Actions: new extremes and challenging opportunities

The key question for stock markets in 2024 is whether there will be a recession. Investors should be overweight resources, cybersecurity and defense stocks, as well as UK and European stocks. They should underweight US mega caps.

It all comes down to the recession

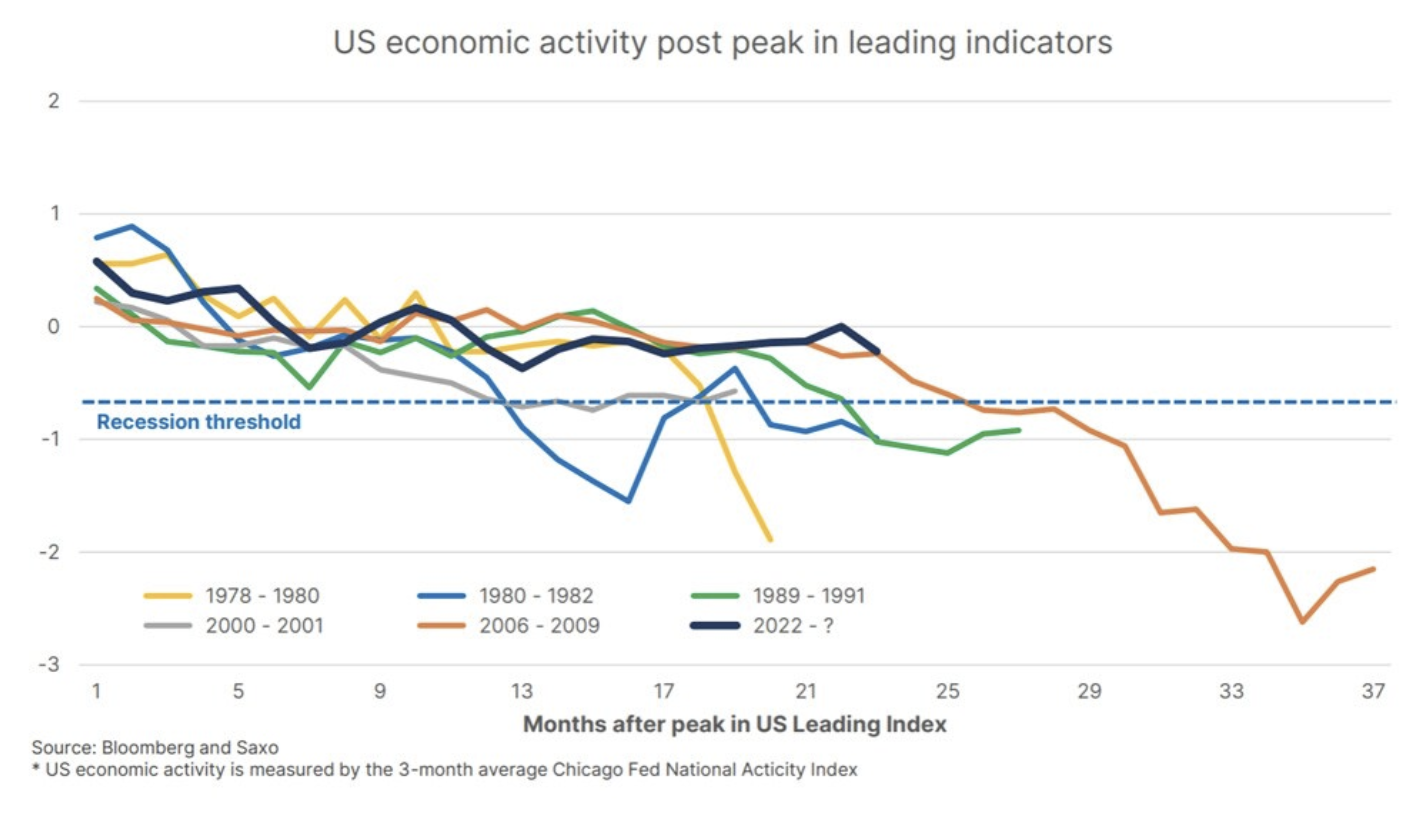

The keyword for stocks in 2023 was economic resilience. Everything pointed to a recession amid the sharpest interest rate increases in decades. However, unprecedented US fiscal policy and the animal instincts unleashed by ChatGPT's mesmerizing prowess have helped the US economy avoid recession and pushed technology stocks to new all-time highs. With the second longest interval in U.S. economic history since 1978, as measured by the recession-free period since the index's preceding peak, the main concern in 2024 is the possibility of a recession.

Economists predict a 50% chance of a recession in the US, highlighting the challenges for investors as 2024 looks ambiguous. The determination of China's policy is still a great unknown. If history is any indicator, stock markets performed largely positively in the months leading up to the first interest rate cut Fed, so for now the current market valuation of rates is not alarming.

Key stock themes to watch in 2024

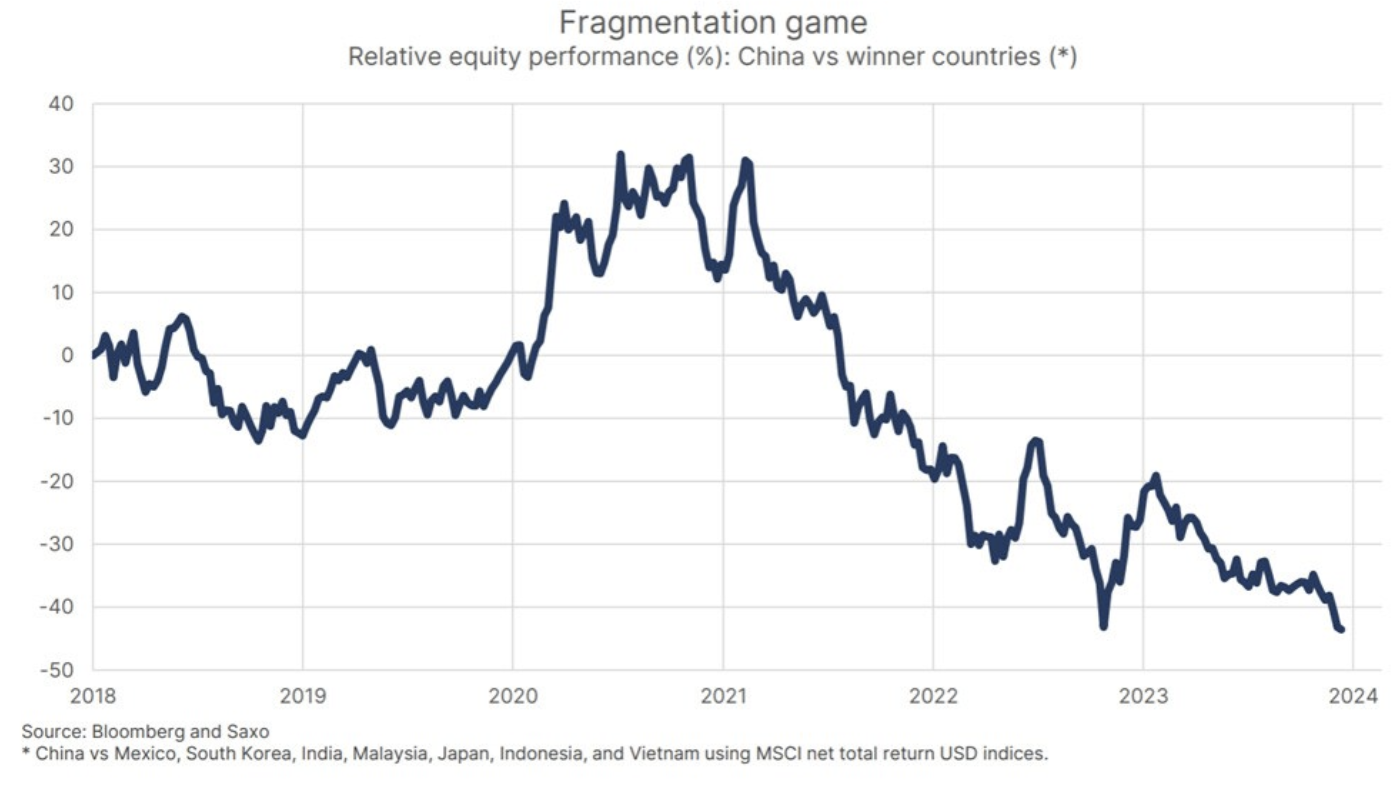

Last year was another year of disappointment for Chinese stocks, especially compared to countries that won the fragmentation game, as supply chains increasingly bypassed China. These countries include India, Mexico, Brazil and Vietnam and we expect the stock market to continue to favor these emerging equity markets at the expense of China. Notably, since the beginning of 2018, Chinese equities have underperformed other key emerging markets by almost 44% in USD terms.

continues and is driven by strong global urbanization, investment in green transformation and limited supply. Cybersecurity and defense stocks will likely continue to benefit from ongoing global geopolitical tensions.

If the market accelerates its bets on further policy cuts in 2024, then battered green transition stocks in wind, solar, energy storage, electric vehicles and hydrogen could see a short-term boost.

We are underweighting mega caps after hitting a new high

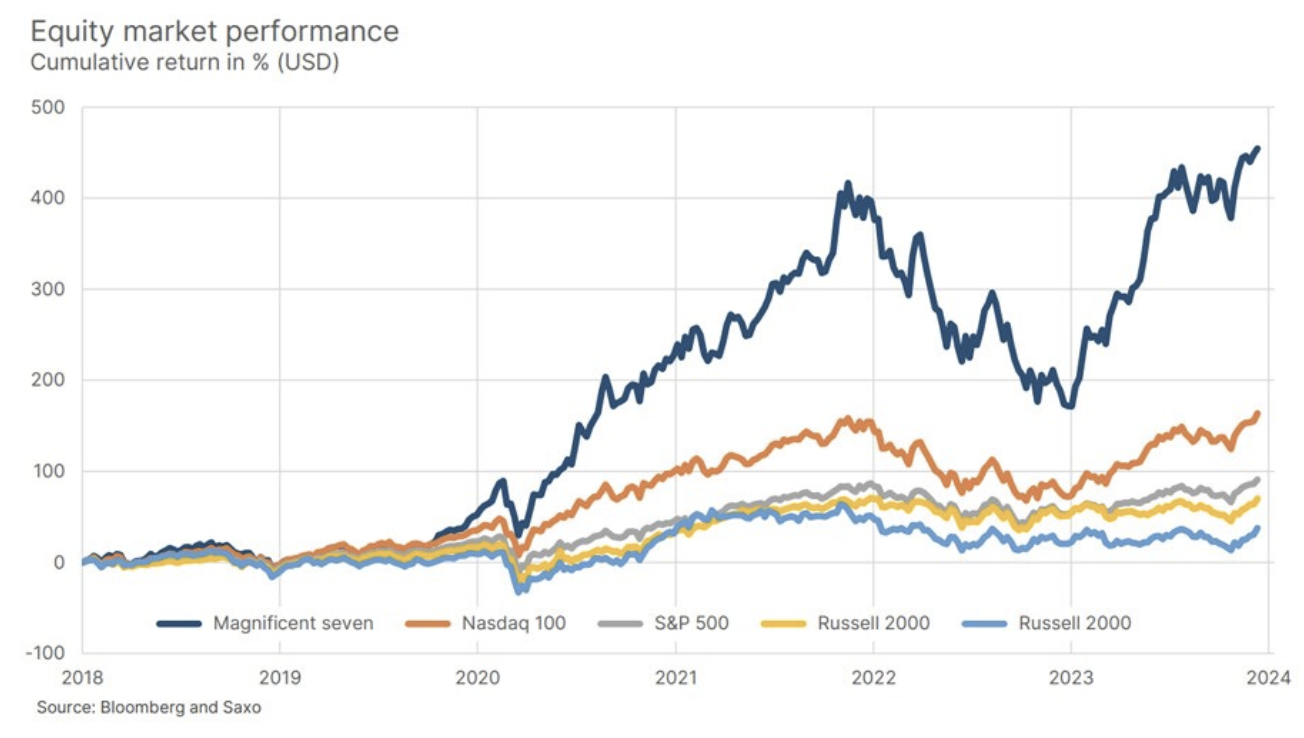

Last year will undoubtedly go down in history as a year of market extremes. The so-called "Magnificent Seven" (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla) are up 104% over the year as of December 15, 2023, as the buzz around generative AI goes into hyperdrive. For comparison, Nasdaq 100, S & P 500 and S&P 500 Equal Weight gained 53%, 25% and 12%, respectively. The Russell 2000 Index declined year-to-date through the end of October 2023 before the market aggressively repriced central bank interest rates for 2024.

As a result, the US stock market is at or near its most concentrated level in the last 100 years. There is a terrifying truth behind this fact. The outperformance cannot be improved unless this small group of U.S. tech companies take over the entire economy and continue to perform well above growth expectations in 2024. High index concentration also makes the U.S. stock market riskier as returns are increasingly driven more by a narrow set of risk factors, one of which is sentiment towards technology stocks. Our key idea for 2024 is to underweight US large-cap companies.

We see value in UK and European shares

In the UK and European stock markets we find the exact opposite of the 'Magnificent Seven' with stock market valuations of 56% and a 28% discount to the US stock market. Since we do not expect US returns to be significantly better than those in Europe over the long term, we believe expected returns for UK and European stocks will be higher. So, if sentiment changes or economic activity slows, these two stock markets also offer greater exposure to defensive sectors.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-300x200.jpg?v=1715232642)

Leave a Response