Will 2023 be the year of hydrogen?

Many believe hydrogen is the solution to decarbonising the economy over the next decade, and hydrogen stocks have kicked off the year on a strong note with a string of big orders in the industry. This may indicate that the current year will prove to be a breakthrough for hydrogen. Although renewable energy can be produced faster than nuclear energy and is greener than burning natural gas, it is not a stable source of energy. With pure hydrogen, we can get baseload electricity and stabilize its prices, but the technology is still expensive.

Hydrogen is the fastest way to generate baseload electricity while developing renewable energy sources

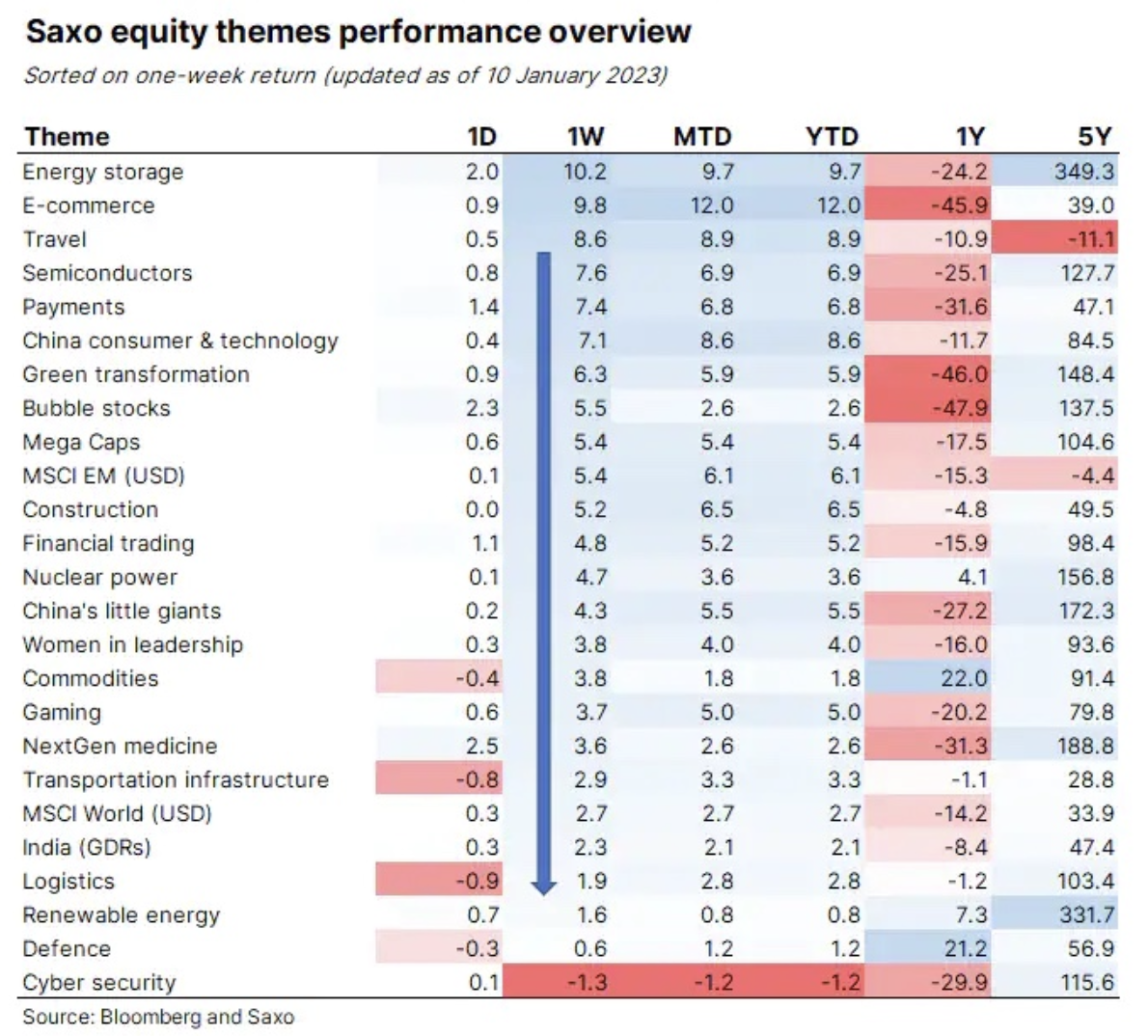

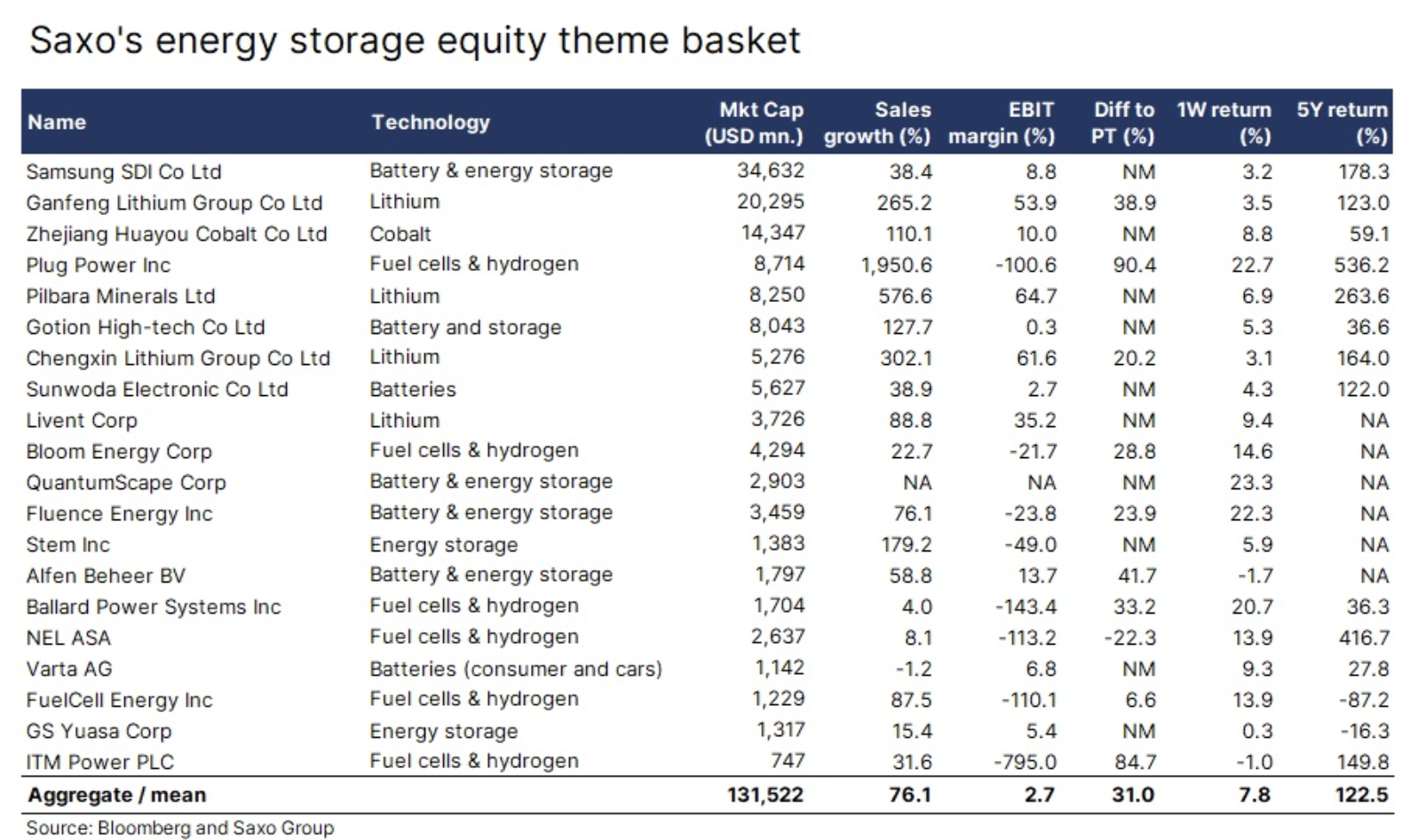

This week, the thematic basket that recorded the best performance was the energy storage basket, which went up 10,2%, making it the second best performer this year. The largest growth was achieved by companies dealing with fuel cells and hydrogen, such as Plug Power, Bloom Energy, Ballard Power Systems, Nell or Fuel Cell Energy. The industry recorded a lot of large orders at the beginning of the year, which suggests that 2023 may be a breakthrough for it.

Last year, we devoted a lot of space to the energy crisis, and in particular to energy prices and the problem of base load in Europe. Due to the fact that renewable energy is an intermittent source of energy, the volatility of electricity prices increases as its share in the overall energy mix increases, unless a base load is applied to stabilize the grid and prices. So far, nuclear energy in France and cheap gas from Russia have been used for this purpose. With the problem of corrosion at French nuclear power plants and soaring gas prices due to cuts in supplies from Russia, Europe's baseload problems have intensified. Due to the rapid increase in demand for electric vehicles and air-to-water heat pumps, the demand for electricity is also growing. This will mean more pressure on Europe's energy grid in the coming years. Pure hydrogen produced from surplus renewable energy seems like a good short-term solution, but it comes at a higher cost.

What alternatives do we have?

Building nuclear power plants takes too long, and fusion power generation technology will not be ready for commercialization for a long time. Natural gas became more expensive, and after cutting off from Russian sources, the use of natural gas power plants for base load purposes has significantly lost its attractiveness. Renewable energy can be produced faster, but this does not solve the base load problem. But thanks to electrolysers, surplus energy from renewable sources can be used to extract hydrogen from water. Such pure hydrogen can be stored and then burned in power plants for base load purposes. This technology will be more expensive than burning gas, assuming access to gas from Russia, but in the short term it may prove to be the only solution to decarbonise energy production in Europe.

Energy storage will increasingly be a key technology in our transformation towards a greener society, but it will also prove to be an absolutely essential technology as further segments of the economy are electrified. Battery manufacturers are already seeing a significant increase in their popularity due to the increase in the popularity of electric cars, and therefore we maintain a very positive attitude towards companies in this sector and entities involved in the extraction of lithium. However, this year may turn out to be a breakthrough year for the shares of companies from the hydrogen industry.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)