Oil prices continue to rise while copper prices stand still

While the metals and agriculture sectors are losing ground, the oil market continues to thrive thanks to a combination of rising demand and OPEC + 's low supply policy. In mid-June, the Bloomberg Commodity sub-indices recorded losses in all sectors except the energy sector. Agricultural commodities fell slightly, and several regions revised their output forecasts upward due to better weather conditions. The worst performers in terms of results broken down by sectors and individual commodities are industrial metals and copper, which recorded the lowest results in six weeks and a decrease of 7% this month.

After prices have risen sharply since April, industrial metals prices have fallen in response to increased efforts by the Chinese authorities to curb commodity prices. The State Commission for Supervision and Asset Management instructed Chinese state-owned companies to control risk and limit exposure to foreign commodity markets. In addition, the National Food and Strategic Reserve Board announced that it will soon release some of the state's metal reserves, including copper, aluminum material i zincwhich will be sold in batches to manufacturers.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

In response to these developments, the fundamental situation in the copper market has weakened. The differences in spot prices in relation to the prices of the three-month LME contracts caused the highest contango in a yearwhich is a sign of increasing supply. Meanwhile, Chinese importers now pay the lowest LME premium in more than five years. In addition, the recent decline in the upside momentum has forced speculators to limit purchases of fine copper to its lowest value in a year. Higher prices are projected in the coming years due to rising demand from the green transition, but in the short term the price - as mentioned - has lost its fundamental footing and until the trend starts to reverse, the markets for copper and industrial metals may be pushed to the defensive.

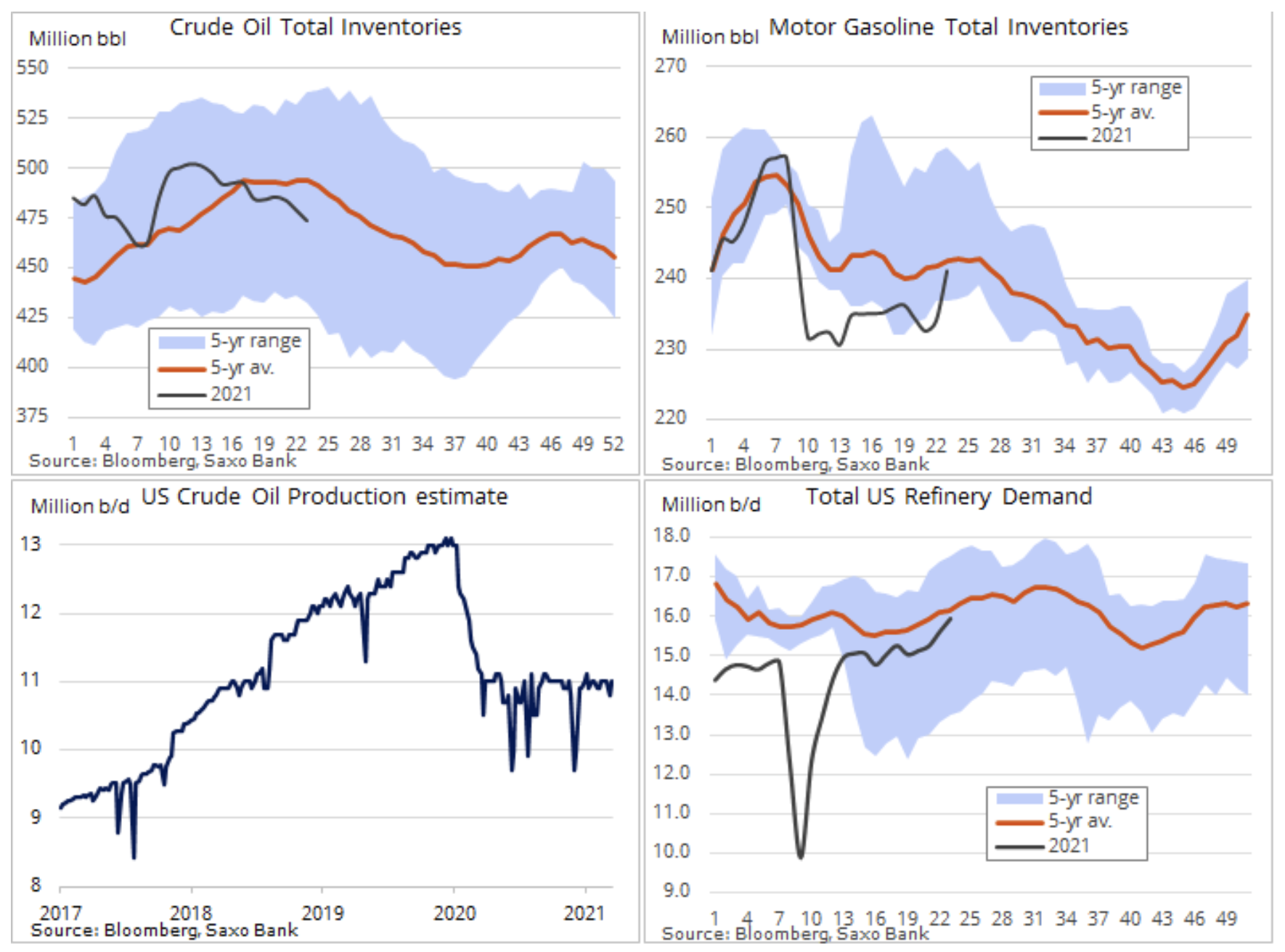

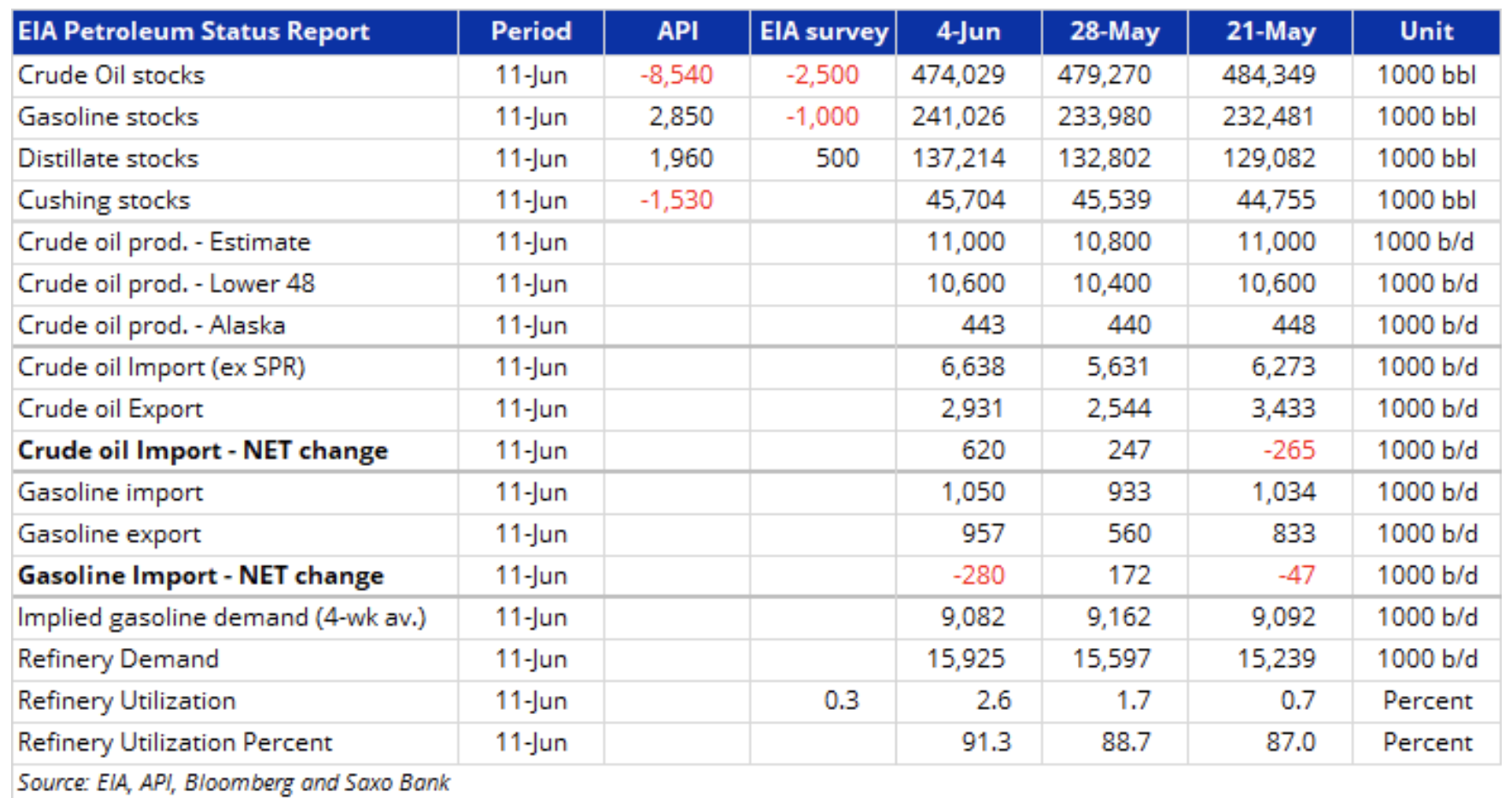

On the oil market, speculators remain a large group of buyers, confident that downside risks are limited thanks to OPEC + keeping supplies at a low level in times of increasing demandwhich, according to the IEA, may return to pre-pandemic levels by the end of next year. Additionally, industry association API recently reported that crude oil inventories plunged 8,5mn barrels last week. This would be the fourth consecutive decline, the largest since January. The forecasts for another weekly increase in product inventories have been slightly revised as refineries prepare for the summer and the increase in demand.

For the present oil price are also influenced by the forecasts of the world's leading commodity traders who during the conference FT's Global Commodity Summit Oil prices could return to $ 100 in the coming years, they said, as investment in new supplies slows down and major oil companies are redirecting investment into renewables rather than continuing oil and gas production. This highlights a potential dilemma in which politicians and investors want to move towards renewables at a much faster pace than real changes can be made. Thus, there is a risk of a shortage of supply before demand finally starts to slow down in the second half of this decade.

Brent crude oil prices are tending to $ 75,6 in 2019, breaking the downtrend (red line) from the 2008 peak. Following the FOMC meeting, the market awaits the Fed's inflation forecasts that could induce investors to hedge against it through long-term exposure on the market of goods and raw materials.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response