Capital markets had a very good year. 2023 stock market summary

Despite the increase in war tensions in many parts of the world and the severe inflation, 2023 ended with a significant increase in most stock indices, and some of them recorded their historical maximum. It appears that investor concerns about the condition of the global economy have decreased and investors hope that the upward trend will continue in 2024.

Key information:

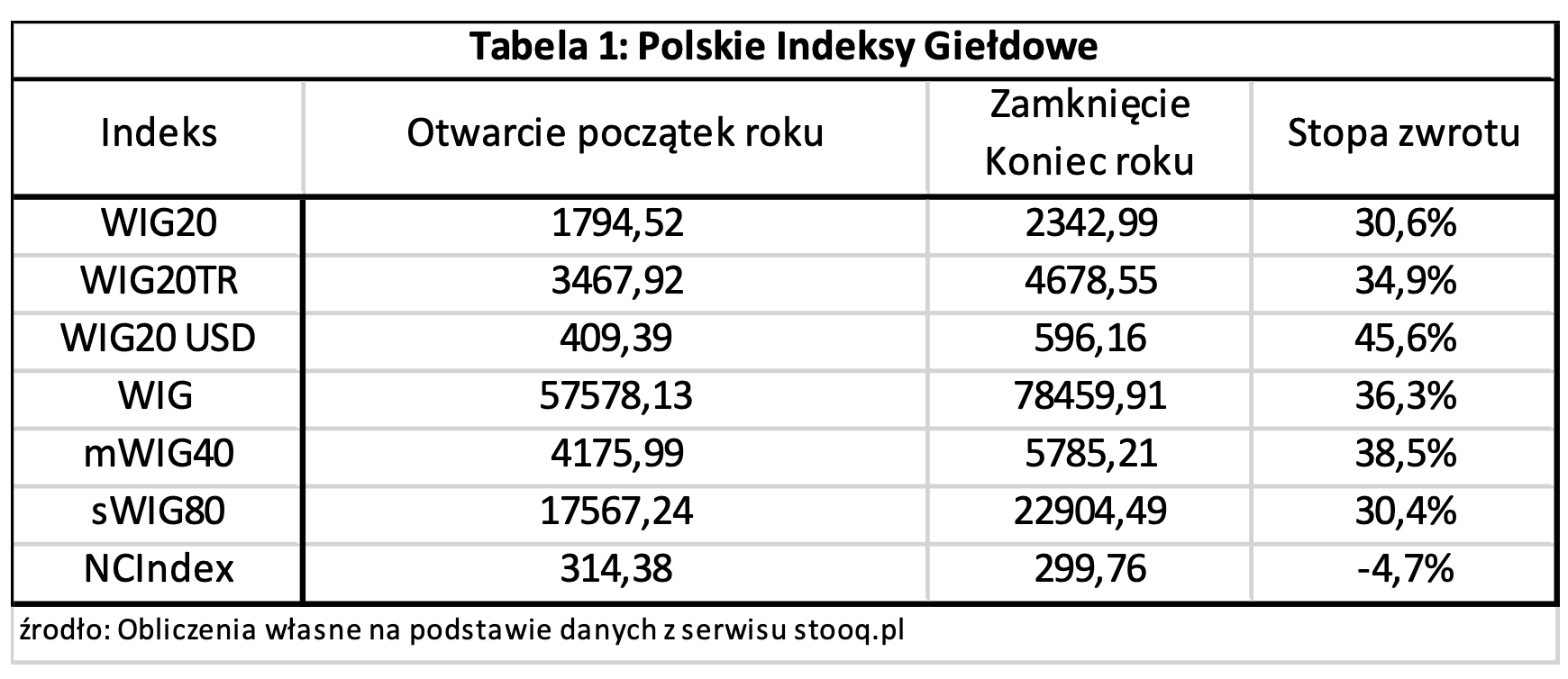

- Polish The WIG index increased by 36,3%, and the historical maximum is certainly the result of hopes for quick release of funds from the KPO.

- A very poor year for the small stock exchange NewConnect – NCIndex lost 5%.

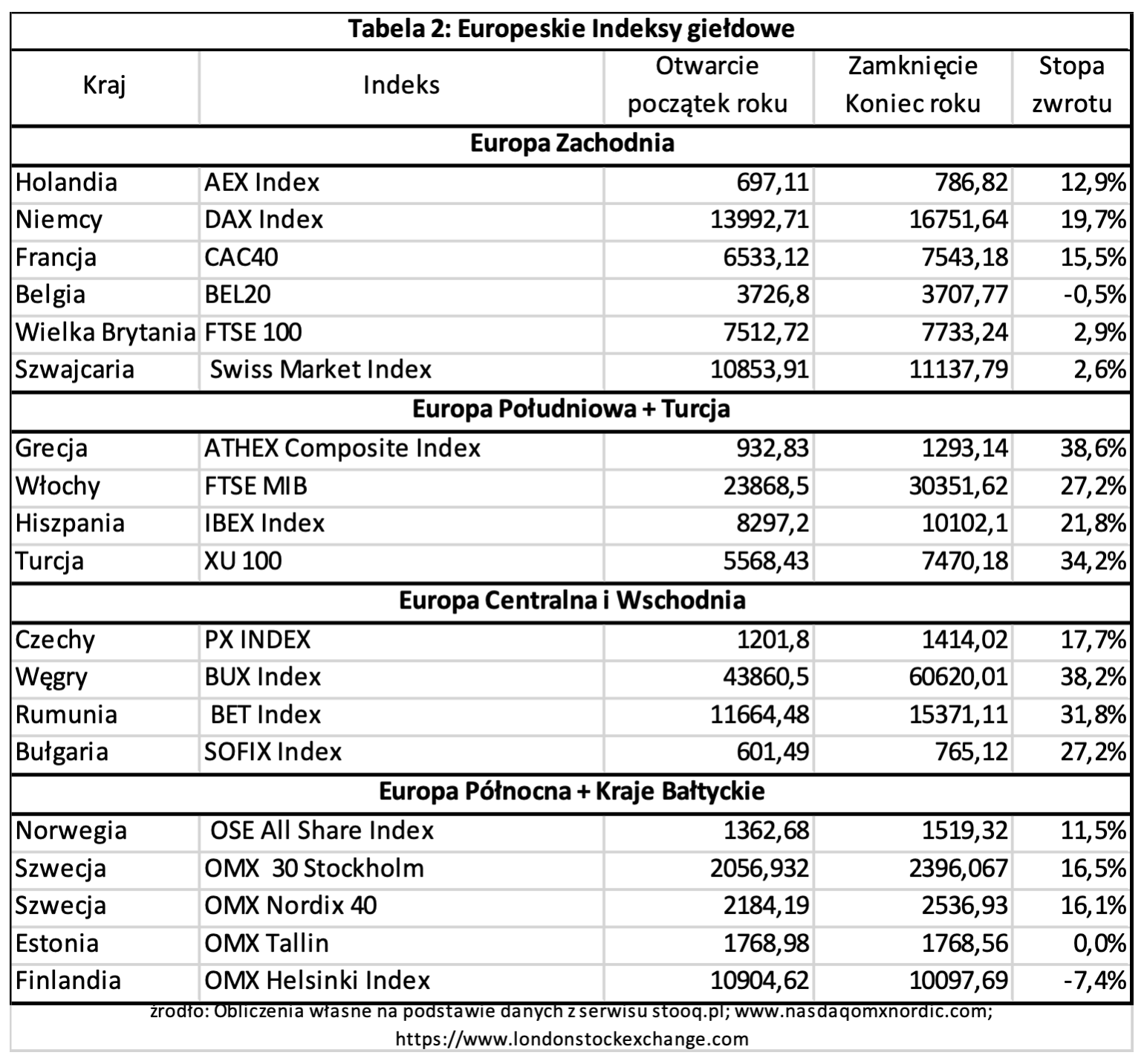

- In Europe, southern countries grew the most, mainly thanks to the expenditure of funds from local, national reconstruction plans. The Greek index grew by 38,2% and the Italian index by 27,2%.

- The Hungarian stock exchange is the leader in Central and Eastern Europe - the BUX index increased by 38,2%.

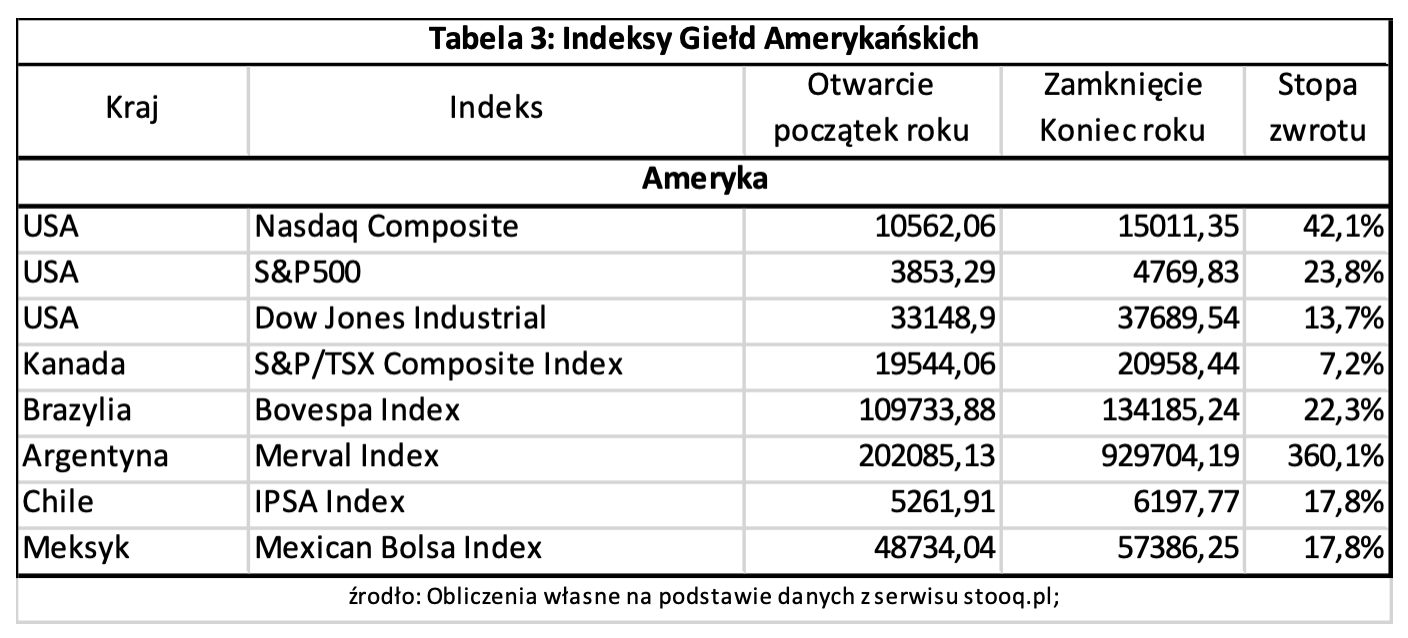

- Stock exchanges in both Americas recorded solid, double-digit results. Nasdaq grew by 42,1%, which is the highest value for indexes of developed countries.

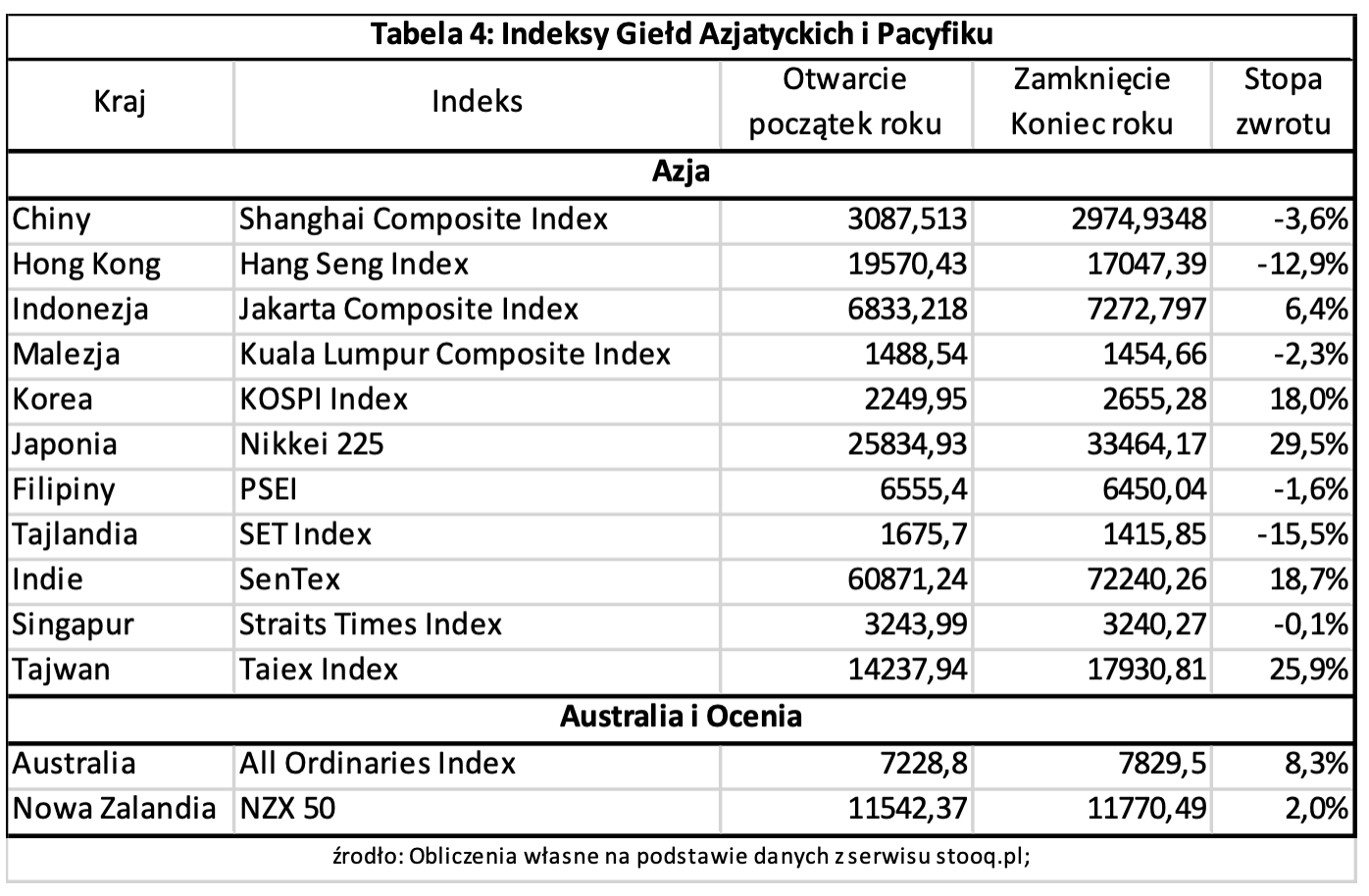

- Asian countries divided into two groups. Japan is the leader in the growth group - the NIKKEI 225 index gained 29,5%. In the relegation group, an unexpected result of the Shanghai index - decrease by 3,7%.

- The year 2024 will be marked by elections in over 40 countries around the world, including the USA.

2023 was a very interesting year from the point of view of financial markets. A period of recovery from inflation caused by the outbreak of the war in Ukraine and a sharp increase in prices of energy raw materials, as well as a huge amount of cash sent to the market to save post-Covid economies. Extremely important, it was also a year of escalation of hostilities, because the conflict in Ukraine that had lasted almost two years was joined by another edition of the fight between Israel and Hamas. The response to the Hamas attack was exceptionally strong, so for over a month, world news outlets shifted their center of gravity to the situation in the Middle East. Despite the announcements by the leaders of Islamic States to support the Palestinians, the conflict has not yet spread to the entire region, which would threaten supplies of energy resources and world trade. Although the situation in the Red Sea has become tense and some shipowners have decided to take their ships to Europe by a roundabout route, for now the trade route through the Suez Canal is still the main trade route from Asia to Europe. However, it is still worth monitoring the situation carefully.

From the perspective of a Polish investor, the October parliamentary elections to the Sejm and Senate and the election results were undoubtedly a very important event. As a result of the change of government, hopes have returned for Poland to "recover" billions of Euro under the KPO, the value of which exceeds PLN 150 billion and, according to the new government, will be unblocked "as soon as possible." Receiving and spending funds from the KPO will undoubtedly be an important factor for capital markets in Poland, as other European markets have shown.

Polish stock exchange with historical high

The Polish stock exchange gave investors one of the best rates of return in 2023 compared to European and global stock exchanges.

The WIG20 index of the 20 largest companies gained 30,6%, and if we take into account the dividends paid by the companies, which is included in the WIG20 TR, the rate of return increases to 34,9%. The foreign investor achieved even better profits. WIG20 USD, i.e. the WIG20 index expressed in US dollars, has gained over 45% thanks to the strengthening of the Polish zloty against the American currency. This rate of return makes the Polish stock exchange one of the top investments last year for dollar investors. At this point, it is worth emphasizing that it was still not the Polish "blue chips" from WIG20 that were the biggest driving force of the Polish stock exchange, but medium-sized companies grouped in mWIG40 index, which gained 38,5%. This was undoubtedly influenced by political decisions, because despite the passage of time and changes in the composition of the WIG20 index, its largest investor is still the State Treasury. The election promises of the previous government caused the WIG20 index to lose over 300 points, i.e. over 13%, from the end of July to the beginning of October, despite such a successful year. Smaller and smallest companies behaved less well. sWIG80 gained 30,4%, which is the least of the main indexes of the Warsaw Stock Exchange, although it still reached its historical highs. The combination of these three indices gives a picture of the entire Polish market and the broad market index WIG, which gained 36,3% and also reached its historical maximum at the end of the year.

On the other hand, compared to the above data, it had a really poor year NewConnect, whose NCIndex lost almost 5% in value. This is the result of two events. Many good companies from NewConnect, taking advantage of the good economic situation, moved to a large stock exchange, which resulted in the share of weaker companies in the index increasing. Then, gaming companies, which are overrepresented in the index, recorded a second weak year, which is still the result of past speculation on these companies and the adjustment of valuations to the new market reality.

Solid Western Europe, and "KPO" is lifting Southern Europe

Table 2 shows the results of selected European stock exchanges, which were divided into 4 economic and geographical regions: Western Europe, Southern Europe with Turkey, Central and Eastern Europe and Northern Europe plus the Baltic countries, due to the common stock exchange operator.

Let's start with Western Europe, which brings together the most developed European markets. Analyzing the rates of return, two trends are clearly visible. German index DAX, French CAX40 and Dutch AEX Index recorded very decent, double-digit growth, reaching their historic highs in December last year. They thus confirmed that they had recovered from the Covid-related turmoil and returned to long-term growth. It is true that the British FTSE100 index also reached its maximum, but this took place at the beginning of the year. Ultimately, it ended the year in a sideways trend with a fairly wide range of fluctuations to achieve a modest 2,9% increase in value. The Swiss Swiss Market Index and the Belgian BEL20 did not reach their historical maximums in 2023. The Swiss Market Index gained only 2,6%, and BEL20 was the weakest of the discussed indices and lost 0,5% of its value.

2023 was a much better year for Southern European stock indices. The weakest of the Spanish markets IBEX Index gained over 21%, Italian FTSE MIB reaching its maximum, it grew by 27,2%, and the Greek ATHEX Composite Index gained as much as 38,6%. Each of these markets benefited from the implementation and use of funds from local, national reconstruction plans, which may be a good prospect for the Polish market in the perspective of starting to spend funds from the Polish KPO. Very well, but the Turkish XU 100 index also performed well for other reasons, which has been one of the best indices in the world in recent years, which is closely related to the weakening lira and very high inflation. Therefore, even a 34,2% increase in the value of the index for foreign investors does not compensate for the decrease in the value of the local currency, which lost over 50% of its value.

Let's now move on to the stock exchanges in our region, which also recorded solid increases. The Hungarian market deserves positive recognition, where the BUX Index gained 38,2% and reached its historical maximum in December. On the one hand, the Hungarian economy is still struggling with high inflation, which fell below 10% y/y only in October. On the other hand, the forint has been strengthening against foreign currencies throughout the year, and the Hungarian government's policy provides the country with supplies of cheap oil and gas from Russia, which benefited the Hungarian economy. A slightly smaller increase was recorded by the Romanian BET index, which gained 31,8% and also reached its maximum last year with a very similar value of the Romanian Lei at the beginning and end of the year. Rounding out the podium is the Bulgarian SOFIX Index, which gained 27,2%, but is still far from its historical highs. The least impressive of the analyzed markets in the region was the Czech PX Index, which gained 17,7%.

Finally, let's move on to the Northern European markets. The Swedish market has behaved the best. OMX 30 Stockholm gained 16,5% and reached its historical maximum at the end of the year. OMX Nordix, which brings together the largest companies from the Swedish, Danish, Finnish and Icelandic markets, where the stock exchanges are operated by the OMX Grupe group (belonging to the Nasdaq group), also performed well, gaining 16,1%. Opposite them, the Finnish OMX Helsinki Index performed much worse, losing 7,4%, which makes it definitely the weakest of the European markets discussed. Interestingly, OMX Tallinn, despite very solid growth at the beginning of the year, ended the year with zero change in value. This was undoubtedly influenced by press reports that numerous analytical centers from the United States and Western Europe believe that if Russia wins in Ukraine, the Baltic countries may be the next target of military action by the Russian Federation in the next 3-5 years.

Historical performance of the US market

American markets recorded solid increases, but here too there are significant differences between the indices.

Nasdaq Composite grouping technology companies, after a very weak year 2022, gained as much as 42,1%, which is definitely the highest value for developed market indices and shows that technology companies not only achieve record results, but also, according to investors and analysts, have very good prospects in the period a few years ahead. The index also recorded very solid increases S & P 500, grouping the 500 largest companies on the American market, which gained 23,8%. The least effective index was the "old economy" Dow Jones Industrial index, which gained only 13,7%, which is a result comparable to the German or French market, but it was the only one from the American market that recorded its historical maximum. The Canadian market behaved much weaker than the American market. The S&P/TSX Composite Index gained only 7,2%. The market is largely related to mining and raw material companies, and due to the increasing pressure to reduce CO2 emissions, they cannot count 2023 as a successful year.

When analyzing Latin American indices, the result of the Argentine stock exchange, Merval Index, is striking, which gained as much as 2023% in 360. Unfortunately, from the investors' point of view we cannot talk about a successful year. This good result is due to the fact that during the same period, inflation in Argentina exceeded over 100%, and the value of the Argentine peso depreciated by over 350%. The Argentine stock exchange was rising because it is dominated by companies exporting goods from Argentina, which achieved record results in their currency thanks to the huge depreciation of the peso. However, when we convert them into US dollars and add the rampant inflation, the record results of the Argentine stock exchange are caused by the exceptionally deep collapse of the local economy. The other stock exchanges in the region did not achieve such stunning rates of return, but their growth has much healthier grounds. The stock exchange in Mexico - Mexican Bolsa Index gained 17,8%, the same increase was recorded by the stock exchange index in Chile - IPSA Index. The Brazilian stock exchange performed slightly better, where Bovespa Index rose by 22,3%, and the Brazilian real gained about 10% against the US dollar during the year. Each of the listed exchanges reached its historical highs at the end of 2023.

Asia divided into two groups: growth and decline

We faced an interesting situation at... Asian markets, which were divided into two groups. Last year was a very successful year for the stock exchanges in Korea, Japan, India and Taiwan, with solid growth. On the other hand, stock markets in China, Hong Kong, Malaysia, the Philippines and Thailand recorded quite solid declines.

The stock exchange in Japan deserves special attention, where the NIKKEI 225 index gained 29,5%, making it the best of the Asian stock exchanges last year. Very solid increases were also recorded by the Taiwanese Taiex Index, which gained 25,9%, the Korean KOSPI - an increase of 18% and the Indian SenTex - an increase of 18,7%, which is another stock exchange recording its historical highs. At the other extreme, we have the Thai SET Index, which lost 15,5% of its value. The HangSeng Index from Hong Kong is performing equally poorly for another year in a row, losing almost 13%. It was also not a successful year for the Chinese market, as the most important index - the Shanghai Composite Index - fell by 3,7%, despite very solid growth in the first half of the year. Symbolic, but declines were recorded by the Kuala Lumpur Composite Index from Malaysia (-2,3%), PSEI from the Philippines (-1,6%) and the Singaporean Straits Times Index (-0,1%), which recorded a symbolic decline thanks to a very solid growth at the end of the year. Of the analyzed world regions, Asia was definitely the least favorable region for investors.

Finally, as an interesting fact, let's discuss the Australian and New Zealand markets. Both recorded increases, but they were not very impressive. The Australian All Ordinaries Index gained 8,3%, which is a result very similar to the Canadian market, where mining and raw material companies also dominate, while the New Zealand NZX 50 index gained 2%.

Outlook for 2024

In the context of Poland, the results of many European markets show that good use of KPO funds can have a positive impact on markets and company valuations. We should therefore hope that the new Polish government will strive hard to carry out the necessary reforms in the judiciary to unlock funds from this program, which should provide a positive impulse for the Polish economy and capital markets.

It is also worth keeping in mind the potential threats that may occur in 2024. The coming 12 months will be a year of elections that will take place in over 40 countries. Undoubtedly, the most important of them are the US presidential elections, where polls indicate that Donald Trump has an increasing chance of returning to the presidency. Elections will also be held in the world's largest democracy - India, Great Britain, but also in the entire European Union, which will elect its representatives to the European Parliament, and polls in numerous European countries clearly show that the Parliament may be reinforced by anti-system and anti-EU parties. In Poland, apart from the European Parliament elections, Poles will take part in local government elections in the spring, which will be the first reliable survey of support for the new government in Poland.

Author: Mateusz Marcinkiewicz, CFO MyInvests SA

An expert with many years of experience in the field of asset management and investments, including working for a brokerage house, an investment fund company, an investment company agent and a VC fund. He also invested his own funds as an investment fund manager and a Business Angel. He has also been involved in financing debt projects for many years. He holds a Securities Broker license No. 2362 and an Investment Advisor license No. 453 issued by the Polish Financial Supervision Authority.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Gaming on the Polish Stock Exchange – Rafał Janik and Paweł Sugalski [Webinar] gaming on the Polish stock exchange](https://forexclub.pl/wp-content/uploads/2023/04/gaming-na-polskiej-gieldzie-300x200.jpg?v=1681291966)

Leave a Response