Asia will not make it through the energy crisis with a dry foot

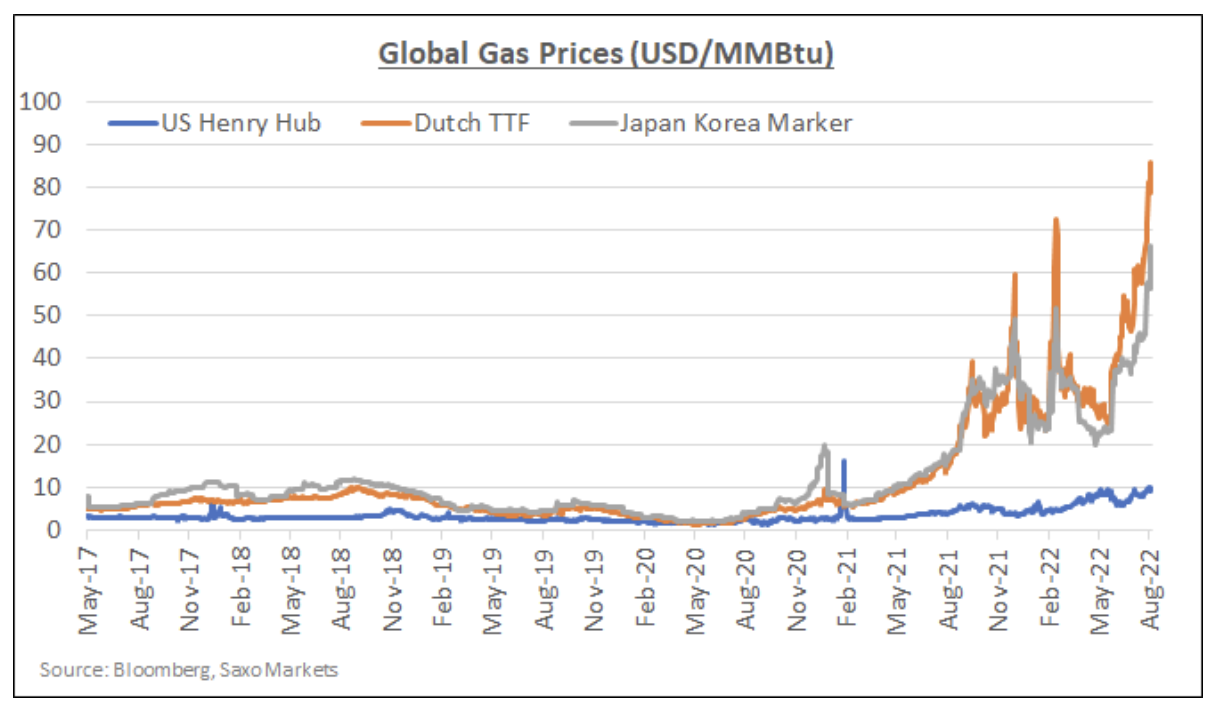

Asia has been struggling with rising energy prices for some time. Now it will face further challenges to secure its supplies as the bidding wars with Europe gather pace. Japan, China and South Korea are the largest regional importers of liquefied natural gas, the prices of which in Asia soared to record levels, following the increase in prices of this raw material in Europe. The energy shortage in China and the return to nuclear energy in Japan are the first heralds of what may lie ahead in the coming winter.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Energy prices and its supply

Despite less dependence on energy supplies from Russia, Asia will not be spared the winter energy crisis. This is due to the greater dependence on the import of this raw material, which has so far been felt in the form of higher fuel prices, which increased the level of core inflation in the region. This has hit emerging and frontier markets such as Sri Lanka, Bangladesh and Pakistan, which have been pushed to the brink of bankruptcy.

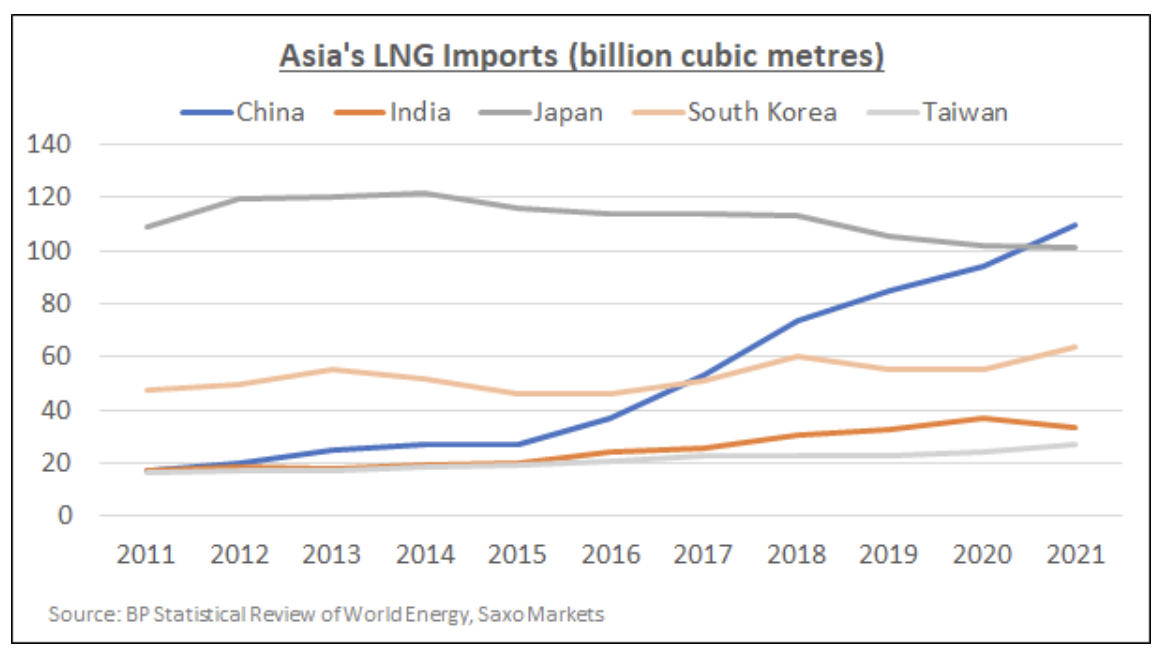

Another, even more serious threat in Asia is energy shortages, which increase the risk of power cuts, production downtime, weaker demand, energy rationing, exhaustion of foreign exchange reserves and market instability. The scarcity of gas supplies from Russia in Europe shifts the demand for liquefied natural gas, which in turn dictates global spot prices for this raw material. Asia is losing LNG loads to Europe in a bidding war, and gas imports to Asia are expected to decline further by the end of the year. Asian countries most exposed to the global shortage of energy resources are Japan, China and South Korea. International Energy Agency (IEA), which predicted Asian economies would account for almost half of global gas consumption by 2025, expects liquefied natural gas to play a key role in meeting Asia's growing gas demand.

Bidding wars for liquefied natural gas: Asia vs. Europe

Asian LNG spot prices for the summer period of 2022, they are at the highest historical level, about 7 times higher than the average price in 2017-2021. India and China recorded some of the largest declines in LNG imports, mainly in the spot market. LNG imports to China in the first six months of 2022 fell by more than 20%, while Indian LNG imports on the spot market fell by around 14% compared to last year. Japan and South Korea also record decreasing LNG imports. Global exports only increased by just over 10 million tonnes to 234,83 million in the first seven months, despite efforts by LNG producers to maximize production and minimize downtime.

Strategic changes on the horizon

Europe has to some extent prepared for the energy crisis and its consequences, but emerging markets are probably just getting ready for a shock. Sources say the level of inventories natural gas in Europe, it has reached nearly 80% of its storage capacity. In Poland, LNG terminals have been launched, and other countries, such as Germany, are also planning them. On the other hand, even if Europe survives the energy crisis, the same cannot be said with certainty for weaker emerging markets.

Significant reduction in demand it may be the only way out of the crisis in Europe and Asia. Several provinces and cities in China have already announced energy efficiency plans in 2022 to prepare for the risk of a supply disruption in the peak of the summer months, and Chinese Prime Minister Li Keqiang has repeatedly called for maximizing domestic coal production and energy supply from all possible levels. sources.

In the medium to long term, the shortage of energy supplies will pose a serious threat to the fundamental drivers of the development of emerging markets, as it may slow down the urbanization process and improve living standards. Therefore, an increase in expenditure on investments in LNG infrastructure, especially in China, which still relies heavily on this raw material to counter potential threats. As for Japan, the country's new strategic energy plan until 2030 foresees a decline in the share of LNG in the energy mix to 20% by 2030 from the current level of 37%.

Means, that Asia will also be moving towards diversifying its energy sources for conventional ones, such as coal, and renewable ones, such as solar, hydro, wind, hydrogen and others. Japan's return to nuclear energy is the first step towards further actions of this type in the region.

You have to see: The real estate bubble in China is bursting

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)