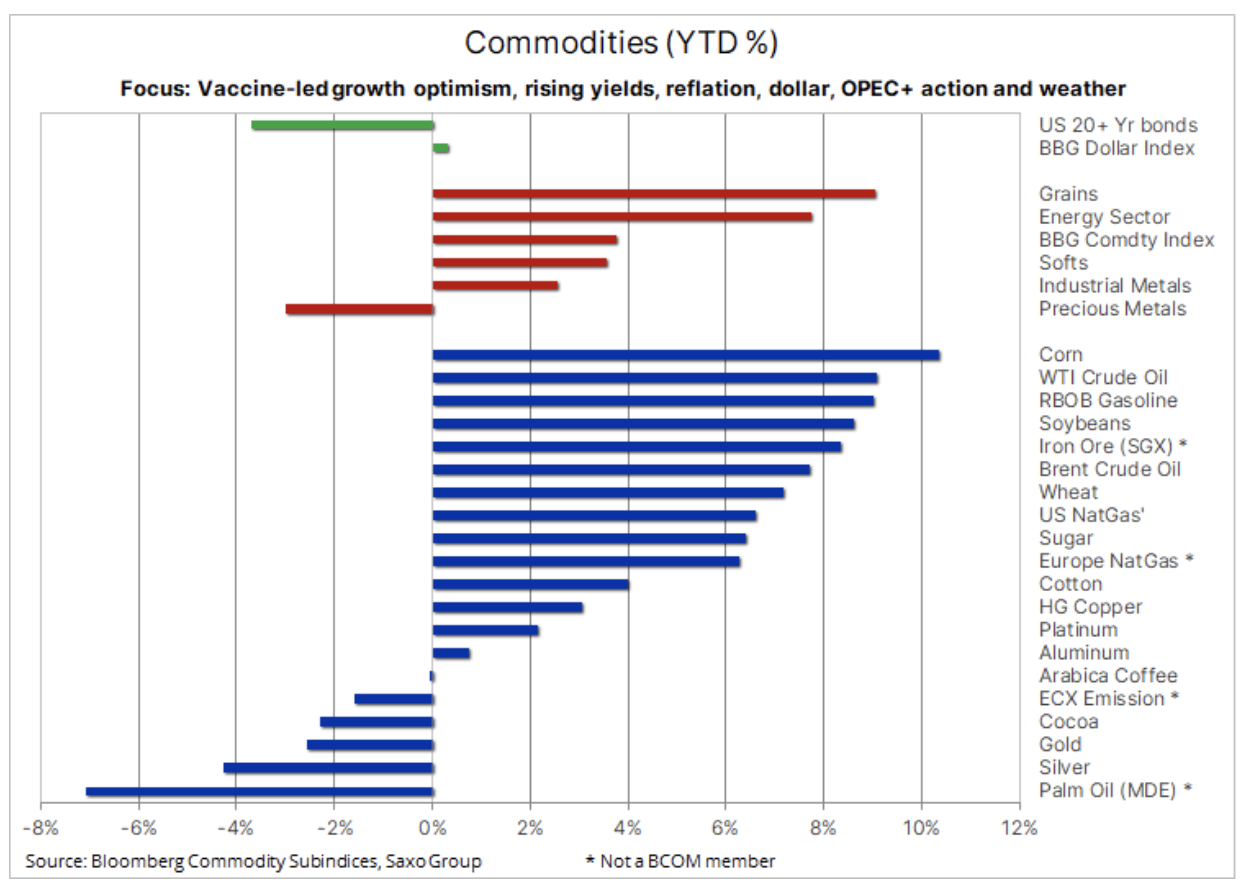

Crops go up, energy and metals hold back

The momentum observed in recent months for most commodities continued in the second week of January, although it slowed down somewhat. The exception was the arable crops sector, which surged after the publication of a government report stating that supply had fallen and demand rose more than expected. Overall, the sector continues to benefit from a number of positive factors in the form of falling supply, the flooding of global cash causing speculation in all markets and the demand for hedging against inflation, as well as the prospect of a recovery in global demand with vaccination initiation, as well as lingering concerns about weather conditions.

At the same time, many countries are still facing the pandemic, particularly in the now winter regions of the Northern Hemisphere, and prospects for improvement, with the vaccine or otherwise, are slim until warming in March and April. As the bull market may hold back until the vaccine program gains momentum, the market remains hopeful that continued investment demand will prove strong enough to support markets in the coming months, when the negative effects of lockdowns and mobility constraints will be greatest.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Last week, neither the dollar exchange rate nor bond yields were on the list of positive factors; in both cases, there was an increase ahead of President-elect Joe Biden's announcement to implement a $ 1,9 trillion Covid-19 aid package. Rising yields and covering short dollar positions contributed to the recent correction in gold and silver prices. The reaction to the president-elect's words was moderate due to the possible limitation of the bailout package as a result of the lack of support from key senators from both the Democratic Party and the independent parties.

Precious metals

Long-term US bond yields soared after the Democrats gained a majority in the Senate, which, coupled with the start of vaccination, sparked temporary fears that Federal Reserve will raise interest rates faster than expected. These concerns were dispelled by President Powell, who informed that the FOMC would not raise rates unless there were some disturbing signs of inflation. This is another signal that the world's central banks are ready for inflation to rise before they act to support growth and create jobs.

For precious metals this is true paragraph 22 as higher inflation expectations automatically make the dollar stronger in response to an increase in yields. Nevertheless, we remain optimistic and based on our forecast that the gold price will reach USD 2 / oz, the high beta of silver should support further solid results, and the relationship gold do silver in 2021, it will be in the lower range of 60-69, bringing the price of silver to around $ 35 / oz.

Against this backdrop, gold may be calibrated against recent dollar moves and yields for a while before it finally resumes further growth. After a decline in early January, gold stabilized in a relatively narrow range around $ 1 / oz, mostly above the two-hundred-day moving average of $ 850 / oz. Gold needs to break above $ 1 / oz in order to pave the way for appreciation, while the trendline support is at $ 843 / oz.

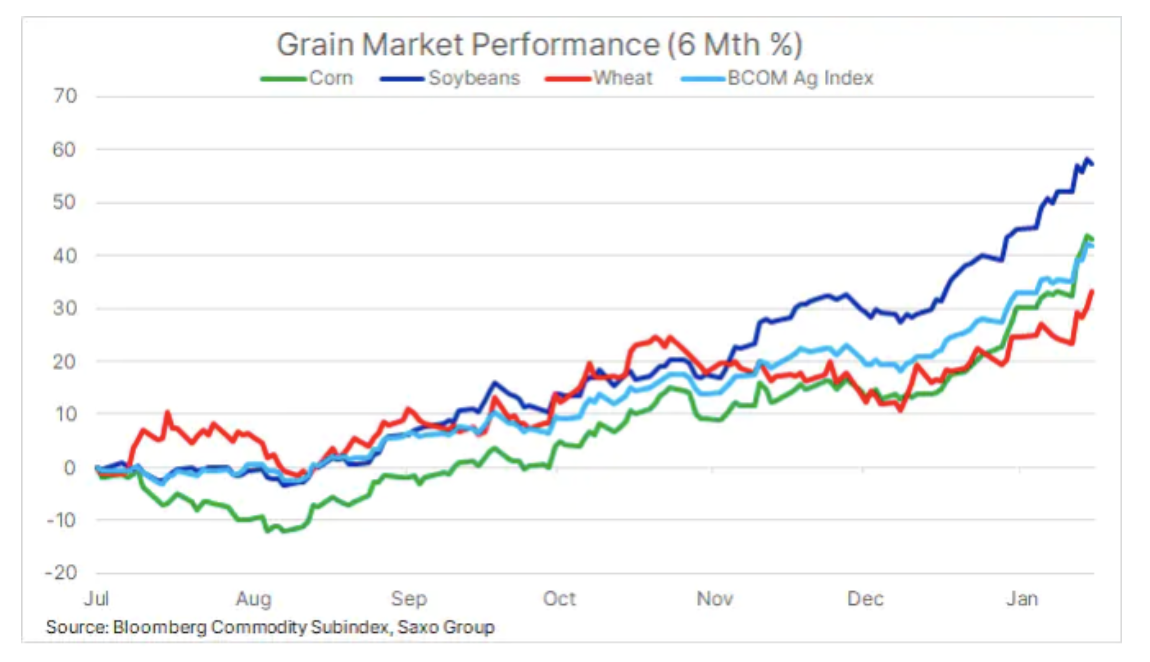

Crops

Crops

Last week's sixth-month boom in the arable crops market gained an additional boost following the publication of the World Agricultural Supply and Demand Report (WASDE), which again lowered forecasts. US production restriction corn i variety and the estimated increase in exports pushed the prices of both crops to the highest level in seven years.

According to the US Department of Agriculture (USDA), the 2020/21 final level of domestic soybean stocks will be 140 million bushels, down 77% compared to the 610 million bushels forecast in August, and of maize 1,552 billion bushels, the lowest level since 2013 and a decrease of over 50% compared to the June forecast. The Department of Agriculture also lowered forecasts for the upcoming harvest in key export countries Brazil and Argentina.

In addition, wheat prices have risen following Russia's announcement that its new export tax on wheat, which will come into force on February 15, in conjunction with the export restriction, will be raised further to curb domestic food prices. As a result, wheat prices on the Chicago Stock Exchange reached a new six-year high.

The boom in agricultural products, primarily grains and oilseeds, to some extent occurred at a time when the market's attention was focused on other issues. However, continued growth, which has seen the Bloomberg agricultural commodity index gain more than 40% in the last six months, raises concerns about the effects of this on economies and inflation.

Petroleum

Impressive bull market oil has started to show signs of inhibition since the first announcement of the start of vaccination in early November. After reaching the level of $ 57,5 / b as a result of Saudi Arabia's unilateral and surprising decision to cut production by 1mbbl / day in February and March, the market focused again on the pandemic and its further negative impact on mobility and thus on demand for fuel products. These disruptions were somewhat offset by the onset of freezing temperatures in Asia, as a result of which the immediate price of LNG temporarily exceeded the chart limits, fueling demand for distillates such as diesel.

The confirmation that Joe Biden will become the new president of the United States has also contributed to the increase in prices. The prospect of an inflationary stimulus package supporting the economic recovery pushed the oil price upwards as investors and speculators sought protection against reflation and the associated possible dollar weakening. Crude oil, gold and copper these are the three most liquid commodity markets, which is why reflation demand is most often concentrated there.

Given this, from the current fundamental perspective, we remain skeptical about the ability of oil to break even much higher at this stage. In the context of price movements since the beginning of November, a correction to the level of USD 49 / b would be only a slight correction within a strong uptrend. In our opinion, Brent crude oil will remain in the lower and middle regions of the range of USD 50-59 / b in the coming months until the fundamentals turn out to be strong enough to support the extension of this move, initially towards USD 60 / b, and later in the year in around 65 USD / b.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)