Actions in 2022 - crossroads for globalization

2022 will go down in history as the year that brutally ended the unfettered globalization of 1980-2021 with the start of Russia's invasion of Ukraine, which made us realize that the world is galloping towards a new global order. The world is beginning to split into two value systems. Global supply chains and technologies will collapse into self-preservation closed systems. At the same time, developed countries are accelerating the pace of green transformation. It seems that all roads lead to inflation. We look back at 2022 from a geopolitical and stock market perspective.

Beginning of the end

The past year has been the most meaningful and crazy year of my 2007 year career at Saxo Bank. As a youngster, I was involved in stocks both in 2010 and during the global financial crisis, when almost everything that had been a chilling experience came to an end. Working at Saxo Bank in late 2014, despite the recession, I felt a surge of hope before things were thrown back into chaos with the eurozone crisis, culminating in Draghi's famous words about taking "all possible measures" that ultimately saved the project of a European currency area. In 20, the oil market crashed as the US dollar strengthened sharply and the Chinese economy sank to its lowest depth of economic activity since the global financial crisis, culminating in the G-2016 meeting in Shanghai in February 20, at in which global policymakers allegedly sealed the "Shanghai Accord" to weaken the USD; this theory was never confirmed, but after the G-XNUMX meeting the situation improved.

Then came 2017 and the lowest-ever volatility across all asset classes turned out to be a one-way street for them, to the point where we at Saxo Bank asked ourselves if the markets were dead for good and if they would ever come back. The volatility selling game has become the opium of the market, offering a "cheap" way to get high returns. However, in February 2018, the so-called "Volmageddon" when VIX index unexpectedly exploded from an average of 11 points in 2017 to over 50 during the trading session on February 6, 2018. The change was so sudden and abrupt that the popular exchange-traded fund XIV, based on short positions associated with volatility, was literally crushed and left a lasting scar on volatile markets. However, this was not the last surprise for investors in 2018. As the end of the year approached, the U.S. Federal Reserve misinterpreted the direction of the economy and market dynamics by raising its benchmark interest rate on December 19, 2018 in an environment of low liquidity, which caused chaos in equity markets. As a result, in early 2019, President Powell was forced to admit a mistake in monetary policy, which showed that it is the market, not the Fed, that dictates the policy of the central bank.

2019 was marked by easing monetary policy as the global economy cooled down and did not turn out to be particularly interesting. The boredom was quickly over, however, as 2020 began with rumors circulating that a virus had emerged in China that eventually turned into a global pandemic. Countries imposed lockdowns, central banks cut interest rates to zero, and governments unleashed fiscal stimulus on a scale not seen since the years following the end of World War II. The fastest pace of vaccine development so far has been around four years. This was the picture of the political decision-makers at the beginning of 2020, and therefore, in retrospect, the scale of the implemented stimulus made sense. In November 2020, mRNA-based vaccines were introduced, breaking all previous records in vaccine work, thanks to which the world opened up much faster than anticipated.

In 2021, bottlenecks became apparent in all areas of the economy and there were many signs of inflation to come. Most economists and central bankers argued that the phenomenon was temporary because supply curves are flexible and will expand to respond to increased demand. Our team has been arguing since December 2020 that inflation will be structural and will remain high for much longer. This is the moment when I felt the greatest pride in my work for Saxo Bank. Our inflation projections turned out to be absolutely correct and we stood by our view even though the consensus strongly favored the temporary nature of inflation. In December 2021 Federal Reserve admitted that inflation turned out to be more persistent than expected, and the Biden administration made it a priority for the US central bank to bring inflation under control. In addition to the aforementioned events, I also experienced several flash crashes, Brexit, the annexation of Crimea by Russia, the presidency of Trump and his trade war with China, and the liberalization of the franc against the euro by the Swiss National Bank.

As you can see, I thought I had experienced all possible phenomena. However, the world is bound up with fat tails of distributions, which means that new crazy phenomena are constantly popping up. 2022 began with warnings from Washington that Russia is deploying troops on the border with Ukraine and information about Putin's true intentions. Everyone ignored these reports, especially Europe, with Germany at the forefront. Although in retrospect it turned out that the Trump administration was right about a number of geopolitical problems, it managed to lose the trust of the Old Continent. On February 24, 2022, Russia launched a full-scale invasion of Ukraine, triggering a great war once again on the European continent. It was the biggest victory for US intelligence agencies since the September 11 attacks took them by surprise and Europe was finally woken from its slumber. Ukrainians showed courage on an unprecedented scale, fighting for their freedom, and maybe even for the freedom of all democratic countries, so during the Christmas Eve supper with my family and New Year's Eve dinner with a friend, the Ukrainian people will be present both in my toasts and in my thoughts.

2022 deserves a much longer description because it will go down in history as the year in which limitless globalization, which began in the early 80s with the launch of market reforms in China, changed forever and the world began to move towards a bipolar balance of power, with the US and Europe on one side and China and Russia on the other. It will also be remembered as the year that inflation returned and we awoke from a long dream that the only significant driving force was the digital world. The physical world is back – and with a bang.

Geopolitical risk will begin to dominate

The above introduction was long but necessary to understand 2022 in its proper context. We are at a crossroads. It is increasingly clear that two value systems are emerging in the world, and each country will most likely have to decide which side it wants to take. Everything will be based on self-sufficiency, that is, making economies less dependent on countries that do not belong to the same value system for energy, metals and agricultural products. Therefore, over time, Europe will become completely independent of Russia and become more involved in Africa, which will lead to competition for resources with China. India is the largest country trying to take a neutral stance on the new world order, taking advantage of the fact that the United States and Europe are moving part of their production there from China.

Globalization was a unique period in modern history because it was dominated by capital and trade flows with limited state intervention. As national security issues now become more important and global supply chains are adjusted to the bipolar balance of power, governments will begin to play a greater role in the economy. This has already happened in the past. Governments will decide on the allocation of capital and the selection of supported technologies, including in energy and semiconductors. This is most clearly seen in the American CHIPS Act passed this year, which is the instrument of the most extensive industrial policy of the United States since the end of World War II. It aims to reduce the dependence of developed countries on Taiwan, as the issue of statehood of this country is becoming the greatest potential risk to the global economy.

All roads lead to higher inflation and thus higher interest rates. The market just doesn't want to see it yet, which will lead to a huge surprise among investors in 2023. The bipolar balance of power in the world will kill the hitherto unstoppable concept just-in-time ("just in time"), creating more buffers and more fragmented supply chains to increase resilience; this will contribute to an increase in inflation. The green transition in the context of war in Europe, lack of energy and metal supplies will make the creation of a greener society much more expensive in the short term, and beyond a certain limit, renewable energy sources will involve significant costs; this will contribute to an increase in inflation. Climate change will disrupt food production at an accelerating rate; this will contribute to an increase in inflation. Mining companies still do not generate much return on invested capital and therefore we need much higher prices for metals so that exploration and supply in this sector can develop to the extent that we aspire to; this will contribute to an increase in inflation. Workers struggling to survive after a blow to their real wealth and income will accelerate wage growth; this will contribute to an increase in inflation. This list is not exhaustive.

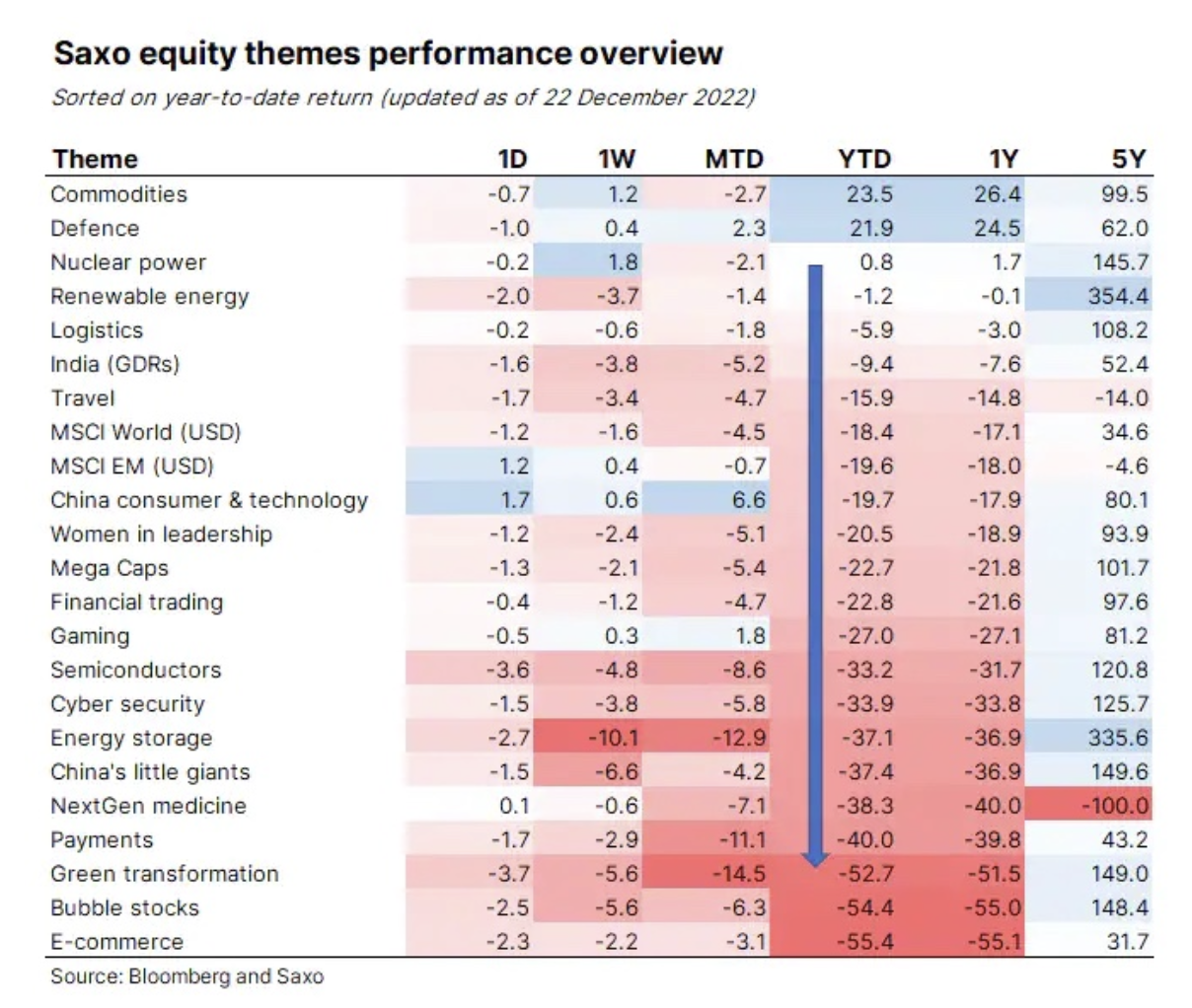

Seismic changes in the world are also reflected in our thematic baskets. Commodity and defense stocks are by far the best performers so far; as of today, they have gone up by 24% and 22%, respectively. Our energy mixes, such as renewables and nuclear, have done relatively well compared to the general stock market. Logistics and India baskets have benefited from the alignment of global supply chains. The worst performers are three thematic areas that have been hit hardest by the physical reopening of the economy after the pandemic, the shock of interest rate hikes and the energy crisis where higher electricity prices have limited the scale of the green transition, the most visible manifestation of which is the fall in demand for cars electricity during the year.

Can US stocks stay ahead as the physical world returns?

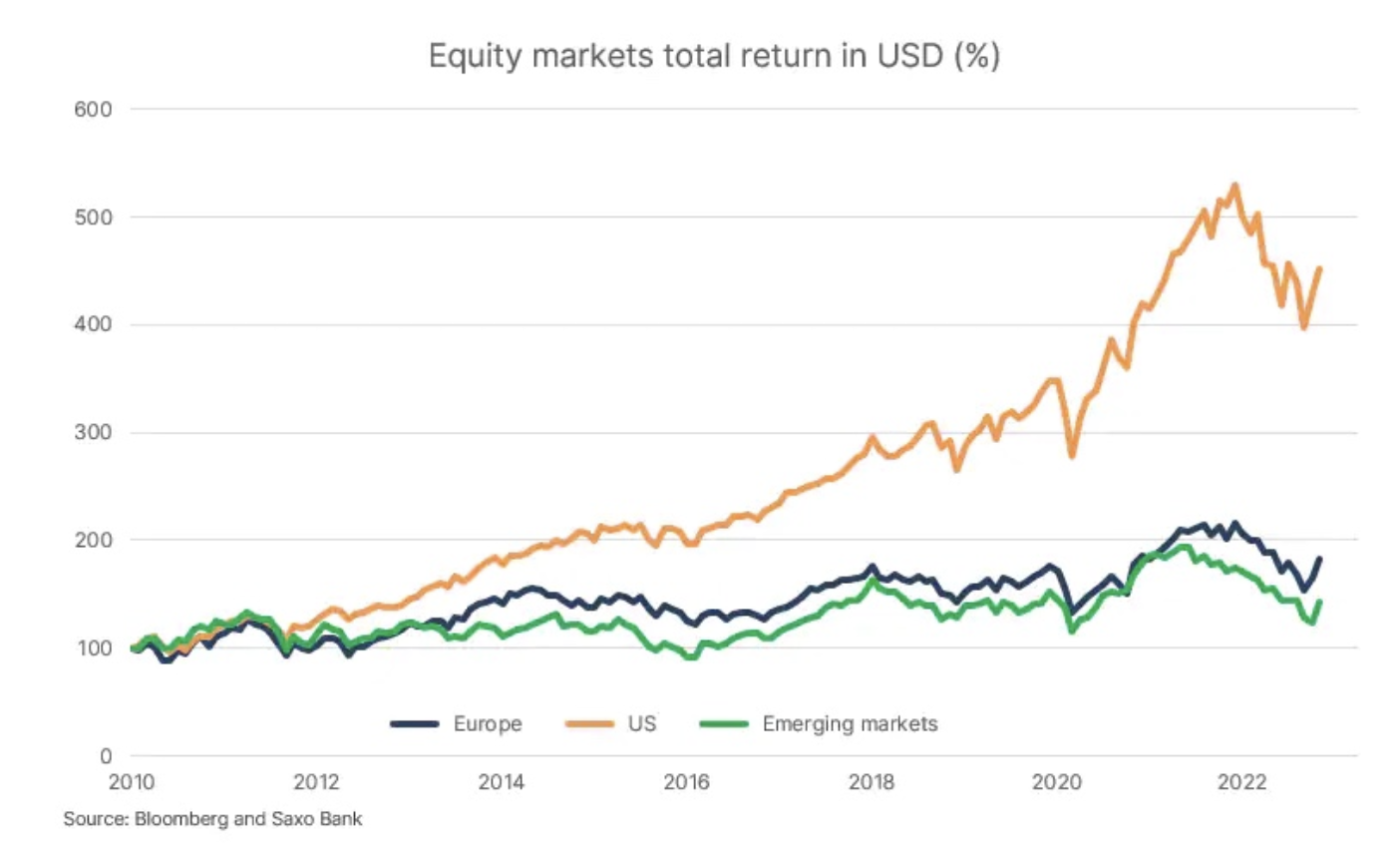

The final stage of globalization was characterized by the development of digitization, which resulted in the emergence of large American companies taking advantage of all the benefits of globalization. This allowed US stock prices to rise, leaving European companies far behind in dollar terms. Chinese stocks have been able to keep pace thanks to the booming tech sector, but their market power has become a political issue in China. Antitrust and anticompetitive laws emerged with the sole purpose of crushing Chinese tech giants under the slogan common prosperity. With increasing centralization and state control in China, shared prosperity will not prove beneficial for shareholders, so we are cautious about Chinese equities in the long term until market reforms return.

The bigger question is: can Europe catch up with the US? Due to the long-term weakening of the dollar and the development of the physical world, we believe that European equities will become increasingly attractive. Europe's goal of doubling defense spending and becoming more assertive in general under the new world order will foster economic growth in the future as energy constraints will be resolved over time. Emerging markets excluding China should also do well given the supercycle in commodity markets and the weakness of the dollar.

Will energy continue to be the most powerful risk-reducing asset during inflation?

For years, investors have been debating which assets would provide hedge against inflation should it return. Real estate and inflation-backed bonds were exchanged, but it turned out that the real hedge against inflation was energy, followed by the broadly understood commodity sector. Everything we do and our entire society is built on energy. Our long journey to endless wealth growth is based on energy. I highly recommend a book by Richard Rhodes called Energy: A Human History ("Energy: Human History"). It is a fascinating journey into the history of energy and technologies that allow you to obtain more and more of it.

With society moving towards electrification in all its aspects, made possible by advances in battery technology, energy will continue to play a key role and bring huge returns to shareholders. In the short term, oil and natural gas will maintain their position as strategic assets, and the ESG movement (focusing on environmental, social responsibility and corporate governance issues) has led to a mispricing that can benefit investors not subject to ESG constraints. In the longer term, hydrogen, fuel cells, renewables, nuclear and fusion energy will become dominant and profitable.

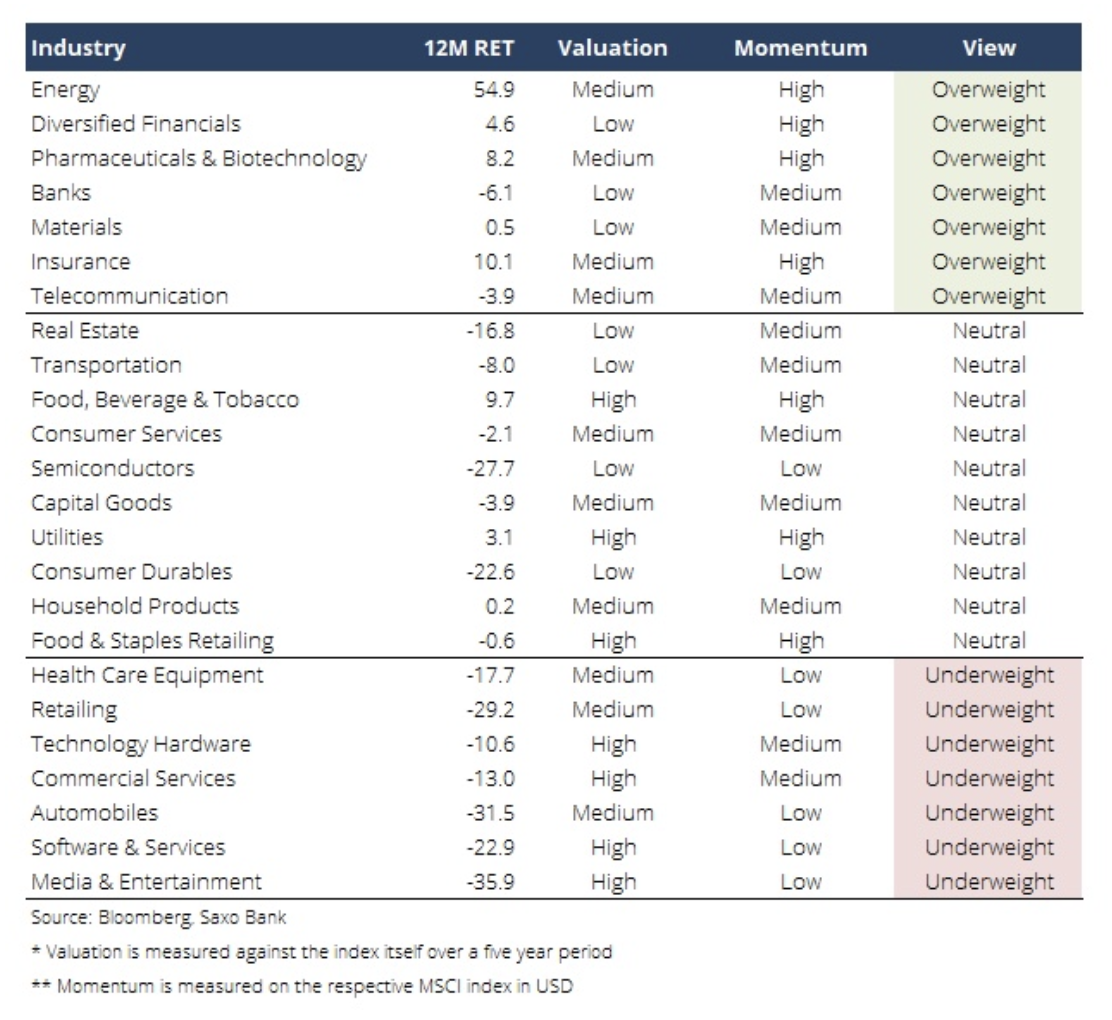

In 2023, the energy sector will remain a key investment area, and structurally higher inflation and interest rate levels in the next business cycle will provide ideal support for the financial sector. Mining companies will also remain a key investment area, while the technology sector has not yet completed the process of adapting to the new conditions. In other words, the underlying concept for investors is a greater balance of intangible and tangible stocks in the portfolio.

Companies with high quality and margins are best able to cope with inflation

As inflation will continue to be the theme in 2023 and wage pressures will begin to dominate the current dynamics, companies will struggle to maintain their operating margins next year. In the current environment, companies that are small, highly leveraged and have a high share of employees as a production input will face the greatest pressure. As we wrote recently, companies with the lowest operating margins in their industries will be most exposed to inflation pressure. During inflation in the 70s and early 80s, Warren Buffett learned that companies with high margins, strong brands, or competing technologies are more likely to survive inflation. This lesson is the same for today's investors, and we hope our clients take this into account when managing their portfolios in 2023.

It was certainly the longest stock market analysis I have ever written. However, this year deserves a well-considered comment because 2022 will undoubtedly be one of those years that we will look back on and say that was when the world changed. As Vladimir Lenin once said:

"There are decades where nothing happens and days where decades pass."

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)