Covid and inflation are the main topics in commodity markets

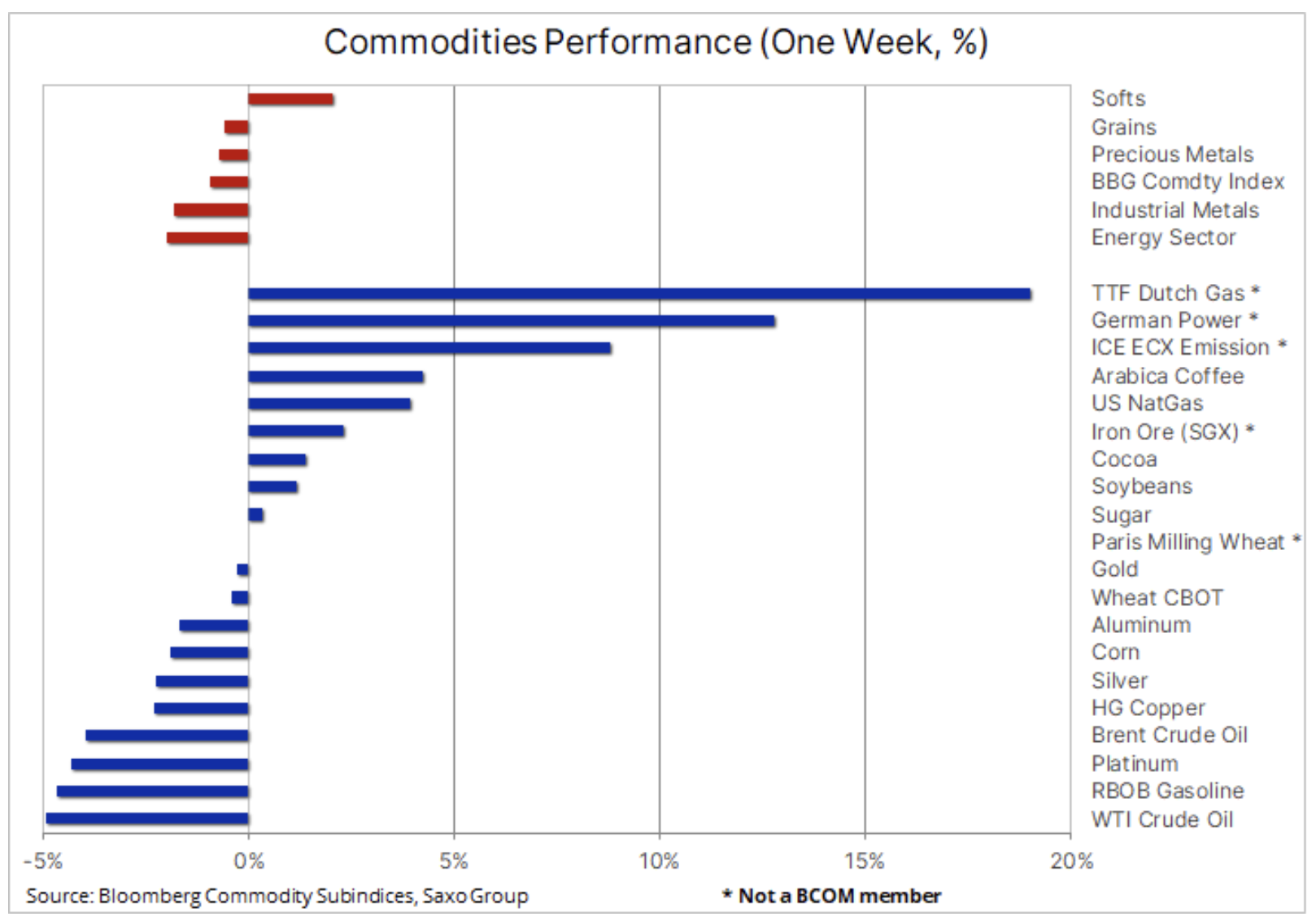

The commodities sector saw a decline for the fifth consecutive week; dynamic dollar appreciation continues to increase the cost of most key commodities denominated in local currencies. The dollar appreciated especially visibly against the euro, which fell to its lowest level in 16 months due to the increasing risk of renewed lockdowns across Europe, painfully high - and therefore damaging to economic growth - gas and electricity prices as well as worsening problems on the eastern borders of the EU.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

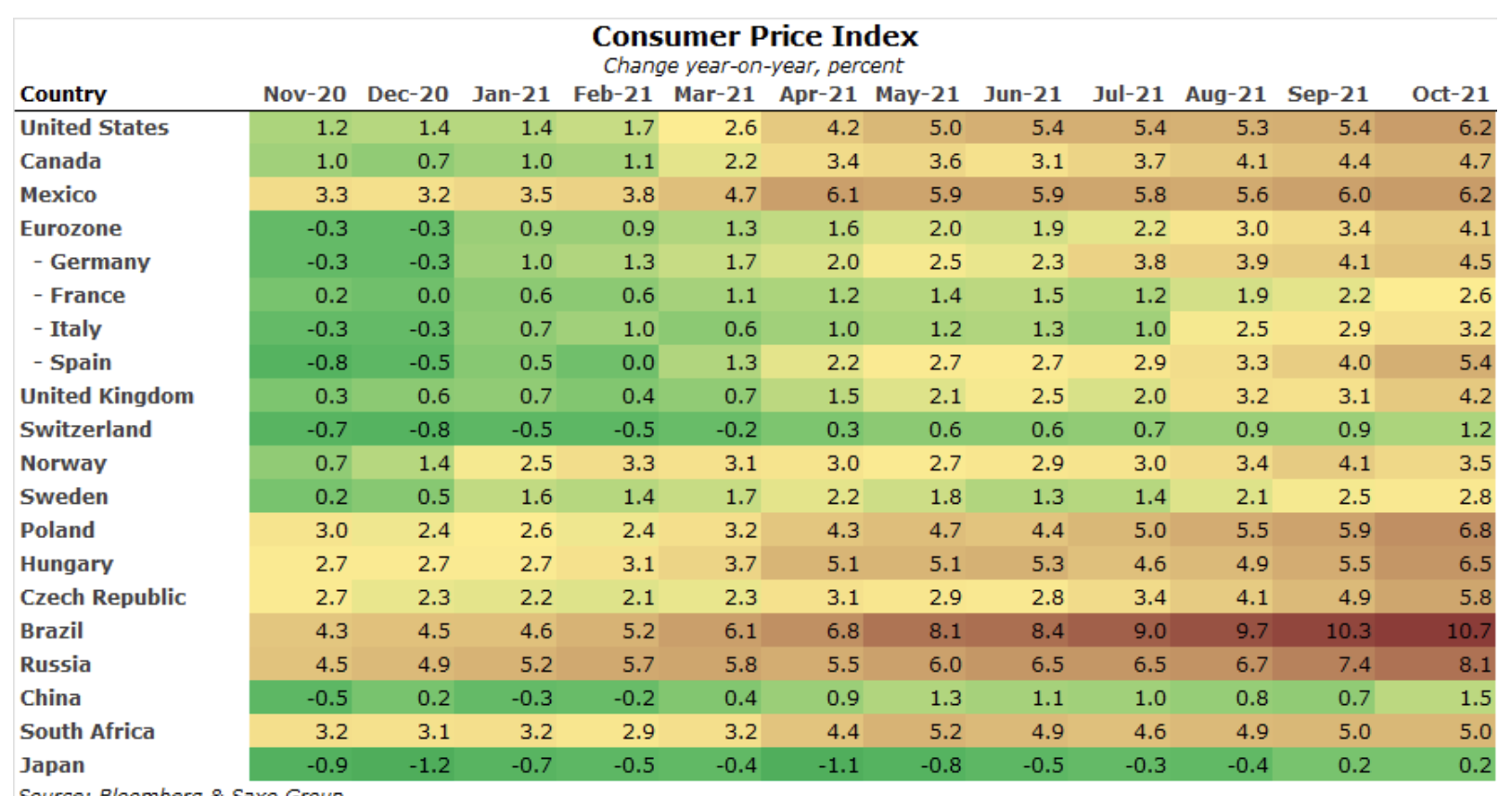

In addition, the market has struggled with threatening economic growth, soaring inflation, as well as worries about the weather and further disruptions to the global supply system due to labor shortages and port congestion. At the same time, investors had to consider the prospect of a strong increase in demand for many key raw materials as part of the green transition, in particular for industrial metals, in the context of the risk of an economic downturn in China, the world's largest consumer of raw materials.

As a result of these developments, the past week was mixed with lower costs of oil, fuel products and industrial metals, while the agricultural sector went against the tide and the Bloomberg Agricultural Index hit its five-year high. In the precious metals market, the situation was mixed, with gold managed to maintain its recent gains in response to the sharp rise in inflation in the United States.

The best performance for commodities was once again recorded in Europe, where the Dutch benchmark TTF gas contract rose after German regulators suspended the certification process of the controversial Nord Stream 2 gas pipeline. Russia has raised concerns that Europe might struggle to provide the supplies it needs to weather the coming winter months. As a result, electricity prices also rose and carbon costs hit record highs with the prospect of increasing demand for more emitting coal to replace possible gas supply shortages.

Agricultural products

The cost of our breakfast and food overall continues to rise, and after several months of a sideways trend, the Bloomberg agricultural index, following a basket of major food futures, has reached a new five-year high. According to the FAO, the cost of the global basket of key food items has increased by more than 31% over the past year, and the outlook for food price inflation as a major topic in 2022 has not changed after the recent spike in coffee, soybean, wheat and sugar in particular. FAO will publish its index for November 2 December.

Such strong increases are due to various reasons, but the common element is a difficult year in terms of weather conditions and the prospect of production discontinuation in the next season due to the La Ninã phenomenon, a popandemic surge in demand leading to widespread disruptions in supply chains and labor shortages, and recently also rising production costs as a result of soaring fertilizer prices and rising costs of fuels such as diesel.

Petroleum

Clothing has fallen for the fourth consecutive week, fueled by the risk of the US releasing strategic reserves and the new wave of Covid infections that has spread across Europe, forcing several countries to retreat from opening up the economy, which could again jeopardize economic growth and mobility, and this in turn will further reduce fuel consumption in a situation where consumers are already grumbling at the highest prices at gas stations for years.

In addition, the latest monthly reports EIA, and recently also IEA, on the oil market point to a lower risk of price increases as the moderate increase in demand due to the next wave of Covid and weaker industrial activity, partly due to higher oil and gas prices, coupled with steadily increasing supply, will support a sustainable market in early 2022 .

Brent crude oil tended to decline by 4% on a weekly basis, thus almost completely offsetting October's gains, which were fueled by the prospect of increased demand for crude oil replacement, particularly for products such as diesel, heating oil and propane. After the price dropped below $ 80 per barrel, the risk of further losses has increased towards the support of the trend line, currently at $ 73.

The repeatedly cited risk of $ 100 per barrel has disappeared, replaced by a more balanced forecast that requires the elimination of speculative long positions to get the market ready for the next rally. We maintain a long-term positive view of the oil market as it faces long years of potential underinvestment - major players are losing their appetite for large ventures, in part due to uncertain long-term outlook for demand but also, increasingly, due to credit constraints imposed on banks and investors in relation to ESG (environmental, social and corporate governance issues) and the emphasis on green transition.

Precious metals

Gold held for the past week in a relatively narrow range between $ 1 and $ 850 awaiting a new boost after the last technical breakout. The impressive rally that took place despite the handicap of strengthening the dollar began to show signs of slowing down, and other metals, such as silver and platinum, struggled. The renewed risk of Covid-related lockdowns in Europe helped the zloty to find new buyers, and lower bond yields due to concerns about economic growth contributed to offsetting the above-mentioned appreciation of the US currency. The recent red-hot inflation readings, especially the 1% in the United States, will most likely continue to provide support for the zloty in defense against a stronger dollar.

Moreover, the reaction of investors via the exchange fund market will be of crucial importance. Over the past year, fund managers have gradually reduced their exposure to gold as declining equity volatility and rising equity prices reduce the need for diversification. So far, despite the recent spike in prices, demand has not yet picked up.

In the short term, gold will need an impulse to grow. If there is no such impulse, there is a risk that there could be a downward return and an approach to the key area of $ 1-830, although gold is likely to find support in this area.

Copper it has been in the range since March, and the lack of momentum and conflicting fundamentals have dampened investor interest to the point where open positions in copper futures traded in London have dropped to a nine-year low. However, this decline was quickly offset as there was still strong support ahead of $ 4 / lb for HG copper and $ 9 / tonne for LME copper.

The first round of presidential elections in Chile took place on November 21, and given the high share of Chile and neighboring Peru in global production, their further course will be closely monitored, given recent speculation that the left-wing candidate will raise taxes on mining companies to promote green hydrogen and reducing social inequalities.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)