The clock is (again) ticking for Italy - 5 possible scenarios

Since 1945, Italy has been headed by 69 governments, changing on average every 1,11 years. This is a real European record. Today Prime Minister Mario Draghi will inform parliament whether he will resign. This would mean the necessity to hold early elections within 70 days - most likely in September. This decision, however, is far from certain. Keep in mind that predicting the outcome of the Italian government crisis has never been easy.

About the Author

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank. He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to the report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank. He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to the report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

There are at least five possible scenarios:

- Draghi remains in office with an unchanged majority. It seems unlikely, however, as it would mean a significant turnaround of the Five Star Movement led by Giuseppe Conte - the largest political party in the coalition (104 of the 630 total members of the Chamber of Deputies and 61 of the 315 senators total). The party created the current crisis by refusing to support Draghi's government in a key vote;

- Draghi manages to establish a new government with a changed majority. However, this is a difficult task as there is no real alternative to the Five Star Movement;

- Draghi is demanding irrevocable resignations without putting it to a vote in parliament. It is unlikely at this stage;

- Under pressure from Italy's President Sergio Mattarelli and several political parties (including Matteo Renzi's Italia Viva party), Draghi agrees to stay in office a little longer to avoid a political crisis. He heads the technocratic government until general elections in 2023 (the "surveillance" government). This could be a compromise solution for the Italian political class and it would certainly be the best scenario for the euro area to avoid holiday confusion;

- Draghi fails to form a new government or refuses to run a transition and provisional government until the next elections. Early elections are held within 70 days (probably in September). Recent polls indicate that the Five Star Movement would be crushed and receive under 12% support. The main winner would be Giorgia Meloni's party - the Italian Brothers. In the last general election in 2018, it obtained only 4,8% of the votes (37 deputies and 21 senators in the current term of office). It is currently the most popular political party in the country with support of around 22,5%. If its members stick together, Italy could be ruled by a center-right coalition led by Meloni. This would be very bad news for the euro area at its worst possible moment in history (lower economic growth in the future, risk of fragmentation in financial markets, low market turnover and risk of an energy crisis in the coming winter). The tightening of monetary policy is already putting a lot of pressure on the financial system: liquidity is deteriorating, and volatility, market makers' constraints and unsuccessful settlements are all record high. If we add the traditional Italian political crisis to this, we get the worst summer cocktail in history. Whether or not this happens, Italian bond yields are expected to rise faster. However, this does not mean that European Central Bank (ECB) it will intervene automatically. First of all, there is a problem with the timing in the context of some technical issues. The ECB is likely to mention counteracting fragmentation on Thursday, but its tool as such is probably not ready yet. The central bank will de facto stall until September. In addition, the ECB is unlikely to intervene anyway, as the increase in spreads is primarily due to political uncertainty rather than 'unjustified' policy tightening.

In our opinion, there is no certainty that there will be complementary elections. Predicting the outcome of the Italian government crisis has never been easy. This should be approached with humility. In most cases, our forecasts turn out to be wrong. Earlier this year, President Mattarella did not want to run for a new term. Market analysts (myself included) expected a new political crisis. Eventually, he was persuaded to remain in office after no successor could be found. This time it could certainly be similar. Draghi he could stay in office a little longer to avoid chaos (scenario 4). What is certain is that Draghi's project of national unity has failed. Political instability continues to be the norm in Italy.

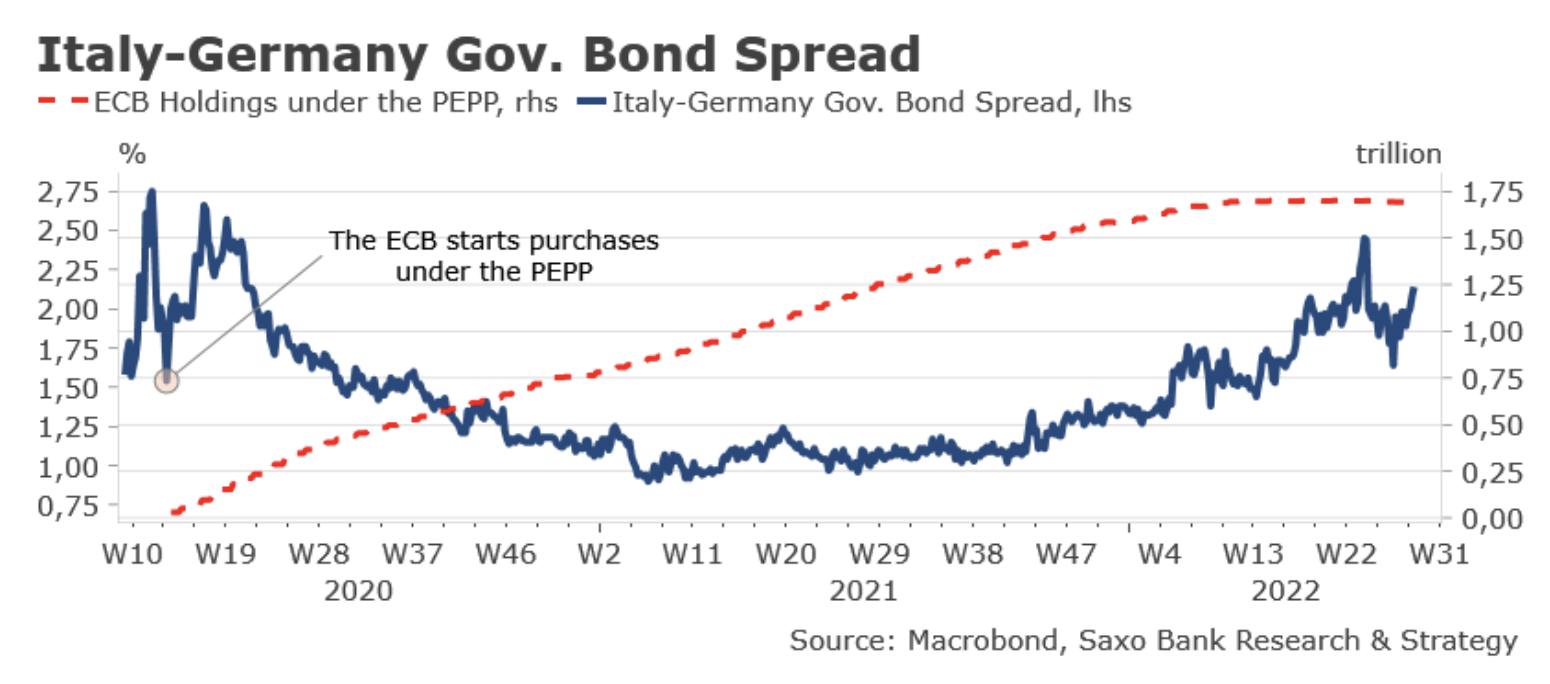

The spread of Italian and German government bonds has increased significantly since the return of the ECB stance in February, when the central bank admitted that inflation is not temporary and requires a policy change (tightening). However, the current spread is still much lower than at the start of the Covid pandemic. When ECB President Christine Lagarde pointed out that the central bank "does not exist to close the spreads", the spread on Italian and German government bonds was 266 basis points. This difference is currently around 200 basis points. It is not yet a risk zone. However, we are definitely getting closer to it.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)