Bank of Japan: What to Expect on October 28?

After the last Japanese intervention, which coincided with the previous meeting of the Bank of Japan in September, the market is eagerly awaiting the next meeting of the central bank scheduled for next week. There is a tug of war between currency traders expecting no change in Bank of Japan policy and bond investors who continue to test the patience of the central bank. However, the Bank of Japan's election is facilitated by expectations regarding the Fed's aggressive peak policy.

Pressure on the Japanese yen

Pressure on the Japanese yen persists despite official government intervention in September and continued verbal interventions. USD / JPY exchange rate it exceeded 1990 for the first time since August 150 and is on track to close the gap to the maximum (160) of April 1990.

Although there is still talk of a real possibility of intervention, the authorities refrain from marking their presence in the markets given the limited impact of their actions. Market participants would likely have an additional incentive to further undermine the value of the yen should it be confirmed that the intervention of the Bank of Japan is not having particular results.

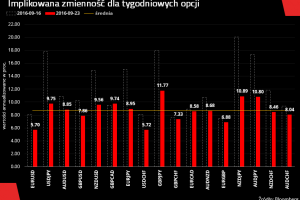

With the forthcoming October 28th meeting of the Bank of Japan and the meeting FOMC in the following week - November 2 - we should expect an intensification of fears related to the intervention. Not only the USD / JPY rate, but also the rates EUR / JPY and GBP / JPY are above levels where the previous yen intervention took place on September 22 (last Japanese central bank meeting). From that date, the only currency against which the yen is stronger is the AUD. We have already discussed methods for playing out intervention expectations on the USD / JPY pair or other yen pairs.

Pressure on Japanese bonds

Meanwhile, bond investors continue to test the Bank of Japan's commitment to yield curve control policies and hedge themselves by positioning on the short side in Japanese Treasury Bonds (JGBs). Ten-year swap rates - a key tool for international funds to voice their opinion on Japanese yields - are more than 30 basis points above the Bank of Japan's ten-year yield ceiling of 0,25%, reaching an eight-year high. Central bank officials are fighting "speculative" attacks on Japanese bond markets and rising ten-year bond yields above the 0,25% limit by carrying out a series of unscheduled asset purchases.

September CPI growth to 3,0% y / y in base terms was the highest in over 30 years and further gains can be expected until the end of the year and the weak yen continues to put pressure on import prices; Mobile phone charges will also go up. These factors will also increase pressure on the Bank of Japan to follow the global wave of policy tightening, but will still be seen as driven by energy prices.

The Bank of Japan faces a major challenge

If the Japanese central bank wants to stop the depreciation of the yen, it will have to adjust its yield curve control policy e.g. by increasing the profitability target or by expanding the range of allowable fluctuations. Any such decision would in fact be seen as a shift towards aggressive policy or a rate hike and would create chaos not only in the Japanese bond market but also worldwide as yields could see new strong gains. Even a suggestion of a policy review could dramatically increase expectations regarding a change in the Bank of Japan's policy and lead to a dynamic strengthening of the Japanese yen.

However, if the Japanese central bank continues to pursue its yield curve control policy and support the bond market, the next level to watch for USD / JPY will be 153, but there will still be potentially more room for maneuver in terms of growth as long as the Fed continues cycle of rate hikes. This may be accompanied by large-scale interventions that could lower the USD / JPY and other yen pairs by 2 to 5 points, but this move is likely to eventually be nullified.

In summary, in the conflict between the integrity of the yield curve control policy and the yen, any of these factors will have to be written off. It should be emphasized that the pressure will build up until the meeting of the Bank of Japan on October 27-28, and expectations assume that the current policy will be maintained.

The peak of the Fed's aggressive policy

Changing the Bank of Japan's policy on yield curve control sounds complicated. It would mean a significantly higher Japanese debt servicing cost and thus fiscal pressure - similar to the UK situation, but on a much larger scale. Japanese households will face significant stress - for around two-thirds of Japanese mortgage loans, interest rates are floating and loan installments can rise sharply.

The fate of the yen will therefore remain in the hands of Prime Minister Kishida aware that large expenses will be necessary, which will severely undermine the currency reserves. The authorities suggest that the weak yen can be turned into a tool for its own benefit, but they declare support for 10 companies, relocating production back into the country, and emphasis on attracting foreign tourists.

The only option therefore seems to be the status quo and waiting for the peak of the Fed's hawkish policy. With US 4,25-year government bond yields above XNUMX%, room for maneuver for further growth becomes quite limited. Assuming the peak of aggressive Fed policy will be in QXNUMX or the beginning of QXNUMX, the pressure on the JGB and the Japanese yen will ease and the Bank of Japan will simply have to wait out the current situation.

More Saxo analyzes are available here.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)