Is gold still a good investment during the prevailing pandemic?

Gold plays an important role in investment portfolios as a source of liquidity and collateral. Fed actions have shown that the lower prices of royal metal have been used to re-purchase it, so despite the recent discount - gold should not lose its safe haven status. Is it worth investing in them?

Gold as a safe haven?

At the very beginning of the Covid-19 pandemic, gold gained value. For a while, even metal quotations reached $ 1700 per ounce. And suddenly there was a strong sale. From March 9, we observed a dynamic sell-off of the raw material, which quickly brought quotations to the level of $ 1450 per ounce, i.e. the holes from November 2019. Is there still a chance for historical levels, announced before the outbreak of the pandemic?

The answer is not clear, because the situation is unprecedented. The sell-offs of gold were accompanied by a fall in the prices of American 10-year bonds, i.e. an increase in their interest rates. The current US Treasury yield is at 0.85 percent, but we still saw 9 percent on the chart on March 0.33.

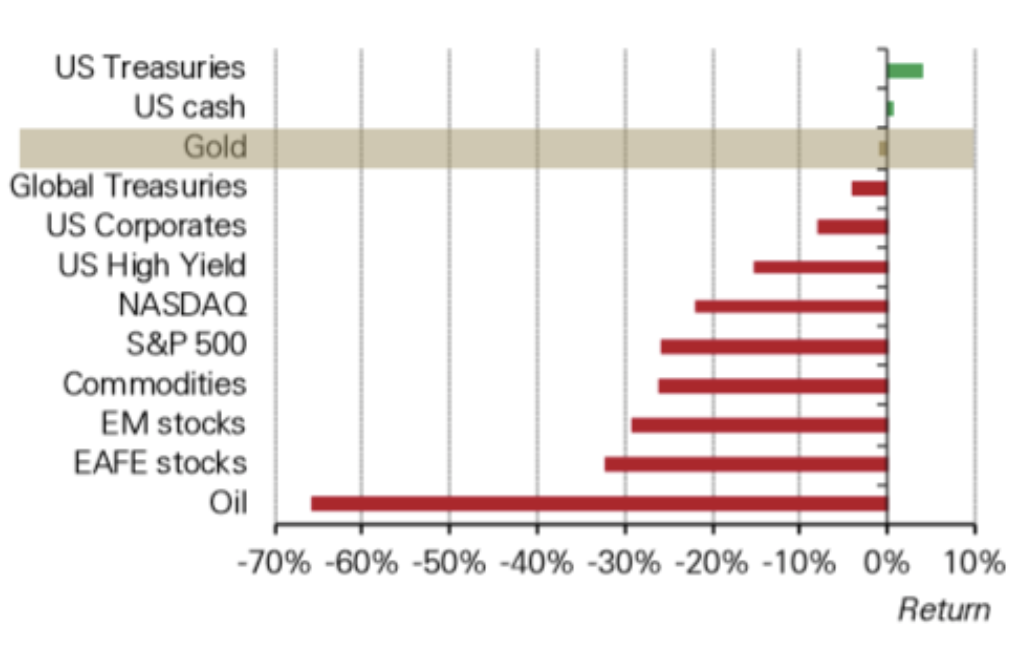

Gold, despite the March discount, is doing relatively well this year compared to other asset classes. The rate of return since the beginning of 2020. Source: WGC

So why such a strong sell-off of gold, when - theoretically - it should gain in value when there is panic on the market and react to additional support from central banks, which have massively loosened their monetary policy. Federal Reserve reduced the mandatory reserves rate to zero, introduced unlimited asset purchases and a fiscal package for $ 2 trillion.

- The Fed's action weakened the dollar and strengthened the gold valuation - so we returned to the strong, negative correlation between the two assets. It's only a matter of time before we see the $ 1700 / ounce level again. Its penetration will open the way to historical levels - evaluates Łukasz Zembik, OTC market expert at DM TMS Brokers.

Withdrawal of capital

One theory of a strong gold sale is that investors are withdrawing capital from the bullion due to replenishment of margins on positions on other instruments. Another, partly related to the first one, explains that all those who bought gold (mainly through speculative transactions using derivatives) simply decided to take profits by closing long positions.

The second indicates that many speculative positions on derivatives have been profitably closed. All investors who bought gold in January or February simply realized short-term profits.

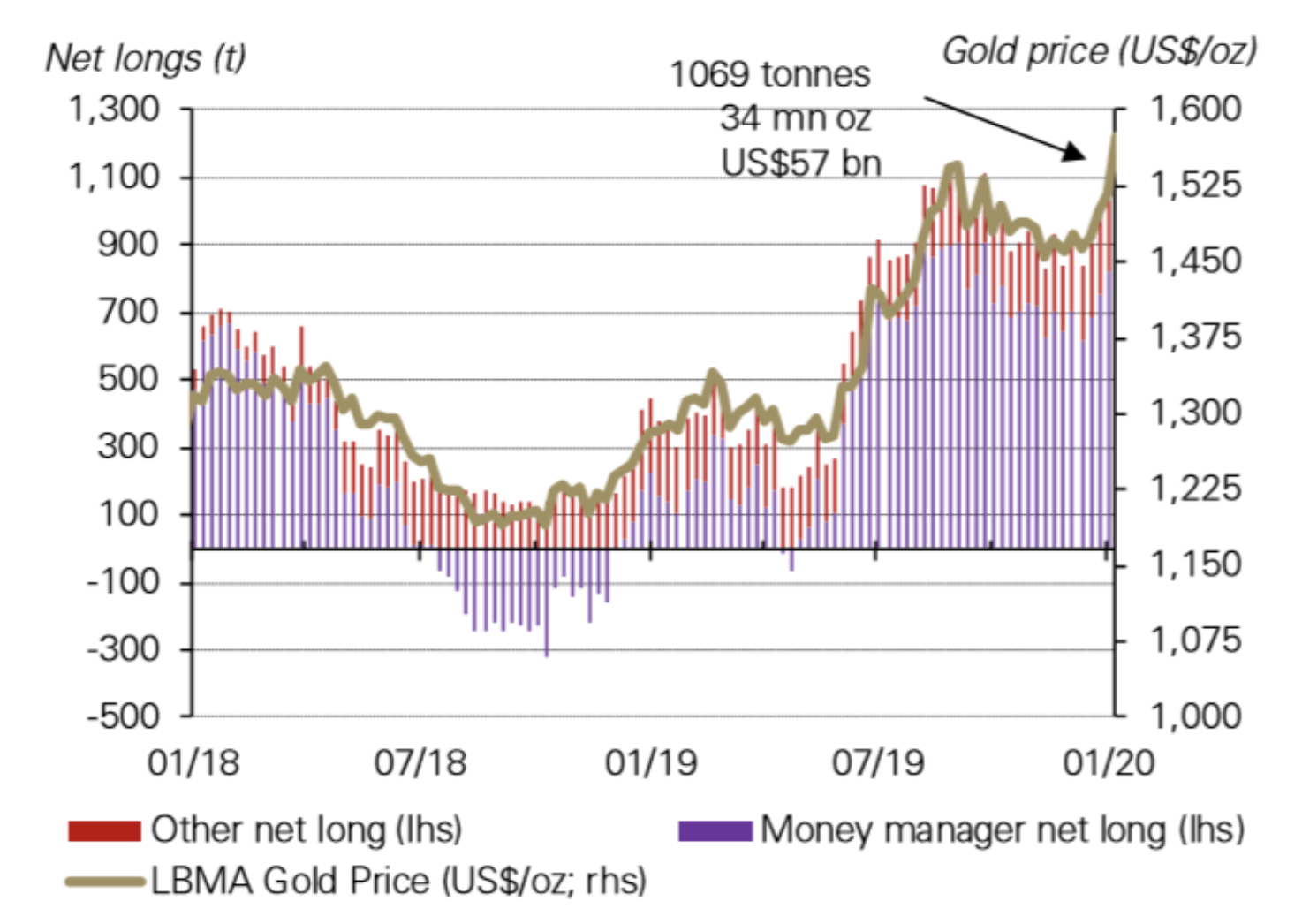

Looking at the positioning of investors on the COMEX exchange on futures contracts, we can see that it was extremely high at the turn of February and March.

Positioning investors on gold futures on the stock exchange COMEX, source WGC, Bloomberg.

Gold, despite temporary drops, is doing very well compared to other assets. From the beginning of the year to March 20, the royal metal lost just 1,75 percent, while the S & P500 - the US stock index - fell by more than 25 percent, while oil was discounted by almost 60 percent.

- It can therefore be assumed that gold was monetized, because investors needed cash, and until recently this commodity, as one of the few assets on the market, was characterized by a positive rate of return this year - says Łukasz Zembik, OTC market expert at DM TMS Brokers.

What is the conclusion?

So the conclusion is that the correlation between gold and the equity market is negative at a time when share prices are falling - explains Łukasz Zembik, OTC market expert at DM TMS Brokers.

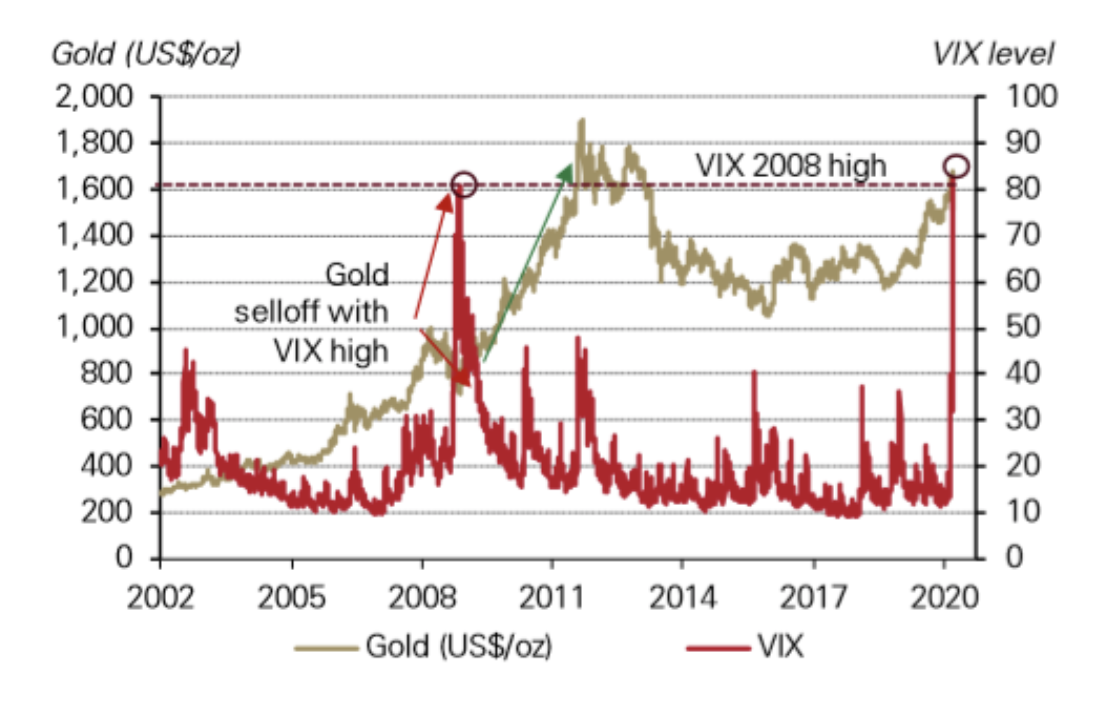

There is a deviation from this rule from time to time on the market. Especially when the sale is very strong and chaotic, when the market is dominated by huge fear and volatility reaches extremely high values. An example is the period between 2008 and 2009 when VIX index (based on option volatility per index S & P500) has grown strongly and gold has come under pressure.

- We are currently dealing with a similar phenomenon. In the long term, declines in raw material should only be seen as a correction - evaluates Zembik.

Speculation around gold

Gold is a speculative asset characterized by high liquidity, which allows it to easily enter the market. And now - according to experts, this is a good time - because after a solid discount in mid-March, we will see increases.

- After the liquidity breakdown, the ore returns to growth. A similar scenario as in 2008 plays out. We remain positive about the outlook for gold and expect to exit over $ 1700 an ounce. The restoration of liquidity to financial markets by central banks means sharp drops in government bond yields, and uncertainty about the outlook for economies will drive capital back to safe havens. The large number of long speculative positions after the recent crash is no longer an obstacle - ocenia Bartosz Sawicki, head of the Analysis Department at TMS Brokers.

Source: Press material of DM TMS Brokers

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)