The Chandler Brothers - the "forgotten" masters of value investing

As a rule, texts about outstanding investors apply to those who have made a fortune only through investing in the stock market. However, history knows cases of such investors who have diversified their portfolio into multiple asset classes. An example is the New Zealand brothers Chandler, who in 20 years from the amount of $ 10 million "They made money" $ 5 billion. During this period, they achieved an astronomical average annual rate of return of 36%. This is more than the rate achieved by such outstanding investors as Warren Buffett, Peter Lynch, Stanley Druckenmiller or George Soros. The Chandler brothers are not very famous because they did not make a lot of appearances in the media. Until 2006, they only gave one interview to the Institutional Investor. Interestingly, a staggering rate of return thanks to good trading in the developing country market. They invested, among others on the Brazilian, Czech or Russian market.

Childhood and early career

As mentioned earlier, the Chandler brothers didn't start from scratch. Richard and Christopher are the sons of a World War II veteran, who ran, among others, beekeeping business with the climber and polar explorer Edmund Hillary. The brothers grew up in the small town of Matangi near Hamilton in the northern part of the "North Island". Richard and Christoper's father, Robert Chandler, founded a store called "Chandler House" in 1972. Parents hired their sons in the store. They helped their father with accounting, while mother educated the children about appropriate purchases for the store. It was then that Richard and Christoper learned valuable lessons about: "Never buy something if you don't know who you can sell it to"and “Buy as many goods as possible that sell very well". After graduating from college, they took over the family business, which they introduced on a different scale. In 1986, they sold the family's assets for $ 10 million. The brothers decided that the amount was raised they will spend on what they like, which is investing. The funds were used to open the Sovereign Global Fund, which they ran for 20 years. Their investing style was suited to their own temperament. For this reason, their strategy was geared towards investing against the market sentiment. At the same time, the brothers were very confident in their choices when investing. This was evidenced by a very concentrated investment portfolio.

Asian investment opportunity

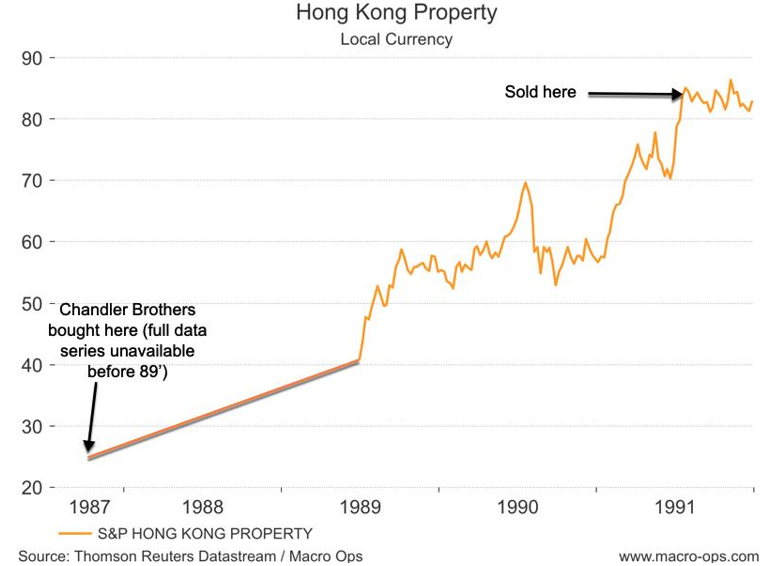

In 1987, the brothers placed all their property in four offices in Hong Kong. The mood in the Hong Kong real estate market was dire in the 80s. Prices have dropped by more than 1981% since the 70 peak. The reason was investors' fear that the United Kingdom would have to hand over Hong Kong to the People's Republic of China. Many investors feared that the "communists" would try to hamper the investment climate in the region. For this reason, real estate in this region was for many Western investors "Non-investable".

However, the brothers disagreed. They began to research the subject thoroughly. They found the current prices to be a great investment opportunity. They were of the opinion that the transfer of this area to the People's Republic of China would not have any negative effects. The reason was that the PRC committed to keeping Hong Kong separate for 50 years. At the same time, the rates of return on renting buildings were 5 percentage points higher than the cost of financing the purchase of real estate. Due to this situation, the investment risk was minimal when the positive scenario materialized. However, the potential profit is very large. The Chandler brothers used debt financing to complete the transaction. In 1987, they acquired the 27,6-story D'Aguilar Place for $ 22 million.

D'Aguilar Street in Hong Kong, 2016. Source: wikipedia.org

At the same time, a significant renovation was carried out, which allowed for a significant increase in rent over the next few years. Rents in this building increased threefold. As a result, there was a surplus of cash, which allowed the purchase of more real estate. After a few years, the fear of "communists entering" the special region was gone. As a result, capital rushed back into Hong Kong, driving property prices up. In 1991, the Chandler brothers sold a real estate portfolio for $ 110 million. After paying off their debt, they had $ 40 million in equity. This meant that assets under management grew by 300% in just 4 years.

Source: macro-ops.com

The Chandler brothers also had a sizeable investment portfolio of Hong Kong equities. The reason was that they also wanted exposure to real estate companies which accounted for a significant portion Hang Seng index. However, on Friday, October 16, 1987, due to falling prices, the Chandler brothers were forced to close the position. The reason was the use of significant financial leverage which made losses on equity much higher. By closing the position, the fund avoided even greater losses in the following days as the downward trend continued. After the experience in 1987, the brothers significantly reduced leverage. This allowed Richard and Christofer to have a much longer investment horizon than high-leverage investors. Richard Chandler, after the events of 1987, mentioned that:

"If you are lucky once, do not use the grace of fate again".

Investment in Latino markets

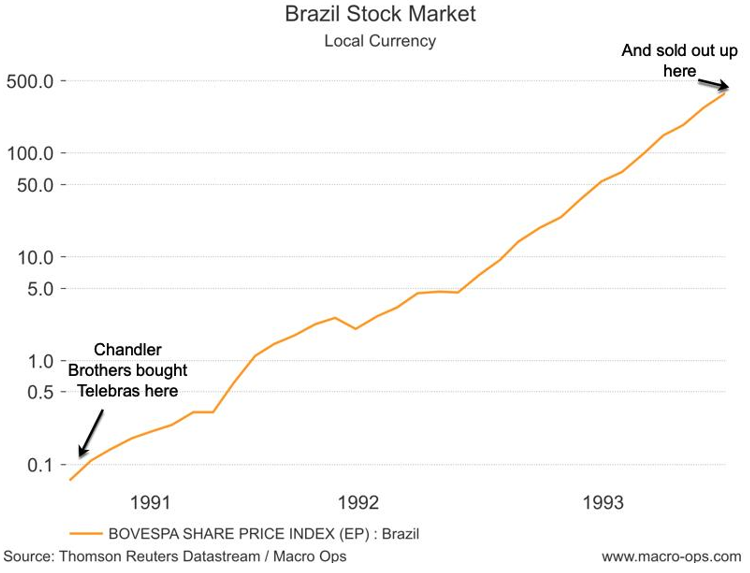

After selling its assets in Hong Kong, the fund decided to change the area of investment. The brothers mentioned at that time that "The fax machine will be more and more popular nowadays". As a result, they decided that the telecommunications sector was an interesting place to invest funds. After a long period of searching, the fund found an interesting company - the Brazilian Telebras. During this period, Brazil was in a very difficult macroeconomic situation. Hyperinflation and problems with economic growth made the Brazilian stock market disliked by foreign investors for many investors. Due to hyperinflation, traditional corporate valuation ratios such as price to earnings (P / E) were useless. The brothers decided to look for comparative measures. They focused on the relationship of capitalization to underlying telecommunications lines. As a monopolist on the Brazilian market, Telebras did not have to fear competition, and therefore could benefit from the monopoly bonus. According to the brothers' calculations, Telebras was traded on the market at $ 200 per access line. By comparison, a Mexican company operating in the same industry traded at $ 2000 per access line. It is worth mentioning that the cost of installing the baseline in Brazil was $ 1600. However, not only the attractive valuation was the reason for investing in the shares of this company. Political changes in Brazil were also a very important factor. According to the Chandler brothers, the administration of President Fernando Collor de Mello will be forced to liberalize the economy and open the country to foreign investment.

After receiving approval from the Brazilian government Sovereign Global Fund was one of the first foreign investors to obtain approval for investment in Brazil. The tactic of investment concentration has made itself felt again. The brothers allocated 75% of their assets, or $ 30 million, to the purchase of Telebras shares. In addition, they also acquired shares in the energy company Electrobras. It was a step against the tide, most investors were very skeptical about investing in such a politically and economically unstable country.

Brazilian stock prices rose sharply following the introduction of budget austerity to combat the budget deficit and to allow foreign investors to invest. In effect the main indices of the Brazilian market tripled their value. However, the enthusiasm did not last. After just a few months, in April 1991, the president was dismissed (impeachment was applied) due to a corruption scandal. The rise in political tensions made Brazilian stocks dove. Many stocks fell by more than 8% over the next 60 months. The decline did not scare the Chandler brothers. Thanks to a 1987 lesson, the wallet was not leveraged. At this point, they were able to look at the company's prospects from a long-term perspective. By 1993, the market recovered from the bear market and continued its dynamic growth. Investments in shares of Brazilian companies increased assets under management to $ 150 million. This meant that the return on investment was 400%.

Source: macro-ops

Meanwhile, the Chandler brothers were speculating in the bond markets of countries such as Argentina or Venezuela. In the years 1991–1994, the fund was looking for opportunities also outside Latin America, an example is the transaction on Nigeria bonds.

Direction - "East"

After selling Latin American assets, the fund began investing in other developing countries. Eastern Europe, South Korea and Russia aroused interest. The investment policy was similar, the brothers looked around and bought discounted assets that few wanted to buy. An example was the purchase of the Czech monopoly on the energy market - CEZ. In 1994, most "Western" financial institutions and individual investors did not have direct access to such an under-liquid market. After acquiring CEZ shares, the brothers managed to implement the GDR program (global depositary receipt). And through the GDRs, the Chandler brothers managed to come out with a modest return on investment in the Czech monopoly.

However, the investment in the Czech Republic was in fact a struggle against serious investments in the most important post-Soviet market - Russia. By the end of 1994, the fund managed to acquire a significant portion of the shares in leading Russian companies that were privatized at that time. The Chandler brothers owned, among others:

- 4% of shares in the largest energy company in Russia - Unified Energy Systems (UES),

- 11% of shares in the Moscow electricity distributor - Mosenergo,

- 5% of shares in the most important subsidiaries of Yukos Oil,

- 15% of shares in the largest Russian steel producer - Novolipetsk Metallurgical Kombinat (NLMK),

- unspecified share in Gazprom.

At that time, the fund managed by the brothers was one of the largest foreign investors in Russia.

NLMK. Source: wikipedia.org

In 1996, Sovereign sold its stake in Yukos and increased its stake in NLMK to 25%. Together with another fund (Sputnik), they held a total of 50% of shares in the company. The brothers began court battles with Sputnik over the appointment of their directors. Investors were of the opinion that NLMK sells steel below market prices to exporting agents. This resulted in profits being siphoned off the company to the detriment of shareholders. However, when the court battles began, Sputnik sold his shares, which put Sovereign in a more difficult position. Nevertheless, in 1999, the brothers sold the shares more expensive than Sputnik.

However, the fund generated great profits from the sale of Mosenergo and UES, as the shares were sold around the 1997 peak (before the Russian crisis). Thanks to these two investments, the brothers achieved over 400% profit. The value of the packages sold was $ 1 billion.

The funds were invested in Gazprom, as a result, the brothers owned about 5% of the gas giant. However, the slump in the market and poor financial results caused the stock price to decline all the time. As a result, the loss on investment was several dozen percent. After the experience with NLMK, the fund started looking for places where money was "leaking" from the company. The problem was the close relationship between Gazprom and Itera. According to the Chandler brothers, Gazprom was selling gas to Itery well below market prices. As a result, minority shareholders were robbed by the directors of Gazprom. At the same time, Gazprom granted very cheap loans to Itery, which meant that the management of the gas producer's assets was at a very low level. The changes came only after Vladimir Putin came to power in Russia, who placed his trusted man - Alexei Miller in this company. As a result, the process of selling the price below the market was stopped. The brothers sold their shares in Gazprom between 2002 and 2003, earning a modest 12,5% on the transaction.

A return to Asia

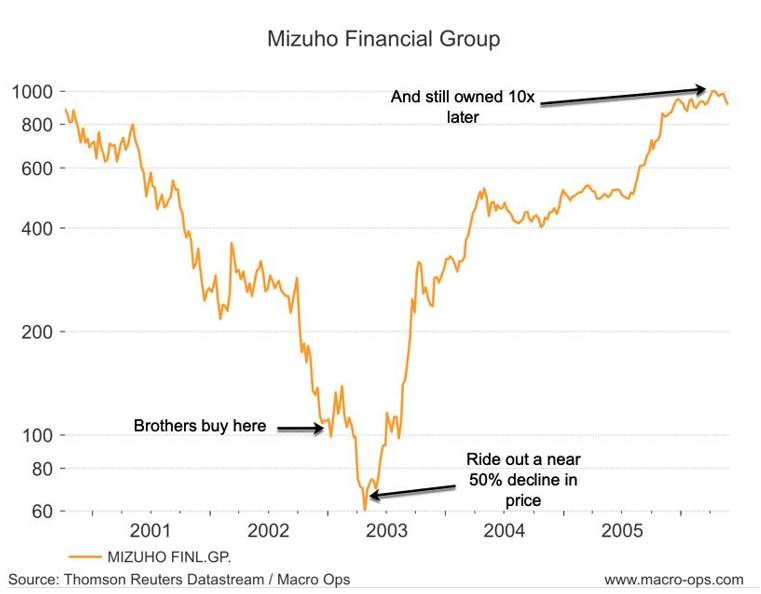

Sometimes the fund also invested in developed markets. However, the reason for the investment was the same - buy overpriced stocks during very low market sentiment. One example is the investment in Japanese financial institutions in the early XNUMXs.

Japan after the bubble burst in the stock and real estate markets, it found itself in a 10-year period of low inflation and economic stagnation. This translated into the stock market. In November 2002, the Nikkei 225 index fell 78% from its 1989 peak. The difficult economic situation left Japanese banks literally stuffed with bad debts. A large percentage of the loans went to "zombie companies", ie companies that were heavily indebted and operated thanks to an environment of low interest rates. The depicted image seemed dull, but the Chandler brothers saw quite a market opportunity. As a result, they started buying shares of companies from the financial sector, which were listed on the Tokyo Stock Exchange. The portfolio includes companies such as UFJ Holdings, Mizuho Financial Group, Sumitomo Mitsui Banking Corp and Mitsubishi Tokyo Financial Group.

As was the case when investing in Brazilian companies, non-standard metrics were the investment criteria. One of the main measures was market cap as a percentage of assets. Japanese financial institutions had a rate of around 3%, while Citigroup had a rate of 15%.

After the asset purchase was made, the market continued southwards. However, thanks to safe investing (no leverage), the fund survived a worse period on the stock exchange. The shares were sold in 2006, when there was a "small boom" in the Japanese market. Some of the profits have been spectacular. For example, the fund earned 900% over three years on the shares of Mizuho Financial Group. Richard mentioned in an interview in 2006 that there are different beliefs behind the fund's success than most managers do: “Most managers focus on what can go wrong, rather than what can go wrong. We act differently.

Transactions with Japanese financial institutions are a typical use of a sentence "Be greedy when others are afraid, be afraid when others are greedy". It is also worth adding that the Chandler brothers were not looking "New Microsoft". They preferred to invest in large enterprises in stable countries (even if they were emerging markets). Thanks to this, companies of this type were on the radar of many financial institutions, it is the fulfillment of their mother's advice (always buy goods for which you are able to find a buyer). At the same time, the fund managed by the brothers was not involved in building a broadly diversified portfolio. Instead, they focused on selecting the "best of the best" companies and built a concentrated portfolio of stocks.

No fear in relations with states

The Chandler brothers were famous for their courageous moves to protect their property in foreign markets. For this reason, they have fought many legal battles with the governments of developing countries. One of the most "difficult" countries to cooperate was Russia. However, the brothers managed to be quite successful in this market. For example, they forced the employment of the first independent director in the state giant - Gazprom. In addition, they fought, among others with corruption practices in South Korean companies. However, the brothers considered themselves to be investing in value, and not as investors - activists (activists, as a rule, force changes in the management board or a change in the company's strategy).

Lessons from the Chandler Brothers' Stories

When you look at the transactions made by a mutual fund managed by the brothers, you can see that in order to achieve long-term high results, you need to invest based on a thorough understanding of the company's business operations and portfolio concentration.

Thanks to the concentration of the portfolio, a few investments were enough to generate most of the profits. In 20 years only 5 investments accounted for 90% of the fund's profits (including Mizuho, UFH Holdings, Unified Energy Systems, Mosenergo). This means that the brothers had to be very confident in their investment choices. The story of the Chandler brothers confirms that the lack of diversification does not forgive mistakes, an example is the story with Gazprom, which almost ended in a catastrophe for the wallet. For this reason, a concentrated portfolio requires a very careful selection of investment ideas.

Another lesson from the fund's history is the influence of time. The biggest investment opportunities don't happen very often. For this reason, the key is not to waste too much money in the "in-between" big investments. An investor using this type of strategy must be patient and not try to force "big opportunities".

It is also worth highlighting being contrarian to the marketplace. Thanks to their long-term view, the brothers were able to use the periods of deep slump to take advantage of "market promotions". As a result, asymmetric investment opportunities appeared. The asymmetry was due to the fact that the risk of failure was much lower than the fulfillment of a positive or neutral scenario. According to the supporters of this theory, the market always misjudges listed companies. Either he is too optimistic or too pessimistic about his long-term forecasts. Many times the positive attitude of the analysts "pushed" the forecast much higher than it was common sense. On the other hand, in times of market bear market, the market has always been too skeptical about a significant part of listed companies.

Another lesson learned from this story is the need to be creative. The Chandler brothers often rejected “standard metrics” and created “creative metrics”. This was the case with investing in Brazilian or Japanese companies. Alternative indicators help to screen out “average” investment ideas from exceptional opportunities.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)