We are approaching a tipping point, but first you have to suffer

The markets were in chaos - not least due to the aggressive policy being maintained by Fed, but also due to the crisis of confidence in the British economy after fiscal policy and the lack of response from monetary policy contributed to a significant sell-off of bonds. At the same time, the sharp appreciation of the US dollar continued to hit a number of currencies, and the effect of last week's intervention diminished Japan. Pressure on corporate earnings could be another reason for the decline, and concerns about a recession must be further factored into valuations.

The high level of inflation forecast by the Fed for an extended period of time is now taken seriously

September meeting Federal Open Market Committee (FOMC) it represented a turning point not so much for the Fed as for markets that had finally understood the Fed's inflation announcement. In particular, the forecast (the so-called dotplot) contained the two key messages mentioned below. Even if its accuracy remains questionable, given its very weak correlation with what actually happened before, it is an excellent signaling tool to understand the intentions of FOMC members.

- The final rate is estimated at ~ 4,6%, ie above the level accounted for in the pricing of futures contracts for Fed funds before the meeting. Even a slower pace of growth and a higher level of unemployment, as indicated in the Fed's projection, will not stop the central bank from raising rates.

- There were negative reactions to premature easing proposals, and the dot plot forecast predicts a rate of 4,5-5,0% even at the end of December 2023.

In addition to its commitment to tighten policies, the Fed is currently in full swing of its quantitative tightening program, which is rapidly siphoning liquidity from the financial markets. The goal is to cut the Fed's balance sheet by $ 95 billion a month, which is twice as fast as in August. While quantitative tightening has a strong impact on liquidity conditions and asset markets, it is less useful in terms of directly impacting inflation. While the systemic risk from quantitative tightening may remain limited, it does contribute to an increase in government bond yields as the Fed balance sheet shrinks and the amount of privately held government bonds increases.

Trussonomy pushes Great Britain to the position of an emerging market

In less than two months, the pound sterling depreciated by almost 10% on a trade-weighted basis, surpassing the Japanese yen as the weakest currency to the US dollar on a year-to-day basis. Immediate reaction Bank of England could save the face of the British economy to some extent, but let us remember that last week's decision of the central bank was also quite divided - two members voted for a 75bp rate hike, while one was inclined to a smaller rate hike by 25bps. Therefore, it is still difficult to expect a prudent political reaction from the Bank of England, and parity hand in hand GBP / USD in this case, it may not be the lowest possible level. In addition, the UK's net foreign exchange reserve of $ 100 billion is sufficient to cover only two months of imports, roughly the equivalent of 3% of GDP compared to 20% for Japan and 115% for Switzerland. In the context of Great Britain, however, it is not only about the pound sterling crisis, but about the broadly understood crisis of confidence. Let's not forget that inflation forecasts for the end of the year are already at 10% + and the market is currently pricing in a rate hike of over 200 basis points by the end of the year in the two remaining meetings. The central bank will have to carry out this wide-ranging tightening simply to keep the pound sterling at its current level, and this will not reverse the impact of government decisions on British markets. The scale and pace of rate hikes may also do significant damage to the economy. Fund on Monday iShares MSCI United Kingdom (EWU: arcx) recorded a decline by another 1,8% and lost as much as 7,3% in the last week.

The Bank of Japan's patience will continue to be tested

We wrote earlier about what will have to change to be able to speak of the peak value of the American currency - and nothing seems to be a foregone conclusion as of now, except that some officials from non-US authorities are beginning to express concern about the weakness of the currency. However, the intervention of the Bank of Japan did not have long-term effects on the USD / JPY pair, although it strengthened the yen against some other currencies such as EUR, GBP and AUD. It could also act as a brake on some speculative short selling. However, coordinated intervention against the yen is still a matter of the future, and the depreciation of the Japanese currency is the result of the Bank of Japan's own efforts to control the yield curve. Japanese government bonds are likely to continue to test the central bank's patience with its yield curve control policy. Downside potential Japanese government bonds (JGB1c1) it could grow exponentially if the Bank of Japan changes policy at some point.

Profit pressure may be next

While Q31 earnings turned out to be better than expected, mounting concerns about inflation made companies more cautious about forecasts and less optimistic about earnings in the near future. In July and August the estimates of the earnings per share ratio for QXNUMX have been revised down to some extent, and a further deterioration in forecasts and pressure on margins cannot be ruled out. According to FactSet, as of August XNUMX, the estimated earnings of the companies z the S&P 500 index in 2022 was $ 226,15 per share. This is a 1,5% decline from the estimated June 30 value of $ 229,60 per share. For 2023, analysts are now forecasting an earnings-per-share ratio of $ 243,68, down 2,8% from their June estimate of $ 250,61. So far, companies have dealt with rising inflation, passing higher costs to consumers as fiscal support from the pandemic strengthened the consumer side. The pass-on of higher costs was also visible in the form of higher CPI readings. However, with the day-to-day deterioration in the economic outlook, consumers will need to begin to resist some resistance, which is likely to be seen in earnings reports. From a sector perspective, tech equities are likely to be hit by this as tight corporate budgets begin to weigh heavily and ten-year US bond yields close to 4%. The semiconductor sector, a barometer of the global economic health, may also remain under pressure. While the oil and gas sector saved its earnings season in QXNUMX, it is likely to come under some pressure in QXNUMX as well, unless the outlook starts to look slightly more optimistic as capital expenditure plans improve.

Another important point will be the return of the dollar

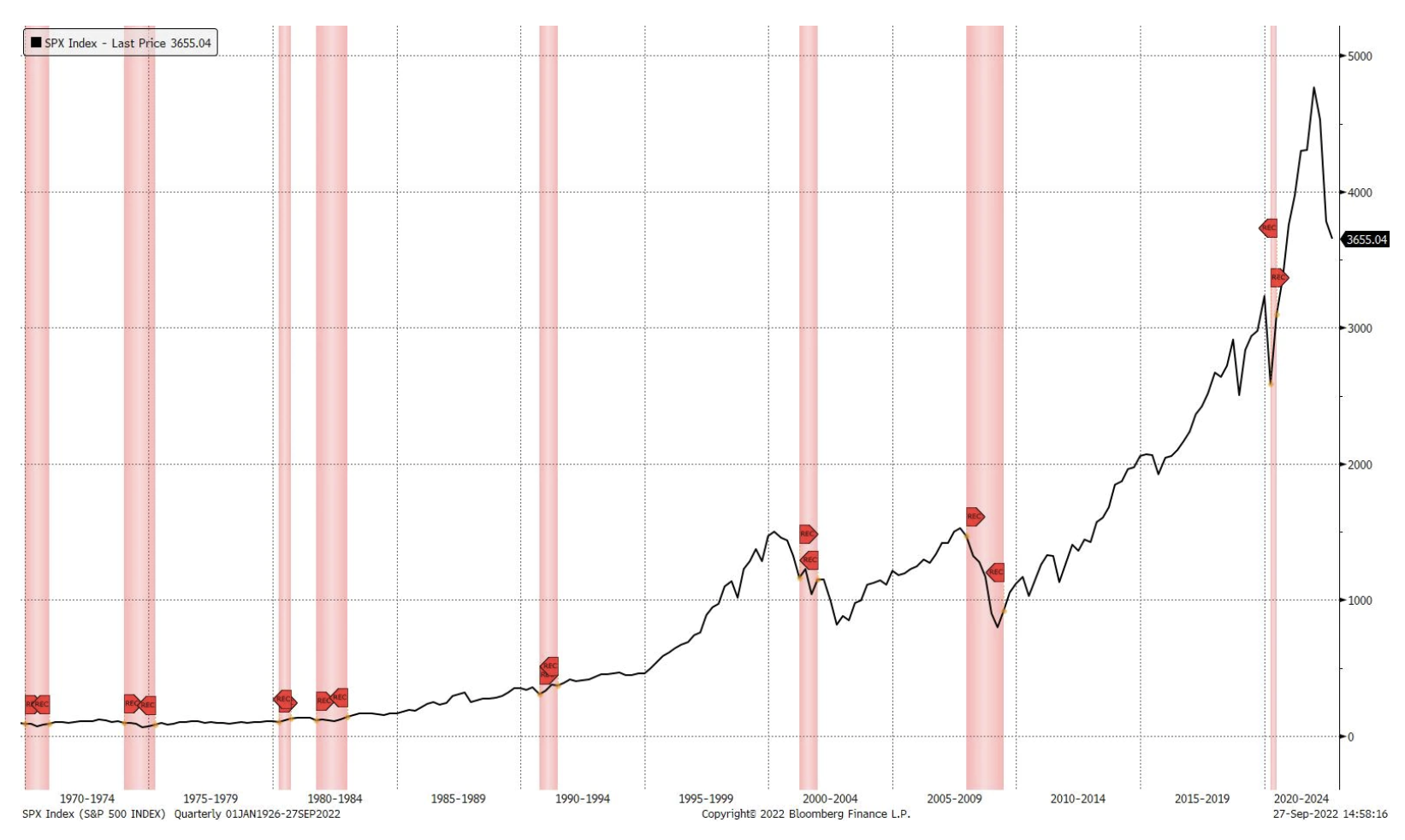

The declines in the market we have seen so far resulted mainly from the sharp change in the cost of capital and the revision of the peak valuation. The next stage, as mentioned above, may be a recession in corporate earnings. However, there is still a risk of an economic recession and history shows that market lows only appear once a recession has started (see the chart below).

Even so, as ten-year US bond yields close to 4% - a level that could potentially be a ceiling - the next turning point is the US dollar reversal, not the Fed's decisions. Testing these key levels could mean a short-term rebound in the stock market, which could be conducive to building new short positions as the trend is still down. Alternatively, it would be optimal for investors to look for signs of selling exhaustion in order to accumulate long positions, e.g. VIX over 40 points. Historically, a 20% drop in stocks means that buying stocks after a 20% drop from their record highs is a positive risk-reward ratio for long-term investors.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)