The shortage of supply will push commodity prices even further

Raw materials continue to enjoy particular interest and demand. The combination of a vaccine-induced revival in global activity, a green transformation and emerging shortages in many key commodities saw the Bloomberg Commodity Index gain a whopping 45% compared to the Covid-19 collapse in April last year. Year-over-day performance pushed the price of commodity-related stocks to the top of Saxo's equity baskets.

After nearly a decade of sideline or declines, the sector has seen a strong rally with individual commodities hitting long-term highs. Although individual commodities experienced periods of strengthening at the time, the boom in recent months has clearly synchronized in all three sectors: energy, metals and agricultural products.

However, following the sharp surge in US bond yields that started in January, the sector's recent success in attracting record speculative buy deals may in the short term - and despite sound fundamentals - force a correction or, at best, a consolidation period.

The rise in commodity prices is the result of a number of factors, but the expectations of dynamic post-pandemic growth are particularly important in this respect, thanks to significant fiscal stimuli that will increase demand for hedging assets and the green transition. At the same time, after years of insufficient investment, the supply of a number of key raw materials is shrinking. These phenomena increasingly contribute to the perception that a new era has begun for commodity markets and, in the future, perhaps another supercycle.

The supercycle is characterized by longer periods of disproportion between rapidly growing demand and inelastic supply. Correcting this imbalance between supply and demand takes time due to the high initial level of investment expenditure for new ventures, as well as the need to organize new supply. For example, in the copper industry, the time from making a decision to production may be ten years. Such long periods often cause companies to delay making investment decisions in anticipation of rising prices, when it is usually too late to avoid further increases.

Earlier demand supercycles included the pre-World War II rearmament and the reform of the Chinese economy, which accelerated after China joined the World Trade Organization in 2001. By the time of the 2008 global financial crisis, Bloomberg's overall commodity return index had risen by as much as 215 %. Supercycles can also be of a supply nature - the last one concerned the OPEC oil embargo in the 70s.

The next commodity supercycle is projected to be driven not only by rising demand, but also by an increased risk of inflation as investors need real assets such as commodities to hedge portfolios after years of disappointing returns. Moreover, after a decade of prioritizing technology investments over hard assets, there is a lack of new supply lines.

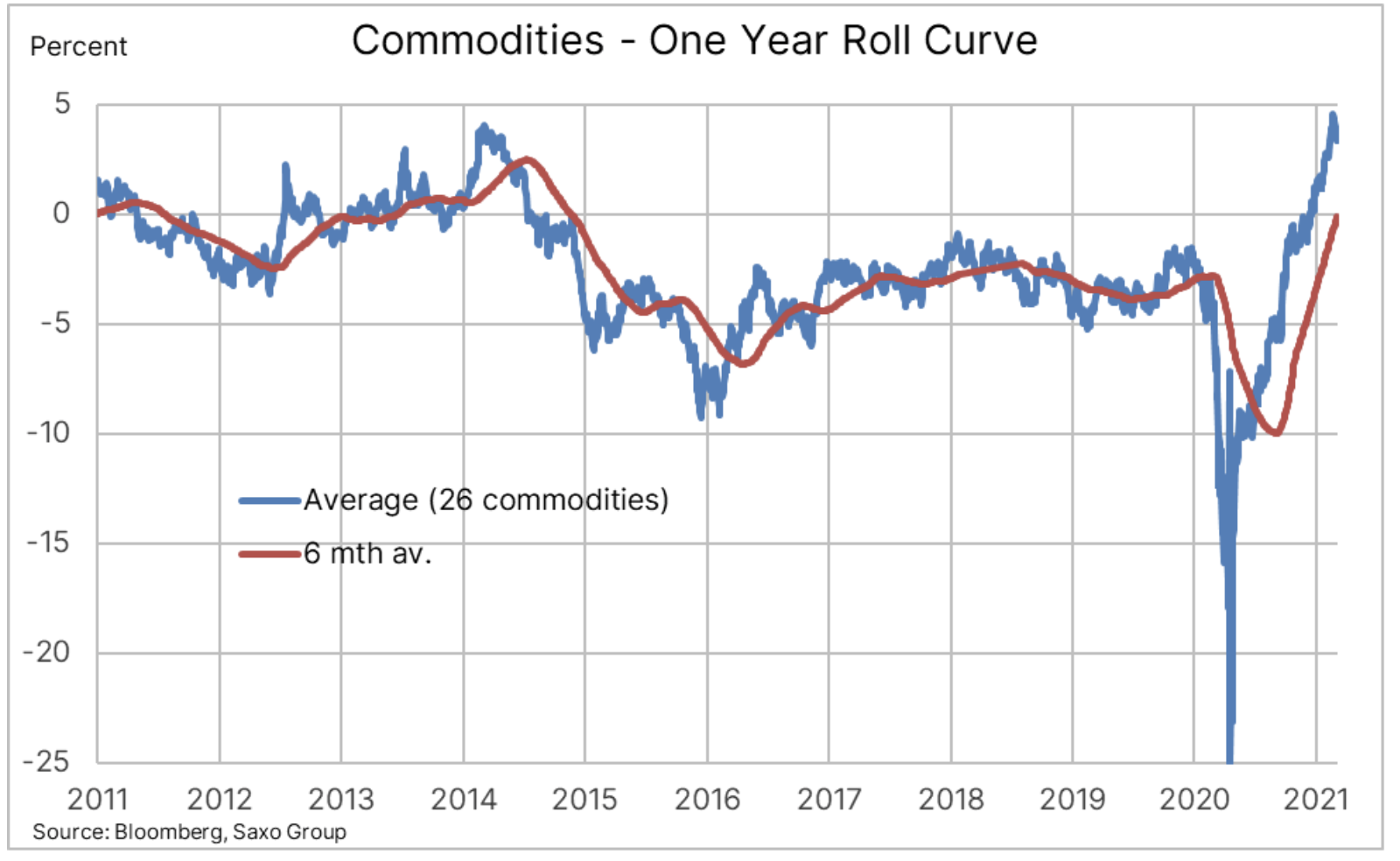

Chart: Shrinking supply for a number of commodities has made holding gains positive for a basket of 26 commodities for the first time in seven years, a trend that is critical and has increased the appetite for investment by long-term investors. passive exposure to raw materials.

The market supply constraint contributing to the creation of a structure known as deportation is at its highest since 2014, and after years of low profits caused by contagion - the opposite structure resulting from oversupply - we are currently observing a renewed increase in interest among investors. The chart below shows the negative impact of the stock market contagion - a structure which means that investors with a position in a futures contract or in a following publicly traded fund receive a negative return on any rollover of exposures from an expiring contract to a higher price contract further down the curve.

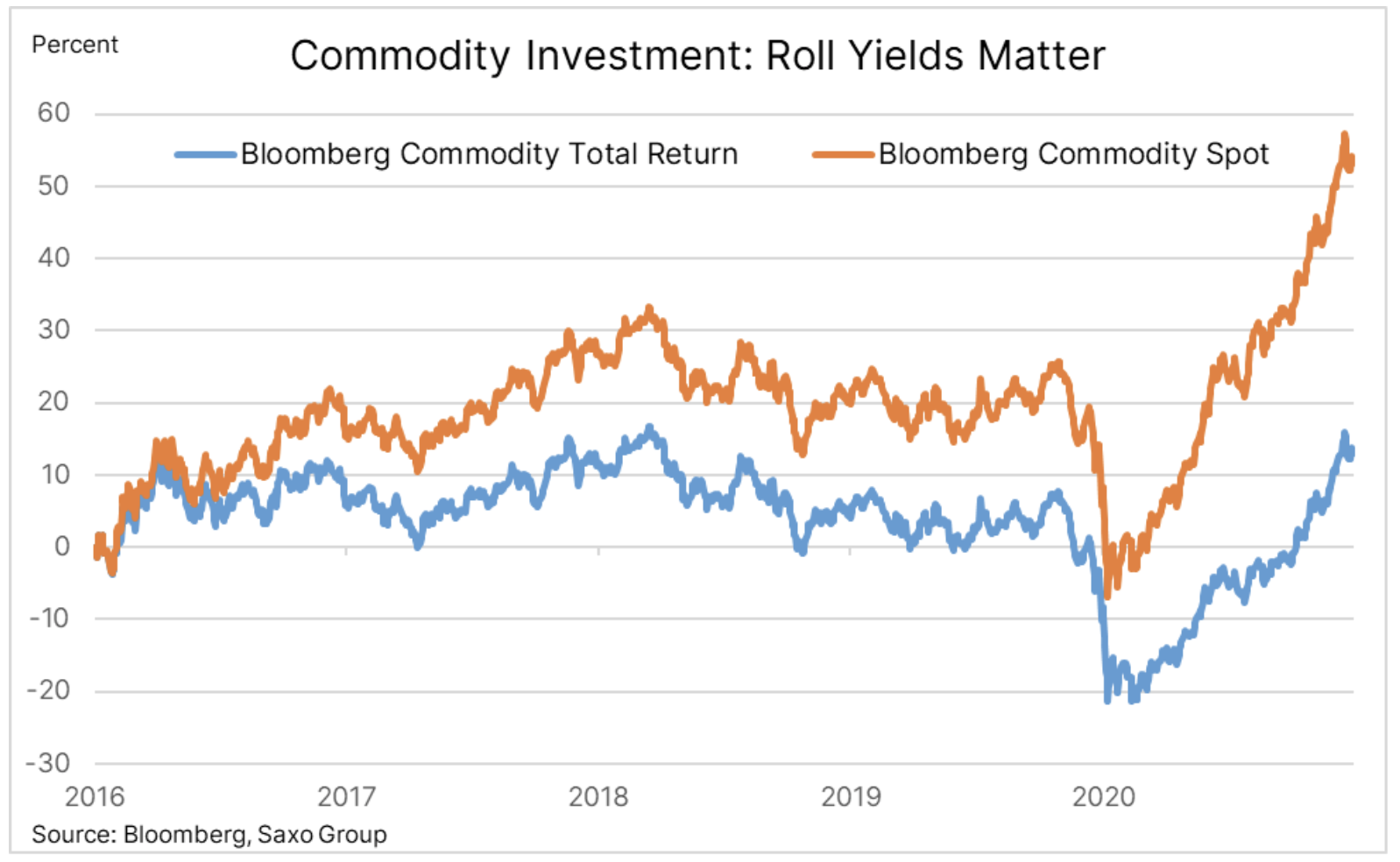

Chart: The Bloomberg spot index monitors contract performance for the coming months, while the overall return index includes rollover gains. The nearly XNUMX% difference in performance over the past five years primarily reflects the negative impact of exposure rollover in an oversupply market.

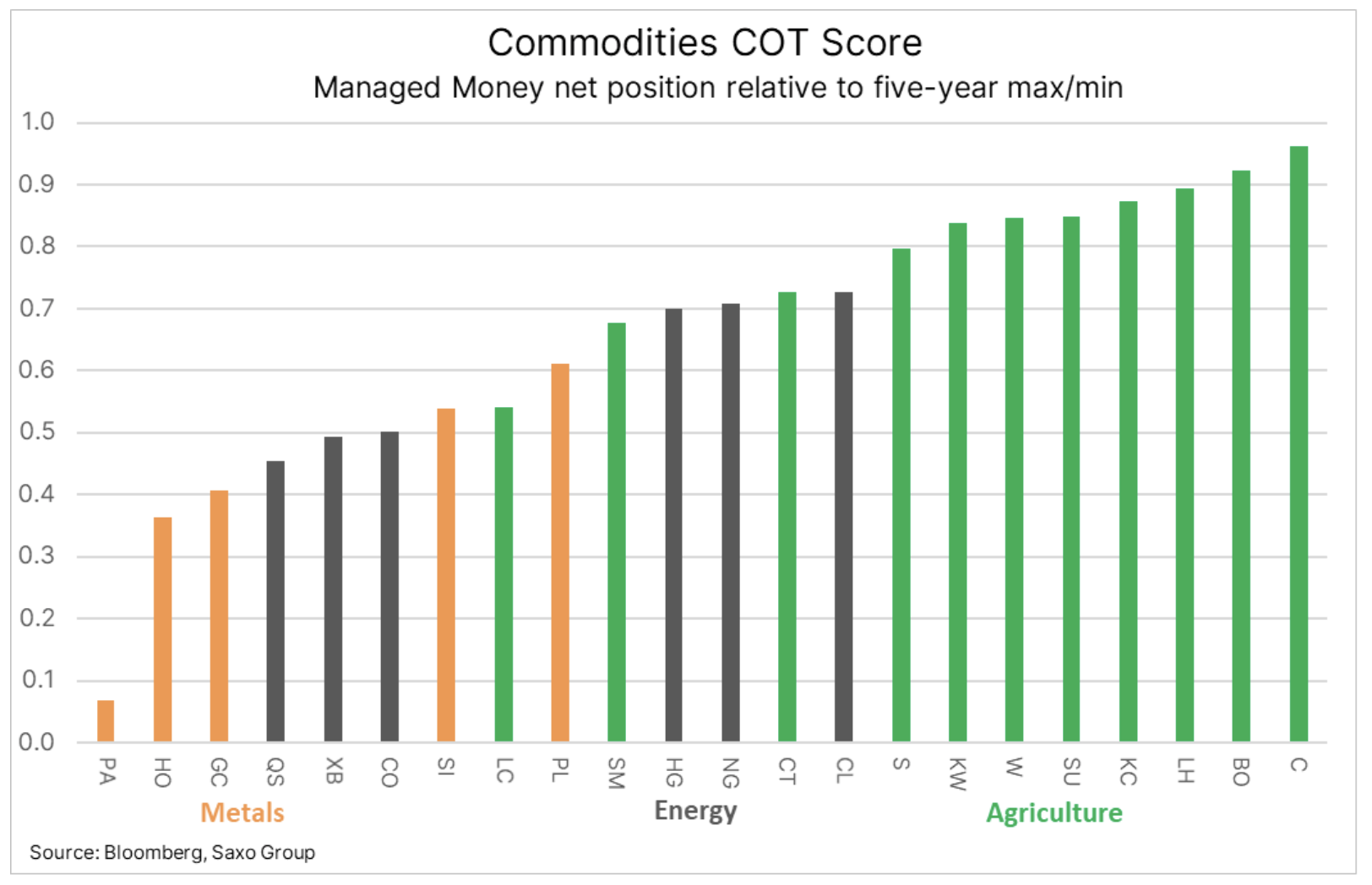

The strong momentum in commodity markets in recent months, combined with signs of a contraction in supply, has fueled buying deals from speculative investors, some of whom are looking to hedge against inflation while others have simply joined in on the wave of rising momentum. While physical demand and limited supply appear to be favorable for prices in the coming months, if not years, the short-term outlook may be more challenging as "paper" investments are exposed to the effects of a decline in risk appetite as a result of the recent rise in bond yields. especially real profitability.

Chart: Fund positions in key commodities in relation to the five-year minimum and maximum, showing the scale of growth of long positions in recent months. This is especially true for agricultural products, especially those that have benefited from strong Chinese demand and recent worries about South American weather-related production.

Petroleum

Prices are expected in the coming months oil will continue to rise as the increasing demand for fuel will allow OPEC + to further back out of the drastic production cuts of last April, which saw prices fully return to their previous levels a year later. However, some challenges will remain, in particular due to the risk that a bull market driven by constrained supply as opposed to a demand driven one could inhibit the return to uptrend in demand.

Part of the risk of allowing such a large increase in prices before demand fully recovers is based on the assumption that US shale oil producers have shifted their focus to extraction at all costs and have begun to generate shareholder value while reducing debt. Given that the price of WTI crude oil is well above the threshold, the coming months will show whether this discipline can and will be maintained.

Assuming this happens, it is obvious that the OPEC + group has embarked on a tight supply strategy in the crude oil market. It will be effective as long as global fuel demand grows by 5,4 million barrels per day, as currently projected by the International Energy Agency, and growth in non-OPEC supply will remain limited at less than a million barrels per day.

While Brent crude oil is likely to end around $ 2021 in 70, we remain skeptical about the timing as the market increasingly needs time to cool down and consolidate. Whether it gets such a breath depends on the pace at which OPEC + brings additional barrels to the market, as well as the continuation of the vaccine-induced recovery in global mobility.

Precious metals

Most sensitive to changes in interest rates and the dollar, they had a difficult first quarter as both gold and silver tried to defend themselves against rising US bond yields, and thus against a stronger dollar. The rise in profitability as such is not a major obstacle as long as it is the result of rising inflation expectations. This did not apply to the first quarter, as rising real yields accounted for half of the increase in nominal yields to around 1,5%.

In relation to the second quarter, we expect a recovery due to the growth outlook inflation by more than the market has valued so far. This will be a slow process that will only accelerate once the momentum reaches a positive enough pace to force hedge funds that have limited their exposure to an almost two-year minimum to return to the market. We reiterate our view that gold could hit $ 2 / oz this year, while silver could do even better at $ 000 / oz. We base this on an additional positive impulse in the form of demand from the industrial sector, which has brought the gold-silver ratio down to around 33.

Copper

Copper remains one of the most robust commodities, which has already doubled the price from the 2020 pandemic low. Demand, both investment and physical, is likely to remain high, and the accelerating shift away from carbon may cause that the annual supply deficit will reach its highest level in many years. Since Joe Biden sat in the White House, the green transition has become global, and the drive towards a more electrified world will require enormous amounts of copper at a time when future supply looks relatively weak. We expect HG copper to be in a wide range, with an upward trend from 2020 lows limiting the downside potential, while in the context of growth, the focus should be on the 2011 record high of $ 4,65 / lb.

Agriculture

A strong boom, and hence - a record investor commitment, should cool down as the sowing and cultivation season begins in the northern hemisphere. Over the past year, the supply of a number of agricultural products, in particular cereals and oilseeds, has become much more limited from a large number. Concerns over the weather in South America in the first quarter and last year's significant buy orders from China have brought projected inventories at the end of the 2020-2021 season at their lowest level in years. In this context, in the coming months, the focus will be on sowing and cultivation conditions, particularly in the United States and the Black Sea region.

Due to the high speculative long position, a strong start to the seeding season could put top positions in maize and soybeans at risk of a correction. Attention should also be paid to the demand from China in view of the successive African swine fever outbreaks that could potentially reduce the demand for foreign raw materials, in particular for the two types of crops mentioned above.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response