Price to book value - What does the C / WK ratio (P / BV) tell us about?

Price to book value is one of the best-known ways of business valuation. Despite its popularity, it is often misused. It is not an indicator that can be used for every company and under all conditions. Moreover, for many industries, it is useless. However, in special situations, it can be a useful tool in the hands of an investor. In today's article, we will explain exactly what the indicator is and how it can be used by investors.

What the reader will learn in this article:

- What is multiplier valuation?

- What is included in the P / BV valuation?

- Why do investors use the P / W ratio?

- Advantages and disadvantages of price-to-book value.

What is multiplier valuation?

One of the most popular ways to use the price-to-book (P / W) ratio is to use it for multiplier valuation. The multiplier valuation allows you to easily calculate the value of the company. The best known multiplier valuations include:

- Price to Profit (C / Z),

- Price to Free Cash Flow (C / FCF),

- Price to Book Value (C / WK).

When a P / BV multiplier is used, the analyst takes the company's book value and multiplies it by the specified multiplier. Where does the analyst get the multiplier? Most often, the multiplier is taken from the average value for companies from the same industry. Applying such a conversion factor to the book value gives an approximate valuation of the company.

Some apply multiple pricing to entire indices or markets. This is due to the fact that the components of the indices do not change dramatically, which allows you to track periods when the P / W ratio is in "oversold" areas, which may induce investors in ETFs to buy an "discounted" index.

Price to book value - what does it include?

The price-to-book ratio consists of two elements:

- Business valuation (capitalization),

- The book value of the enterprise.

The capitalization of an enterprise is otherwise a stock market valuation. The company's capitalization is calculated by multiplying the number of all shares by the value of one share on the stock exchange. Many academics confess the theory of an effective capital market, which means, that market valuations reflect all available market information for the company. Of course, market researchers and practitioners argue over how much the market discounts all information. For this reason, there are three efficient market hypotheses (weak, semi-strong and strong). Proponents of the use of multiplier pricing believe that the market is at best efficient according to the weak variant. This means that all historical news is included in the prices, but the market cannot price the future effectively.

The book value of the enterprise is nothing more than the value of the enterprise's equity. Equity is part of the company's liabilities, i.e. the sources of financing the company's assets. There are two types of asset funding sources: external and internal:

- External financing are the company's obligations towards other entities. The external financing includes, for example, liabilities to suppliers or interest debts (loans, credits, issued bonds).

- Internal sources of funding include retained net profits or contributions from founders. Equity is simply net assets less all liabilities of the enterprise.

Thus, it can be said that the value of equity shows how much the company would be worth if it sold its assets to pay off all liabilities. The value of equity capital divided by the number of shares informs about the amount of net assets of the enterprise per one share.

According to the formula, the indicator Prices to Book Value it is calculated by dividing the market capitalization by the value of equity. In the case of companies from capital-intensive industries, as a rule, a multiplier ranging from slightly above zero to one is considered low values. A C / WK value of 1 means that the market valuation is equal to the net asset value. Of course, there are times when the P / W value is below zero. This is a situation where the enterprise has greater liabilities than assets. As a result, the book value is negative.

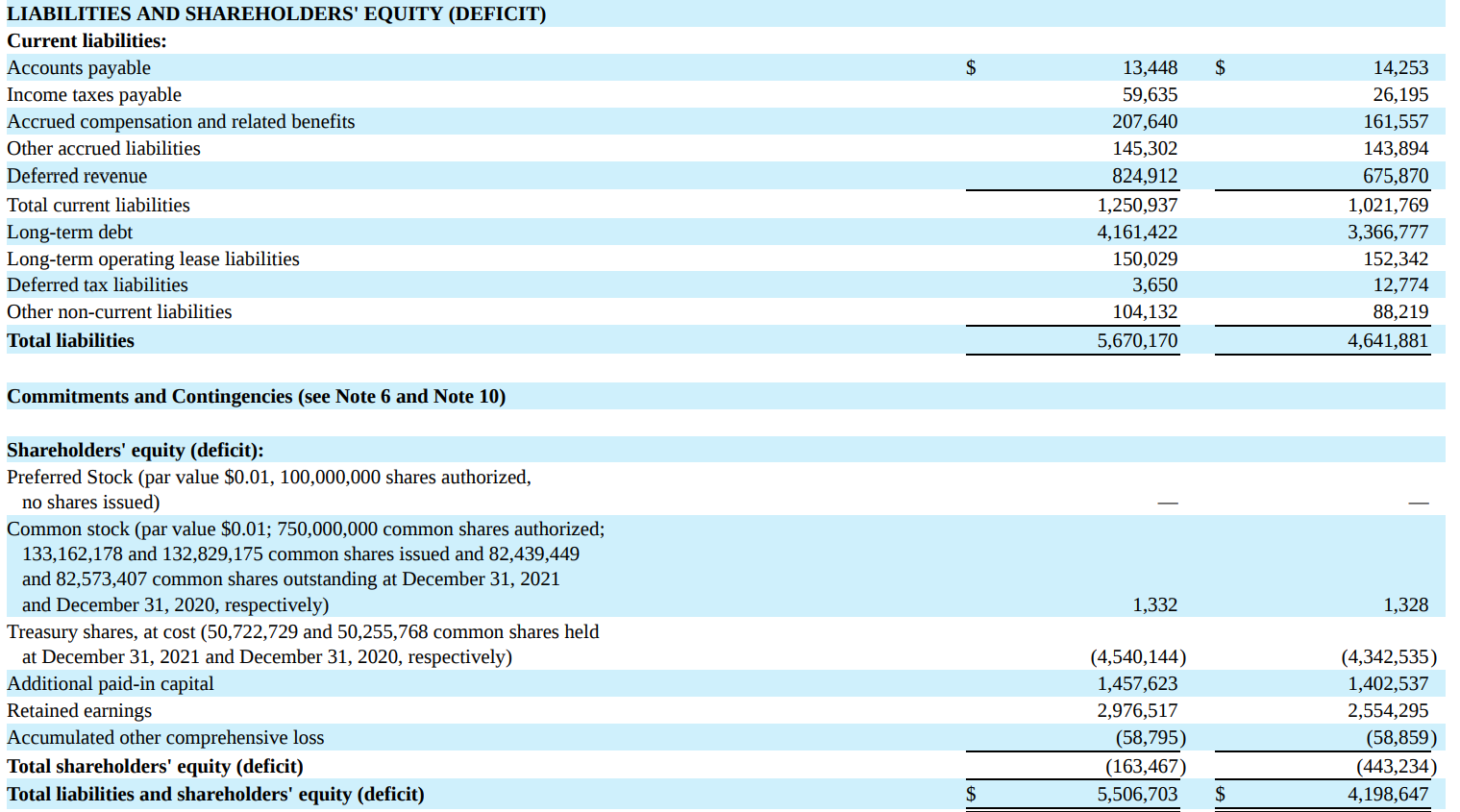

The image below shows an excerpt from MSCI Inc.'s balance sheet. As you can see in 2021 (1 column), the value of equity was-$ 163 million. You can also see the components of equity capital. It includes core capital of $ 1,3 million, purchased stocks-$ 4,54 billion, additional paid-in capital of $ 1,45 billion, retained earnings $ 2,97 billion and other losses-$ 58 million. The company has negative equity despite earning nearly $ 3 billion in profits over its lifetime. The reason is generous share purchases and paid dividends.

Source: Annual Report for 2021 of MSCI Inc.

Why do investors use the P / W ratio?

Investors use it to find undervalued companies. According to supporters of this type of investment, companies with ratios below 1 and above 0 are undervalued. In such a situation, there is a chance of earning above average. Ideally, a low C / WK value is lower than the average value for listed competitors or companies in a similar industry. The price-to-book ratio is used in the analysis of companies from the banking sector and enterprises whose greatest value is a set of assets, and not the generated cash.

Another reason for using C / WK in the valuation of the enterprise is the situation when the company does not generate net profit or positive free cash flows. In such a situation, the use of a price / book ratio may be an alternative multiplier valuation. However, such a strategy does not work for the valuation of asset light companies (e.g. software companies).

On the other hand, some investors believe that if a company has a very high price / book value, there is a risk that the company is overvalued. Of course, other investors focus more on the company's cash generation rather than the company's owned assets.

Value trap for P / W ratio

One of the biggest risks in investing on a self-employed basis is the so-called "Value trap". This is where a company is valued "cheaply" relative to historical multipliers. However, very often the company is cheap for a reason (periods of large bear market are ignored). When the P / W ratio is very low, there is a risk that it is a classic value trap. Such a situation means that the share price, despite attractive valuations, may move "southwards" due to fundamental factors. Examples include a shrinking business or internal factors. The market may be skeptical about the reliability of the company's assets valuation or may impose a discount due to off-balance sheet liabilities (e.g. guarantees). Another reason may be the low creditworthiness rating of management, who may want to "take out" the assets through accounting tricks or ordinary financial frauds. For this reason, a low C / WK value alone is not an indicator of a company's undervaluation, but only a signal that perhaps the market is valuing the company below its intrinsic value.

Behavior was an example of a value trap Hydrobuildings in August 2011. The C / WK for this construction company was 0.03, which seemed absurdly low. However, after the publication of the report for the first half of 2011, it turned out that the company had a negative book value due to the reported losses.

A low P / BV ratio could also be a signal that the company is probably very low or even negative return on assets (ROA). In turn, a high C / WK is a signal that the company can generate very high ROE or ROIC. Therefore, investors are willing to value the enterprise at several times the net worth of the enterprise.

Book value and the internal value of the enterprise

For novice investors, the book value may be the same as the company's valuation, also known as the company's intrinsic value. Nothing could be more wrong. Of course, it happens that the book value is equal to the intrinsic value of the enterprise. However, these are very rare situations. It happens much more often that the actual goodwill differs significantly in minus or in plus from the book value. This is because most enterprises are valued based on future cash flows discounted to date. For such companies, the book value is irrelevant as the income stream counts.

There are companies that, despite generating large amounts of cash, do not have significant equity. What it comes from? Most often because of the generous sharing of profits with shareholders. McDonald's is a great example. In 2013, the book value per share of this company was approximately $ 16,2 per share. Three years later, its value dropped to $ -3 per share. Was the company in a difficult financial situation? The answer is simple: no. At that time, the company still had an operating profitability of around 2,7% and was generating a solid performance free cash flow (FCF). The reason was different. In 2013-2016, the company purchased shares worth $ 22,2 billion and paid a dividend of $ 12,6 billion. At the same time, the company's net profit was $ 19,6 billion. This caused equity to decline to negative levels despite maintaining high profitability and generating high cash flow (FCF). A brief summary is provided below:

| Billion $ | 2013 | 2014 | 2015 | 2016 |

| Purchase of shares | 1,8 | 3,2 | 6,1 | 11,1 |

| Dividend | 3,1 | 3,2 | 3,2 | 3,1 |

| FCF | 4,3 | 4,1 | 4,7 | 4,2 |

| Equity | 16,0 | 12,9 | 7,1 | -2,2 |

Source: own study based on the company's annual reports

Defects of the indicator

One of the biggest disadvantages of C / WK is its susceptibility to asset write-offs. A write-down is a situation when a company makes a downward adjustment of the valuation of its assets. An example is perishable inventory. The write-off of inventories causes the value of assets to decrease. Liabilities, on the other hand, do not change, which means that equity is falling. Therefore, in the event of a write-off, the company's net worth decreases (ceteris paribus), even though the operating activity has not changed. That is why the application of the C / WK ratio is not easy because it requires the analyzer to carefully look at how the company's assets are valued. If the accounting is "liberal" and values the assets too optimistically, then using the book value in the balance sheet does not have much added value.

Another disadvantage of the P / W ratio is the focus only on "accounting" liabilities. There are situations when off-balance sheet liabilities are more important, which may significantly exceed the "accounting" debts. The off-balance sheet liabilities include guarantees or sureties for loans or borrowings.

The ratio is not suitable for the valuation of companies operating in the asset light model. This is because such enterprises do not need machines, factories or a car fleet to generate income. Instead, they are satisfied with teams of skilled programmers who create software sold as a service (the SaaS model). The problem is also that you don't see the company's ability to generate shareholder value in book value. Another disadvantage of the company's book value is that the intangible and legal property (patents, brand) is poorly valued "in the books". It is very often very underestimated. For this reason, C / WK does not work for the valuation of technology companies or companies with a very wide portfolio of strong consumer brands.

Another example where C / WK does not fulfill its role are companies operating in the franchise model. Sharing the concept of a restaurant and transferring the costs of opening points to franchisees does not require capital expenditure on the part of the company. Such situations mean that the wealth of enterprises operating in the asset light model is not too large.

Companies with negative equity are not always in a difficult financial situation. For this reason, a negative P / W ratio does not mean that the company has no value. Sometimes it results from the adopted policy of sharing the generated profits with shareholders.

Another disadvantage is that the valuation of assets in the books may differ significantly from their actual value. Large, including the impact of depreciation, which may not reflect actual changes in market prices of the assets held.

It is worth paying attention to the nuances such as shares with subscription rights or the large number of stock options held by employees. In such a situation, there may be a strong dilution of capital, which will reduce the book value per share.

Advantages of the indicator

One of the biggest advantages of this indicator is its uncomplicated. The investor has to divide the capitalization by the company's equity. Moreover, many websites publish this information for free on their websites. If the investor wants to calculate them himself, it is enough to open the financial statement and start looking at the liabilities of the company.

Another significant advantage of this indicator is that it has it you can compare the valuations of competing companies operating in other tax systems. This is because only the level of assets less liabilities is taken into account here. The different level of taxation of profits does not have a direct effect on the valuation of assets only on the item "retained earnings".

P / BV is an interesting idea for "valuation" of stock indices, because it can easily present an aggregated valuation of shares of a given market. This was the case in 2009, when low P / W ratios suggested that this was an ideal opportunity for a long-term investor to buy shares.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)