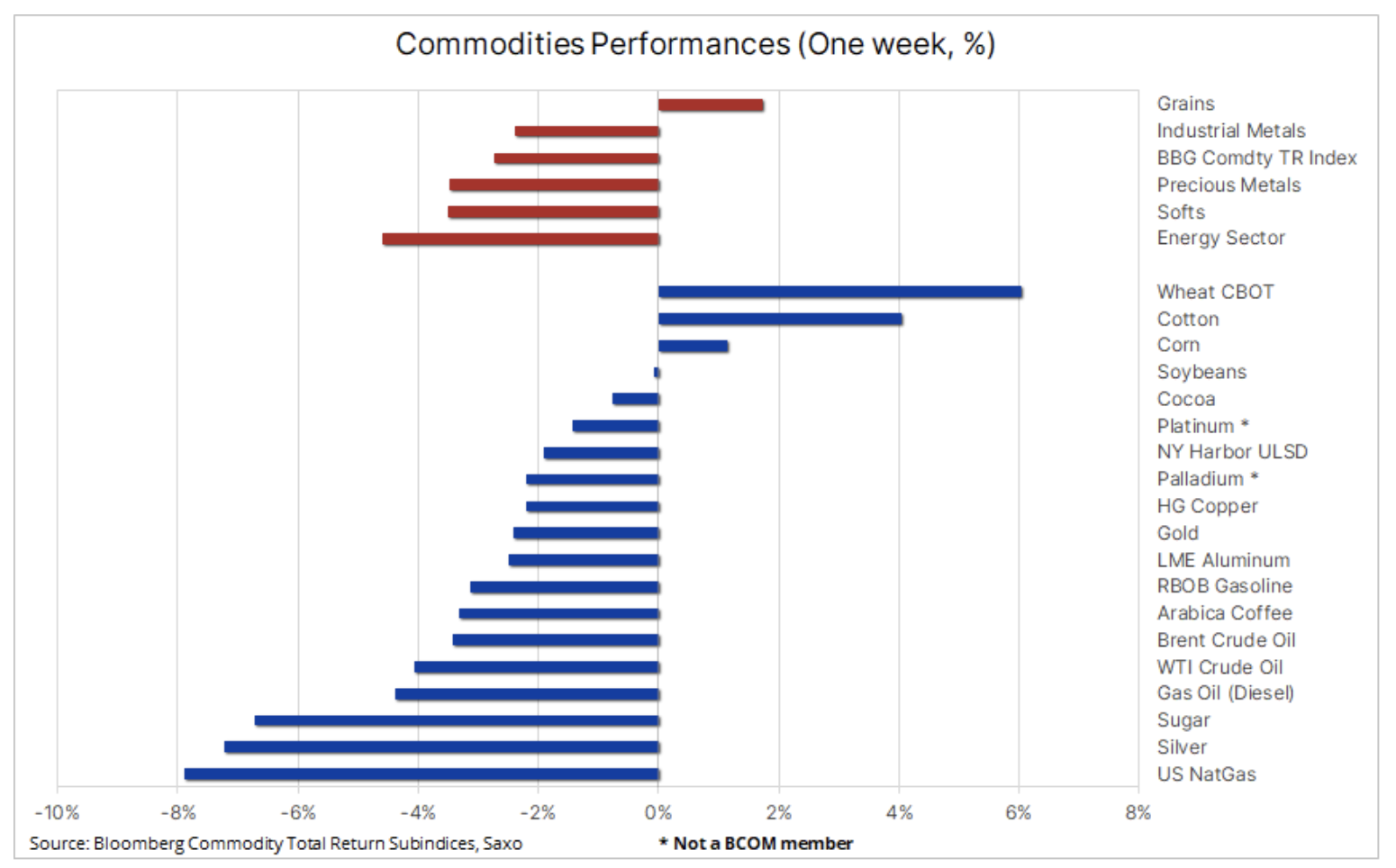

Widespread commodity weakness amid growth concerns

During the first week of December, weakness spread across all major commodity sectors, with grain being the most notable exception. The Bloomberg Commodity Index, tracking 24 major commodity futures in the energy, metals and agriculture sectors, was headed for a 2,7% loss for the week, driven by demand-driven energy and industrial metals sectors on persistent concerns about the near-term direction of the global economy : especially in China, where data continues to show weakness, and in the US, where the prospect of a soft landing continues to gain ground.

These concerns caused the index to post a year-over-year loss of around 8%, with the biggest culprit being US natural gas, which fell 2023% in 64 as a result of rising production and lower weather-related demand. The agricultural sector was mixed, with the recently strong soft goods sector seeing some profit-taking, led by a 7,5% decline in sugar, while grains headed for a second straight weekly gain, led by a strong wheat rally.

Precious metals suffered a setback after gold's dramatic and unsuccessful attempt to break through, badly affecting both buyers and sellers. Meanwhile, crude oil posted its longest streak of weekly losses since 2018, fueled by signs of weaker demand in China and growing doubts about the implementation of additional production cuts announced earlier this month. With producers struggling with growing budget deficits, the plan to support higher prices has backfired in recent months, hurting demand while leaving the door wide open to rising non-OPEC production.

The FOMC will meet for the last time this year on December 13, and although no changes in interest rates are expected, the meeting could cause high market volatility ahead of the quiet Christmas and New Year period. Markets are eyeing a 125 basis point rate cut by the end of next year as investors quickly declare the death of inflation. However, the FOMC's September scatter chart shows that policymakers only intend to cut rates twice next year, making the divergence between markets and the Federal Reserve's forecasts an explosive mix of volatility.

Wagon rally in Chicago, large purchases by China

Chicago wheat futures are headed for their biggest weekly gain since June, and the futures contract is on track to post its longest streak of gains since 1993. The reason for the nearly 7% rally from a three-year low is the extraordinary jump in Chinese demand for the US, caused by heavy rains destroying the harvest at the beginning of the year. The 1 million tonne purchase announced by the US Department of Agriculture last week was the largest order in a decade. The program is likely to continue, which will help offset some of the negative impact on prices following a strong production year in the Northern Hemisphere. However, pressure is on and net short positions held by speculators in the futures market are increasing. Additionally, Russian attacks on Ukrainian export facilities on the Danube have raised concerns about Ukraine's dependence on the river as a major grain export route after Russia withdrew in July from a UN-backed agreement that allowed shipments through Black Sea ports.

After rising from a low of $5,275, the March 2024 delivery contract has broken above the 200-day average and is trending down from the 2022 record high. However, it will likely encounter some resistance at $6,50, given the prospect of increased production in Australia and record Russian production.

Chinese copper demand remains strong despite economic fluctuations

In early December copper reached a five-month high of $3,933 a pound, fueled by supply concerns following the closure of a large mine in Panama, before correcting 5% to $3,73 a pound on profit-taking in response to a stronger dollar, weak Chinese production data and Moody's downgrading the Chinese government's credit rating outlook from stable to negative on concerns about China's fiscal, economic and institutional strength.

However, the weakness turned out to be short-lived. The physical market continues to send a signal of strong demand after November imports of China's unwrought copper and copper products, widely used in construction, transportation and energy, rose 10% from the previous month to the highest level in almost two years. Prices are strengthened by demand from green transition industries, leading to tighter inventories, and more recently by a stronger yuan, despite concerns about the broader global economic outlook through 2024.

Our structural long-term bullish view on copper has only been reinforced by recent changes in supply and demand, with the global copper market likely to see a deficit as early as next year, which could force prices to rise earlier than expected.

Premature FOMO surge poses a short-term challenge for gold

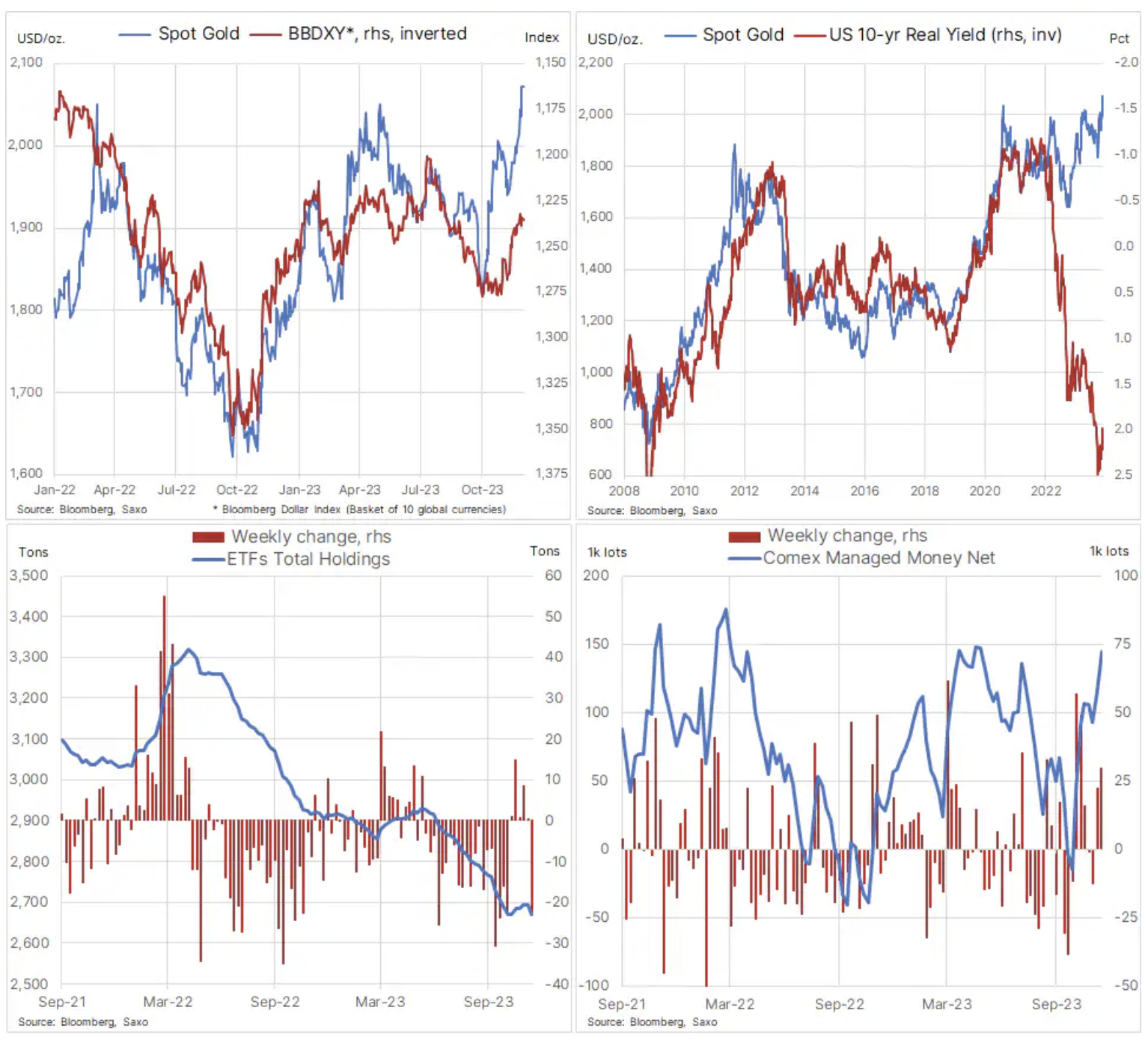

After closing last week at a record high of $2040, gold continued to rise last Monday, and short coverage and fear of missing out (FOMO) pushed the price briefly above $2135 before falling $125, driven in part by the realization that fundamentals were not yet sufficiently aligned.

Despite the latest setback, which did not significantly hurt the prospects for higher prices, gold has gained more than 11% this year and is on track for its best year - in dollar terms - since 2020, when it jumped by a quarter. The sharp decline in US bond yields amid signs of a weakening economic outlook and declining inflation increases the likelihood that the aggressive policy of raising interest rates we have seen over the past few years will be replaced by an equally aggressive cycle of cuts next year, currently amounting to five cuts of 25 basis points each.

We maintain a bullish outlook for gold through 2024 in the belief that interest rates have peaked and Fed Funds and real yields will begin to decline. However, with the market having already priced in much of the monetary easing, both silver and gold will continue to experience periods where beliefs may be questioned. It is also worth noting the continued lack of demand from ETF investors, especially asset managers, who remain on the sidelines and have actually sold out in the recent rally amid the wide gap between gold and real US yields, as well as the current high cost of carry, which is only going to come down when the Federal Reserve starts lowering interest rates.

The recent rally was mainly driven by hedge funds and other momentum traders, and it is worth remembering that speculators are not "married" to their positions and will adjust if the technical and/or fundamental outlook changes. For the Santa Claus rally to stay on track, gold needs to stay above $2000. If successful, we see the potential for this area to become a new floor from which gold can make new attempts to grow in 2024.

Oil price declines are easing amid threat of OPEC+ intervention

Oil prices are showing signs of stabilizing after a six-day decline that pushed WTI and Brent prices to six-month lows and near levels that previously helped trigger OPEC+ intervention through production cuts. The latest weakening was due to slowing demand, especially in China, which saw a 1,2 mb/d decline in crude oil imports in November, which, combined with lower margins and slower refinery rates, paints a picture of weakness for the world's largest importer. crude oil.

Moreover, some of the weakness was due to speculation that OPEC+ was running out of power to contain a new decline, especially after its November 30 meeting that highlighted an emerging rift within the group. Instead of taking decisive action to stem price weakness caused by lower demand, the group has opted for additional voluntary cuts that, if implemented, would amount to about 2,2 million barrels per day in the first quarter of next year. Reducing production while prices fall is a very painful process for producers, who must maximize production in the coming years before the shift away from fossil fuels finally begins to erode demand.

Some market stability emerged ahead of the monthly U.S. jobs report after Russia and Saudi Arabia provided verbal support to the market, underscoring continued efforts to stabilize global oil markets through active supply management. Risk of calling an extraordinary meeting OPEC + In the event of further price declines it also helped to strengthen the market.

Given the current prospects for further demand growth in 2024, albeit at a lower rate than in 2023, the risk of significantly lower prices seems unlikely. We expect Brent crude to trade mostly in the low $80s in the period ahead, with the biggest risks being non-compliance and concerns about OPEC+ unity. Upside potential is also limited by the risk of an economic slowdown in the US and China, as well as the continued focus on growing spare capacity, especially among producers in the Middle East, led by Saudi Arabia and the United Arab Emirates.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)