Commodities: Buyers return ahead of key quarter

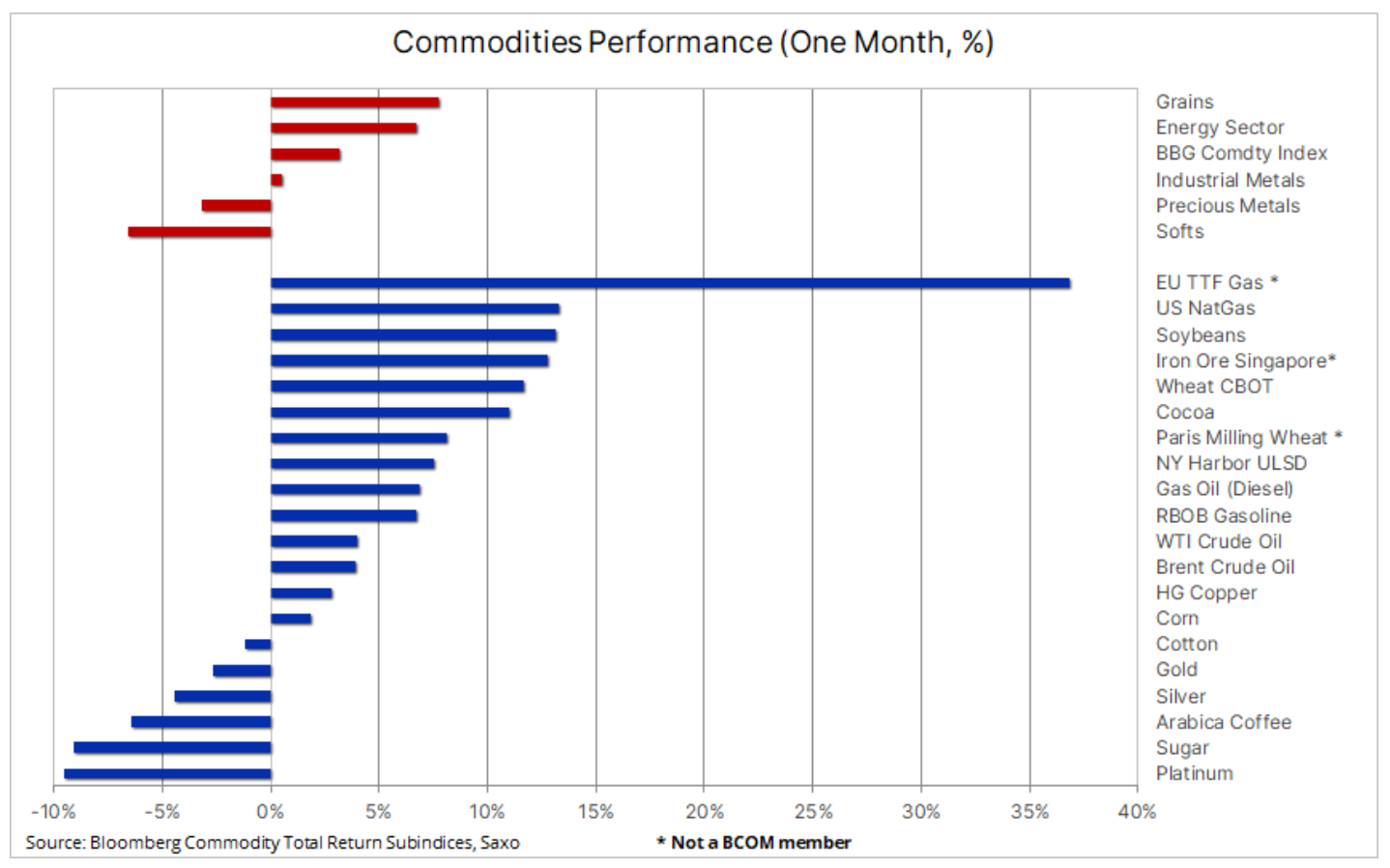

The commodity sector declined for the second week, but June was the first month to end in profit since November last year, mainly due to very strong increases in the first half of the month. The Bloomberg Commodity Total Return Index, which tracks the performance of 24 major commodity futures, including energy, metals and agricultural commodities, headed for a monthly gain of 3%, just below the MSCI World index. The gains were led by the grain sector, which at one point recorded a 20% increase before ending the month with a 7,5% gain, amid deteriorating crop conditions on the one hand and favorable rains on the other, taking into account the impact of speculation.

Energy gained 6,5% thanks to a 13% increase in US natural gas prices, while crude oil gained 3,5% in a well-established range with bottom support provided by OPEC production cuts and high demand concerns in the world's two largest economies. Natural gas prices in Europe, meanwhile, rose at the fastest pace since July last year due to uncertainties stemming from unscheduled supply interruptions, competition from Asia and a heatwave. The industrial metals sector posted a slight gain as copper prices rose after a month of ups and downs driven by news of additional economic stimulus in China. Precious metals posted another monthly loss as the prospect of higher US interest rates pushed up real yields across the curve. The agricultural products sector, led by sugar and coffee, also posted another monthly loss due to improving supply prospects.

Two main factors continue to drive most of the energy and metals price trends, both industrial and precious. The first is the impact on global economic growth of central banks' constant attempts to curb inflation by raising interest rates. The second factor is the situation in China, which is the world's largest consumer of raw materials. The slow economic recovery in the Middle Kingdom continues to puzzle the market, while raising speculation that the government will have to step in with additional support.

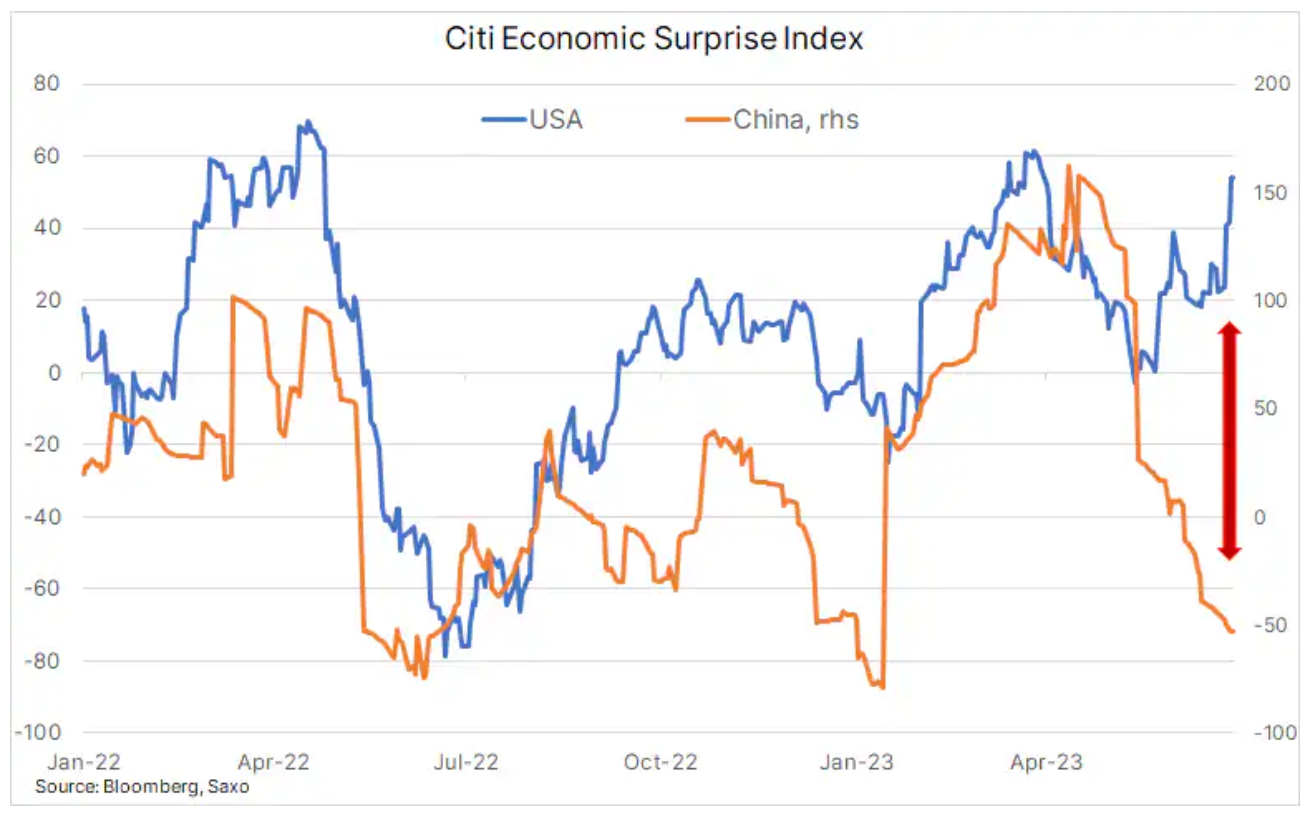

Over the last few months, the economic surprise index (Citi Economic Surprise Index) showed a sharp divergence between market expectations for US and Chinese economic data. US economic data surprised on the upside, with lower than expected jobless claims, indicating to the continuing good situation on the labor market. In addition, QXNUMX GDP was revised upwards due to higher consumer spending. These factors could force the FOMC to continue its rate hike cycle, potentially limiting growth and demand. The result is much higher bond yields, a stronger dollar and the market pricing in additional rate hikes before the end of the year. In China, meanwhile, the outlook for demand remains questionable due to a slow recovery and disappointing economic data.

The combination of these circumstances is a major driver of commodity prices, easing mid- to long-term price pressures in some cases and magnifying supply challenges for several key commodities. The third quarter is likely to provide answers to some of the questions, the most important of which is whether the Chinese government and central bank will make further attempts to support the economy. For now, China seems to be holding off on a decision, awaiting the Politburo meeting at the end of July.

Copper: results below expectations

Copper prices fell for the second week in a row, reaching the lowest level in more than four weeks. This was due to the fact that the optimistic economic data from the US and hawkish comments of several central bankers, led by Fed chairman Jerome Powell, reduced the appetite for risk. In addition to concerns about economic growth, there is also the issue that the various stimulus measures announced by the Chinese government and the People's Bank of China have so far failed to impress the market. The decline, which gained momentum after falling below the 200-day moving average currently at $3,8250 on the High Grade Futures, was mitigated by the continued decline in copper inventories monitored by major futures exchanges in London, New York and Shanghai. The seventh consecutive weekly drop ended at 242 tonnes, the lowest level since December last year.

Whether or not there is stimulus from China, we see a clear trend towards higher prices in the coming years as the issues of the green transition and its impact on several so-called green metals will continue to provide strong winds in the sails, especially for copper, the most optimal electrically conductive metal for the green transformation, which is used in batteries, electric traction motors, devices for generating renewable energy, energy storage and modernization of the grid. In the coming years, producers will face the challenges of lower grades of ore, rising production costs and a pre-pandemic lack of investment appetite as the emphasis on ESG has reduced the available pool of investments offered by banks and funds.

After falling below the 200-day moving average again, copper may enter a trading range pending further information on China's stimulus initiatives and overall risk appetite. The key support level is the May low of $3,545/lb.

Crude oil: a breakthrough quarter ahead

The quarter, which saw two significant production cuts by OPEC, did not hold back oil before extending a streak of quarterly losses amid an ongoing cycle of interest rate hikes leading to growth and demand concerns. Due to the slow economic recovery in China, the price of Brent is hovering in the sevens ahead, although OPEC, led by Saudi Arabia, are aiming to break above USD 80. For now, prices are in the $71,50 range between $78,50 and $XNUMX. Prices rose slightly on Thursday in response to better-than-expected U.S. economic data and a weekly inventory report showing a significant decline in crude oil inventories, while demand for gasoline and jet fuel remains consistently strong.

The coming quarter may be crucial for the oil market. It all depends on whether the optimistic forecasts of OPEC and the IEA regarding the increase in demand come true, or whether - which Saudi Arabia tried to prevent by imposing unilateral production cuts in July - we will see a slowdown in economic activity to the extent that prices fall further. It will be interesting to see how OPEC handles this situation. The Saudis, which have already cut production, giving up market share to support prices, are likely to put strong pressure on other producers to make similar cuts.

However, we believe that a recession in the US will be avoided and that China will step up its efforts to support the economy. However, it is not known whether this will be enough to support higher prices by tightening the market. In the current situation, macro funds again prefer to trade oil from a short-term perspective as a hedge against further economic weakness.

In the near term, OPEC will focus on supply management, keeping prices above $70 for now. An upward breakout seems unlikely if the economic outlook continues to deteriorate. From a technical point of view, the $80 Brent level will be a big resistance, and funds bent on further weakness are unlikely to change their negative stance until we see a return to the top XNUMX.

Gold: Bull versus bear fight

On Thursday at gold market We saw an impressive bull-and-bear fight after better-than-expected U.S. unemployment and GDP figures sent a sell-off below the key levels of $1900 in cash and $1910 in futures. Breaking the lowest level since March, however, saw buyers return, and after a battle for more than 6 million ounces in the August futures contract, the price rebounded to force a new round of short selling coverage. In the short term, the prospect of more interest rate hikes in the US coupled with rising real US bond yields around cyclical highs could be a challenge for gold.

In our view, the scenario of peak interest rates will be a factor that will trigger another increase in precious metals prices. With recent signals from the US Federal Reserve suggesting that the deadline has once again been postponed, market reaction in the coming weeks will continue to depend heavily on incoming data as any sign of economic weakness will weigh in on how the market prices the prospect of interest rate hikes.

For several reasons highlighted in the previous ones articles, despite the current situation, we maintain a positive long-term outlook for gold. At the moment, however, gold remains in a downtrend with a break above the trend line, and a 21-day moving average around $1940 would be required to turn things around.

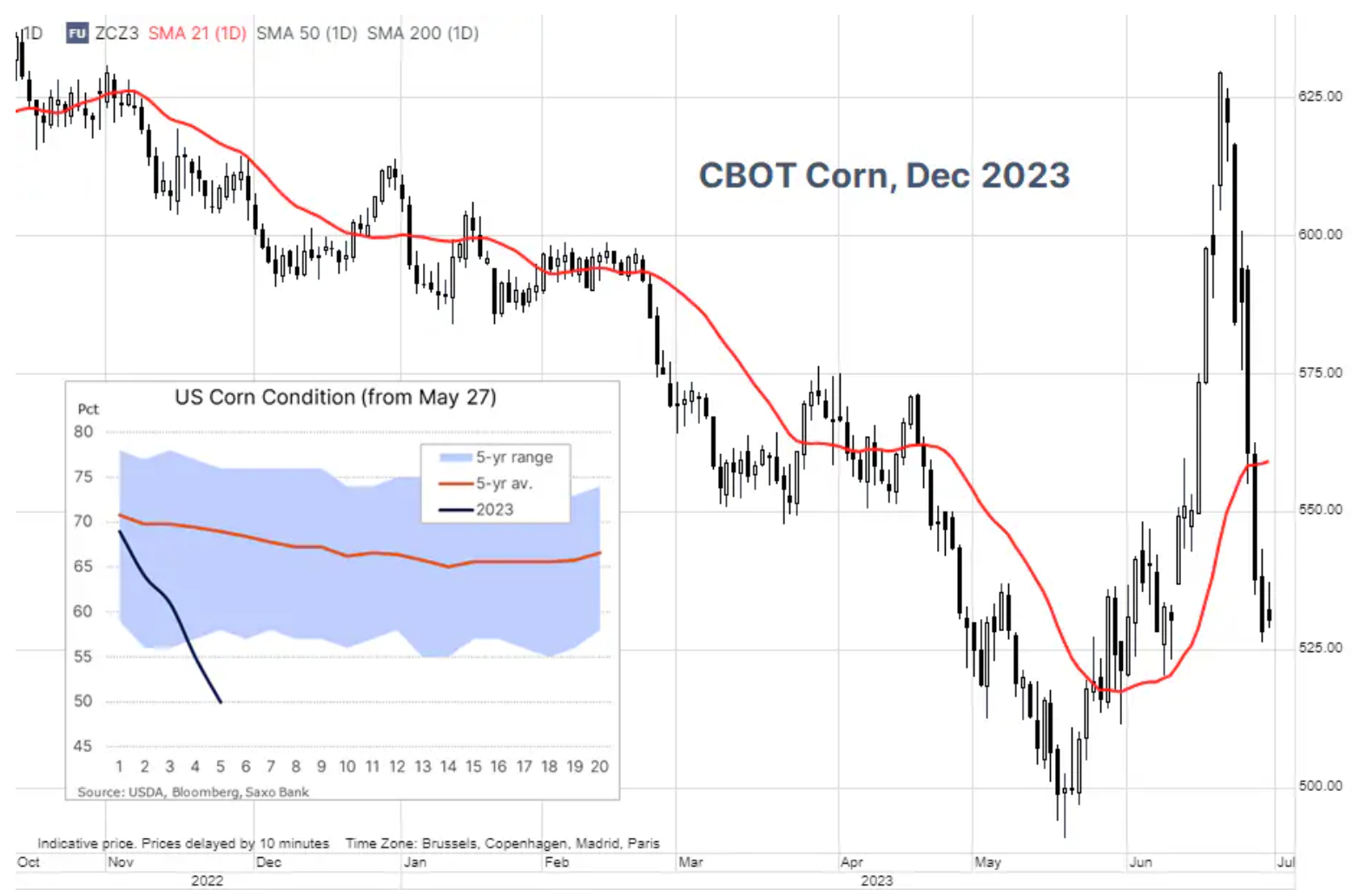

Cereal sector: collapse due to rainfall and speculation

The most intense drought to hit the US Midwest farmland since 2012 has deepened in recent weeks, reducing soil moisture and threatening crop yields in major US corn and soybean growing areas. However, recent strong increases in prices have been largely reversed with a series of rainstorms forecast over the next two weeks, which could stabilize and improve crop conditions. The +6% drop in the Bloomberg Grains Index last week, triggered by rain forecasts, was accelerated by speculators selling out of recently created and currently loss-making long positions. The next update is expected on Monday, and in addition to grain crop conditions, the market will also be on the lookout for key acreage and stock data due to be released on June 30.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)