Bad news is bad news? What spooked the markets? Can oil rise?

The third week of the New Year is behind us, in which it can be said that something has potentially changed in the markets. The first two weeks left no more doubts about the behavior of the markets: we have rapidly falling inflation, falling commodity prices, the opening of the Chinese economy, a quick pivot of the Fed and a "soft landing" in the US economy. Nevertheless in the third week it turned out that "bad news is bad news" – that is, weaker data (bad news) ceased to be good news for the markets. Even if such a change was temporary, the "chance" for a repeat of such a market reaction with subsequent poor macro data in the coming weeks/months will be greater.

Until now, markets have generally treated bad news from the economy as good news for the markets, because it meant a faster change in the monetary policy of the US central bank, the so-called. pivot (i.e. faster rate cuts). And the best strategy in the stock market for the past 14 years has been to buy stocks whenever there is an economic downturn and falling inflation - which sooner or later meant a dovish reaction from the Fed and "automatic" increases in stock prices.

Will it be so this time? This is what those investors who play under the “FED pivot” are counting on. But whether FED Will he be willing to repeat this approach this time? The first "small test" on February 1 - when we will see the FED in action. Some investors repeat like a mantra: don't look at what the Fed says, but at what it does...

Bad news is bad news? What are the markets afraid of?

Last week we had the first "unusual" reaction of the US stock markets to the bad news coming from the economy in some time. Unusual, because so far bad news meant faster interest rate cuts by the FED, which is good news for the stock markets. On Wednesday and Thursday, the S&P 500 fell by a combined 2,31% after poor retail sales and industrial production data in December 2022. We can also add to this data the US PPI inflation, which fell well below expectations. Of course, recent falling inflation is good news for markets, but falling inflation is normally associated with a slowing economy – and a slowing economy is bad news.

The data was indeed weak (including downward revisions for November) and was able to push down the forecast of GDP growth in Q4 2022 according to the GDPNow Atlanta FED model from 4,1% to 3,5%. However, on Friday, US stocks rebounded strongly, negating to some extent the bad news from the previous days, but still ending the week with a drop of -0,66% on the S&P500 index. The chart below shows the S&P500 with a selection of "good" and "bad data" for the past week.

Of course, it's only one/two days of declines S & P500 and it does not have to mean a change in the market regime (to "bad news is bad news"), and possibly the upcoming correction of the increases in the upward wave started in October 2022 may simply turn out to be mild anyway. Nevertheless, such market behavior after weaker macro data is already a "crack on the glass". This rare "anomaly" can also be seen in the different behavior of bonds and equities, which tend to rise and fall together in the current cycle. On Wednesday, as you can see in the chart below, bonds rose strongly (+0,91%), while equities fell more strongly (-1,56%). This is how these asset classes tend to behave during recessions.

W. 2 S & P500 i iShares US Treasury Bond ETF until January 19.01.2023, XNUMX. Source: own study, ishares.com

In the past week, Polish indices fell (except for small companies), and WIG20 dropped the most (-1,6%), while sWIG80 increased by +1,2%. Since the beginning of the year, the sWIG80 increased the most, by as much as 9,3%. However, since the lows of October 2022, the WIG20 has increased by 39,3%. The details are presented in the table below (the results are sorted by the last column, i.e. the rates of return in the passing 3rd week of the new year).

The chart below shows changes in Polish indices since the beginning of 2022.

If we compare the main Emerging Market markets and Europe (which benefits from the opening of the Chinese economy, especially Germany), China grew the most last week (+1,4%), which is already +14,9% since the beginning of the year. In second place this year is the MSCI Germany index with a score of +12,0%. Details are presented in the table below (results are sorted by the last column, i.e. returns in the past 3 weeks of the new year, returns in USD). India is weaker in the current growth wave (only +2,0% this year), which had great results in both 2020 and 2021 and a relatively small decline in 2022 (a classic "return to the average", markets that fell less in 2022, they also reflect less in 2023).

The chart below presents changes in selected indices of Emerging Markets countries since the beginning of 2022.

W.4 Indexes MSCI China, India, Korea and Poland until January 20.01.2023, XNUMX. Source: own study, isahres.com

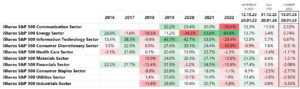

Looking at the main US indices, the S&P500 fell -0,65% last week and is now 3,5% up in 2023 (details of the rates of return on the respective ETFs are presented in the table below). Nasdaq100 fared much better last week, growing +0,67% and is already +6,2% since the beginning of the year. If in the past week "bad news" from the economy turned out to be "bad news" for the markets, it is not surprising that small companies (S&P Small-Cap) fell the most, because it is small companies that will first feel the slowing US economy.

If we look at the main stock sectors, the Communication sector increased the most in the past week +2,32%, which is already +11,3% since the beginning of the year. The cyclical industrial sector (Industrials) performed the worst in the past week, confirming the market's fears of an economic slowdown ("bad news is bad news"). The Energy sector performed well, "confirming" rising oil prices and further growing Chinese companies (under the opening of the Chinese economy).

What will the Fed do? Will it go its own way or the one indicated by the market?

While the FED likes falling inflation, it certainly doesn't like the market's valuation of the rate at which inflation is expected to fall. According to the market, already in Q4 2023 inflation will fall to 2,5% in the USA. The market is also pricing in two rate cuts (25 basis points each) in 2023. Why don't the Feds like these market valuations? Because these are only market valuations and in a few weeks they may be completely different. The Fed cannot yet be sure that inflation has already been defeated.

The market is not so sure either, but this is how it is priced today. Unlike the market, the Fed cannot "change its mind" every few weeks and "price up" the path of interest rate cuts differently. So why does the Fed not like market valuations of rapidly falling inflation and rapid interest rate cuts? Because they "unscrew" interest rate hikes. In other words, higher stock prices, bond prices, a weaker dollar, and tighter credit spreads mean softer financial conditions, which work in the opposite direction to tightening monetary policy by the Fed. The softer the financial conditions, the harder it is to beat inflation. The FED may be afraid, and is right, that too fast interest rate cuts may, as in the 70s, lead to a return of inflation (and another cycle of interest rate increases even to higher levels).

Some well-known investors express the opinion that the main goal of the head of the FED J. Powell is to eradicate “FED put options” from the market. That is, for the market to stop thinking that in the event of a decline in stocks, the FED will step in and stop the decline by easing monetary policy. Powell could theoretically do just that in this cycle of interest rate hikes. But this requires showing "claws", and hawkish rhetoric alone is not enough. Many times we hear opinions that It's not what the Fed says but what it does.

The next test of whether the FED may be more hawkish will take place on February 1 (decision on another interest rate hike). But when we look at the 30-day Fed Funds Futures contracts - this the market expects an increase of 1 percentage points on February 0,25 with a probability of 97,2%, i.e. according to the market, there is only a 2,8% chance of an increase of 0,50 percentage points. The Fed has three main tools to be more hawkish: raise rates higher, keep rates high longer, or shrink its balance sheet by selling bonds it has bought in previous years.

So could the FED surprise the market and, for example, raise rates by 50 basis points? It seems very unlikely, but looking at the statements of the members FOMC certainly the probability is more evenly distributed (and not as extreme as the market estimates). So let's check the last statements of FOMC (Federal Open Market Committee) members in the past week:

- Tom Barkin is not in favor of withdrawing from increases too early and the target rate will depend on the path of inflation and believes that rates must continue to rise as long as inflation remains elevated,

- Patrick Harker reiterated his support for 25 bp hikes and noted that the time for higher interest rate hikes is over, expects the FED to raise rates "a few more times" this year,

- Esther George stated that markets may have a different view of what the Fed should do

- Loretta Master She said the Fed's key rate should rise "a bit" above the 5%-5,25% range. She did not comment on her preference for the February meeting but noted that the economy and markets were able to cope with a 50 basis point hike in December,

- James Bullard said that his point forecast for 2023 is 5,25-5,50%, which is slightly above the Fed median of 5,1%, and that the current policy of the Fed is not quite restrictive yet, and that the rate must be above 5 %. Bullard added that the Fed should act as soon as possible to break the 5% level and then react to incoming data, noting that he prefers a 50 bp hike at the next meeting (against the 25 bp consensus),

- Lael Brainard said she expects a 25 basis point hike in February, and that the Fed had already lowered the pace of rate hikes in December to wait for more data, and that that logic still applies today,

- SuzanneCollins reaffirmed her view that interest rates need to rise probably just above 5%, and then the Fed needs to keep them there for a while. She said it was appropriate to slow down the rate hikes, especially in the current case where the risks are now more bilateral,

- John Williams did not comment on the scale of the hike at the next meeting, but pointed out that destination, not speed, is the key issue in interest rate hikes, and added that the Fed still has plenty of room to shrink its balance sheet,

- Christopher Waller is in favor of a 25bp hike at the February meeting. He wants to see the (inflation) data for six months, not just three, and only then could the Fed end the hikes (pause). He noted that based on the latest economic forecasts from the Fed, interest rates will probably go up by 75 bps.

As you can see from the above list, the fate of the hike on February 1 is not as clear as the market estimates. Moreover, it is worth noting that we have not learned the opinion of J. Powell, who has by far the greatest influence on the FOMC decisions. I've even come across an opinion that if someone wants to analyze the Fed's message, they should look at 75% of what Powell says, 24% of what The Wall Street Journal journalist Nick Timiraos (commonly regarded as an informal spokesman for the Fed) says ), and all other people are only 1%. Following Timiraos on his Twitter account, you can see that he "confirms" a hike of only 25 basis points at the FOMC meeting on February 1 this year.

We will have to wait until February 1 for the FED's decisions, and from January 21 the period of banning communication of FOMC members with the market begins (the so-called trading and external communication blackout).

The market may be overly optimistic about the future path of the Fed's interest rate (even if the Fed raises only 25bps now), and if the FED turns out to be really hawkish in this cycle - sooner or later it will be reflected in lower stock and bond prices.

Can oil rise sharply under the opening of the Chinese economy?

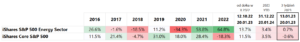

In general, the energy sector (also generally raw materials) has provided investors with very high rates of return in recent years. For example, just look at the iShares S&P500 Energy Sector ETF - for example, the rates of return in 2021 and 2022.

The main fundamental factor behind the increases in oil prices, for example, is the very low level of investment in oil exploration and production vs what would be needed to meet the ever-increasing demand. The years 2020 and 2021 highlighted this problem even more, when the CAPEX of the sector fell by about 35% and 23% versus 2019. Lower CAPEX only for OPEC+ countries (i.e. OPEC countries plus Russia) could reduce today's production capacity by about 3,7 million barrels per day (source: estimates recently provided by the UAE Minister of Energy - United Arab Emirates).

Added to this, of course, is the war in Ukraine and the East-West conflict in general. So, you may ask, why did the oil price fall from over $120 in June 2022 to around $71 (WTI oil) in early 2023 and now around $81? Because overall, in the shorter term, concerns about a global economic slowdown and recession matter more.

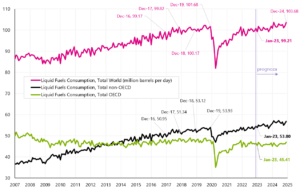

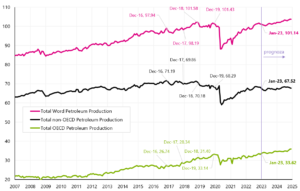

In 2023, additional demand for oil from the Chinese economy should also be added to the bill (the famous opening of this economy), but the consensus says that demand from China will increase around 400-500 thousand tonnes. barrels per day (increase vs. 2022). To put this into perspective, global oil consumption (or demand) is currently around 99,21 million barrels a day – and supply (or production) is around 101,14 million barrels a day.

V.6 Global oil demand in million barrels per day, including the forecast until December 2024. Source: own study, EIA

W.7 Global oil supply (production) in million barrels per day, including the forecast until December 2024. Source: own study, EIA

If in Q2 the Chinese economy will have the strongest quarterly growth this year - then, of course, this may translate into increases in oil prices. But if the global economy, including the US, were to enter recession later in 2023, then the global decline in demand may easily outweigh the additional demand from Chinaor even a possible rebuilding of strategic oil stocks in the US (this is also an additional demand). For example, global demand for oil fell in 2020 (during the pandemic) by about 20 million barrels a day (around 20%), in 2008-2009 by about 5 million barrels a day (a decrease of 5,6%), and during the recession in 2001 million barrels in 2002-3 (decrease by 3,4%).

Too in the short term, the price of oil may fluctuate depending on how the global balance of oil demand changes, but the next cycle of expansion (e.g. after going through a slowdown/recession and starting another cycle of interest rate cuts by central banks) could result in significant increases in raw material prices, because there will be insufficient supply (with strongly growing demand) due to the underinvestment of the entire industry. Then the price of oil may rise to new heights, similarly to other commodities and the Energy sector in general.

Summation

Last week, US stocks fell slightly, but during the week (Wednesday and Thursday) we had 2 days of declines mainly due to bad macro information from the economy (retail sales, industrial production). In other words, "bad news is bad news." Today, it looks more like a "crack on the glass", but if the markets were to react in this way to possible bad macro data in the coming months, it would be a significant change in the market regime. Markets could fear a recession rather than “enjoy” the bad data that herald faster interest rate cuts by the FED.

The FED may play a very important role at this point in the cycle. Will he really be hawkish and leave his feet at high levels for a long time? This is what FOMC representatives say, but the market claims that it is a bluff (we know this by looking at market valuations of the future path of the FED rate, and it is also confirmed by rising share and bond prices).

The next opportunity for the FED to show its "hawkish nature" is February 1 this year. (another FOMC meeting and another rate hike).

About the Author

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)