The commodity boom is not over yet

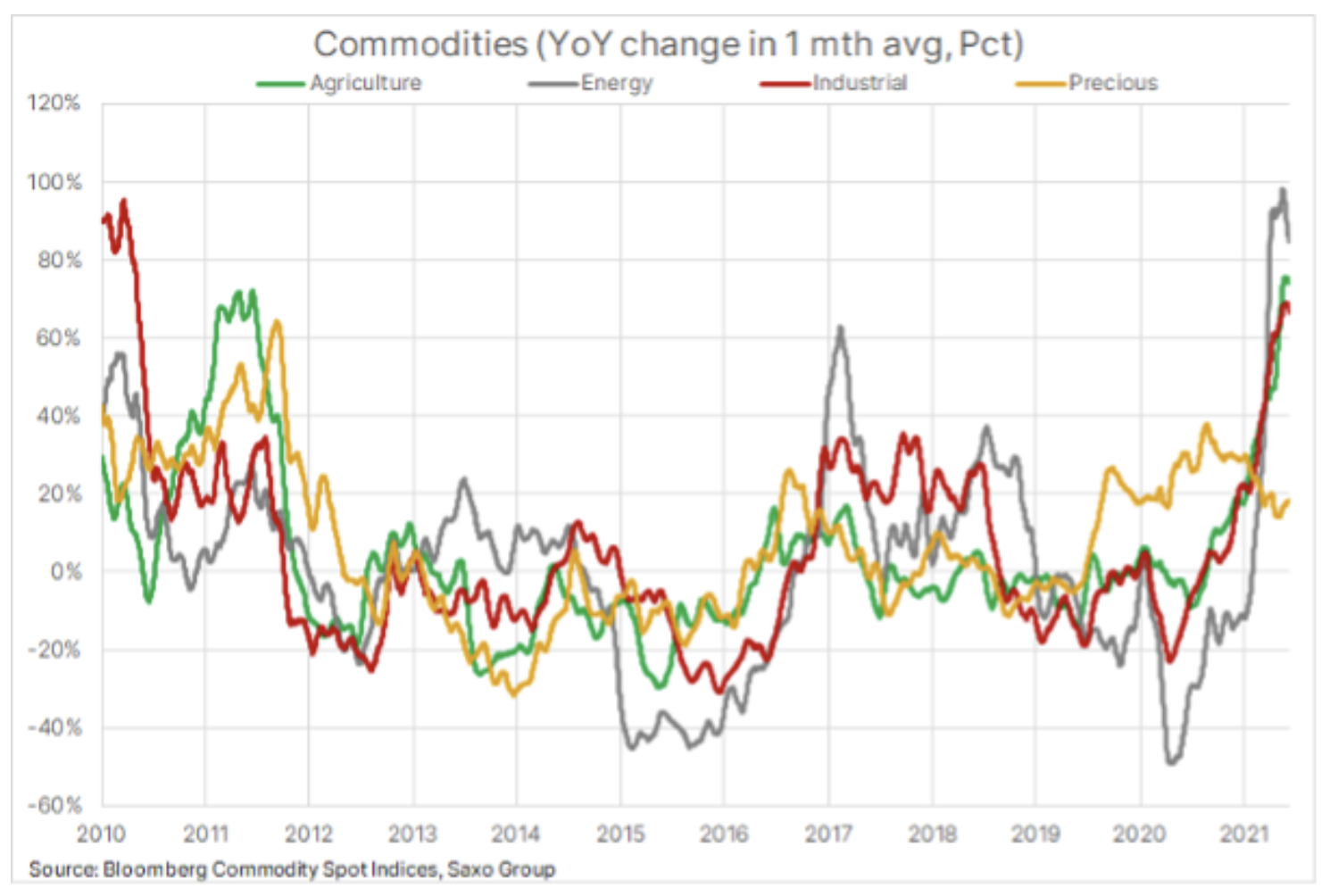

Despite five consecutive quarters of profits, the commodities sector seems poised for a further boom in Q2021 75 - though its pace is slowing somewhat as some of its recent dynamic factors begin to lose momentum. Since last March lows due to the pandemic and global lockdowns, the Bloomberg spot commodity index, following the performance of major commodity futures contracts with the earliest expiry date, ranging from energy to metals and agricultural products, has climbed by as much as XNUMX% and reached ten-year maximum. This gave rise to speculation that we have entered a new supercycle in commodity markets.

The supercycle is characterized by longer periods of mismatch between growing demand and inelastic supply. Correcting this supply and demand imbalance is time consuming due to the high initial capital expenditure for new ventures and the time needed to capitalize on the new supply. For example, in the copper industry, it may take up to ten years from the decision to production. Such long periods often cause companies to delay making investment decisions in anticipation of rising prices, and then it is too late to avoid further increases.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Demand-driven supercycles to date have included pre-World War II rearmament and the reform of the Chinese economy, which accelerated after China joined the World Trade Organization in 2001. China's unlimited appetite for raw materials contributed to an increase in the Bloomberg spot commodity index by almost 350%. Supercycles can also be supply-based: the last such case was the OPEC oil embargo in the 70s.

Some economists believe that the current commodity price boom is cyclical rather than structural, fueled by exceptionally strong demand in China. This demand is currently holding back as credit tightens, while disruptions in supply chains overlap with fiscal-driven economic growth in Europe and the United States. To this should be added the fact that the prices of key agricultural products have reached long-term highs as a result of the worst drought in 90 years in Brazil, strong demand in China for feed and increased competition for edible oils from the biofuels industry.

However, we believe that individual events in all three sectors will continue to provide support. Even though the supply oil is not limited, the market will be supported by a period of synchronized worldwide growth in demand, during which OPEC + producers will be able to increasingly control the price due to the prospect of non-reaction to higher prices from non-OPEC + producers; this is particularly true for North American producers who have quit mining at all costs.

On metals, increases in government spending on infrastructure and decarbonisation will continue to drive significant metal demand, including copper and iron ore - a key raw material for steel production - as well aluminum material, cynkand even semi-industrial metals such as silver or platinum. To this should be added the perspective of increasingly volatile weather conditions, which will potentially prevent the process of necessary replenishment of stocks of key agricultural products.

Moreover, we believe that the rise in inflation is likely to be long-term rather than temporary, thus sustaining demand from investors who will need real assets such as commodities to back up their portfolios. Moreover, given our overall negative outlook for the dollar, precious metals - both gold and silver - should continue to generate demand, particularly if the projected rise in US Treasury yields is driven by rising inflationary expectations, thereby curbing excessive real yields growth.

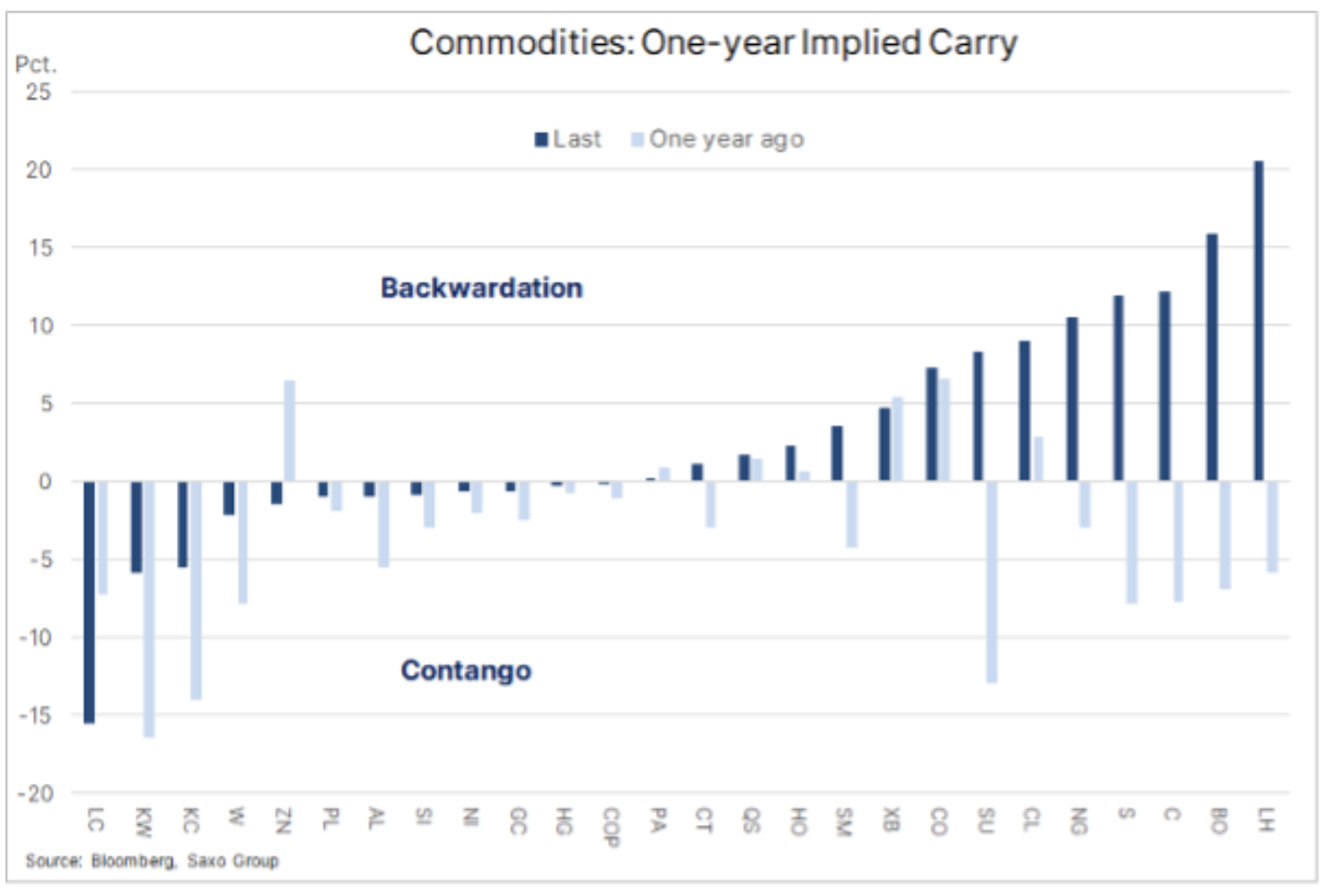

The reduction in supply in the market over the past six months is another reason why asset managers are again seeing commodities as an interesting investment opportunity for the first time in many years. As a number of commodities saw supply constraints, their forward curves went into deportation, meaning futures contracts with the closest expiry date show a premium over deferred contracts. The larger the spread, the higher the profitability that can be obtained from rolling over contracts outside the curve.

The chart shows the change in market conditions in favor of passive long-term investors in the past year. A positive rollover profit has emerged for most major commodities, with the highest cost of holding being for agricultural and energy futures.

While increasing physical demand is seen as the main driver of further increases in commodity prices, investment demand plays an equally important role. Their common feature is that the overwhelming majority of investments by asset managers and hedge funds are in commodities, and ultimately this wave will reach the futures market. This influx of investment, often initiated for reasons that have nothing to do with the foundations of the individual raw materials, provides an extra layer of support. Examples of motivations of asset management decisions regarding broadly understood investments in raw materials, apart from the fear of omitting something important fear of missing out, FOMO), include momentum or hedging against rising inflation and the weakening of the dollar; both may result in a shift of funds from other asset classes.

The three best-known commodity indices that are followed in some form by billions of dollars are the Bloomberg Commodity Index, the S&P GSCI, and the DBIQ Optimum Diversified Commodity Index. Providers of publicly traded funds, incl. Invesco, iShares, iPath or WisdomTree, they offer different variations of these commodity indices. Some follow an index without any selection, while others seek to optimize return by selecting the optimal investment location on the futures curve.

Detailed analysis: carbon dioxide emissions

The EU Emissions Trading System (ETS) was established in 2005 and is now by far the largest and most successful market. It is an exceptionally fluid system of ceilings and transactions, with governments setting an acceptable cap for the carbon dioxide emissions produced by an economy or region. The main source of supply in the ETS is allowances that are allocated free of charge to issuers; auctions are the second source.

The ETS is now a stable and very transparent system. It covers about 40% of greenhouse gas emissions in Europe from industries such as utilities and the industrial sector. At the moment, the system does not cover other sectors such as agriculture, construction and transport (including shipping), while some are foreseen to be included in the coming years.

Until more than EUR 50 per ton of CO is broken2 Earlier this year, the ETS went through a series of phases, the first of which failed a few years ago as too many permits were issued and the sale of surplus permits sustained the price pressure. In the two years to 2019, many of the initial problems were resolved, but the price remained low, failing to meet the goal of forcing the most polluting generators - by increasing their costs - to switch to renewable energies and move away from most pollutants such as carbon.

Last year, and in particular since November, ICE EUA futures contract for one tonne of carbon dioxide emissions (ticker: CFIZ1) it went up strongly to EUR 40, ie by 300% above the average price in the last five years. What happened in November? Most notably, the first vaccine was announced, signaling a clear path to global recovery; moreover, Joe Biden became president of the United States, preferring a more environmentally friendly policy.

Finally, politicians realized that more aggressive action was needed to reduce emissions by 2030% by 55 compared to 1990 levels. Considering that emissions have been reduced to less than half of the target in the last 30 years at 55%, with only 9 years left, the system is finally showing signs of working. Over the next 9 years, the system will cover additional industries and the total number of allowances in circulation ( total number of allowances in circulation, TNAC) will be gradually phased out to the so-called market stability reserves, which will limit supply and put upward pressure on prices.

As a result, the cost of issuance will most likely continue to rise. Given the strong momentum seen last year, it will also attract more and more speculative investors who are almost guaranteed to increase volatility and periods of correction. Overall, however, the price is projected to rise and could reach as much as EUR 2030 per ton by 100.

In order to achieve such a massive reduction, utilities, industry and other highly polluting sectors will increasingly look to alternative low-carbon energy sources.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)