opportunities.

Two of the most discussed topics in the market over the past few months are artificial intelligence and Japan, and their combination means a flood of new opportunities for investors.

We have already mentioned how many positive factors are affecting Japanese markets - from stronger economic growth to higher inflation, negative interest rates, improved corporate governance, geopolitical shocks, attractive valuations and growing interest in Warren Buffett this market. Both the Nikkei 225 and the TOPIX index have recently recorded highest levels in 33 years and while there may be reasons for a tactical retreat or a short-term downturn in sentiment such as a shift in Fed policy or a devaluation in China, the emergence of AI coupled with the current dominance of robotics has strengthened the long-term case for investing in Japanese equities.

Japan intends to confirm its position as the world leader in the production of microprocessors

In the 80s, Japan was the epicenter of microprocessor production, and despite some problems still maintains a key position in selected sectors semiconductor industry, such as NAND chips (a type of flash memory that does not require power) or sensors. The authorities appear to want to re-establish Japan's position in the global microprocessor manufacturing industry and plan to revise its manufacturing strategy to triple domestically produced semiconductor sales to more than 2030 trillion yen ($15 billion) by 108.

The new strategy is a conscious step towards increasing the production of advanced semiconductors, which are a global key strategic commodity for economic security and technological progress, including the latest technology in the form of generative artificial intelligence. At the same time, world leaders are increasingly concerned about the threat to Taiwan's microprocessor manufacturing industry, which produces more than half of the world's chips and 90% of the world's most advanced chips. Access to Taiwanese microprocessors remains crucial for the development of the global digital economy and further progress in the development of artificial intelligence.

In order to build a national network for the production of next-generation semiconductors, in 2022, the Japanese authorities created a consortium called Rapidus, involving investments from eight Japanese companies, including Sony, Toyota and Softbank. These companies over the next decade plan to make investments of a total value of USD 36 billion, with the government offering them approximately USD 500 million in subsidies to enable the production of next-generation microprocessors in a 2-nanometer process. In addition, the government committed to provide financial support of up to JPY 476 billion to TSMC's new plant in Kumamoto, southern Japan, and to provide a JPY 92,9 billion grant to flash memory specialist Kioxia Holdings for the development of its central Japanese plant.

American companies, such as Micron, are also expanding their operations in Japan; a new cooperation program between the United States and the Land of the Rising Sun in the field of semiconductor research and development was also recently announced, of particular interest to local entities such as Tokyo Electron.

With its long-standing leadership in research and technological innovation, Japan has the potential to fill the gaps in the market and help global semiconductor manufacturers reduce the risk associated with the process of relocating operations from China and Taiwan. Development of Japanese investments fits in with the global need to diversify supply chains and bodes well for Japan's return to the game with tech giant status.

High potential for success of generative artificial intelligence

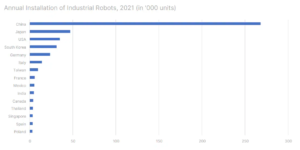

Japanese companies have traditionally been leaders in the production, export and use of robots in industry. In Poland, the integration of robots in industrial applications was particularly popular and easy to implement due to a shrinking workforce, taking into account the dynamics of the aging of the Japanese society and the lack of immigration. As a result, Japanese businesses and workers are more likely to invest in robots to increase productivity, total output and GDP growth. Companies such as FANUC, Kawasaki Heavy Industries, Sony and Yaskawa Electric Corporation were at the forefront of robotics development during the rise of Japan's economic power.

Japan's success in robotics and its commitment to earlier AI booms creates great potential for the country in the context of the recent interest in generative AI. The companies will remain open to the implementation of new technologies due to demographic constraints and easy access to microprocessors. About 60% of Japanese companies have net cash with very low debt levels, which also allows them to invest in research and development related to artificial intelligence – unlike international competition, which can collide with the problem of high interest rates. In addition, there is a large supply of skilled workforce in technology and artificial intelligence in Japan, due to the country's past successes in robotics and other technology fields and its ongoing cooperation with global technology companies.

Robots + AI could mean a leap in productivity and a new era for Japanese manufacturing

Japan's greatest potential may lie in combining its success in robotics with new AI capabilities to develop a completely new technology that could change the face of the global economy. Artificial intelligence applied to robotics enables robots (software) a new way to perform commands or tasks. This means that robots can become more independent and able to learn, understand, solve problems, reason and react, while at the same time becoming somewhat independent of human commands. For the industry, this could mean a robot moving through a crowded warehouse, adapting to the need to change routes in the event of unforeseen events, or a robot understanding supply chains and improving inventory management while analyzing data for possible disruptions.

This kind of marriage of robots and artificial intelligence can bring a leap in productivity as well labor and world trade improvements, which could spell a new era of Japanese economic power. Japanese companies from various sectors use artificial intelligence. SoftBank's mobile technology department is developing a Japanese equivalent Chat GPT. CyberAgent announced that it has launched its own Large Language Model (LLM) that enterprises can use to build AI chatbot tools.

NTT also plans to develop its own LLM in the current financial year and make it available to other entities. Industrial conglomerate Hitachi has set up an internal body called the Generative AI Center to facilitate the use of generative AI to improve employee productivity; also plans to provide consulting services in the field of artificial intelligence to other enterprises.

The potential of Japanese AI means numerous investment opportunities

The potential for innovation complements other positive factors for Japanese equities and means numerous additional investment opportunities in Japan. Below is a list of inspirations.

- Microprocessor manufacturers and testers: Advantest, Kyocera, Renesas, Lasertec, Shibaura Mechatronics, Screen Holdings, Tokyo Electron, Tokyo Seimitsu

- Manufacturers from the automation industry: SMC Corp, Omron, Yaskawa, Keyence, FANUC

- Products integrated with artificial intelligence: Sony, Nintendo, Nikon, Hitachi, Kawasaki, Mitsubishi, Toshiba

- AI-powered services: Appier, Change Holdings, NTT Data Corp, AI Inside, Advanced Media

- Listed funds: Global X Japan Semiconductor ETF, Global X Japan Robotics & AI ETF

threats

Despite the enormous potential for Japanese manufacturing to gain a competitive advantage, companies seeking to diversify their supply chains outside of China are likely to hesitate given the low labor supply and rising wage pressure in Japan. Reshoring among Japanese companies may also be limited to producing higher-end products on a smaller scale. The weak yen also means high costs of importing raw materials for companies planning to move production to the Land of the Rising Sun. On the other hand, a sharp appreciation of the yen could reduce demand for Japanese-made consumer electronics and other products. At the same time, the recent strong gains in semiconductor stocks may also mean that expectations of technological progress have already been factored into valuations.

An easing of tensions between the United States and China may slow down or even reverse the process of adjusting global supply chains. Japan also announced some export restrictions on semiconductor chips, which could affect the profits of key Japanese microprocessor manufacturers. In addition, possible progress in the development of artificial intelligence may be disrupted by regulatory risks or constraints in energy supplies.

All Saxo Bank forecasts available here.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response